Lots of critical levels to test.

We are back to using our 20% Bounce Lines, which have been a great guide all year for where we expect support and resistance using our fabulous 5% Rule™ and there's a lot of red on the board – especially the Nasdaq already below its base – which iindicates we may be consolidating for a move another 10-20% lower. Fortunately the Dow still has about 5% to fall before it's really in danger but any break below 31,680 will likely mean it's time to go to a lower-zone chart.

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong).

- Nasdaq is using 13,500 as the base. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,760 (weak) and 1,920 (strong)

|

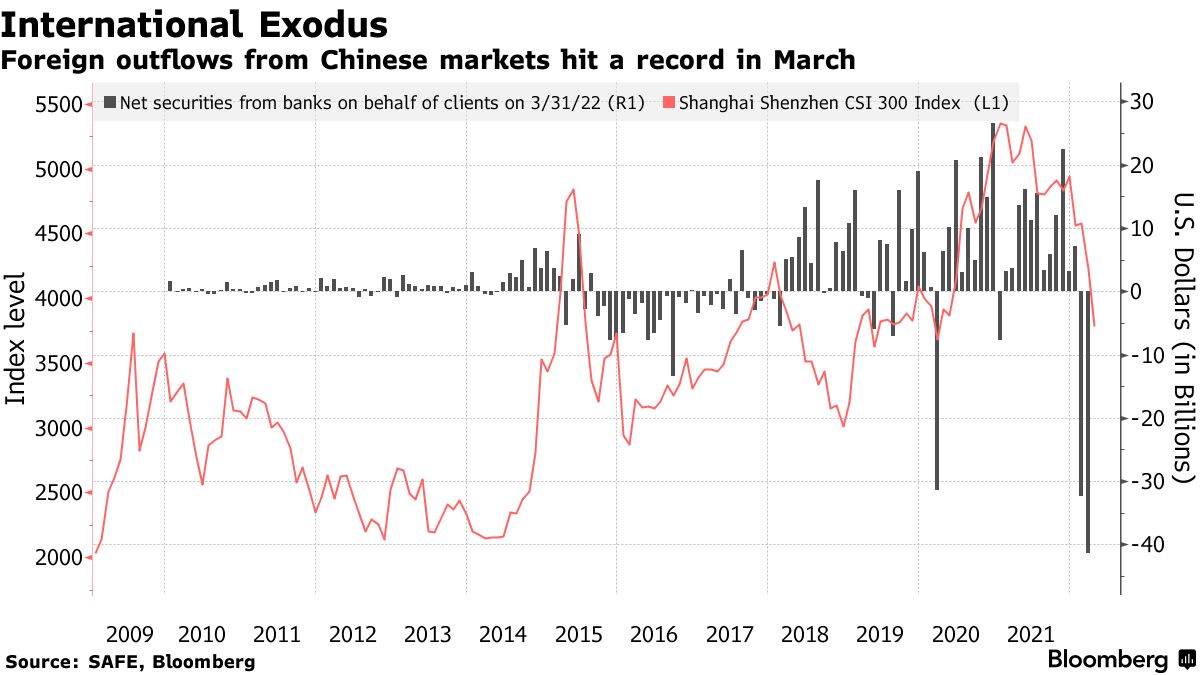

The only "positive" note I have to add at the moment is the strength of the Dolllar, now 102.73, has been putting tremendous pressure on stocks and we thought it would correct a bit this week but China is still propping up their economy as their Property Sector is still in melt-down and the Covid lockdowns are killing their economy in general. The Central Bank has been easing over there in what Bloomberg is calling "unprecedented liquidity." Sounds like fun, right?

The only "positive" note I have to add at the moment is the strength of the Dolllar, now 102.73, has been putting tremendous pressure on stocks and we thought it would correct a bit this week but China is still propping up their economy as their Property Sector is still in melt-down and the Covid lockdowns are killing their economy in general. The Central Bank has been easing over there in what Bloomberg is calling "unprecedented liquidity." Sounds like fun, right?

“The PBOC’s struggle reflects the broader predicament Chinese policy makers are facing amid a challenging external environment — how to find balance between contradictive policy goals of zero Covid and a 5.5% economic growth target,” said Seema Shah, chief strategist at Principal Global Investors in London. “This is not the time to go overweight given the uncertainty that lies ahead.”

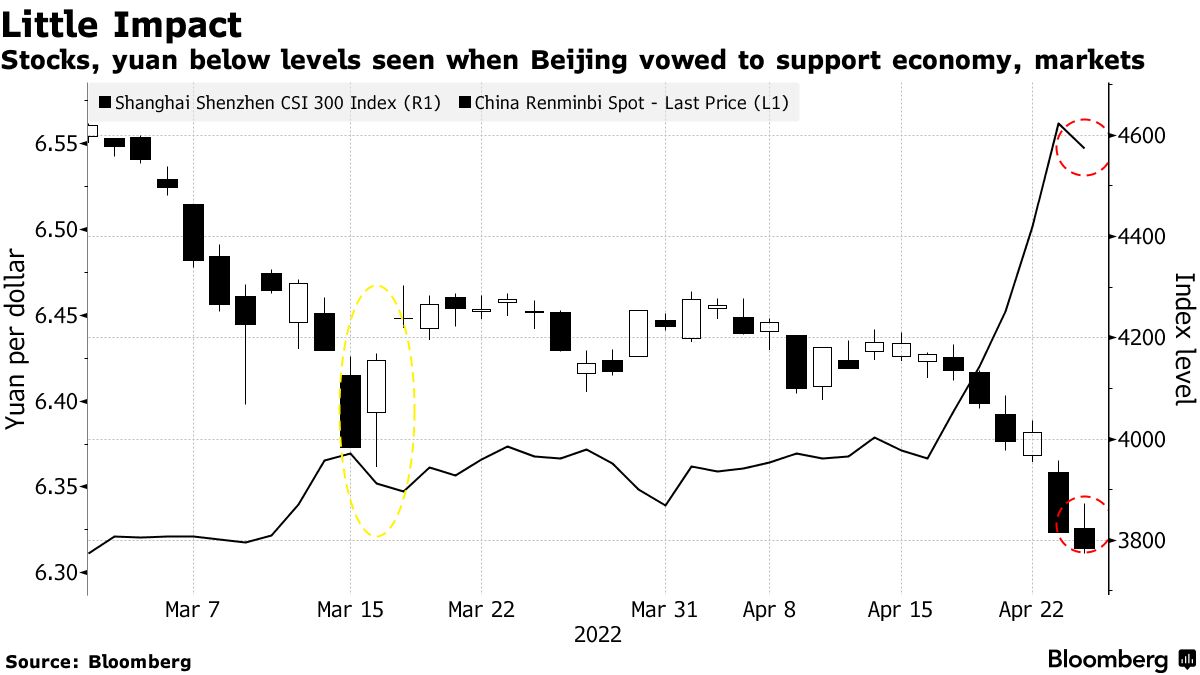

China has taken more decisive actions to spur growth and prop up markets – with little visible success. Just this month, authorities freed up liquidity in the banking system, nudged the country’s social security fund, banks and insurers to boost equity investments and made foreign currency more readily available onshore in a bid to stop the yuan from weakening further. The PBOC said just yesterday that it will promote the healthy and stable development of markets and provide a good monetary and financial environment – reiterating that liquidity will remain reasonably ample but that's going to have the opposite effect as our Fed is removing liquidity – so the Yuan can't compete with the Dollar.

Just like with Covid – China wants to have it both ways – they want to have lockdowns and economic growth and they want to have more liquidity and a stronger Yuan. Unfortunately, reality doesn't work that way and you would think China should understand that and the fact that they clearly don't is extremely concerning going forward.

Just like with Covid – China wants to have it both ways – they want to have lockdowns and economic growth and they want to have more liquidity and a stronger Yuan. Unfortunately, reality doesn't work that way and you would think China should understand that and the fact that they clearly don't is extremely concerning going forward.

If Zero Covid does not work as a policy in China, then FIRST they have to abandon it and then they are two years away from herd immunity and first there would be a serious spike in infections and death as the people feel the Government has betrayed them and is just letting them die (like our Government did). The US "only" had 1M citizens die of Covid, China's population is 1.4Bn – 4 times the size of ours.

So that sounds like a terrible idea but attempting to keep 1.4Bn people from getting Covid is proving more terrible so far and, ultimately, if it fails, you are back to herd immunity anyway. Either way I'd say let's not count on China to prop up the Global Economy any time soon and Europe is at the beginning of World War III, so they are a little distracted and that means it's all up to us and our $32Tn in debt to help avoid a Global Recession by…. I don't know – sprinkling fairy dust?

That's why Texas Republicans (redundant) are going after Wall Street firms who are trying to fight climate change by steering their investments to "environmentally responsible" companes. Texas calls this "boycotting" of their Fossil Fuel industry and they are looking to restrict the business of companies that try to save the planet elsewhere from doing business in their state. Firms that end up on the list will face restrictions on doing business in the state, possibly losing out on managing billions of dollars in public-pension assets, for example. Several other Republican States are preparing similar legislation.

Isn't that bat-shit crazy? We are so doomed it's pretty much just funny at this point – you can see why Nero said "F-it" and grabbed a fiddle – he had a Senate too!

