Come on people, let’s give Trump 2.0 a chance.

Come on people, let’s give Trump 2.0 a chance.

As investors, we should not pre-judge or speculate on what Trump MIGHT do. It’s less than 24 hours into his 2nd term in office and let’s just focus on the things he ACTUALLY does and then simply analyze how that might affect us as citizens and investors. After all, we just voted for this guy and we certainly knew what we were buying after the Trump 1.0 test run.

- Stock Market Today: Dollar Whipsaws on Trump Tariff Plans; Futures Tick Higher

- Trump orders US exit from Paris climate agreement and WHO

- Trump Lifts Biden’s Freeze On Liquefied Natural Gas Exports

- Trump declared an emergency at the southern border. Here’s what that means.

- U.S. Treasury set to use ‘extraordinary measures’ starting Tuesday

- Donald Trump to sign orders ending diversity programs, proclaim there are only two sexes

- Oath Keepers Founder Leaves Prison After President Trump’s Pardon

- Trump Orders Agencies to Halt Spending From Biden’s Climate Law

- Millions Targeted for Immediate Expulsion as Trump Fulfills Vow

- In Shake-Up, Trump Administration Jolts F.B.I. by Installing Acting Leader

- Trump orders government not to infringe on Americans’ speech, calls for censorship investigation

- Trump Administration Fires Immigration Court Officials as Crackdown Begins

- Trump to declare ‘national energy emergency’ to open up resource extraction

- Trump revokes security clearances for 50 ex-intel officials — including 4 former CIA directors

- ‘We will pursue our manifest destiny into the stars.’ President Trump wants astronauts to raise the American flag on Mars

- Trump’s crypto-frenzied inauguration weekend makes first family billions of dollars richer

- Donald And Melania Trump Memecoins Crash, Erode Billions In Investors’ Wealth

- Trump signs executive order attacking birthright citizenship guaranteed by the Constitution

- Trump Plans to Impose 25% Tariffs on Mexico, Canada by Feb. 1

- Trump orders end to remote work, hiring freeze for federal workers

- Trump revokes Biden executive order on addressing AI risks

- Trump Signs Two Orders to Dismantle Equity Policies

- Trump rescinds Biden’s census order, clearing a path for reshaping election maps

- Trump signs executive order to reverse Biden’s electric vehicle policies

- Trump Orders End to All Wind Energy Permits

- Trump’s Return Nudges Economists’ Inflation Outlook Higher

- Trump’s return puts Medicaid on the chopping block

You know, I was going to comment on each item but there’s 27 items in 20 hours and I’m pretty sure I missed a few. As a quick, overall view, I’d say this is good for Energy Companies (oil, gas & coal), great for Financials (deregulation), great for Private Prisons (as we predicted post-election) and, of course, paradise for Defense Contractors.

The above changes look challenging for EV Manufacturers on a major policy reversal that I bet somehow carves out an exemption for Tesla. Renewable Energy Companies and anyone trying to stop the planet from bursting into flames have been kicked to curb (perhaps “Disco Inferno” is more appropriate than “YMCA“? – especially as it’s by “The Trammps” – so we just need to flip one letter!).

Apparently if you or your company rely on anything imported from Mexico or Canada – you are sh*t out of luck and Tech Companies who did not attend Trump’s Coronation will also be facing regulatory scrutiny designed to hold them back while Trump’s Magnificent 7 supporters consolidate their monopolistic gains. This is going to be a fun 4 years!

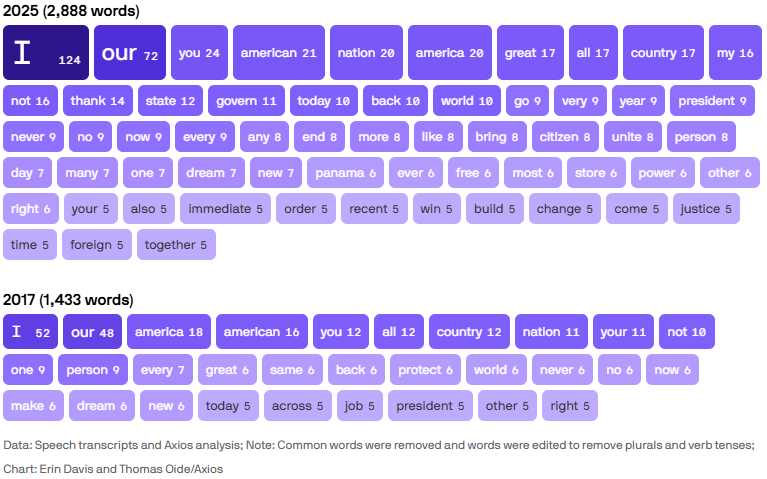

Trump’s 2025 Inaugural Address was 90% longer than his 2017 address but he talked about himself (“I“) 138% more often and talked about “you” twice as often (losing ground) and only talked about “Americans” 31% more (essentially ignored). Also ignored was “World“, which fell from 6 mentions to Zero. That does about sum it up – don’t you think?

