I love the Money Talk Portfolio!

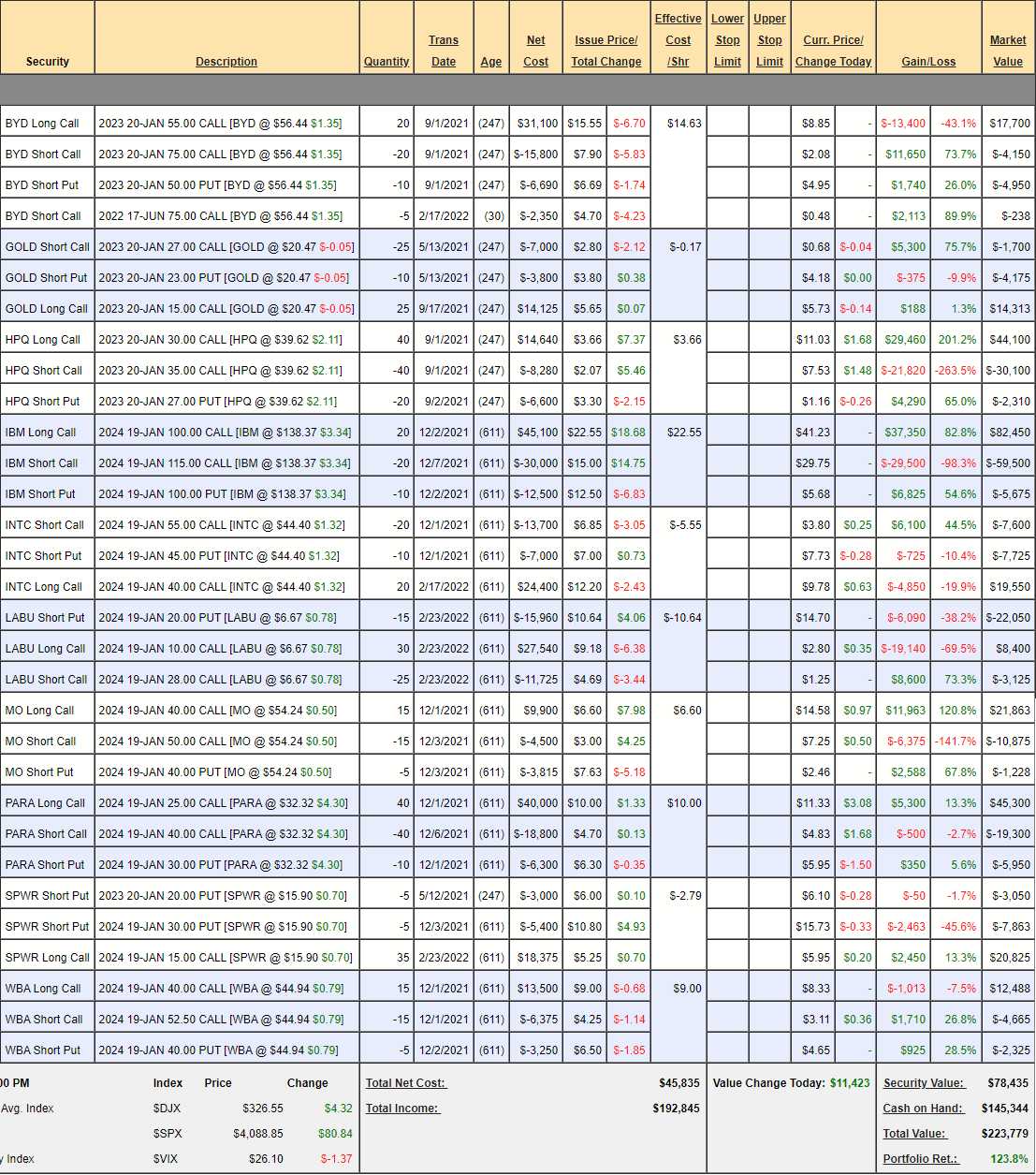

It’s a real test of skill since we can only do adjustments on show days and tonight I’ll be on Money Talk (Bloomberg, Canada) at 7pm for the first time since Feb 16th. At that time, we were up 140.9% at $240,926 and we had gotten very defensive, moving to 2/3 CASH!!! ahead of the coming correction – which we felt was long overdue. The S&P was around 4,400 at the time and is now 7.3% lower, at 4,076, and our portfolio is down 7% at $223,779.

This is exceptionally good as our newest trade, LABU (Biotech ETF) was a huge mistake at the time and we’re down $16,630 on that which means there is nothing wrong at all with the rest of our positions and just the one that needs to be fixed. We still have $145,344 (65%) in CASH!!! – and it should be a good time to deploy some as there are real bargains out there.

