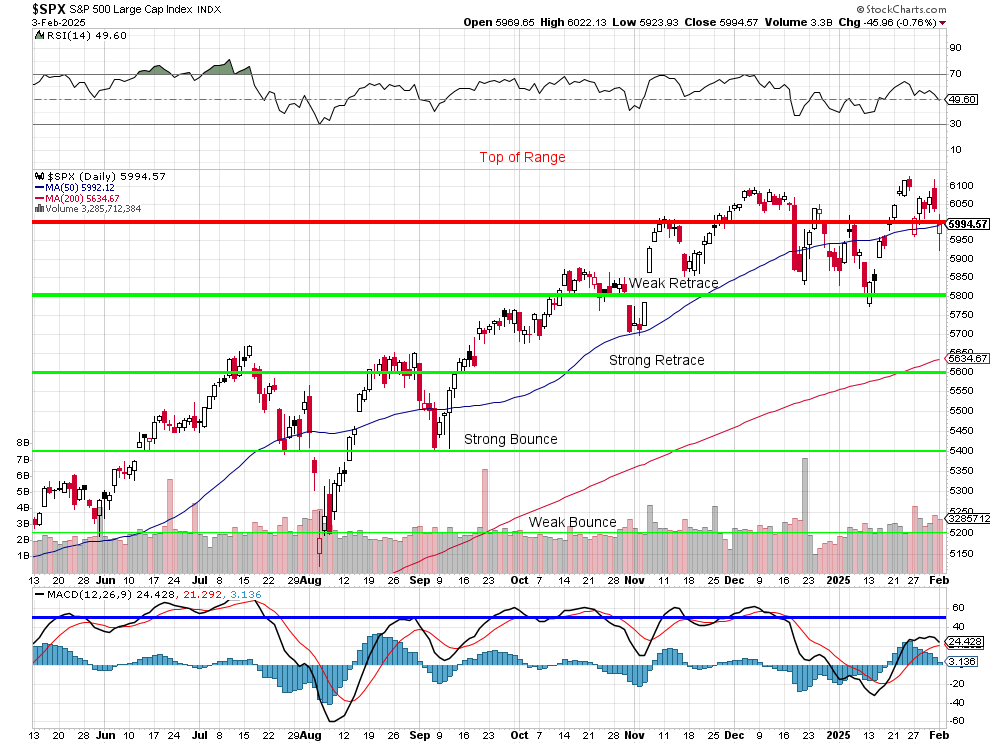

We are still testing 6,000 on the S&P 500:

Trump or no Trump, we’ve been doing it since November and that’s after 45 Executive Orders and 3 tariff announcements – two of which have now been pushed back 30 days. With ALL this nonsense going on – we are still in the SAME range we expected to be in when Kamala Harris (remember her?) was leading in the polls. It’s the same range we expected when Joe Biden (remember him? – he doesn’t) was running for re-election.

And why is that? It’s because, after the rules are changed and the rhetoric is shouted and the dust begins to settle, what always remains is VALUE! What are these stocks WORTH? THAT is what matters in the markets – nothing else. That is why we’ve been holding our long positions and hedging against the idiocy – because the idiocy does pass – and the value remains.

Notice the 200-day moving average of the S&P 500 has crossed over the Strong Bounce Line at 5,600 and that makes it very unlikely we are going to fall below that line and that line is only down 400 points from here (6,000) and that’s only a 6.66% decline (Donald’s favorite number!), which means we are probably over-hedged.

