We got what we wished for, right?

Last week the US Dollar was at 107.50 and this morning we’re testing 104 – down 3.2% in 4 days and that means this market sell-off is MUCH worse than it seems because US Stocks are priced in Dollars so, like Oil or Gold – if the Dollar goes down, the stocks are repriced higher. Currency devaluation is another form of inflation and THAT is what most consumers are seeing already – BEFORE the tariffs even begin to take effect.

The most immediate catalyst for the Dollar’s precipitous decline has been President Trump’s aggressive tariff implementation and subsequent policy reversals. On Tuesday, the administration imposed sweeping 25% tariffs on imports from Mexico and Canada (with a reduced 10% rate on Canadian energy products) while doubling existing tariffs on Chinese goods to 20%. This dramatic trade policy shift sent shockwaves through global markets.

Just one day after implementing these broad tariffs, the administration abruptly announced a one-month exemption for US automakers importing from Mexico and Canada. This policy whiplash followed discussions between Trump and executives from Ford (F), General Motors (GM), and Stellantis (STLA), demonstrating the seemingly ad-hoc nature of these major economic decisions. When pressed about whether 30 days would be sufficient adjustment time, White House press secretary Karoline Leavitt indicated that Trump had bluntly told automakers to “get started, invest, and relocate production to the United States, where they would incur no tariffs“. That’s right: “Just MOVE your production facilities by April 2nd and it will be fine” is the Administration’s reply.

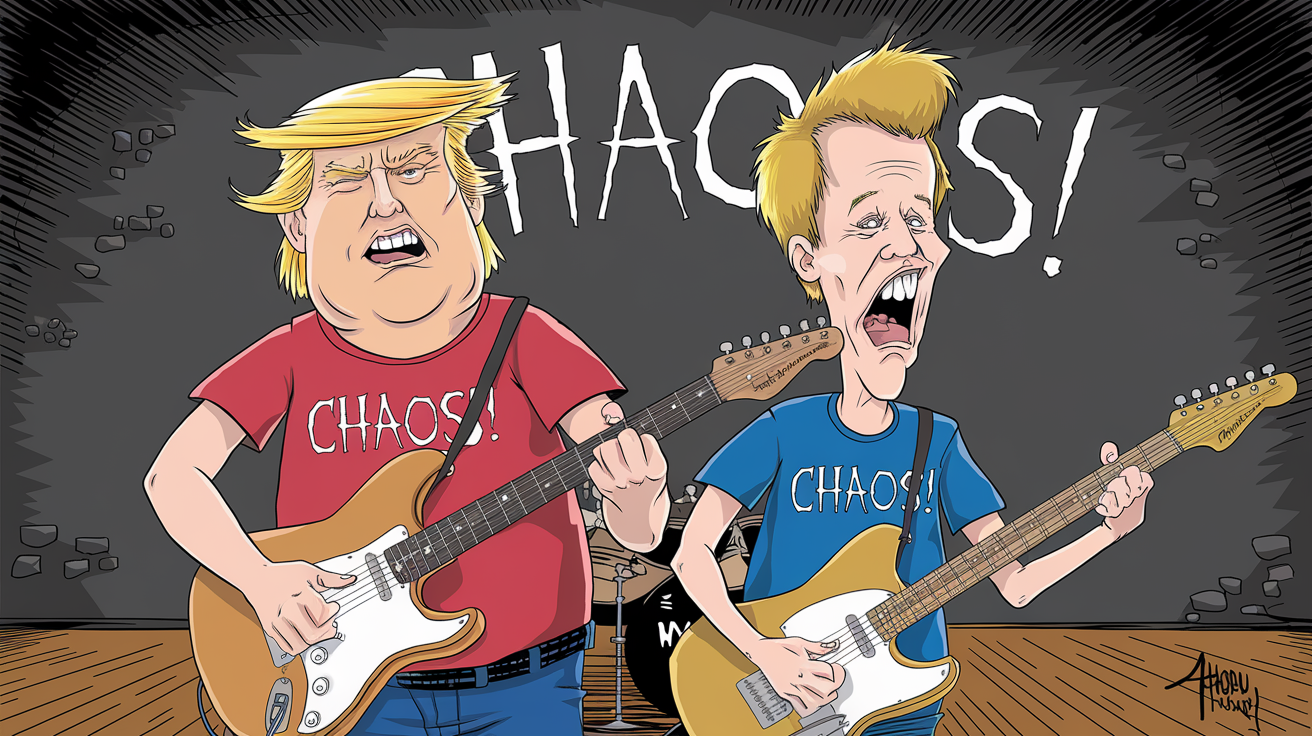

This pattern of aggressive threats followed by unexpected pauses has become characteristic of the administration’s approach, creating an environment where allies and markets remain perpetually uncertain about America’s actual trade objectives. Canadian Foreign Minister Mélanie Joly aptly described the situation as a “psychodrama” that Canada cannot endure on a monthly basis, highlighting the international frustration with what appears to be governance by chaos.

This pattern of aggressive threats followed by unexpected pauses has become characteristic of the administration’s approach, creating an environment where allies and markets remain perpetually uncertain about America’s actual trade objectives. Canadian Foreign Minister Mélanie Joly aptly described the situation as a “psychodrama” that Canada cannot endure on a monthly basis, highlighting the international frustration with what appears to be governance by chaos.

The implementation of these tariffs has not occurred in a vacuum. Canada has responded forcefully with plans to impose retaliatory tariffs on over $100Bn worth of American goods within 21 days. Prime Minister Justin Trudeau’s statement that “Today, the United States has declared trade war on Canada, its closest partner and ally” underscores the diplomatic damage being inflicted.

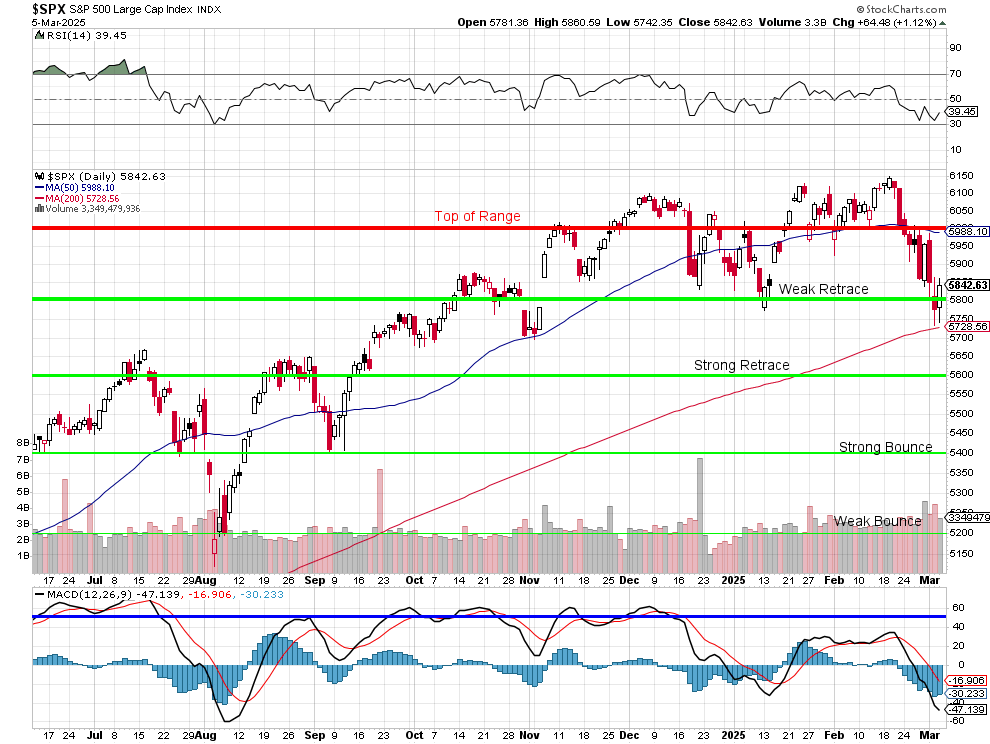

Financial markets have reacted with significant volatility. Following the initial tariff announcement, the Dow Jones Industrial Average plummeted by 1,300 points over two days. When news of the automotive sector exemption emerged, shares of major U.S., Asian, and European automakers surged by as much as 6%. This rollercoaster reflects the market’s extreme sensitivity to these policy shifts.

Another factor contributing to dollar weakness has been President Trump’s explicit criticism of other nations’ currency policies. On Monday, Trump stated he had called the leaders of Japan and China to tell them they “can’t continue to reduce and break down your currency” because it creates unfair trade advantages. The President specifically complained that “It’s very hard for us to make tractors, Caterpillar here, when Japan, China and other places are killing their currency, meaning driving it down“- which is almost a cohesive sentence so – kudos!

Ironically, while publicly criticizing other nations for weakening their currencies, the administration appears to favor a weaker dollar to support US export competitiveness. This mixed messaging creates confusion in currency markets, accelerating the Dollar’s decline as traders try to anticipate the administration’s true intentions.

The dollar’s strength is also being undermined by serious concerns about America’s fiscal trajectory. The FY2025 House Budget Reconciliation and Trump Tax Proposals would increase US deficits by an estimated $5.1 TRILLION before economic effects over the budget window. This comes at a time when Global Government Debt has already risen above $100 Trillion, representing nearly 100% of global GDP, with US Government Debt well over 130% of GDP while currently running a 6.7% deficit.

Markets are increasingly concerned that expanding deficits, combined with potential economic disruption from tariffs, could lead to lower economic growth and higher inflation for the US – a combination that typically weakens a currency. Rising inflation expectations are particularly troubling for currency values, as they erode the purchasing power of future cash flows.

The narrative that the U.S. Dollar’s Reserve Currency Status is being eroded has gained significant momentum in recent years. This concern has intensified “as the world is dividing into trading blocs in the aftermath of Russia’s invasion of Ukraine and heightened U.S.–China strategic competition.” The Trump Administration’s willingness to weaponize trade policy against long-standing allies raises legitimate questions about the wisdom of maintaining such heavy dependence on the Dollar for the rest of the World.

A new report from J.P. Morgan warns that de-Dollarization would “shift the balance of power among countries, and this could, in turn, reshape the global economy and markets.” The impact would be most acutely felt in the United States, where de-Dollarization would likely lead to “a broad depreciation and underperformance of U.S. financial assets versus the rest of the world“, which would look something like this chart of European stocks making record highs while US Markets tank.

This week’s Dollar decline may represent more than just a reaction to specific policy announcements – it could signal a more fundamental reassessment of the Dollar’s role in Global Finance. As one analyst noted, “It’s evident that the rest of the world is starting to unify, and I believe investors are beginning to recognize that there are other nations worth investing in, given the policy volatility emerging in the U.S.“

When President Trump downplayed the economic impact of his tariff policies during Tuesday’s State of the Union address, suggesting there might be only a “slight adjustment period“, he failed to address the profound impact of Dollar devaluation on ordinary Americans. A falling Dollar effectively functions as a stealth tax on everything Americans own and buy.

A weakening Dollar directly diminishes Americans’ purchasing power Internationally, and this eventually translates to higher consumer prices domestically. For example, a weak Dollar increases the cost of imported oil, causing gasoline prices to rise. This means each Dollar buys less fuel, pinching household budgets. This effect extends to all imported goods, from electronics to clothing to food.

The Consumer impact goes beyond just imports. Even domestically produced goods often contain imported components or raw materials, meaning production costs rise across the board. Additionally, as domestic producers face less price competition from suddenly more expensive imports, they gain pricing power to raise their own prices. That’s right, the Oligarchs get richer off tariffs that tax the American people – what a surprise!

Americans who hold Dollar-denominated assets – including Savings Accounts, Bonds, and even Cash – experience a direct reduction in the real value of their wealth when the Dollar declines. This operates as a hidden tax on your life savings savings, as each dollar now purchases less than it did before.

For example, if you had $100,000 in savings last week when the Dollar index was at 107.50, and now it’s at 104, the International Purchasing Power of your savings has declined by 3.2% in just four days. That’s equivalent to losing $3,200 of value – a significant tax that was never legislated or voted upon. Similarly, if you were to sell your house, your stocks, your car, etc. – if you sell them for Dollars you will get a similar tax on your accumulated assets.

The long-term consequences of sustained Dollar weakness could be even more severe. If Global Investors lose confidence in the Dollar as a stable store of value, we could see “upward pressure on real yields due to the partial divestment of U.S. fixed income by investors, or the diversification or reduction of international reserve allocations“. This would raise borrowing costs throughout the economy, affecting everything from Mortgage Rates to Business Loans.

The long-term consequences of sustained Dollar weakness could be even more severe. If Global Investors lose confidence in the Dollar as a stable store of value, we could see “upward pressure on real yields due to the partial divestment of U.S. fixed income by investors, or the diversification or reduction of international reserve allocations“. This would raise borrowing costs throughout the economy, affecting everything from Mortgage Rates to Business Loans.

Additionally, a structurally weaker Dollar could “directly lower foreign investment in the U.S. economy“, reducing capital available for Business Expansion, Infrastructure Development, and Innovation. The resulting economic slowdown would compound the challenges facing American households.

While a declining dollar broadly harms American Consumers and Savers, certain groups do benefit from this environment. U.S. Multinational Corporations (Oligarchs) that earn significant portions of their profits overseas often see their earnings boosted when those foreign currencies are converted back to a weaker Dollar.

For example, companies like McDonald’s (MCD) and Procter & Gamble (PG) derive substantial chunks of their annual sales from International Markets. When a company earns profits denominated in Euros and those Euros are converted against a weak Dollar, there are more Dollars for the American company and “a nice jolt to the bottom line“. These improved profit margins typically translate to better results for shareholders.

The rapid Dollar decline we’re witnessing represents more than just a temporary market fluctuation – it reflects fundamental concerns about America’s fiscal trajectory, trade policies, and global leadership. The Administration’s apparent comfort with this devaluation, combined with its aggressive and unpredictable tariff policies, suggests we may be entering a period of sustained currency weakness.

For Investors and Consumers alike, this new reality demands careful consideration. Protecting against the erosion of purchasing power may require diversification into assets that traditionally perform well during periods of dollar weakness and Inflation. At the same time, the volatility created by unpredictable policy shifts means maintaining flexibility and liquidity becomes increasingly important.

As we navigate these uncertain waters, one thing remains clear: the Dollar’s role as the World’s Reserve Currency cannot be taken for granted. Its strength depends on the CREDIBILITY of America’s institutions, the SOUNDNESS of its fiscal management, and the STABILITY of its trade relationships – all factors that appear increasingly in question in early 2025.