In the MTP, we seek to find “bullet-proof” positions that we won’t need to adjust from month to month as we only get one random day each quarter to make our changes. Though LABU was a bit of a risk, it’s a generally conservative portfolio but we felt we could afford a risk as we were up 140% at the beginning of year 3.

The market is still a bit iffy – so we’re not going too crazy but there are some compelling moves to make.

- BYD – 20% off the top is not bad and still good for a new trade at net $8,362 on the $40,000 spread so we have $31,638 (378%) of upside potential if BYD can get to $75 but 8 months is too much pressure so let’s buy 12 more by rolling 20 2023 $55 calls at $8.85 ($17,700) to 30 2023 $45 ($17.50)/65 ($8.50) bull call spreads at $9 ($27,000). Now it’s a $60,000 spread with a lower target and it cost us $9,300 to make the roll so in for net $17,662 overall and a $42,338 upside potential. No more short call sales until we resolve the short Jan $75s, of course.

- GOLD – A great inflation hedge but not acting like it lately. Fortunately, we are deep in the money and I’m comfortable with our targets on this $30,000 spread that is currently at net $8,438 so we have $21,562 (255%) of upside potential on this one.

- HPQ – Blew past our goal and no pullback – winner! It’s a $20,000 spread at net $11,690 so $8,310 (71%) upside potential if they hold $35 which may sound a bit dull but you make that in January (8 months) so about 9% a month should keep you ahead of inflation, right?

- IBM is our PSW 2022 Trade of the Year and it’s here, in all it’s glory at net $17,275 on the $30,000 spread that’s deep in the money but still has $12,725 (73.6%) left to gain and we started at net $2,600 – so we’re already up $14,675 (564%) – mission accomplished and then some!

By the way, that is our return on a trade that we played simply not to go lower than it was at Thanksgiving. You don’t have to swing for the fences or chase high-flying momentum stocks to engineer fantastic returns using these very simple option strategies – that is what PSW is all about teaching our Members!

- INTC – Intel did not make our Stock of the Year because this is not destined to be their year but next year should be. This trade is still about where we started at net $4,222 and it’s a $30,000 spread so we have $25,778 (610%) of upside potential – but it’s going to be a bumpy ride.

- LABU – Our newest and worst-performing position. I didn’t think Biotechs would drop further but they went down with the market anyway and there are tremendous bargains in the space – most notably MRNA as $142.28. While it would be tempting to flip to a play concentrating on that stock – I don’t want us over-committed on short puts. Our best bet is to adjust this position but we need to be realistic about the prospects. If Biotech bounces back 50%, LABU will go up 150% from $6.67 to $16.675 – so that should be our target. We can roll the 15 2024 $20 puts at $14.70 ($22,050) to 30 of the 2024 $10 puts at $6 ($18,000) for net $4,050. The obligation remains the same net $30,000 if we are assigned and we’re using $4,050 of the $15,960 we originally collected so now we have a net $11,910 credit remaining or $3.97 per contract so our net entry would be $6.03 – that’s a nice fix!

- We can also take advantage of the dip by rolling the 30 2024 $10 calls at $6.67 ($8,400) to 60 of the 2024 $5 calls at $4 ($24,000) and we’ll sell 30 of the 2024 $10 calls for $3 ($9,000) to help pay for it. That adjustment then costs us net $6,600 in addition to the $4,050 we’ve spent on the puts and we began with a net $145 credit originally so now we are in the spread for net $10,505 and we have 60 2024 $5 calls, 30 of which can make $5 at $10 ($15,000) and 30 of which can make $10 at $15 ($30,000), which we feel is a reasonable target. We can make more but let’s count on $40,000 less our $10,505 outlay and call this $29,495 (280%) of upside potential.

While it would have been nice if LABU had popped higher right on the button in February, our options spread left us flexible enough to simply put in some money (we had not put in any yet – just margin) with no additional margin and now we have a bit less upside potential (was $40,550) but a much lower target price ($15) to be successful.

- MO – Another one that didn’t go down much during the sell-off and we’re well over our goal so just sitting back waiting to collect the full $15,000 on what is currently a net $9,760 spread so $5,240 (53.6%) upside potential if MO simply holds $50.

- PARA (was VIAC) – We got off to a slow start but just yesterday, Warren Buffett announced he would join us with a 20% stake in the company so I think we’ll be good. It’s a $60,000 spread and currently net $20,050 so that’s $39,950 (199%) upside potential if they can make it to $40 in 18 months.

