It's a rumor-driven market.

It's a rumor-driven market.

Early this morning, the Futures were up because, SUPPOSEDLY, another round of "peace talks" have been scheduled and, why not, they've done nothing so far? Meanwhile, in reality, China is back to lockdowns as Covid is once again spreading over there and that, by itself, would be enough to knock down the markets (ding to the global economy, more supply chain issues, etc.) and oil is still around $104, which again, by itself would be enough to take down the market but I guess it's better than $128 last week so YAY! – I guess.

This is why we use our Bounce Charts during a crash – they keep us grounded and remind us that all this short-term movement is meaningless in the big picture and, in the big picture, we're not making any progress. That's why on Thursday I can write a Morning Report titled "Thursday Failure – Rally Fails at the Strong Bounce Line (/ES 4,320)" and you can see above that we EXACTLY failed on Friday at 4,320. When you see us make predictions over and over again that get hit ON THE BUTTON – you have to think there may be something to our 5% Rule™ – right?

Remember, these are the same levels we've been using since we topped out in December and predicted a 20% correction in the markets and that was before the war:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong).

- Nasdaq is using 13,500 as the base and we bottomed yesterday at 13,103. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,780 (weak) and 1,960 (strong).

We're still where we were last Tuesday, with the Russell on the cusp (1,979) but the S&P is now dangerously close to 4,160 and, if that goes, then expect the Dow to begin catching up. That make the Dow the best downside hedge at the moment and, at 33,025 this morning, we can play a cross below 33,000 short with tight stops above the line – risking some small losses against a potential gain of $7,500 per contract if we fall back to 31,500 (a bit below the strong bounce line).

We're still where we were last Tuesday, with the Russell on the cusp (1,979) but the S&P is now dangerously close to 4,160 and, if that goes, then expect the Dow to begin catching up. That make the Dow the best downside hedge at the moment and, at 33,025 this morning, we can play a cross below 33,000 short with tight stops above the line – risking some small losses against a potential gain of $7,500 per contract if we fall back to 31,500 (a bit below the strong bounce line).

In our Short-Term Portfolio, we have a mattress play shorting the Dow ETF (DIA) which we initiated back in January:

| DIA Long Put | 2022 16-SEP 350.00 PUT [DIA @ $330.02 $0.00] | 50 | 1/28/2022 | (186) | $125,750 | $25.15 | $6.73 | $23.74 | $31.88 | $0.00 | $33,625 | 26.7% | $159,375 | ||

| DIA Short Put | 2022 16-SEP 320.00 PUT [DIA @ $330.02 $0.00] | -50 | 1/28/2022 | (186) | $-75,750 | $15.15 | $3.43 | $18.58 | $0.00 | $-17,125 | -22.6% | $-92,875 | |||

| DIA Short Put | 2022 18-MAR 335.00 PUT [DIA @ $330.02 $0.00] | -10 | 2/15/2022 | (4) | $-4,400 | $4.40 | $3.33 | $7.73 | $0.00 | $-3,325 | -75.6% | $-7,725 |

At the time, our target for March was $335 and we're a bit ahead of schedule with those short puts expiring on Friday. Of course, we will just roll them to April or May whatevers as we're 5:1 covered and the real trick to a Mattress Play is that, if the market drops faster than you think, then we are triggered to double down with another long spread as we roll down to 2x something lower – which then increases our coverage and provides us cover to take profits on our original long puts (the Sept $350s in this case).

Note the $350 puts are now $31.88 – more than the $30 max payout for the spead. If we were to buy, for example, 50 Jan $325 ($26)/295 ($17) bear put spreads for net $9, then we could take some of those Sept $350 puts off the table using $30 for a stop. Since we only paid net $10 for the first set and were in for net $19 total – it won't take long before we have a free spread and we can start the cycle again if we have to.

There are a lot of moving parts to a Mattress Play and the best way to learn is through practice but, unfortunately, it's been about 10 years since we've had a flat to down market to practice in – that's where these hedges are appropriate. We can also do them with companies we feel have topped out, like Chevron (CVX), which rose a ridiculous 70% since October and that's $100 BILLION in market cap to $332Bn for a company that madee $15.6Bn last year. Not terrible but they lost $5.5Bn in 2020 and oil is going to crash hard if this war ever ends. Also, they are talking about windfall profit taxes on oil companies and that would also spook investors.

So, in the Short-Term Portfolio (STP), we can:

- Buy 15 CVX Jan $200 puts for $40 ($60,000)

- Sell 15 CVX Jan $170 puts for $21 ($31,500)

- Sell 5 CVX April $160 puts for $5 ($2,500)

This is a $45,000 spread we are buying for net $29,000 so we have $16,000 (55%) upside potential if CVX simply finishes below $170 (where it is now) – in January. We'd have to lose over $30 per short put to be hurt on that side and the June $150 puts are $5 and the Sept $140 puts are $5, so we can probably roll along to $130 or $120 and still have our $30 edge and, of course, if things are going that well – we can buy more long puts...

Should CVX move higher, the April puts go worthless and then we sell $2,500 more for the next 45 days and we have 312 days to sell so let's say 5 more chances at $2,500 could lower the cost basis to almost $15,000 on the $45,000 spread if all goes well.

It's a good, educational play, the kind I like to have in our hedging portfolio for our Members. Since we do believe CVX will come back below $150 eventually, we'll also take any chance we can get to roll the $170 puts to the $160 puts and then the $150 puts when and if it can be done for $5 or less – widening the spread by $10 each time.

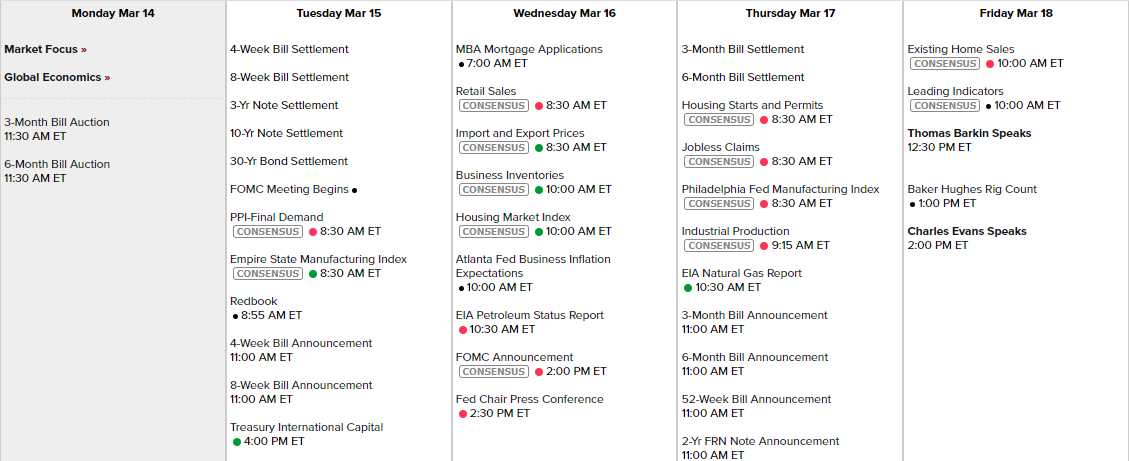

And don't forget we have the Fed this week on Wednesday at 2pm, followed by a statement from Powell at 2:30. We'll be covering that in our Live Trading Webinar, Wednesday at 1pm – 3pm. We should always be nervous when the Fed shedules a dove (Evans) at the end of a week – it means they expect trouble. After Powell, we have the Philly Fed, Industrial Production, Housing Starts, Home Sales and Leading Economic Indicators – the last of which could be very ugly.

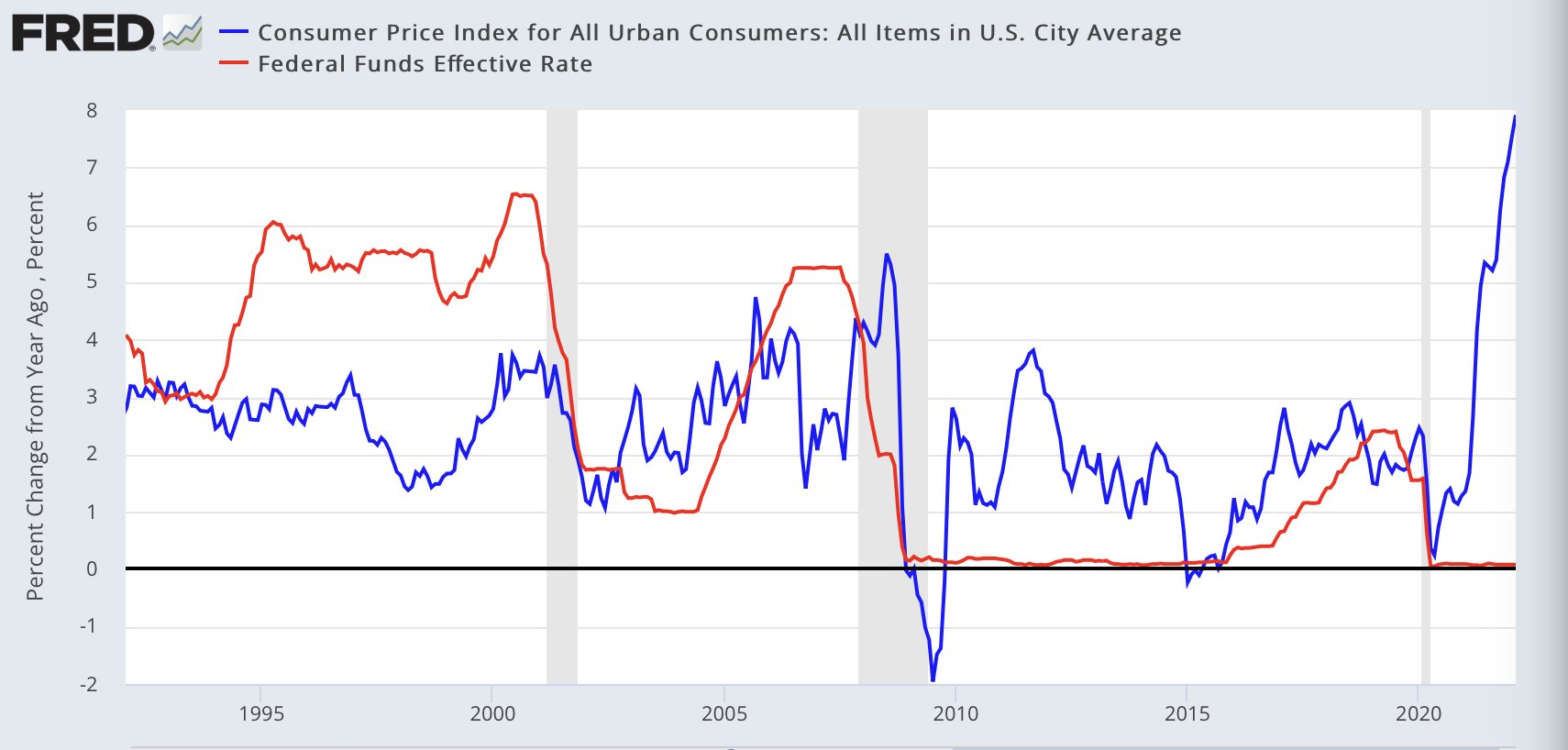

And speaking of the Fed Meeting – here's how ridiculous things are at the moment:

And look at all these earnings reports still coming in:

And, of course, as my fellow soothsayer, Spurinna said: "Beware the ides of March."