Welcome to day 21 of Trump 2.0.

Mondays tend to be good and Friday’s tend to be bad and the pattern continues at the start of Trump’s fourth week in office (again) as he said before the Superbowl that Canada should be a state and DOGE will be swarming the Department of Education where Trump aims to save Billions by not wasting money educating handicapped or otherwise disadvantaged children – who tend to cost the DOE a lot of money with all their “special needs.”

With most of America watching, Trump described Gaza as a “large real estate opportunity” – especially now that it’s been bulldozed flat by Israel. Trump proposes relocating Palestinians (2M of them) to other regional countries and yes, of course they are about as thrilled with that plan as Trump would be if 2M Mexicans were being relocated to Palm Beach County.

The interview with Bret Baier was notably light on follow-up questions, with Trump often giving rambling answers that didn’t address the original soft-ball questions. The full interview was only partially aired during the Super Bowl pregame show, with the remainder scheduled to air on Baier’s Fox News show – so potentially more damage to come.

Meanwhile, Trump is suing Paramount/60 Minutes for $20Bn for their edits of an interview with Kamala Harris that “made her look good” and his legal team has dropped their originally idiot claim that Trump’s freedom of speech has been violated to an even more ridiculous claim of “Unfair Competition” because, to DJ Trump, the US Presidency is indeed a business and any attempt to prevent him from skimming the funds causes damages to him which, of course, everything is all about.

Trump’s FCC appointee, Brendan Carr, opened an inquiry into CBS and ordered the release of the raw interview footage and transcripts (unprecedented trampling of freedom of press, which is the First Amendment). The unedited footage confirmed CBS’s account that Harris was quoted accurately but that isn’t stopping the lawsuit and the lawsuit IS stopping PARA’s $8Bn Merger with Skydance and that’s causing Shari Redstone to pressure PARA to settle and that settlement then becomes leverage for Trump to sue more media outlets and *PRESTO!* freedom of the press disappears!

Carr has linked the “investigation” of the Harris interview to the FCC’s approval of the Skydance merger so the FCC has already been weaponized to attack Trump’s enemies in the press. META already paid Trump $25M for daring to ban his hate speech the last time he was President and DIS paid Trump $15M over something George Stephanopoulos said on ABC news that Trump didn’t like and here we have the blueprint for using Regulatory Power to force Media compliance. Enjoy the show!

[ctct form=”12730731″ show_title=”false”]

There’s a reason we care about Geopolitics at PhilStockWorld and that’s obvious this morning as Gold taps $2,932 – getting close to our predicted “$3,000 by Summer” mark and Copper is likewise flying up to $4.635 and, right after Trump was elected, on Nov 18th we put out a Top Trade Alert for the US Copper Index Fund (CPER), which was $25.86 at the time and our trade idea was:

CPER is a Copper Fund and it hasn’t been below $25 since April and only for a day or two so here’s a nice short-term play for Copper:

-

-

- Sell 10 CPER April $25 puts for $1 ($1,000)

- Buy 10 CPER April $22 calls at $4 ($4,000)

- Sell 10 CPER Jan $26 calls for $1 ($1,000)

-

That’s net $2,000 on the $4,000 spread that’s 100% in the money and if CPER is not up on Jan 17th, we simply sell 10 April calls and further lower the basis, which makes it hard to lose (though we may end up owning it if Copper fails to hold $4). Let’s put this in the STP just so we remember to track it.

CPER is at $29.24 this morning and that’s up 13% in three months but, through the magic of options, the April puts are now 0.13 ($130) and the $22 ($6.70)/26 ($3.00) bull call spread is already net $3.70 ($3,700) so this trade is net $3,570 and already up $1,570 (78.5%) and well on its way to the full 100% gain – congratulations to all who played!