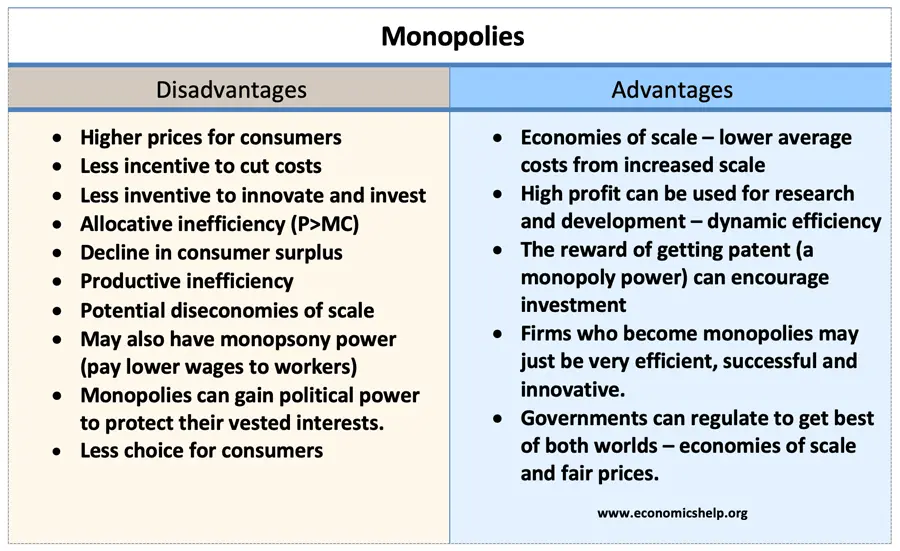

Of course, we’re not hedging the S&P – those are the stocks we have long positions in. Our primary hedges are the Nasdaq (Tech) and the Russell (Small Caps) as the Nasdaq has a lot of overbought stocks in it and the Russell has a lot of stocks that are still suffering from Inflation, Labor Shortages, Tariffs and, of course, runaway large-cap monopolies that are controlled by our beloved Oligarchs, who are also now in control of our Government.

Of course, we’re not hedging the S&P – those are the stocks we have long positions in. Our primary hedges are the Nasdaq (Tech) and the Russell (Small Caps) as the Nasdaq has a lot of overbought stocks in it and the Russell has a lot of stocks that are still suffering from Inflation, Labor Shortages, Tariffs and, of course, runaway large-cap monopolies that are controlled by our beloved Oligarchs, who are also now in control of our Government.

[ctct form=”12730731″ show_title=”false”]

Here’s a nice way to look at the flow of the markets since the election – using the ETF performance over the past 3 months:

The market has been generally “risk-on” (which is why we’re at all-time highs) but yesterday was a wake-up call on how quickly things can change with a stroke of Trump’s pen (or eraser) and the dust hasn’t settled yet so we maintain our love for large-cap value plays (SPY).

Real Estate (IYR), Materials (XLB), Home Builders (XHB, ITB) and Biotech (XBI) are our big laggers but does that make them bargains or sectors to avoid? A lot of that depends on which policies stick over the next few months so we’ll check back from time to time to see how things are going.

Trump did not reverse or delay the China Tariffs (10%) and the Empire is already striking back with tariffs in kind while also further limiting exports of Rare Earth Materials (which we REALLY need) and launching an anti-trust investigation into Google, who have been banned (search) from China since 2010 and now it seems like Nvidia (NVDA) is also going to be investigated!

Speaking of value plays, Merck (MRK) is taking a big hit this morning as they beat Q4 expectations but lowered forward guidance from $9 to possibly as low at $8.88 (1.3%).

This is a ridiculous over-reaction though there is some danger in MRK’s long-term outlook as Keytruda, whose sales were up 19% in Q4 is now 46% of MRK’s revenues AND the patent is expiring in 2028. Gardasil is their 2nd biggest drug and they are halting first-half shipments to China and Forex headwinds cut 2% off their profits in 2024 due to the strong Dollar.

Still, MRK is trading at 10x forward earnings at $90 and, as always, the company has a strong pipeline. I do like PFE better and they just had good earnings as well and are moving higher but we already have PFE in pretty much all of our Member Portfolios. We will take advantage of MRK’s downturn to at least sell some short puts – like the 2027 $90 puts for $12+, which would net us in for $78 – a very good place to start!

As to PFE, the train is leaving the station but it’s a big ($150Bn), slow train and you can still jump on before it pulls away. PFE is also trading below 10x forward earnings and they pay a very nice 6.4% ($1.70) dividend – which means there are many, many ways we can make money trading PFE!

[ctct form=”12730731″ show_title=”false”]