That's what Warren Buffett said about the markets at this weekend's annual convention for his company. That did not stop Buffett from making $40Bn worth of bets this quarter – using about 1/4 of Berkshire's cash pile – mainly to by Occidental Petroleum (OXY) and Chevron (CVX). As we did, Buffett took advantage of the extreme volatililty to pick up some undervalued equities but he and I disagreed on CVX, as we took a short position – albeit after his long posltion caused the stock to make what we felt were undeserved new highs. We took the following position in our Short-Term Portfolio (STP):

| CVX Long Put | 2023 20-JAN 200.00 PUT [CVX @ $156.67 $-5.12] | 15 | 3/25/2022 | (263) | $60,375 | $40.25 | $9.40 | $40.25 | $49.65 | – | $14,100 | 23.4% | $74,475 | ||

| CVX Short Put | 2023 20-JAN 170.00 PUT [CVX @ $156.67 $-5.12] | -15 | 3/28/2022 | (263) | $-33,300 | $22.20 | $3.85 | $26.05 | – | $-5,775 | -17.3% | $-39,075 | |||

| CVX Short Call | 2022 17-JUN 170.00 CALL [CVX @ $156.67 $-5.12] | -5 | 4/13/2022 | (46) | $-4,250 | $8.50 | $-5.61 | $2.90 | $-1.61 | $2,803 | 65.9% | $-1,448 |

“We depend on mispriced businesses through a mechanism where we’re not responsible for the mispricing,” Mr. Buffett said.

Buffett felt CVX was undervalued at $140 and we felt it was overvalued at $170 and, so far, both of us are right though we're up $11,127 (48.7%) from our $22,825 outlay in just over a month while Buffett is up maybe 10% but, of course, he's up Billions as he has more money to play with…

Still, that's why they have penny slots in the casino – not everyone can play in the high-roller room with Musk and Buffett, who buy companies as often, and as easily, as we buy new shoes. To some extent, Buffett's confidence in ATI, ATVI, HPQ (we bought that one first), OXY and CVX is one of the things giving me confidence to hold our longs at the moment but, on the other hand, Munger was buying BABA and we stayed in – to our regret so far.

Are we still playing with Warren Buffett at the top of his gain or is this like when your Grandfather tells you something with absolute certainty that only makes you realize he's losing it after you follow his advice and he turns out to be totally wrong?

Are we still playing with Warren Buffett at the top of his gain or is this like when your Grandfather tells you something with absolute certainty that only makes you realize he's losing it after you follow his advice and he turns out to be totally wrong?

My father, David, was a brilliant man and a World class chess player and, when I was young, he would spot me a queen and two rooks and still kick my ass. Probably one of the saddest days of my life was the first time I beat him at chess. I was about 37 and he was 62 and I knew I wasn't that much better – he was slipping. It's very subtle but people who play chess know what I mean – you get an intimate view of your opponent's mind when you play.

I feel the same way about Buffett's trading decisions. I've been watching him closely for 40 years, studying his moves, analyzing his choices and I have very rarely had occasion to disagree with him but I was very vocal a few years ago, when he violated his own rule about owning airlines and, since then unfortunately, I've had more and more occasion to disagree with his choices. It doesn't make me happy to be right – it makes me sad.

ATVI, for example, Buffett bought on the news that MSFT was buying them but he bought around $85, which he justifies by saying MSFT's offer is $95 but, as noted above, we can make 10% a lot faster than that and we expected regulatory issues to hold up the deal for quite a while and, of course, ATVI has a toxic culture that can't easily be cured. MSFT clearly wants the software talent at ATVI and will PROBABLY close the deal eventually but I did not agree with tying up $85 on "probably".

Buffett also reduced his positions on V and MA, which is not something I would do with inflation boosting consumer spending – in addition to forcing them to put more things on charge accounts as consumers have to borrow to make ends meet. Will it end in disaster with defaults and charge-offs? Most likely, but not yet.