US Natural Gas Exports took a pause under Biden as Biden was concerned about the Environmental Impact and methane leakage along the LNG chain was an immediate threat to the planet (Earth, that is – also with zero mentions). Biden was also concerned that allowing the planned 66% increase in Natural Gas (/NG) production over the next 3 years would cause us prices to come into line with the rest of the World (as we export our surplus) the way it has with Oil and Gasoline. As it stands now, US Consumers are paying roughly one-quarter of what the rest of the World pays:

US Natural Gas Exports took a pause under Biden as Biden was concerned about the Environmental Impact and methane leakage along the LNG chain was an immediate threat to the planet (Earth, that is – also with zero mentions). Biden was also concerned that allowing the planned 66% increase in Natural Gas (/NG) production over the next 3 years would cause us prices to come into line with the rest of the World (as we export our surplus) the way it has with Oil and Gasoline. As it stands now, US Consumers are paying roughly one-quarter of what the rest of the World pays:

-

- Henry Hub (US): $3.95 per million British thermal units (MMBtu)

- Dutch TTF: $14.17 per MMBtu

- UK NBP: $14.43 per MMBtu

- LNG Japan/Korea Marker Platts: $13.74 per MMBtu

Natural Gas represents 36% of our total energy production but we are also the World’s top consumer of /NG – using 22.1% of the World’s supply. So, if 1/3 of our energy consumption jumps 4 times – will that cause inflation? I know, it’s a puzzler and we’re not pre-judging Trump’s policies – so we’ll see how things play out!

Exiting the Paris Climate Accords and the World Health Organization are two more consequence-free accomplishments for day one. This is so exciting isn’t it? Speaking of no consequences: How great is it to know that you can attack the Capital and expect to be pardoned (if you back the right horse)? That can never backfire…

The “national emergency” on resource extraction bodes well for our friends at Northern Dynasty Minerals (NAK), who we have played on and off during the year and is bouncing back to 0.69 this morning and I love them as a speculative play on “anything goes” for the miners (enjoy your salmon while you can).

In fact, let’s add 1,000 shares ($690) of NAK to our $700/Month Portfolio!

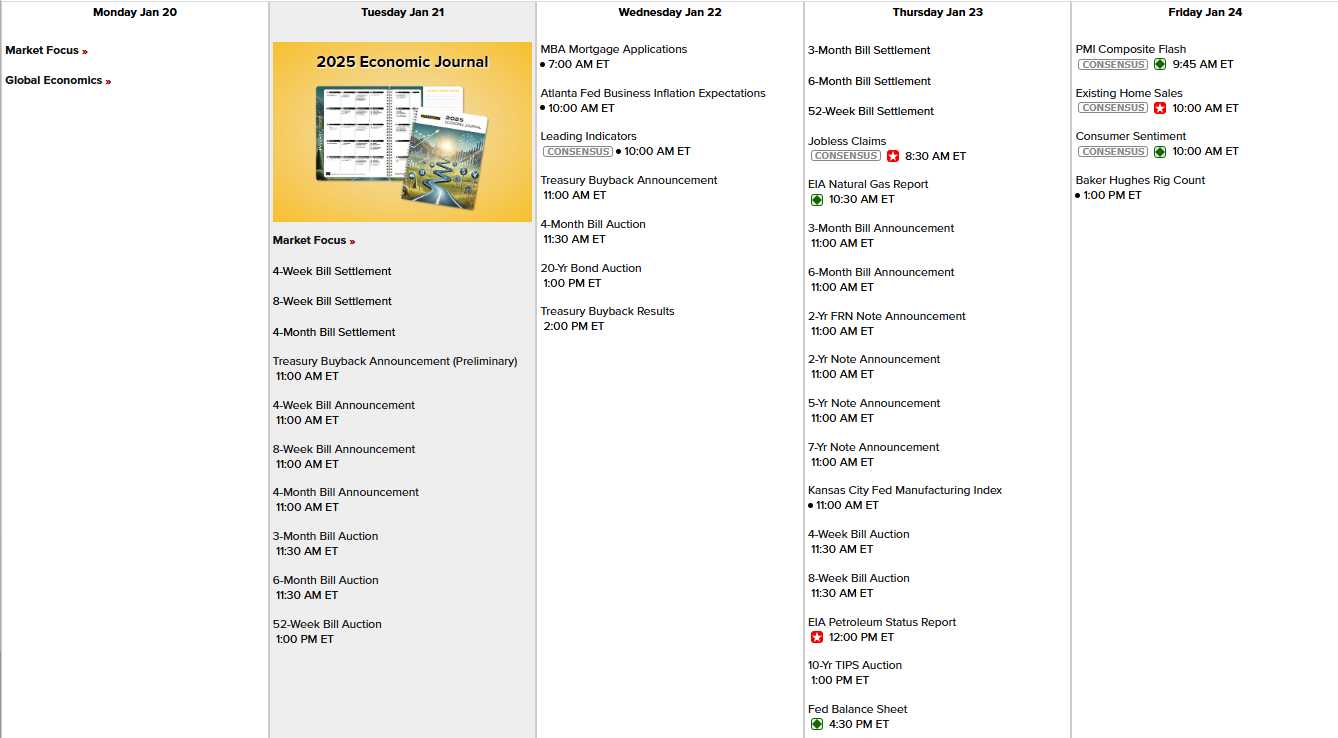

Meanwhile, it’s a short market week and, holy cow, next week is the end of January already! Lots and lots of note auctions this week along with Leading Economic Indicators and Business Expectations tomorrow and PMI and Consumer Sentiment on Friday – pretty dull, actually:

Earnings, on the other hand, are coming in fast and furious, with many, many key reports:

So far, we’ve had generally good news and guidance and, this morning, the Futures are up about 0.5% while the Dollar is down 0.75% (108.40) – so let’s not get too excited. Oil has fallen 2.5% to $75.44 because, as we discussed last week – there was no reason for it to hit $80 – certainly not because Trump wants to increase drilling…

All these wild regulatory swings should make for a very interesting earnings season that will be full of opportunities – come join us inside!

[ctct form=”12730731″ show_title=”false”]