- SPWR – Like LABU, SPWR was underperforming and we gave it some love, taking a very aggressive stance last quarter. It did pop 50% but now it’s back in the same spot as the tarriff review process (for all solar, not just SPWR) continues to make a mess of the buisness. I still have faith and I expect them to be right back on track to $25, where we’ll sell some calls but $30 seems very fair as that should be $6Bn in market cap or 50x next year’s anticipated $120M in profits for a company in a huge growth cycle. That would put our $15 calls $15 in the money for $52,500 and currently we’re at net $9,912 so it’s $42,588 (429%) of upside potential and even more if we ever get a chance to sell short calls and reduce our cost basis. Who’s with me? Warren???

- WBA – I’m a little pissed off that they are selling Boots but how can I stay mad at a company that’s making $4.3Bn against a $38Bn valuation? They have $12Bn in net debt and the cash should knock down half of that and still leave them with over $2Bn to spend on their planned “Health and Wellness” upgrades to 9,000 US stores ($222,000 per store). Net $5,498 is about where we came in on the $18,750 spread and we still have $13,252 (241%) upside potential at $52.50, which I think is very reasonable.

So we have 10 existing positions using $87,735 in cash and $217,250 of ordinary margin (much less if portfolio margin, depending on your broker) and they have $241,238 of upside potential over the next 20 months. Will every one of them hit their goals? Probably not, but there’s no targets we aren’t comfortable with so we just have to hope the market does find a nice bottom around the 4,000 mark on the S&P 500 – though we think an addition dip to 3,600 could easily happen in between.

That would be just another opportunity to improve our positions!

Speaking of positions, on Monday, we discussed how ridiculously cheap Foot Locker (FL) is. I’m not going to rehash why I like it here. I’m tempted to take the stock position as it still returns 118% with the help of our option augmentations but why lay out the cash when we don’t have to? We’re going to go with the following spread:

- Sell 10 FL 2024 $30 puts for $8 ($8,000)

- Buy 25 FL 2024 $25 calls for $9 ($22,500)

- Sell 20 FL 2024 $40 calls for $3.75 ($7,500)

That puts us into the $37,500 spread for net $13,000 and it’s my intention to make that up by selling 5-10 short calls per quarter along the way. For example the Aug $35 calls are $1.85 so we could collect $1,850 selling 10 of those but, since it’s just ahead of earnings and we feel the market is underestimating FL – we’ll take a chance and wait for the results first. We have 613 days so sell so 6 sales like that would put $11,100 back in our pockets and blow the doors off the dividends. Upside potential as it stands now is $24,500 (188%).

We will see how the prices hold up, FL did pop yesterday but it’s dropping back this morning – we’ll have to wait for the market to open to price them out properly.

SOFI is a New Age Finance Company, offering Student and other loans to a younger crowd. They are mostly on-line but have 3 branches in California. Ordinarily, I would not pick a pre-profit company for the Money Talk Portfolio but SOFI has been trashed over a major misconception about how they will be affected by Biden’s proposed Student Loan Forgiveness. The average loan Sofi has with a student is $70,000. If $10,000 is forgiven – for one thing SOFI gets the money – it’s not a loss! For another thing that still leaves $60,000 (85%) of debt to be repaid yet the market is pricing it like that whole business line is gone. They JUST got chartered as a National Bank – that would not have happened if they were on the verge of bankruptcy. They just INCREASED their guidance for 2022, expecting to make $105M this year on $1.5Bn in revenues. That puts them at 65x earnings at $7.05 ($6.5Bn i market cap) but revenues are up 50% from last year and getting their charter gives them access to the Fed and cheaper money to lend out so more profits going forward and FDIC backing to help attract new clients. I love them!

Let’s add the following options spread:

- Sell 10 SOFI 2024 $10 puts for $5 ($5,000)

- Buy 40 SOFI 2024 $7.50 calls for $2.70 ($10,800)

- Sell 40 SOFI 2024 $12.50 calls for $1.65 ($6,600)

That gives us a net $800 credit on the $20,000 spread and the spread is out of the money but we’re speculating at this stage so, like LABU above, we can fix it if we’re wrong and, if we’re right, we should easily get to $12.50 in 18 months. Upside potential here is $20,800 if all goes well.

And just like that we added another $45,300 in potential gains to a $223,779 portfolio – so about 20% over the next couple of years. If we do that once per quarter, we can continue to do quite well for ourselves – without taking any crazy risks. We are simply following our core strategy – as summed up in this PSW Training Video: