Happy Juneteenth!

Happy Juneteenth!

The US markets are closed on Monday and that could be a good thing because they certainly suck when they are open. On June 3rd we finished at 4,100 on the S&P 500 (/ES) and June 10th found us at 3,900, which was down 4.87%, but close enough and now, on June 17th, we're down another 200 points to 3,700 and that's now pretty much 5% on the nose. Usually we're happy with a 1% bounce off a 5% drop but really this is a 10% drop so we need a 2% (of the index) bounce, which would be 80 points (20% of the 400 we lost) on the S&P 500.

That would take us to 3,780 and that would be a massive one-day move in /ES (not that we haven't had them on the way down) so let's not count on it. That means we can't be cute with our hedges and need to stay well-covered into the weekend – even if today does look LIKE a recovery.

We've been going through our Member Portfolios this week and, generally, we've been making bullish adjustments as this still has the smell of a forced bottom. The untouched Money Talk Portfolio, which we reviewed on Tuesday at $200,566 (up 100.6%) has slipped to $192,786 (up 92.8%)as of yesterday's close – as I said at the time, as long as we pick solid stocks with sound, Fundamental Values – we can ride out these little corrections.

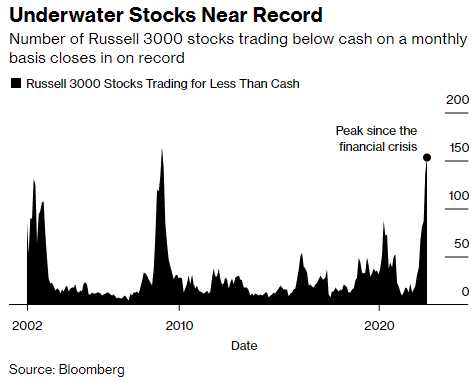

A good measure of market panic is how many stocks are "underwater", which is what M&A people call stocks that are trading below their cash levels (ie. great takeover targets). At the moment, there are 167 stocks on the Russell 3000 that are underwater, beating the previous record of 165 in February of 2009. They represent $55Bn worth of valuations – another clear record.

A good measure of market panic is how many stocks are "underwater", which is what M&A people call stocks that are trading below their cash levels (ie. great takeover targets). At the moment, there are 167 stocks on the Russell 3000 that are underwater, beating the previous record of 165 in February of 2009. They represent $55Bn worth of valuations – another clear record.

Trading platform Robin Hood (HOOD) is one example of a company trading below cash as their market cap has fallen below $6Bn at $6.89 but they have $6.2Bn in the bank. HOOD lost $3.6Bn last year and expects to lose $1.3Bn this year – so I'm not saying they are a good one – just pointing out an example. You still have to pay attention to the Fundamentals and, in the case of HOOD, they simply had generous investors and raised a ton of cash in their IPO – and now they are burning through it.

MUFG is more interesting as they have $150Bn and a market cap of $69.5Bn at $5.59. This happens with foreign stocks because their Cash Balance is priced in Yen and the Market Cap is priced in Dollars and a lot of programs don't convert well so they don't show up on screens. As with many banks, a large portion of that money may be investor deposits – you have to dig deeper but this bank is a huge value at this price.

MFG, BCS, DB, NWG, SAN, BK, ING, HBSC, UBS… all are starting to get attractive – it's been ages since we invested in Financials but, now that panic has set in and things are on sale – we may do a bit of shopping in that sector.

Outbrain (OB) is an interesting one. They are a sort of ad provider on the Web and they IPO'd in 2021 and have gone straight to Hell ever since but they still have $171M in cash, which is more than half their $269M valuation (at $4.66) – even though they have been executing their plan and made $11M last year and expect to make $33M this year.

Outbrain (OB) is an interesting one. They are a sort of ad provider on the Web and they IPO'd in 2021 and have gone straight to Hell ever since but they still have $171M in cash, which is more than half their $269M valuation (at $4.66) – even though they have been executing their plan and made $11M last year and expect to make $33M this year.

You can give yourself a discount selling OB Nov $5 puts for $1, which nets you in at $4 for a 14% discount if it drops or a 100% (25% of your risk in 6 months) profit if it pops – I like those odds!

OPTT are old friends from Jersey sitting on $63M yet valued at $30M I love their technology (wave power generation) but it's still in development, so risky to own – even at 0.53. RWLK is another speculative penny stock and this one is in our Future Is Now Portfolio. At 0.88, it's $55M in market cap and RWLK has $82M in the bank and burned $12M last year so it should last them and I love their technology.

ITOS is working on cancer cures and investor impatience has taken them down to $658M but they have a nice $824M in the bank and they just made $1.82 per share in the last quarter. It's the kind of Biotech I like to give a chance to. The Jan $15 ($6)/20 ($4.25) bull call spread at $1.75 is 100% in the money and pays up to $5 at $20 for a $3.25 (185%) potential gain in 6 months.

That's why I like those kind of plays.

Have a great weekend,

– Phil