So far, so good.

So far, so good.

ATVI missed by quite a bit yesterday and only fell from $79 to $78. They are trading at about 20 times earnings and it's good to see that the market doesn't seem to consider that too much since that's on the low end of most stocks' valuations these days. KO beat and went nowhere, WHR beat last night and has a pre-market bump this morning but MMM not getting love off their 15% beat while ADM is crushing it on their 25% beat.

GLW is blasting higher, DHI is popping, GE is getting no love on their 20% beat, IVZ missed and is getting punished, JBLU beat but still losing 0.80 per $13.20 (now $12.80) share – so getting what they deserve. NVS being punished for being inline, PEP down on a small beat, BPOP jumping (we just added them), RTX loving the war with a 10% beat but not getting loved back by traders, SHW flying higher on unexpected beat, UPS is humming along, VLO had a great Q – as expected and WBD (spun off from T) looks good in their first report.

It takes us a week or two to figure out how traders are likely to react and THEN we get to prognosticate over what we feel companies are likely to earn. This early on it's just folly to bet on earnings as both the results and the subsequent reactions are total wildcards. On top of that we have a fluid macro environment where, on any given day, Covid can be better or worse, the War can be more or less brutal, Inflation can be more or less brutal, etc…

That makes it very difficult to make good calls, so we generally abstain. Sometimes we catch over or under-reactions and those are fun to bet on but, so far, only the NFLX selling seems egregious and we're waiting for the dust to settle on that one still. We shorted NFLX at $600 as that was silly but that doesn't mean $200 can't be silly as well – after all, $200 is $93Bn in market cap and NFLX makes $5Bn a year so we're talking 18.5x earnings and yes, they lost subscribers but it's down from EVERYONE signing up during the pandemic. An optimist might even say they KEPT 90% of the new subscribers who signed up during the pandemic and they are miles ahead of the projections they had for subscriber growth in 2019.

We can discount an entry into NFLX even further using options, promising to buy them for $150 by selling the 2024 $180 puts for $32, which would actually net us in for $148, which is another 29% below the current price. That's a nice way to plant a flag in the stock if you like them as you either end up owning them for net $148 or, if they don't go lower – you keep the $32 for doing nothing more than promising to buy a stock you wanted to buy anyway. Since your risk is $148 (and realistically we don't think NFLX is going bankrupt, do we?) $32 represents a 21% return in 20 months. 1% a month is better than money in the bank and you're not even taking the money out – just promising to….

Microsoft (MSFT) looks a bit too cheap at $280 ahead of earnings although that's $2.1 TRILLION in market cap. That does seem like a lot but the company made $60Bn last year and is on track to make $70Bn this year and expects to make $80Bn next year and you can see where this is heading as they race to catch up to AAPL's $100Bn in earnings – and AAPL has a $2,666,000,000,000 market cap that's also looking a bit too low – as crazy as that seems.

AAPL and MSTFs combined $5Tn market cap is what the entire S&P 500 were worth in 1996, just before the DotCom bubble. We were only at $7.5Tn in March of 2009, but that was down from $13.5Tn at the highs. Now, including our T-level players, the S&P is at the $27Tn mark in overall valuation – that's 500 companies "worth" 25% more than the GDP of the entire United States and its 330M people, whose average family incomes are 1/16,666,666th of just $1Tn.

When you see numbers like that (as we did in 1999 and 2008), you have to wonder if that $27Tn is sustainable. You see, no one actually put $27Tn into the market. What happened is that last bunch of people who TRADED (like baseball cards) the stock certificates that represent the market caps of those 500 companies, TRADED them at a level that IMPLIES a valuation of $27Tn. If in fact, those people were asked to ACTUALLY purchase those companies for $27,000,000,000,000 – you would quickly find out that they certainly don't have that kind of money.

