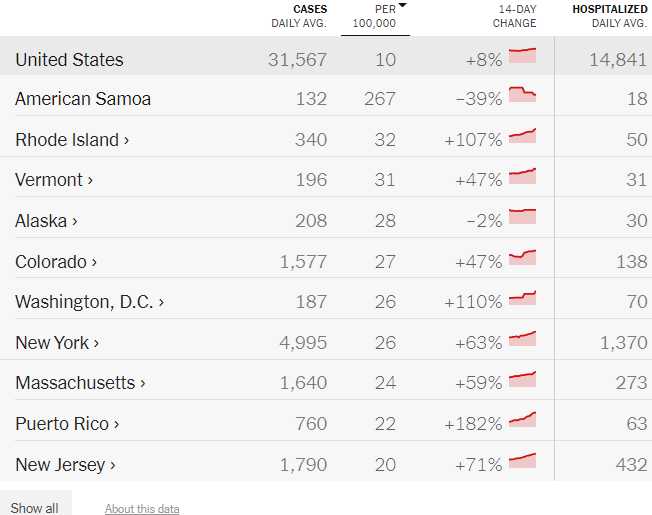

As you can see, we are having some big infection rates on the rise again and the rate of hospitalization is very high because MOST cases of Covid are now unreported UNLESS they are serious. Test kits are no longer free and most vaccinated people get mild cases and simply get over it like the flu and never report being sick so the majority of cases that do get reported are severe and since the severe cases tend to be among the unvaccinated – they tend to get Covid bad enough that they end up in a hospital.

Unfortunately, Covid has great timing and always seems to swing up around our holiday weekends (after is obvious but before is just mean) and when 2 people per 1,000 have a severely infectious disease and you get a lot of people together in airports and churches and at family gatherings – well, statistics tends to take care of the rest.

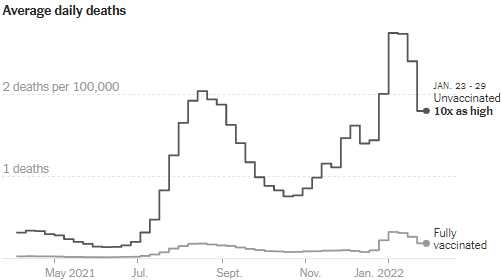

So please be sensible this holiday weekend and, for God's sake, get vaccinated if you haven't been and get a booster if you should. You are 10 TIMES more likely to die from Covid if you catch it and are not vaccinated. That is a very stupid way to die, isn't it?

So please be sensible this holiday weekend and, for God's sake, get vaccinated if you haven't been and get a booster if you should. You are 10 TIMES more likely to die from Covid if you catch it and are not vaccinated. That is a very stupid way to die, isn't it?

Not only that but severe Covid has some very nasty long-term effects that you are also much more likely to avoid if vaccinated but one of those effects is a decrease in cognitive funcions – which then leads people to make poor decisions regaring getting vaccinated. That's a very clever virus – making the victims too dumb to defend themselves!

Also too dumb to defend themselves are our Leading Economorons, who still only react to things AFTER they've seen the news. Currently, our Nation's diminishing Brain Trust is forecasting a 28% chance of a Recession in the next 12 months and 33% was as high as we've ever gotten without actually having a recession and that was 2011, when we were still recovering from the 2008/9 Recession and the Fed was lowering rates – not raising them.

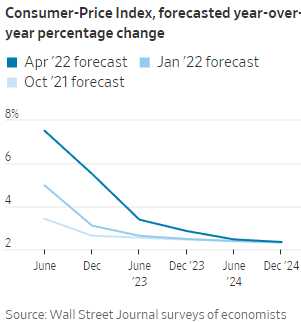

As you can see from the same Economorons CPI Forecast, in October they thought the June CPI would be 3.4% and in Jan they thought the June CPI would be 5% and now, they think it will be 7.5% despite us JUST yesterday getting an 8.5% reading and it being almost mathematically impossible to get to 7.5% by June. Even worse, they clearly haven't even bothered to change their 2023 forecasts – as if all this ACTUAL data will magically go away next year.

As you can see from the same Economorons CPI Forecast, in October they thought the June CPI would be 3.4% and in Jan they thought the June CPI would be 5% and now, they think it will be 7.5% despite us JUST yesterday getting an 8.5% reading and it being almost mathematically impossible to get to 7.5% by June. Even worse, they clearly haven't even bothered to change their 2023 forecasts – as if all this ACTUAL data will magically go away next year.

Are wages going to reverse? Clearly that's a key, underlying driver of inflation. We can suppose the war will end as there is still hope of that and we can then assume Energy Prices will stablize but what about the Fed raising rates from 0.5% to 2.5% – won't that drive up prices or will companies just choose to make less money? Supply Chain issues are not likely to unwind all that fast and the real food shortage from Ukraine missing a planting season will not even hit us until the fall – when the crops don't get harvested.

