143,000.

143,000.

That’s how many jobs were added in January, down from 307,000 in December and there’s no sign of the massive adjustments that were supposed to be coming from the BLS. The rest of this Quarter hods the “promise” of MASSIVE Government layoffs – so it’s going to be a very interesting start to 2025.

Despite the low labor additions, Unemployment DROPPED to 4% from 4.1%, indicating lower Labor Force Participation (bad) and hourly earnings jumped from 0.3% to 0.5% and that is TERRIBLE news for our Corporate Masters, which is very likely to keep the Fed from lowering rates until we get back to 0.3%.

What is indicated here is that Companies are paying more money to retain existing workers – rather than expanding hiring (hence the sharp drop in relative Productivity yesterday). There SHOULD have been a massive (2M+) adjustment due to Census Population Adjustments and it’s not clear why this didn’t happen. It’s possible Trump/Musk delayed the revision so they could take credit for the gains next month.

The bottom line is that wage-push inflation remains very strong and the Labor Market is still very tight. Tariffs are not going to help the situation – adding more inflationary pressure so we’re pushing the Fed back to Q3 at this point and you can already see the bond market reacting, with the 10-year now a full point off the week’s high and only 2 points off the low.

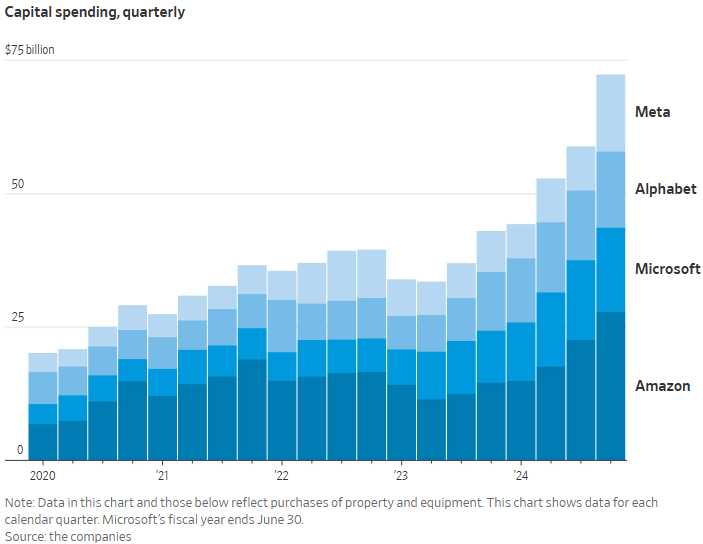

Take all that into consideration with the fact that just four (4) of the Tech Titans – AMZN, GOOGL, META and MSTF – spent $73 BILLION last quarter and are projecting (with AMZN’s $100Bn pledge) to spend $315Bn in 2025, so far! That’s going to require a lot of workers as it’s the entire GDP of Hong Kong, which takes 7.5M people to produce – talk about an upcoming labor shortage!

Take all that into consideration with the fact that just four (4) of the Tech Titans – AMZN, GOOGL, META and MSTF – spent $73 BILLION last quarter and are projecting (with AMZN’s $100Bn pledge) to spend $315Bn in 2025, so far! That’s going to require a lot of workers as it’s the entire GDP of Hong Kong, which takes 7.5M people to produce – talk about an upcoming labor shortage!

Don’t worry, kicking out all the immigrants will fix that – somehow…

Minneapolis Fed Chief, Neel Kashkari said this morning “We’re in a very good place to just sit here until we get a lot more information on the tariff front, on the immigration front, on the tax front, I would expect the federal funds rate to be modestly lower at the end of this year.”

[ctct form=”12730731″ show_title=”false”]

If traders can’t figure out that that is bearish news today – someone is bound to explain it to them over the weekend.

Next week we get CPI on Wednesday and that was 0.4% in December so imagine if we get a worse reading than that! We get PPI on Thursday and that was only 0.2% in December but still totaled 3.6% in 2024 and Food is up in January along with Natural Gas, Petroleum Products, Interest Rates, Coffee, Lumber, Sugar, Gold, Copper Silver, Platinum, Cattle, Corn, Wheat…

And then Friday we get Retail Sales, Import/Export Prices and Industrial Production & Capacity Utilization and, of course MORE EARNINGS!

Have a great weekend,

-

- Phil

[ctct form=”12730731″ show_title=”false”]