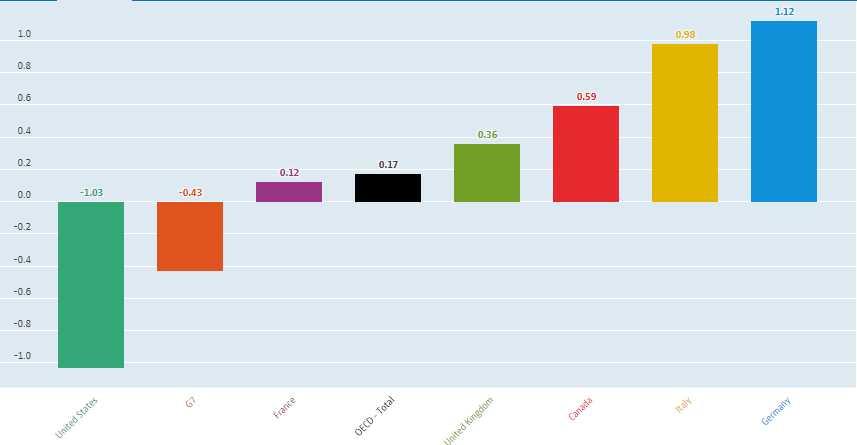

As you can see from this chart of Disposable Income – US Households don't even have enough money to pay their current bills – let alone buy Trillion-Dollar companies. US Households are currently such a money pit that we are dragging the entire G7 average into negative territory but even Germany, our economic star (before the war), was only slightly on the plus side. After 2 months of war and the ensuing inflation, we may all be in deeply the red!

That then brings us to valuation issue #2 – clearly we can't all be Elon Musk and buy companies the way normal people buy impulse items at the check-out counter but, according to the chart above and your own personal expericences – we also can't afford to buy the stuff these companies are selling. Certainly not at these prices. Inflation hits the economy in waves and the first wave is prices rise for whatever reason. In our case, it's too much stimulus money sloshing around, Covid causing supply chain issues and then a war putting pressure on commodities – especially energy costs. That's given us 8.5% inflation – probably over 9% now.

That then brings us to valuation issue #2 – clearly we can't all be Elon Musk and buy companies the way normal people buy impulse items at the check-out counter but, according to the chart above and your own personal expericences – we also can't afford to buy the stuff these companies are selling. Certainly not at these prices. Inflation hits the economy in waves and the first wave is prices rise for whatever reason. In our case, it's too much stimulus money sloshing around, Covid causing supply chain issues and then a war putting pressure on commodities – especially energy costs. That's given us 8.5% inflation – probably over 9% now.

When companies raise prices, at first people use their credit cards (negative disposable income) and then they find themselves forced to demand higher wages from their boss or they are forced to seek other jobs (the quitting cycle). What we are getting so far from companies is the rising costs being passed on but it's still early in the labor cycle for them to be hit by those rising costs – so Corporate Profits are not terrible – yet.