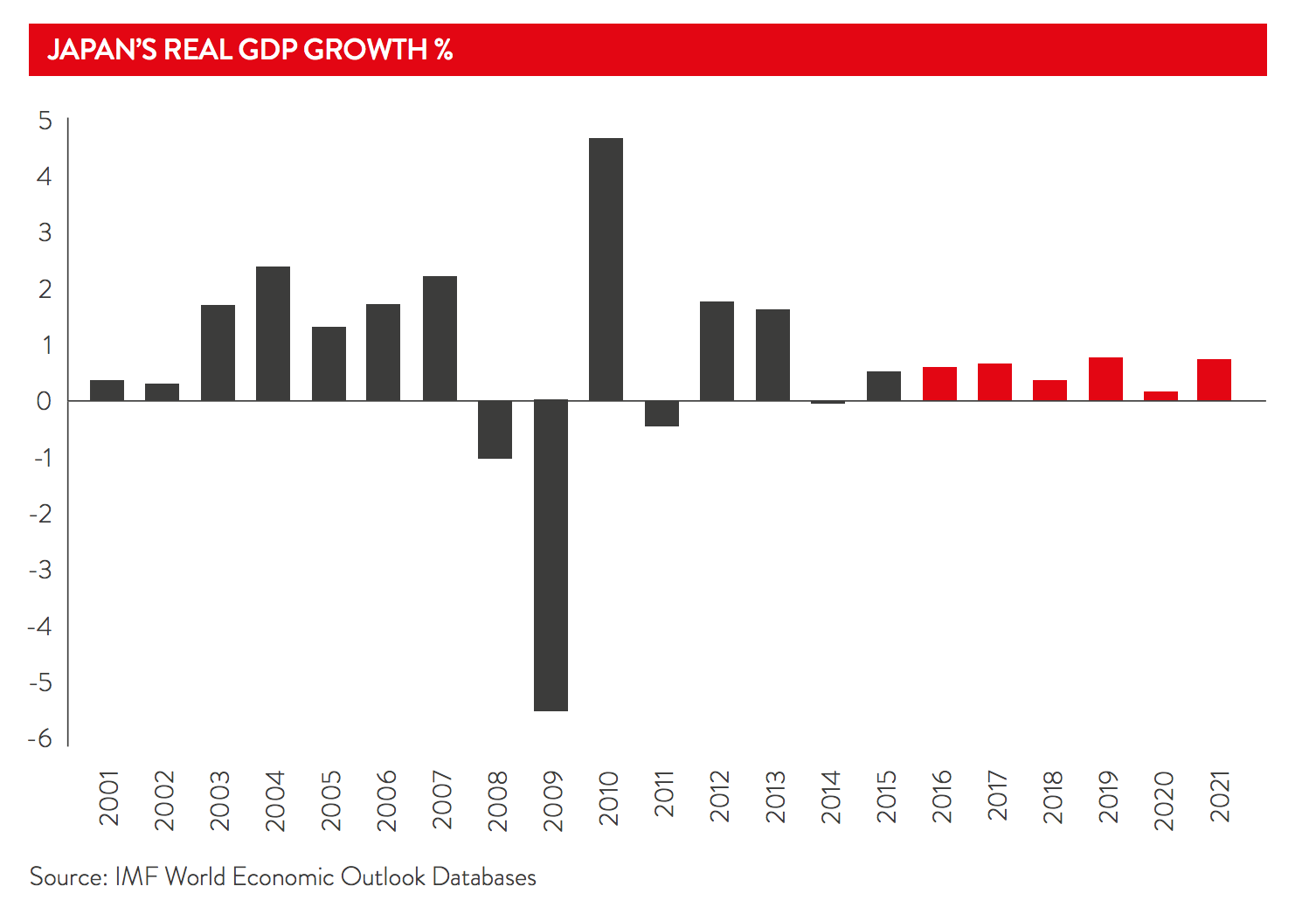

Also pushing the Dollar to higher highs this morning are our friends in Japan as the BOJ keeps their rates unchanged (negative) against our Fed's tightening. So you still have to PAY Japan to hold your money – getting back less than you give them to hold. Japan has an interesting problem as their economy is SO DEAD that they still don't even have 2% inflation – despite painfully high fuel prices. They have been trying to get their economy moving for the entire Century now in what used to be called "beating a dead horse."

Also pushing the Dollar to higher highs this morning are our friends in Japan as the BOJ keeps their rates unchanged (negative) against our Fed's tightening. So you still have to PAY Japan to hold your money – getting back less than you give them to hold. Japan has an interesting problem as their economy is SO DEAD that they still don't even have 2% inflation – despite painfully high fuel prices. They have been trying to get their economy moving for the entire Century now in what used to be called "beating a dead horse."

GOOGL is being beaten like a dead horse this morning – down 5% and slipping below $1.5Tn in valuation (awwwww) for the first time since last May. $2,400 is a 20% pullback from the November highs – back when Covid was "cured" and Putin was "strong", Inflation was "transitory" and the Supply Chain issues would be cleared up "right after the holidays"… Ah, good times…

As I said to our Members in yesterday's Live Chat Room:

GOOGL – As noted above, it's too early in the cycle to have any idea how these guys are being affected by war, inflation, covid, supply chain – doesn't make sense to guess. I imagine if NFLX saw pullback, YouTube might as well so GOOGL might take a hit but who wants to bet against them?

GOOGL is actually doing well compared to Zoom (ZM), who are down 75.8% from the high, PayPal (PYPL) down 73%, Netflix (NFLX) down 71.7%, Etsy (ETSY) down 67.5%, Penn National Gaming (PENN) down 61.9%, Match Group (MTCH) down 56.3%, Generac (GNRC) down 56.1%, Biogen (BIIB) down 55.8%, Meta/Facebook (FB) down 52.9% and Wynn (WYNN) down 50.1% – all big names that have taken big dives and – most notably – no one seems to consider them bargains just yet.

THAT is how overpriced the market has been, which is what I was preaching all of last year. A CORRECTION is just that – stocks dropping back to their CORRECT level – it does not mean they are going to bounce back to ridiculous prices that investors should not have been paying in the first place. We talked about NFLX in yesterday morning's Report and, even down 71.7% – it's only just now getting interesting to get in. We had been shorting it in the fall.

We thought it was safe to go back in the water on Boeing (BA) but they just reported losing another $1.24Bn on supply chain issues and Russian sanctions and the stock dropped to $160 this morning – where we still like it but it will take a while to recover. Microsoft (MSFT), at least, came in strong, led by growth in Cloud Computing.

FB reports this evening along with QCOM, PYPL, TROX, DFS, F, CAKE, AMGN and AFL – the fun continues…

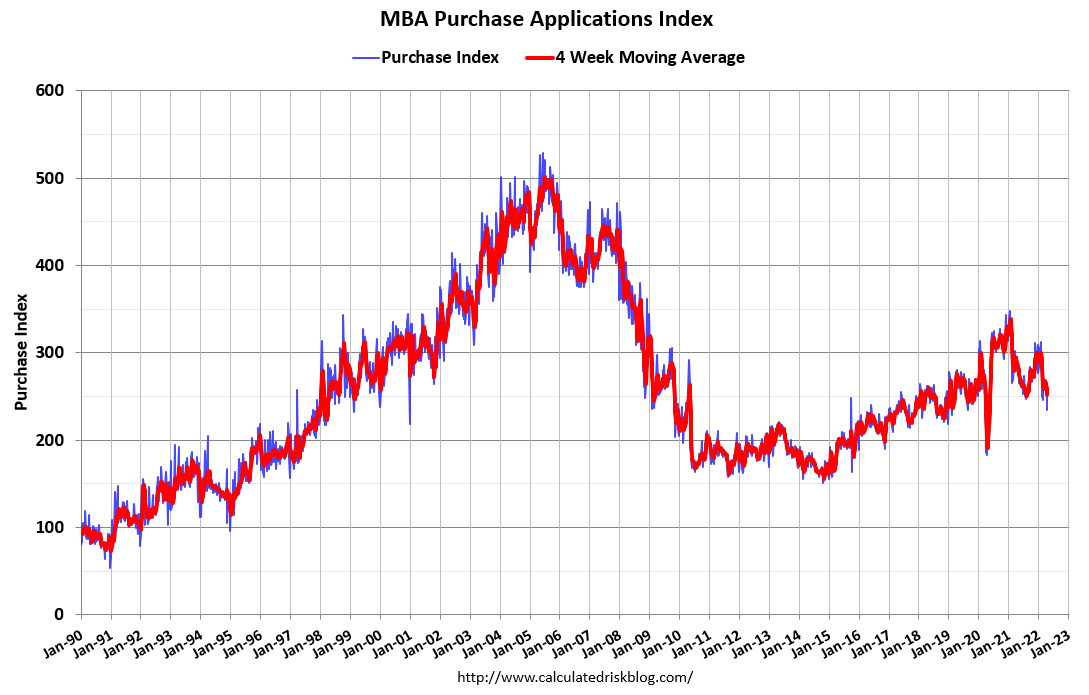

Mortgage Applications dropped another 8.3% this week, which is what we expected with the combined rise in borrowing rates over 5% and the Median Sales Price of all home rising from $360,000 last year to $436,700 in March – more than 20% higher. So, last year, a $360,000 mortgage at 3% cost $1,518/month (+ taxes, insurance) and now the same house at $436,700 at 5.5% costs $2,480/month (+taxes, insurance that have also gone up). That's a 63% increase in monthly payments for the year!

Something has to give….