7% (440 points)

I, for one, am very glad we decided to cut back on our longs and double down on our shorts going into the weekend (see our Wrap-Up Report for a nice overview) as things are NOT improving DESPITE President Trump putting off the tariffs – again.

But did he put off all the tariffs or some of the tariffs or certain tariffs or were there new tariffs… Does anyone actually have a coherent picture of the Administration’s policy? At all? Well, maybe that’s the problem as the markets – FOR SURE – do not like uncertainty and this Administration has (as I may have mentioned) been pure CHAOS!!! for the past 49 days.

That’s right, we are almost halfway through the first 100 days of President Trump’s 2nd Presidency and by March 10th of 2017, we were also having doubts in Trump’s plan (See “Non-Farm Friday – Is America Working Bigly?“) and the S&P 500 was at 2,380 – not even half of where it is now though our GDP was $19.6Tn and now it’s $29Tn – so up $9.4Tn (47.9%) while our markets are up 139% so perhaps, maybe, they are a bit overvalued?

At the time, we were $19.5Tn in debt and now we are $36Tn in debt so it cost us $16.5Tn top add $9.4Tn to our GDP. If a company were “growing” like that – we would dump it, right? And speaking of companies who grow by spending the GDP of medium-sized countries – how are the Magnificent 7 doing this year?

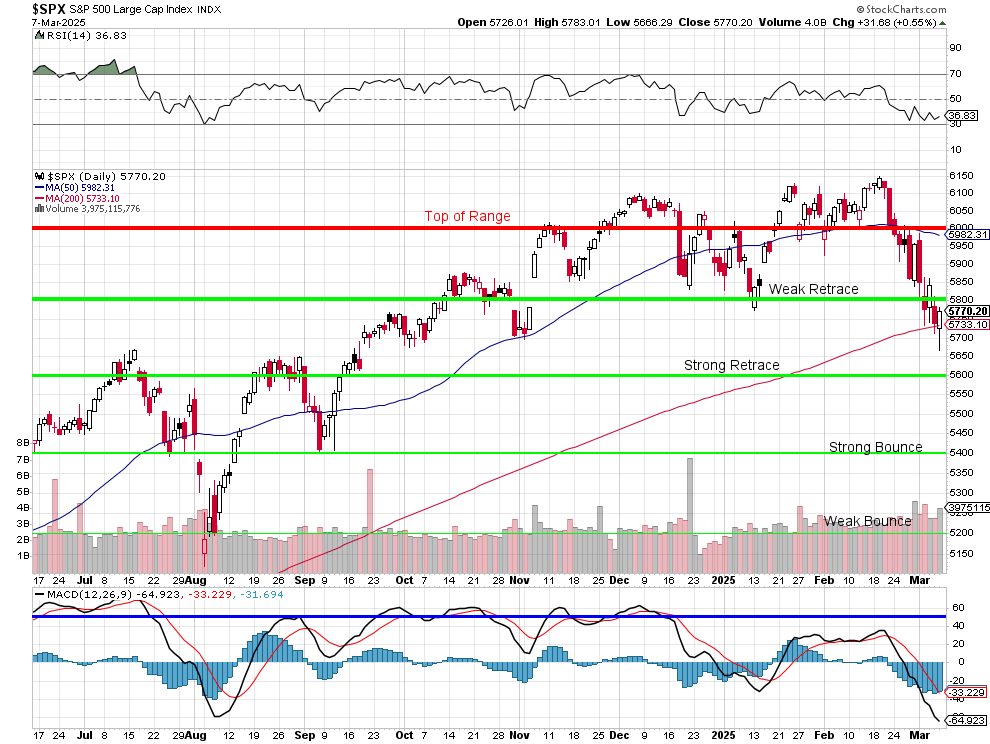

Not so magnificent, right? Good illustration of why you have to be careful when stocks (or indexes) fail long-term support channels. Which brings us back to the S&P 500, which is also failing a long-term support channel (both the Weak Retrace Line AND the 200-day moving average) and that Strong Retrace Line is basically a 10% drop from the top and we HOPE (not a valid investing strategy) that holds because, if not, a 20% correction is on the way and that would be 4,920 and that would STILL be 2,540 (106%) higher than 2017 against a 47.9% gain in GDP!