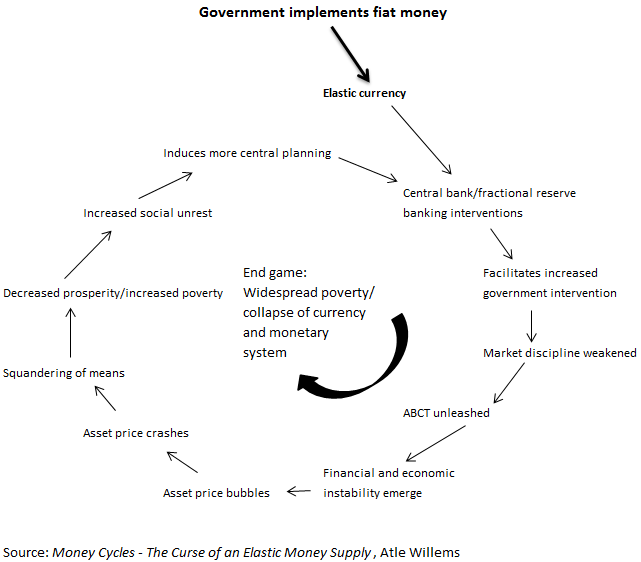

As noted on the chart above, we may be in the end game for Fiat Currency – hence the rise of Crypto and just this morning, Fidelity announced that you can now put your retirement money into BitCoins – isn't that insane??? Fidelity holds $2.4Tn in 401K accounts – about 1/3 of the total retirement market, which itself is terrifying because if you divide $7.5Tn by 165M workers that's only $45,000 each saved for retirement – but that's another gloomy article we can mull over later – when the Social Unrest begins.

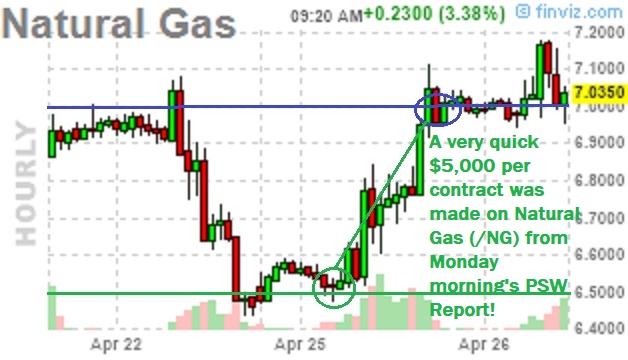

That should pop BitCoin back over $40,000 but we have better ways to make money like yesterday's trade ideas to go long on Gold (/GC) at $1,900, Silver (/SI) at $23.50 and Natural Gas (/NG) at $6.50. This morning we are at $1,909 on /GC and that's up $900 per contract, $23.75 on /SI and that's up $1,250 per contract and /NG is at $7.03, which is up a lovely $5,300 PER CONTRACT – wasn't that easy?

That should pop BitCoin back over $40,000 but we have better ways to make money like yesterday's trade ideas to go long on Gold (/GC) at $1,900, Silver (/SI) at $23.50 and Natural Gas (/NG) at $6.50. This morning we are at $1,909 on /GC and that's up $900 per contract, $23.75 on /SI and that's up $1,250 per contract and /NG is at $7.03, which is up a lovely $5,300 PER CONTRACT – wasn't that easy?

Congratulations to all who played along but remember – we only play the Futures when ALL the factors are lined up in our favor – which is hardly ever. Futures trading is very dangerous so we look for turning points at strong support lines (like $6.50), which HOPEFULLY give us a chance to exit with small losses when they fail. If our Risk is controlled then a nice Reward (like this one) tends to wash out quite a few mistakes on the way to a winning trade but the overriding key is only to trade when you are 80% certain – then you might be right half the time and the rest can be acheived with smart money management techniques.

Oops, almost forgot to check Durable Goods, which were up 0.8% in March but that's below the 1% expected and very sad since February was -1.7% so net -0.9% for two month is NOT GOOD. Home Prices continued to rise, however, up 2.4% from last month and 20.2% for the year with Miami, Phoenix and Tampa up around 30% and all accelerating so far this year but these are February numbers and it seems like rate hikes have put a damper on things in March – but that won't be confirmed until next month.

Oops, almost forgot to check Durable Goods, which were up 0.8% in March but that's below the 1% expected and very sad since February was -1.7% so net -0.9% for two month is NOT GOOD. Home Prices continued to rise, however, up 2.4% from last month and 20.2% for the year with Miami, Phoenix and Tampa up around 30% and all accelerating so far this year but these are February numbers and it seems like rate hikes have put a damper on things in March – but that won't be confirmed until next month.

Consumer Confidence is out at 10:00 and we'll see how that looks. Expectations are for a continuing downtrend to 105 from 107.2 last month but I think we're in for a bit of a steeper decline as you can see those Disposable Income numbers drying up – that's a glimpse into people's checkbooks, which is what they think about when answering these survey questions.