We're on very shaky ground.

We're on very shaky ground.

The World is reeling from crisis to crisis and shortages are piling up and that's causing companies to issue warnings about future profits on an almost daily basis. We just ran out of Baby Formula, for goodness sakes! This is not getting better, it's getting worse as countries are starting to curb exports of things like wheat, corn and oils – as they aren't sure they have enough for their own people.

Russia is blockading Ukraine's wheat and that's about 10% of the entire World's supply. Wheat is used in lots of things so that shortage cascades down to food manufacturers and then to restaurants and, of course, Cost of Living Indexes.

Meanwhile, in our typical American fashion, we hear about India having a month straight of over 100 degree days and ignore it – even though the World is round and tends to spin so weather gets to us all eventually. The US is flat out not able to provide enough electricity to keep people comfortable in that kind of weather and we're looking at a summer of rolling blackouts if we suffer the same temperatures.

Why? Because we never spent the $2Tn we needed to spend to upgrade the Power Grid. Our Power Grid loses 67.8% of the electicity we generate, so it costs us Trillions of Dollars NOT to fix it. We have known about this for 20 years and we have done nothing for 20 years so my Top Trade Alert for this morning is to get solar panels, a home storage battery and a generator – the Government isn't going to save us so we have to save ourselves (and, by doing so, we take a little pressure off the grid as well).

Yes, it is actually that insane that to deliver 12.5 QBTU of energy to end users we use 31 QBTU of Fossil Fuels AND 6.4 QBTU of renewable energy. CLEARY addressing this problem would make the World a better place and CLEARLY it would be well worth borrowing $2Tn to save an estimated $500Bn PER YEAR in losses AND drastically reduce emissions but the Coal, Natural Gas and Nuclear lobbyists have fought tooth and nail for 20 years against any such improvements. Just ask Joe Manchin – who is single-handedly destroying the planet as we speak – or any Republican, of course…

This morning's bad news, other than 21 people being shot in a school in Texas or "Wednesday" as we like to call it in gun-crazy America, is the Dollar making a comeback after being down for two days of Davos. That's putting pressure on Stocks, Oil, Gold, etc, which is a shame as we went long on Silver (/SI) yesterday at $22 (but tight stops) – but we'll try again when it stops falling.

This morning's bad news, other than 21 people being shot in a school in Texas or "Wednesday" as we like to call it in gun-crazy America, is the Dollar making a comeback after being down for two days of Davos. That's putting pressure on Stocks, Oil, Gold, etc, which is a shame as we went long on Silver (/SI) yesterday at $22 (but tight stops) – but we'll try again when it stops falling.

The Dollar is going to be strong because the Fed is raising rates faster than other Central Banks and also because there are multiple political, natural and economic disasters all over the World and the Dollar is the "safe haven" currency that everyone DEMANDS when shit hits the fan.

Frankly, if it weren't for a Dollar that rose 13% in the past two years, inflation would be MUCH higher than it is now. But what makes us happy makes others sad and the Euro tested $1.05 this week as the Dollar hit 105 so figure 110 on the Dollar will be $1 for the Euro and that would be a complete catastrophe for the Euro Zone who, of course, are feeling the brunt of the war already as they move into their own long, hot summer.

Frankly, if it weren't for a Dollar that rose 13% in the past two years, inflation would be MUCH higher than it is now. But what makes us happy makes others sad and the Euro tested $1.05 this week as the Dollar hit 105 so figure 110 on the Dollar will be $1 for the Euro and that would be a complete catastrophe for the Euro Zone who, of course, are feeling the brunt of the war already as they move into their own long, hot summer.

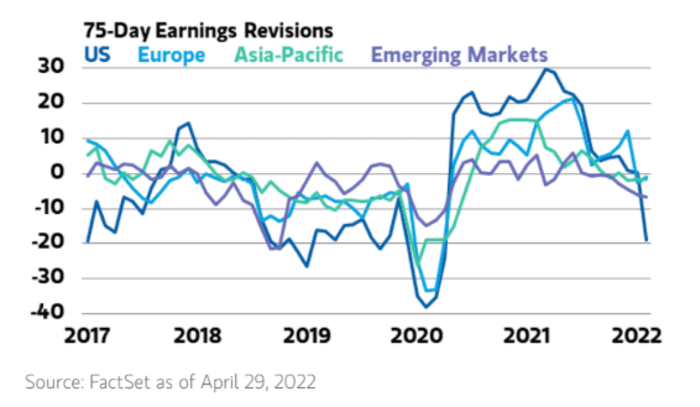

Earnings revisions in Europe and the US have gotten fairly drastic now down 20% for the Quarter in the US and that was only through the end of April, we've gotten a lot more bad news since then. As I have LONG pointed out, $11Tn in stimulus was 25% of our GDP in the past two years – lack of stimulus this year is, OF COURSE, going to lead to a lower GDP and lower Corporate Earnings – you can't wish it all away with positive thinking:

That's why I keep saying this is a CORRECTION – as in we are moving down to the CORRECT market levels – and not a pullback, which indicates that we expect to get back to the highs. The highs were WRONG – no one should have paid that much for those stocks and those people will now have to live with those decisions. It doesn't mean all stocks are bad but, unfortunately, a major market repricing can drag down good stocks – just as a major rally can lift bad ones. We are now in a reversal of both.

We have Fed Minutes at 2pm and people want to know what "neutral" will look like. Most likely there are two 0.5% hikes ahead of us but, after that, who knows? It's all going to hit the fan next month anyway, when the Fed stops buying TBills. Who will buy them? You???

The 10-year is bouncing off its lows at 118 but down from 140 is 22 so, by applying our 5% Rule™, we'll be looking for 4.4-point bounces to 122.4 (weak) and 126.8 (strong) and failing the weak bounce this week would be BAD!

Oh, I'm sorry, BAD makes it sound like it won't happen but it will. 140 to 118 is -22 which is 15.7% but it's a 10-year note so, if you bought one with 2% interest at 140 and rates go up to 3.5%, then your note is worth 1.5% less than a new note PER YEAR, or 15% less than the new notes. If the market begins to accept the fact that the Fed Funds Rate going forward will be more like 3.5%, then a TBill will be more like 5% and that would be a 3% annual disadvants for 2% note-holders and that would bring us to 140 x 0.70 = 98.

That being the case, there is no "bounce" – just a pause on the way to new lows.