And we keep forgetting – we're not getting our stimulus checks this year. Stimulus has been 25% of our Economy for the past two years and, even this year, Biden did pass a $1.2Tn Infrastructure Bill and that is 10% of our Economy – but that won't go to the people. What is going to the people is $100 fill-ups at the gas station – THAT they do get – and don't even think about going to a grocery store…

That's why the Government likes to measure inflation "Ex Food and Energy" – as if that's how people live their lives. The excuse is that food and energy are volatile but even the Ex Food and Energy gague of the Core CPI was up 6.5% yesterday. Keep in mind the Fed's stated target for Core CPI is 2% so, to say the Fed is behind the curve on this is a major understatement.

That's why the Government likes to measure inflation "Ex Food and Energy" – as if that's how people live their lives. The excuse is that food and energy are volatile but even the Ex Food and Energy gague of the Core CPI was up 6.5% yesterday. Keep in mind the Fed's stated target for Core CPI is 2% so, to say the Fed is behind the curve on this is a major understatement.

As I mentioned yesterday, Wage Income, which grew at a blistering 10% annual rate in the last three months, fell 1.2% when adjusted for Inflation. Last year in Q1 we had Stimulus Checks, Child Tax Credits and Forgivable Business Loans – all are gone now and have been replaced by Higher Interest Rates (30-Year Mortgages are already 5.13%) – how is Q1 going to be good? We'll find out as companies start reporting their eanings this week and next but JP Morgan (JPM) already reported a 42% drop in Income vs last year.

And, keep in mind, Russia is only just now starting to default on their debts – that's going to really sting the IBanks at some point. On the Consumer side, the concern is that a lot of last year's earnings might have reflected a once-only spending spree as Consumers equipped home offices, bought exercise equipment or replaced appliances. This could leave businesses vulnerable to the “Peloton effect,” a sudden drop off in orders as consumers conclude they have enough stuff and stop buying – which is how you get a Recession.

Private data tracked by the Federal Reserve Bank of Chicago points to a 2.9% drop in retail sales excluding vehicles in March from February, or 4.2% when adjusted for inflation. First quarter economic growth was probably close to zero.

Also, as we discussed in last week's Live Trading Webinar, a record 243 MILLION square feet of office space will be hitting the market this year as many pandemic extensions have expired. That's 11% of all office space in America. Government support allowed many businesses to continue to pay their rents – even when there were no employees showing up but now less people are showing up, even for fully re-opened companies so most companies don't want the same amount of space as they had before – even if they can afford to stay.

Also, as we discussed in last week's Live Trading Webinar, a record 243 MILLION square feet of office space will be hitting the market this year as many pandemic extensions have expired. That's 11% of all office space in America. Government support allowed many businesses to continue to pay their rents – even when there were no employees showing up but now less people are showing up, even for fully re-opened companies so most companies don't want the same amount of space as they had before – even if they can afford to stay.

Many office tenants whose leases expired last year or in 2020 negotiated extensions of only a year or two, rather than renewing at the typical length of 10 years or longer, as these firms tried to determine how much less space they might need under a hybrid approach.

“I don’t think the landlords have felt the pain yet,” said Jeffrey Peck, vice chairman at commercial real-estate brokerage Savills. “Now they’re going to start feeling the pain.”

This is another one of those slow-moving crises that can't be stopped – it just sort of rolls up on you. It's hard to run a profitable building when 15% of your space is vacant and essentially impossible once that number hits 20%. 2022 lease expirations are going to be 40% more than they were in 2019 and historic vacancies of 9.6% are already at 13% – it won't take much to push Commercial Landlords to the brink and they can't refinance their buildings as the rates are double what they've been for the past 10 years – quite the connundrum!

This is another one of those slow-moving crises that can't be stopped – it just sort of rolls up on you. It's hard to run a profitable building when 15% of your space is vacant and essentially impossible once that number hits 20%. 2022 lease expirations are going to be 40% more than they were in 2019 and historic vacancies of 9.6% are already at 13% – it won't take much to push Commercial Landlords to the brink and they can't refinance their buildings as the rates are double what they've been for the past 10 years – quite the connundrum!

Real-estate analytics firm Green Street estimates that hybrid work will cause a 15% drop in demand for office space. Because most building expenses are fixed, even a small drop in leasing revenue often leads to a big drop in profits and an even bigger drop in a building’s value. An economic slowdown could add further strain because office leasing is highly dependent on the economy.

Troubled loans to office building owners are also on the rise. In February, 21.2% of office loans made after the global financial crisis packaged into commercial mortgage securities were either being handled by special servicers or on watch lists, two closely watched categories that could lead to defaults, according to a Barclays report. That’s the highest level since 2010.

Watch the reports from Community Banks, who are the first to be affected as they lend to the smaller landlords, who don't usually have deep reserves to bail out struggling properties. If their write-offs increase sharply – it is likely to be the tip of a very large iceberg the economy is heading right into. About $1.1Tn worth of loans backed by office buildings are outstanding and about $320Bn of those loans are maturing this year and next, according to data firm Trepp Inc.

Problem loans have already started to surface. Blackstone Inc. is expected to hand back to creditors a troubled Midtown Manhattan office building with a $308 million debt load, according to people familiar with the firm’s thinking. The building’s loan was turned over to a special servicer after its main tenant, L Brands, decided not to renew its lease when it expired last month. The retailer is taking much less space in a new location, in part because it is turning to a hybrid-work strategy.

That's the danger for the larger lenders too – companies like Blackstone will just strategically abandon a building when it no longer projects profits.

Be careful out there!