Here we go again.

Here we go again.

Will the Fed raise interest rates by 0.25% or 0.5% in March? That is the question that investors are anxiously waiting for an answer from Fed Chair, Jay Powell, who speaks to the Senate this morning at 10am. I think it may be 0.5%, and here is why:

The Fed’s last meeting in January resulted in a 0.25% hike in the Fed Funds Rate to 4.75%, but this was not enough to cool down the economy or curb inflation expectations. Mortgage Rates have soared to 7%, indicating that investors anticipate further tightening from the central bank in the near future.

The Fed’s goal is to slow down investment spending and lower asset prices by making borrowing more expensive and less attractive. However, this strategy has not worked so far. Hiring has remained strong with 517,000 jobs added in January, and consumer spending has shifted towards labor-intensive services that keep demand for workers high.

In contrast, higher rates have increased costs for businesses and consumers alike, creating upward pressure on prices and wages. Powell acknowledged this risk at his press conference after the last meeting: “We’re going to be looking carefully at the incoming data between now and the March meeting,” he said. “If we come to the view that we need to move up rates beyond what we said in December, we would certainly do that.”

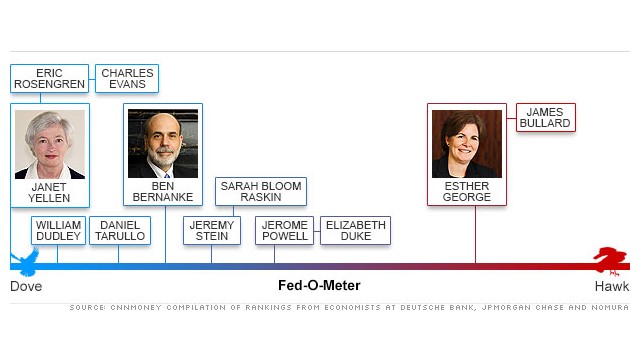

Therefore, I believe that Powell will signal a more hawkish stance today and prepare us for a 0.5% hike in March. This would be a bold move that would surprise many market participants and could send stocks and real estate back down again – so check your hedges! It would also signal that the Fed is serious about fighting inflation and preventing a possible recession.

Moreover, recent data shows that inflation is not only high but persistent. The Commerce Department reported that inflation rose by 5.4% in January from a year earlier, well above the Fed’s target of 2%. The core inflation measure that excludes food and energy was also high at 4.7%, up from December’s level.

This surge in inflation came as Americans’ spending and income rose by 1.8% in January, which was the largest increase in nearly two years. This suggests that consumers are confident and willing to spend despite higher prices. Some factors that might have boosted their income include higher state minimum wages and annual cost-of-living adjustments for retirees.

Last week Mastercard estimated that U.S. retail sales, excluding cars, rose 8.8% in January from a year earlier. Bank of America said credit- and debit-card spending per household rose a seasonally adjusted 1.7% in January, reversing a 1.4% decline in December. Higher state minimum wages and annual cost-of-living adjustments for retirees might have contributed to the rise, the bank said.

These factors also contribute to higher inflation by increasing labor costs and demand for goods and services. According to Cleveland Fed President Loretta Mester (who does not have a vote this year), these inflation pressures are “pretty ‘in there’.” She means that they are not likely to fade away soon without policy intervention.

The Fed needs to act more aggressively than most investors expect. Most investors are expecting three 0.25% hikes this year – one in March, one in May, and one in June – bringing the Fed Funds rate to around 5.5%, but I say 6% is more likely when they’ll finally be done.

We’ll see what Powell says today but I’d be a lot happier if he prepares the market for an 0.5% hike in two weeks – as it’s more likely to have an actual effect that will begin to cool inflation off. Otherwise, these hikes could just drag on all year.