Buffett did keep AXP and I assume that's because it's not really a charge card in that people pay it off at the end of the month so they don't generally accumulate debt they will defualt on. Also, AXP serves a richer client base and has a much lower P/E (17) than V and MA (around 30) – so I agree on that one, but I'd wait for a pullback to jump in.

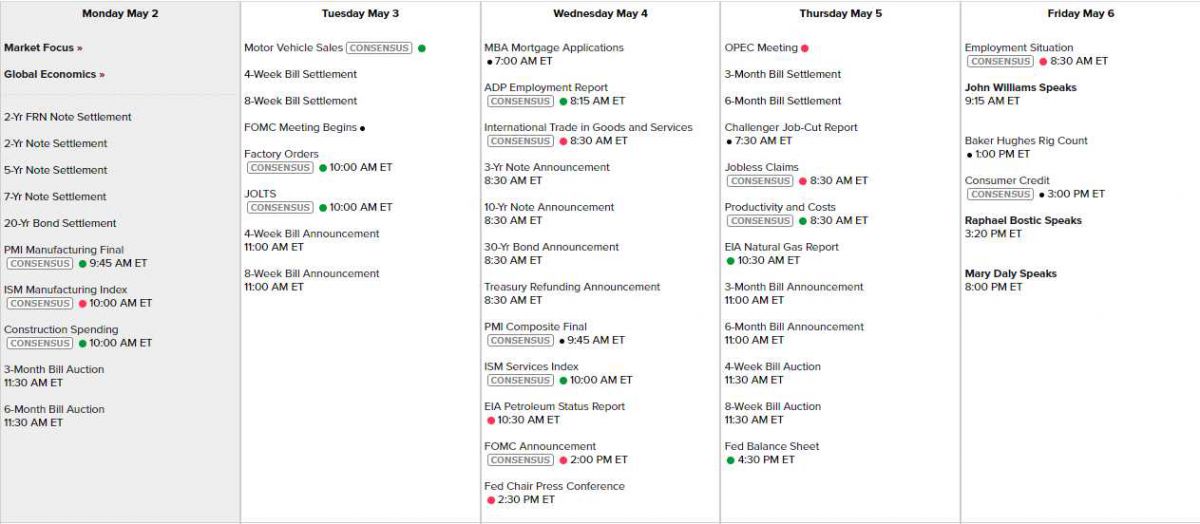

We'll all see what's good to keep and what's not this month as we move into the manic phase of earnings but this week it's all about the Fed and their Wednesday Rate Decision, which seems fixed at 0.5 – 0.75% – almost certainly 0.5% after last week's tragic GDP number (-1.4%). So, to some extent I think the market has over-reacted to recent Fed commentary but we're hitting some tragic levels on our bounce chart – so let's see if we get out of the woods before we aim for the stars:

- Dow 36,000 to 28,800 would be a 7,200-point drop with 1,440 bounces to 30,240 (weak) and 31,680 (strong).

- S&P 4,800 is 20% above 4,000 and that makes it an 800-point drop with 160-point bounces so 4,160 (weak) and 4,320 (strong).

- Nasdaq is using 13,500 as the base. 14,100 is the weak bounce and 14,700 is strong.

- Russell 1,600, would be about an 800-point drop with 160-point bounces to 1,760 (weak) and 1,920 (strong)

Since last Wednesday, we added a red box to the S&P 500 but that's the only thing that's changed so there's nothing to get excited, or worried, about – unless we can't take 4,160 back. The Dow is our lagging index so they are the best one to short at the 33,000 line (/YM), with tight stops above. A drop in the Dow to 31,680 at $5 per point would net $6,600 per contract and stoping out at 33,020 would cost $100 – a pretty good reward/risk ratio – don't you think?