And THAT is why we lightened up on our longs on Friday as it was a decision we agonized over all week but, when push came to shove – it wasn’t worth just adding hedges to protect ourselves and end up even at 4,920 when it would be SO MUCH MORE FUN to have 100% of our gains locked in AND able to re-buy our favorite stocks at a 20% discount. THAT is the potential reward for our caution and what is the risk? That stocks will go back to 139% of where they were in Trump’s first term?

Let’s not forget that term ended in disaster as the S&P topped out at 3,397 (up 42.7%) on Feb 21st, 2020 and then fell all the way back to 2,174 (-8.6%) – a 36% drop from the top. Now, that was Covid and the whole country was closed (eventually) and 1.2M Americans DIED, the worst catastrophe in US history which Team Trump still maintains was a hoax:

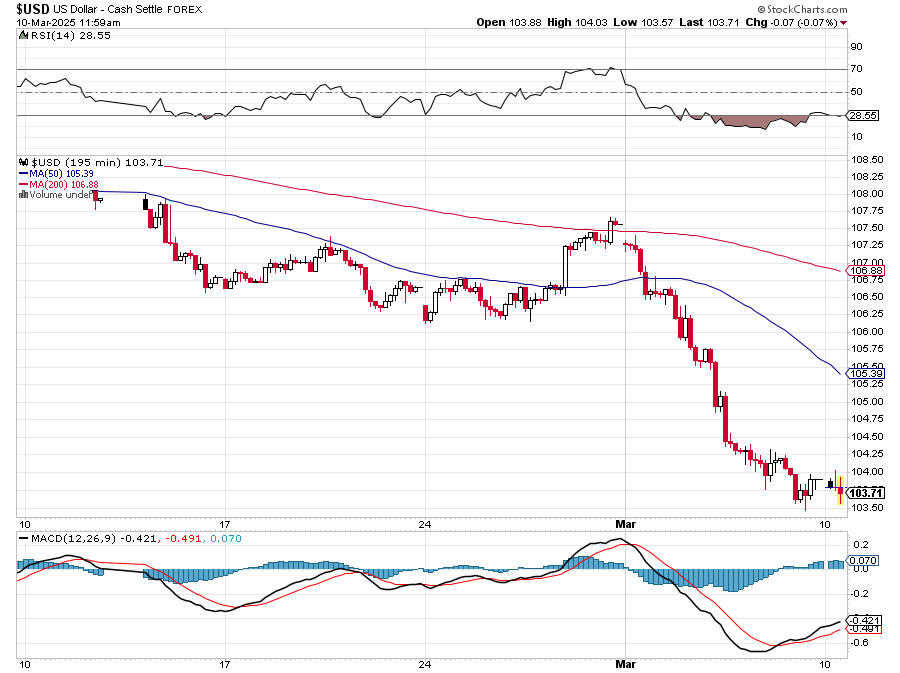

So let’s HOPE (still not a valid investing strategy) that that doesn’t happen again (*cough* Bird Flu! *cough*, *cough*) and that we only have to contend with the self-inflicted wounds of Tariffs, Trade Wars, Dismantling the Government, Hunting down Immigrants, Tax Breaks for the Wealthy (again), Global Warming, the Removal of the Social Safety Nets, Recession, Inflation, the Loss of US Leadership in the World and, of course, our Declining Dollar.

So let’s HOPE (still not a valid investing strategy) that that doesn’t happen again (*cough* Bird Flu! *cough*, *cough*) and that we only have to contend with the self-inflicted wounds of Tariffs, Trade Wars, Dismantling the Government, Hunting down Immigrants, Tax Breaks for the Wealthy (again), Global Warming, the Removal of the Social Safety Nets, Recession, Inflation, the Loss of US Leadership in the World and, of course, our Declining Dollar.

Yes, as I noted last week, you have already contributed 6% of your entire Net Worth to Trump’s cause (so far) in lost purchasing power ON TOP OF any losses in your equity positions or home(s) value and the extra cost of Insurance, Health Care, Education, etc. – all in the cause of “making America great – again.” That’s another one of those ill-defined goals, isn’t it? You would think that after almost 10 years of hearing it we’d at least be able to articulate WTF it means, right?

Yes, as I noted last week, you have already contributed 6% of your entire Net Worth to Trump’s cause (so far) in lost purchasing power ON TOP OF any losses in your equity positions or home(s) value and the extra cost of Insurance, Health Care, Education, etc. – all in the cause of “making America great – again.” That’s another one of those ill-defined goals, isn’t it? You would think that after almost 10 years of hearing it we’d at least be able to articulate WTF it means, right?

Here’s a fun example of what happens when you fail to articulate your goals:

Saudi Arabia’s $8.8 trillion NEOM project is collapsing under the weight of its own fantastical ambitions. The Crown Prince’s sci-fi inspired dreams – including a 106-mile-long pair of skyscrapers and an upside-down glass “chandelier” building – have hit the wall of reality after burning through $50Bn.

Saudi Arabia’s $8.8 trillion NEOM project is collapsing under the weight of its own fantastical ambitions. The Crown Prince’s sci-fi inspired dreams – including a 106-mile-long pair of skyscrapers and an upside-down glass “chandelier” building – have hit the wall of reality after burning through $50Bn.

What’s particularly telling is how executives shielded the Crown Prince from the truth, with an internal audit finding “evidence of deliberate manipulation” of finances. When costs skyrocketed, they simply inflated projected revenues – suddenly a “boutique hiking hotel” that was supposed to charge $489 per night became $1,866 per night to make the math work. Anyone who challenged these fantasy numbers was promptly removed from the project. Sound familiar???

This leadership style mirrors Trump’s casino empire collapse in Atlantic City. When his Trump Taj Mahal required an impossible $1.3 million daily revenue to break even, reality didn’t matter – the fantasy had to be maintained. His casinos lost 37% more employees and 33% more revenue than competitors, while going through more bankruptcies than any other major American business.

Trump’s management approach was remarkably similar to the Saudi crown prince’s – when his casinos were struggling, he hovered anxiously over baccarat tables, terrified that customers might actually win. Executives were “humiliated” as Trump signaled his fear. When things inevitably went south, he blamed executives who had died and couldn’t defend themselves.

The pattern is clear: Leaders who surround themselves with yes-men, reject reality-based criticism, and pursue grandiose visions disconnected from practical constraints inevitably create disasters. At NEOM, dissent was crushed and McKinsey consultants were told “we must not proactively mention cost at all” before key meetings.

This is precisely what we’re seeing in the first 49 days of Trump’s second term – chaotic policy announcements, reversals, delays, and an Administration where speaking truth to power appears impossible. The markets are reacting exactly as you’d expect when fantasy collides with reality.

As we watch the S&P 500 break through support levels, remember that the most expensive words in investing are “This time it’s different.” It never is. Whether it’s a Saudi Desert Metropolis, Atlantic City Casinos, or Economic Policy, leadership that prioritizes ego over reality eventually faces a reckoning. The only question is how much damage will be done before reality forces a course correction?

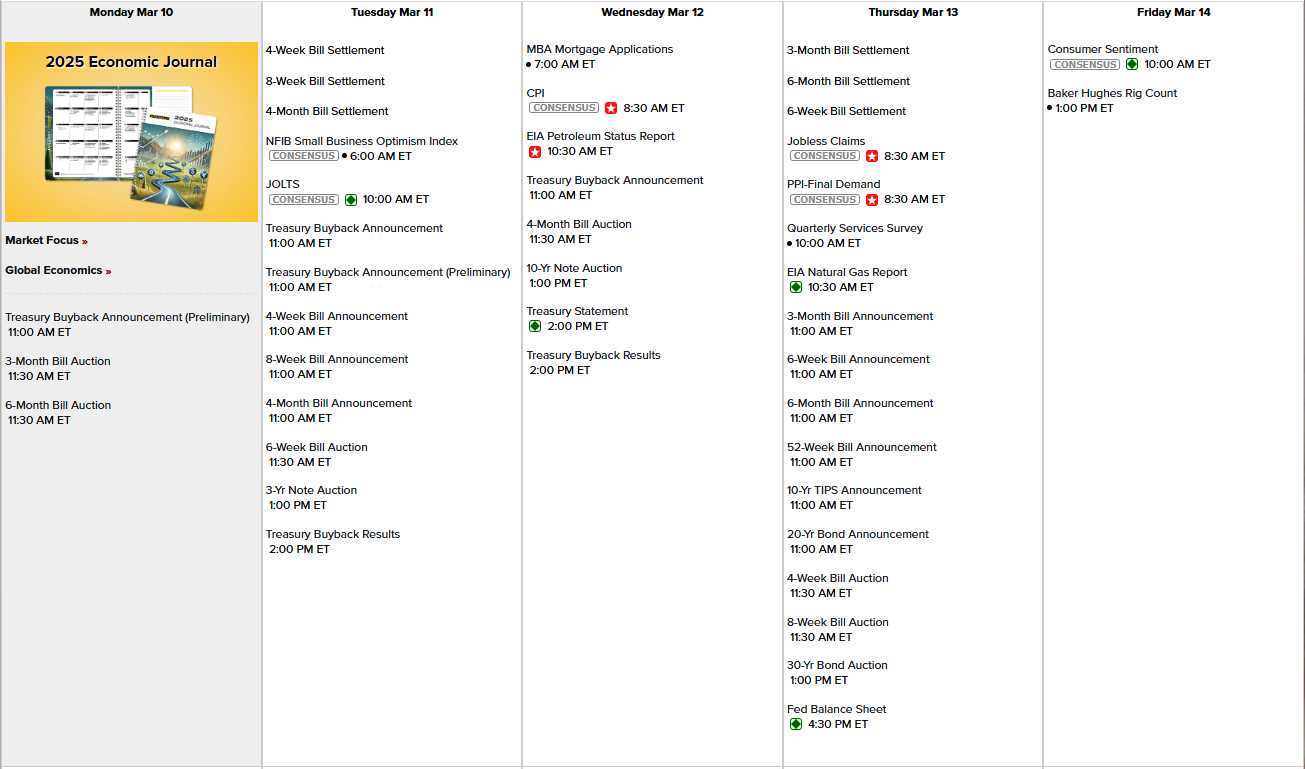

This week we have a very light Economic Calendar devoid of Fed Speak ahead of next week’s FOMC meeting (Weds). We do have a lot of Bonds and Notes to auction off and wouldn’t it be funny if no one wants more of our debt? We’ll see how that goes but, seriously, amazingly little data this week so the focus will be on Trump (God help us) and what’s left of earnings:

We do still have some fun earnings reports like ORCL this evening and MTN, KSS, DKS, GRPN, IRBT (old favorite), ADBE, QBTS, DG, DOCU, ULTA, GOGO… Lots of fun:

We’re expecting this drop to at least go another 3% down (to -10% total) but, as I noted – even a 20% drop would still leave us with a generally overpriced market. Hopefully, we kept the good ones but, in the very least, we kept the babies we feel are worth working with and adding to if they do get thrown out with the bathwater in early 2025.

** I was going to go with “Point of Know Return” but Boaty thought this would be better – Happy monday! **