This is how it works, folks! We read the news and interpret the policies and events and what those policies and events are likely to lead to and we place our bets accordingly. So yes, excuse me if I end up talking about the President a lot – he is the President and he does a lot of stuff so, like it or not – we have to pay attention…

Meanwhile, it’s still Earnings Season and we’ll be paying a lot of attention to that this week but we’re past the halfway point so we’re starting to get enough of a handle on certain sectors to make some short-term bets. Barrick Gold, in fact, reports on Wednesday and I just talked about them last Thursday with a fantastic Leftovers Trade for those of you too cheap to buy an actual Membership – enjoy!

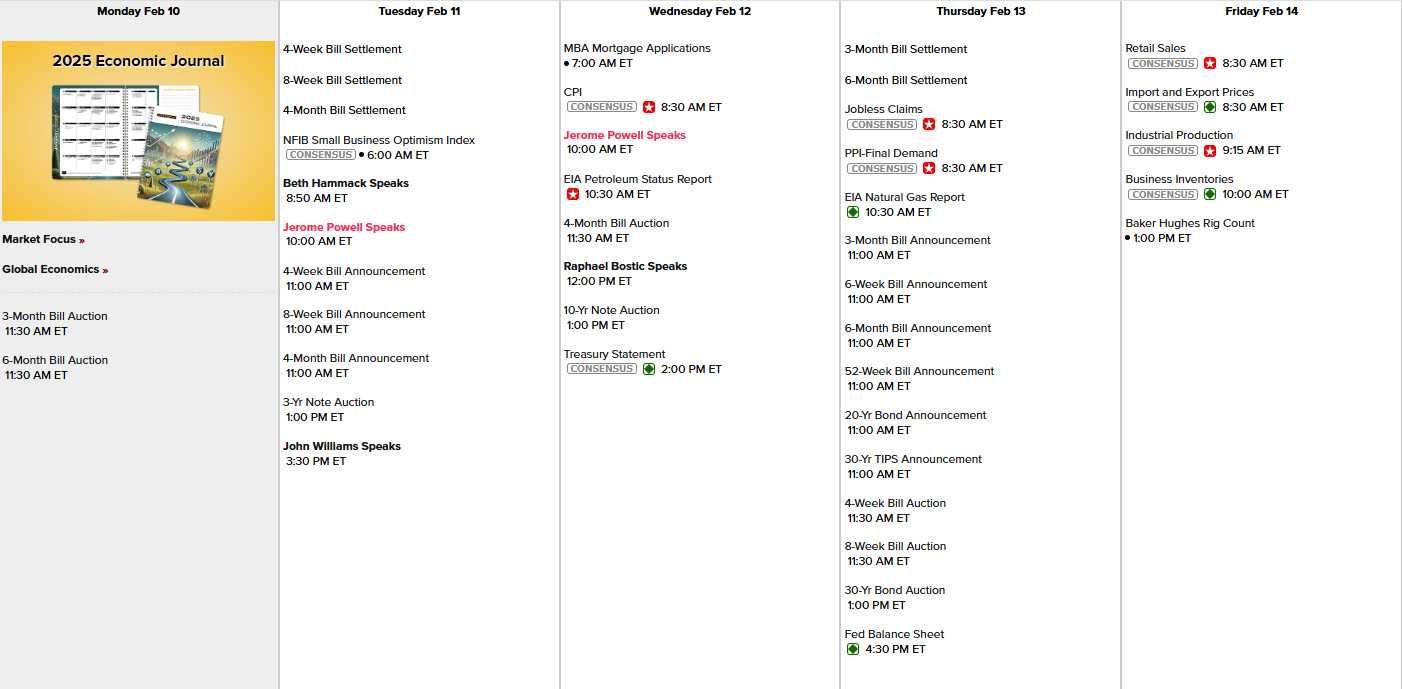

Using my Romper Room Magic Mirror I see lots of Note Auctions, Small Business Optimism, CPI, PPI, Retail Sales and Industrial Production looming and that will give us an idea of whether or not inflation is under control (it isn’t) so another Friday plunge does seem likely but, for now – let’s enjoy the new tariffs – while they last.

[ctct form=”12730731″ show_title=”false”]