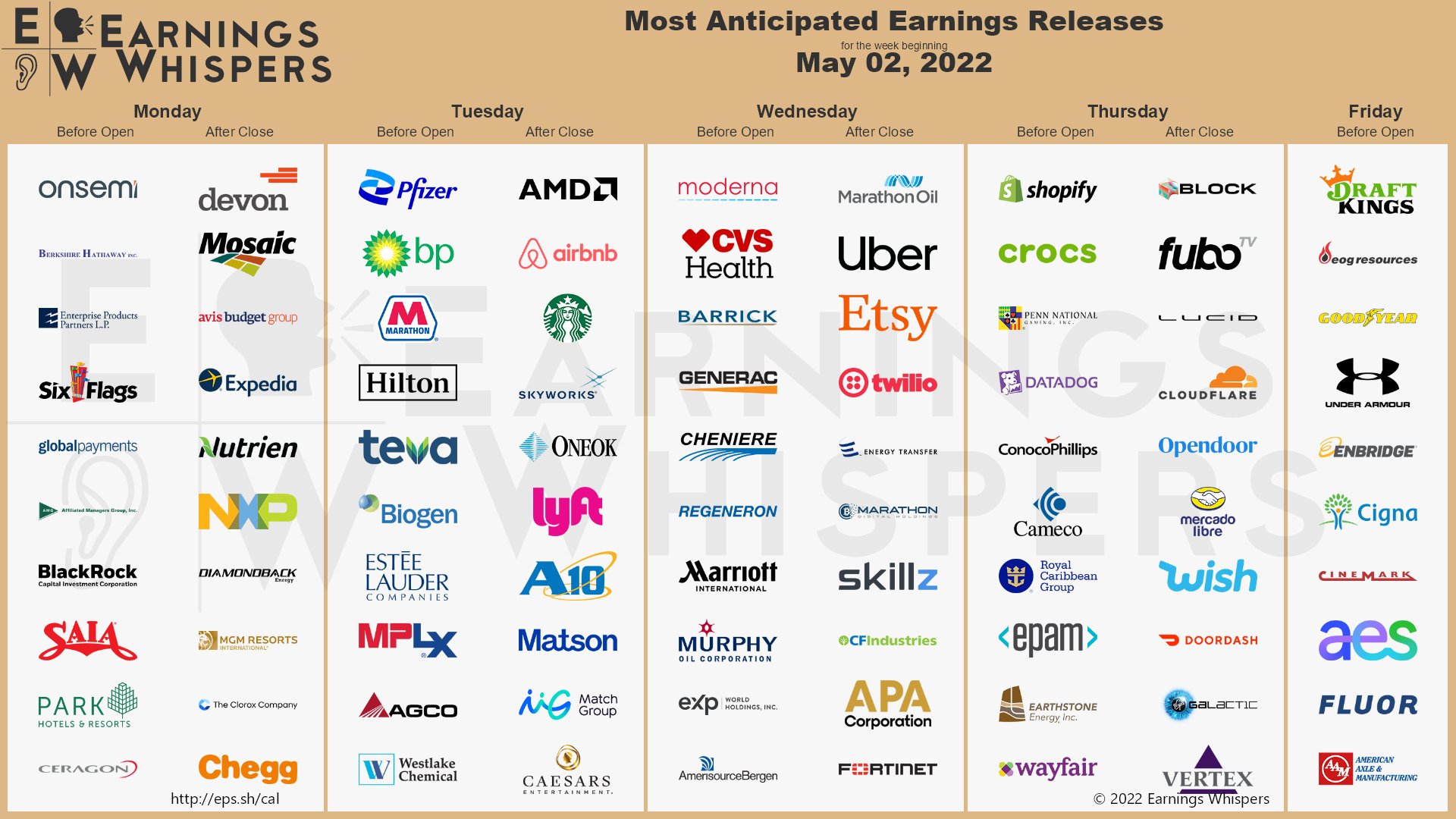

About 20% of the S&P 500 will report this week, along with a Fed Dow components but it's all about the Fed: