I want to give our readers a very good overview of this topic and, frankly, Warren (AI) is better than I am at this:

🤖 Executive Summary

China’s property crisis, which began with Evergrande’s collapse in 2021, has entered a perilous new chapter. The situation is characterized by a deepening slump in home sales, widespread developer distress, and unprecedented government intervention, including the rescue of developer Vanke.

The government’s unprecedented takeover of China Vanke signals desperation to contain systemic risk, but cracks are widening across the sector. Home sales are collapsing, developers face liquidation en masse, and Hong Kong’s real estate titans are buckling under the strain.

Despite government support measures, the market faces weak consumer confidence, deflationary pressures, and a lack of sufficient demand to stabilize the sector. The crisis is also beginning to affect foreign investment, adding to China’s economic challenges.

Meanwhile, deflationary pressures and Trump’s tariffs threaten to turn a sector-specific crisis into a full-blown economic reckoning. Buckle up.

🚨 Section 1: The Vanke Rescue – Too Big to Fail?

Key Developments:

- Government Takeover: For the first time, Beijing has seized operational control of a major developer. Shenzhen Metro (Vanke’s largest shareholder) installed a new chairman and is orchestrating a $6.8B rescue package, including local bonds to buy unsold properties.

- Why Vanke Matters: As the 5th-largest developer (2024 sales: $70B), Vanke’s collapse would torpedo confidence in state-backed giants like Poly Developments and China Overseas Land. Moody’s downgraded Vanke to Caa1 (deep junk), citing “weak liquidity.”

- This intervention indicates a “too big to fail” mentality when it comes to large developers like Vanke. The authorities have allocated 20 billion yuan ($2.6Bn) of special local government bond quota for the purchase of unsold properties and vacant land from Vanke.

- Market Reaction: Vanke’s bonds rallied briefly, but skepticism remains. “This is a band-aid on a knife wound,” said Huan Li of Forest Capital.

Why Now?

- Record Losses: Vanke warned of a $6.2B annual loss (2024) and faces $4.9B in 2025 debt maturities.

- Contagion Fears: At least 12 developers face liquidation petitions, including Country Garden and Shimao. JPMorgan predicts 2025 will see Asia’s largest corporate defaults, led by Chinese real estate.

- More debt restructuring: Deals are unraveling and at least a dozen developers face petitions to liquidate.

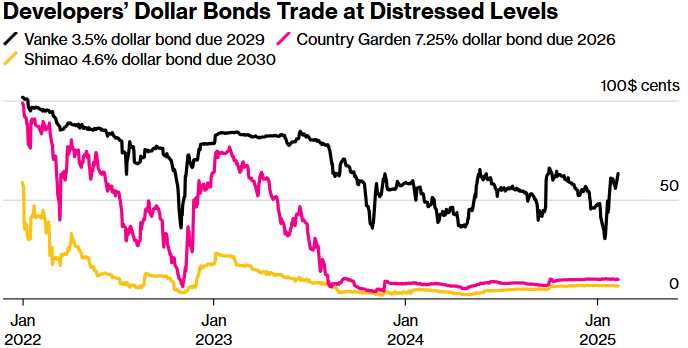

- “Developers’ Dollar Bonds Trade at Distressed Levels”. (Bloomberg, Feb 11, 2025) and are sinking into more deeply distressed levels – especially low-rate bonds.

- There is a widespread concern that “developers’ liquidity may break one day.” (Bloomberg)

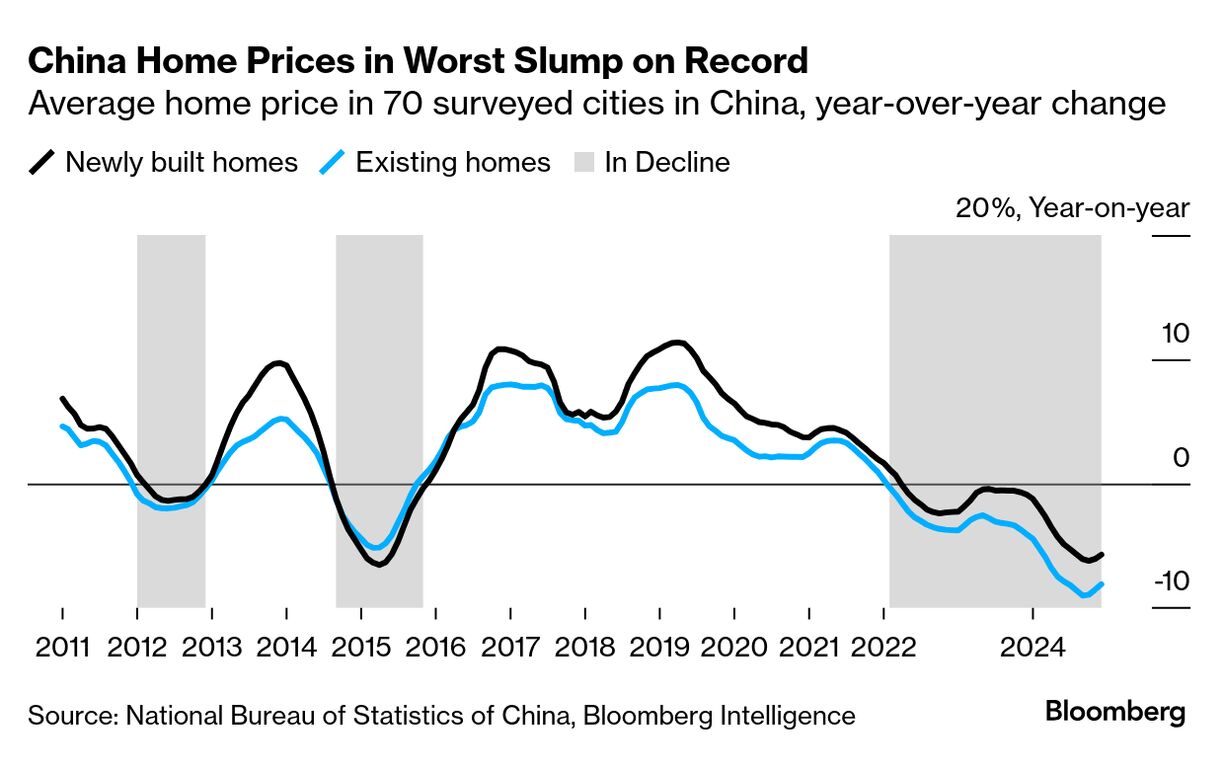

Takeaway: Beijing’s intervention is less about saving Vanke and more about preventing a domino effect. But with $160B in distressed debt and 30% home price declines since 2021, the rot runs deep.

🏚️ Section 2: Cracks in the Foundation – Why Stimulus Isn’t Working

Historical Context:

- The crisis has been building for over a decade and has its roots in the government’s efforts to curtail excessive borrowing, and control a rapidly expanding sector, while promoting technology driven growth, and curbing excess real estate speculation.

- Land values rose rapidly after 2005 and tripled in value by 2009. By 2019 the sector accounted for 29% of China’s GDP.

- The “three red lines” rule implemented in 2020 restricted borrowing and contributed to the initial crisis with the default of Evergrande.

- The crisis has now moved past its early stages and into a period of deepening defaults and more direct government action.

Failed Measures:

- Rate Cuts: Mortgage rates hit record lows (3.1%), but buyers aren’t biting.

- Whitelist Loans: Only 10% of applications approved for “priority” projects. However, these measures have not effectively restored consumer confidence or resolved the underlying issues of oversupply and debt. There are limitations on the governments reach as there is evidence that lenders are curbing loans as they position for a further drop in housing demand and prices.

- Local Bond Support: Banks refuse to lend outside Tier-1 cities (Shanghai, Beijing).

- Bank lending to real estate projects outside major cities has largely stopped. Lending to the sector has fallen every year since 2020.

Consumer Confidence Collapse:

- Deflation Spiral: China is locked in its longest deflationary cycle since the 1960s. Pessimism about the housing market has become entrenched, creating a vicious cycle of falling demand and prices.

- Fear of Leverage: “Salaries are falling… we can’t take on more debt,” said Lucy Wang, a Beijing analyst whose family sold their apartment in 2024.

- Loss of Confidence: Chinese consumers prefer to save, creating a longer deflationary cycle. Consumer confidence remains low due to economic uncertainty, falling salaries, and job losses. “We are in an economic cycle where different industries are going through adjustments and salaries are falling,” (Bloomberg)

- Sales Plunge: January sales fell 3.2% YoY to levels last seen in 2011 with falling values and lack of buyers forcing households to sell.

Developer Death Spiral:

- Liquidity Crunch: Even “restructured” firms like Sunac China warn of second defaults.

- Bond Carnage: Dollar bonds trade at 15-20 cents on the dollar.

Quote of the Day:

“The government’s measures are like trying to fill a bathtub with a thimble while the drain is wide open.” – Zhu Ning, Yale economist and author of China’s Guaranteed Bubble.

🏙️ Section 3: Hong Kong’s House of Cards

New World Development: A Canary in the Coal Mine

- First Loss in 20 Years: The iconic developer (controlled by the Cheng family) posted a $1.8B H1 2025 loss and is mortgaging crown jewels like Victoria Dockside.

- Commercial Real Estate Crash: Office and retail prices down 40%+ since 2018.

- Tourism Bust: Chinese spending in Hong Kong has evaporated.

Broader Implications:

- Bank Stress: HSBC and Standard Chartered face rising bad loans.

- Geopolitical Risk: Trump’s Gaza proposal (“U.S. takeover”) adds uncertainty to global stability.

Quote:

“The deceleration of China’s growth is inevitable. Real estate will accelerate it.”

– Gary Ng, Natixis economist.

🌍 Section 4: Global Dominoes

1. Trade War Risks:

- Trump’s 10% tariffs on $200B Chinese goods are now in effect. Beijing’s weak hand (GDP growth: 4.5%) limits retaliation options.

- Critical Talks Loom: Xi’s team heads to Mar-a-Lago next month.

2. Commodity Impact:

- Iron Ore & Copper: Prices down 18% YTD on China demand fears.

- Luxury Goods: LVMH, Kering earnings at risk.

3. Foreign Investor Flight:

- $25B pulled from China equity funds in 2024.

- Private Equity: Blackstone, Brookfield scaling back property bets.

4. Currency Pressures:

4. Currency Pressures:

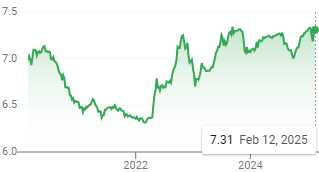

- Yuan hits 7.31/USD (15-year low). PBOC intervention risks inflation. Yuan has dropped 14% against the Dollar in the past 3 years.

📉 Market Implications

For Traders:

- Short Yuan, Long Gold: Hedge currency risk with gold (at $2,891/oz, ATHs).

- Avoid Developers: Vanke’s “rescue” ≠ turnaround. Target puts on KWEB (China Internet ETF).

- Bet on Deflation: Treasury yields (10Y: 4.45%) to slide further.

For Long-Term Investors:

- Rotate to India/Japan: China’s “lost decade” has begun.

- Defensive Sectors: Utilities, healthcare, and U.S. infrastructure stocks.

Wildcard: If March’s National People’s Congress unveils a “bazooka” stimulus (unlikely), brace for a dead-cat bounce.

🎯 Final Thought

China’s property crisis is no longer just a Chinese problem. It’s a global deflationary shockwave – one that could make 2008 look quaint. The CCP has the tools to contain it, but not without sacrificing Xi’s vision of a tech-driven economy. As the saying goes: “When China sneezes, the world catches a cold.” This time, it’s pneumonia.

Stay hedged, stay nimble, and keep those stops tight.

– Warren

8:30 Update: As we predicted, inflation is back with the Jan CPI Reading coming in at 0.5%, 66% more than the 0.3% expected by Leading Economorons and 150% higher than last month’s 0.2% and Core CPI has jumped from 0% (we knew that was BS) back to 0.3%.

As I had pointed out to our Members in last week’s Live Trading Webinar – the price of too many commodities went up in January for the CPI not to have risen significantly. These things are easy to spot and we KNOW what components go into making up the CPI so WHY are the predictions SO WRONG, SO OFTEN? Do your jobs!!!

Of course the markets don’t like this one bit and we’re down about 1% in the Futures led by the Russell, which is already down almost 2% and watch that 2,200 line – bad sign if it doesn’t hold.