Nothing has changed.

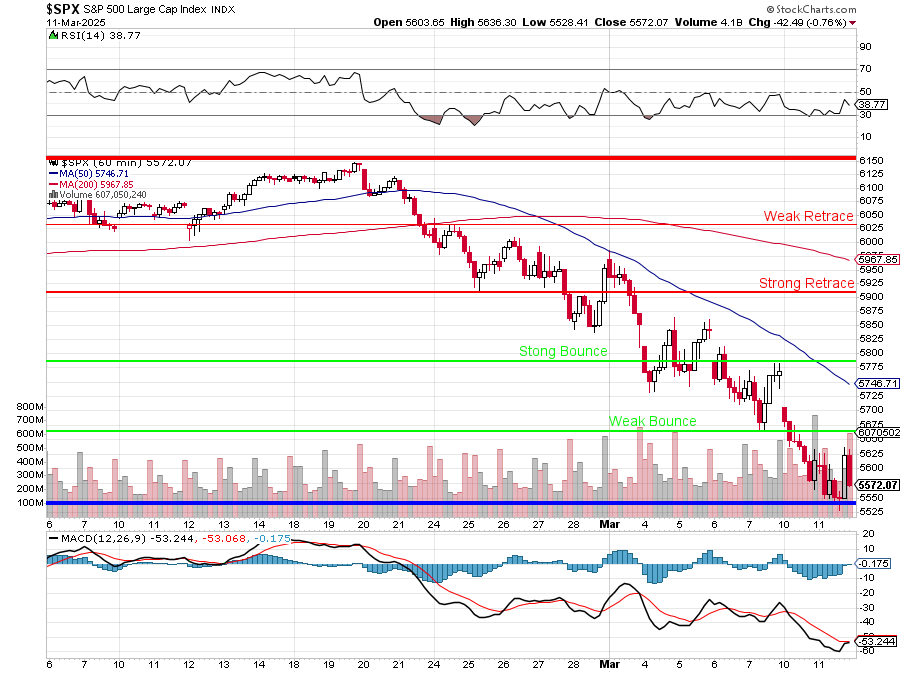

There are rumors that Trump will reverse the tariff deals he was just bragging about last night and I hope he does as the alternative is NOT GOOD for the Economy or the Markets… Woops! That is EXACTLY what I said last Wednesday in: “Wednesday Weakovery – Trump’s House of Lies Suckers the Faithful to Buy the Dip.” That came right after Trumps State of the Union BS gave us a little pop on the morning of the 5th and we popped ALL THE WAY back from 5,770 to 5,850 (1.4%) because THAT IS WHAT A WEAK BOUNCE IS OFF A 7% DROP!!!

There are rumors that Trump will reverse the tariff deals he was just bragging about last night and I hope he does as the alternative is NOT GOOD for the Economy or the Markets… Woops! That is EXACTLY what I said last Wednesday in: “Wednesday Weakovery – Trump’s House of Lies Suckers the Faithful to Buy the Dip.” That came right after Trumps State of the Union BS gave us a little pop on the morning of the 5th and we popped ALL THE WAY back from 5,770 to 5,850 (1.4%) because THAT IS WHAT A WEAK BOUNCE IS OFF A 7% DROP!!!

The 5% Rule™ tells us to expect 20% retraces off a 5% move but it applies to any high to low move – it’s just strongest on the 5% lines. The “problem” is that traders have a hard time dealing with the MATHEMATICAL FACT of: The bigger the fall, the bigger the meaningless bounce! That’s just math, when we were down 300, a weak bounce was 60 points but now we’re down 600 points in less than a month and a weak bounce is 120 points before we should be even the tiniest bit impressed (and we need a strong, 240-point bounce to ACTAULLY be impressed).

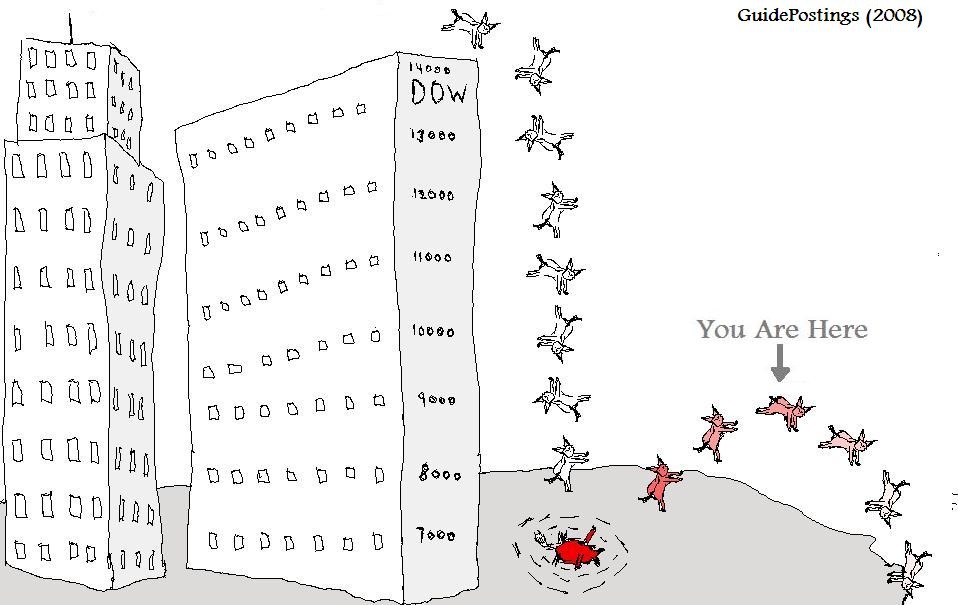

The Dow fell 3,500 points in 30 days, from 45,000 to 41,500 and that means a weak bounce would be 700 points but we’re conditioned to think 700 points is a huge move (and it is, of course) but not when we take in the PHYSICS of a Dead Cat Bounce.

The Dow fell 3,500 points in 30 days, from 45,000 to 41,500 and that means a weak bounce would be 700 points but we’re conditioned to think 700 points is a huge move (and it is, of course) but not when we take in the PHYSICS of a Dead Cat Bounce.

The term “Dead Cat Bounce” isn’t just Wall Street slang – it’s a laws-of-physics warning wrapped in morbid humor. Born in 1985 when Financial Times journalists likened Singapore’s stock rebound to “a dead cat bouncing,” it’s the market equivalent of Newton’s First Law: An object in freefall tends to stay in freefall unless acted upon by an external sucker.

A real recovery needs to have significant VOLUME as well – so we’ll be keeping an eye on that. Since the market began falling on Feb 20th, the daily volume on the SPY ETF has DOUBLED and volume (as we have often discussed) has been dead for a very long time:

If you REMOVE 55 points from 2/21-3/11 at a volume of 1Bn shares and you then gain back 55 points but only with 500M shares – you have built a WEAKER foundation for your new rally and that becomes MORE LIKELY TO COLLAPSE. In fact, that’s what’s been happening for a long time and it’s one of the main reasons we have been so skeptical about this year’s gains – it was built on a very weak volume foundation…

Another habit that’s hard to shake is our belief that the Government is using FACTS to tell us the TRUTH. Not to bash Trump but, more than half the time, the TRUTH is the opposite of whatever he is saying and he has surrounded himself with armies of “Yes Men” who say even more outrageous things to defend or justify what the President says.

That’s why it’s insane to rally the market because Trump said tariffs are on or off or the Economy is better or worse or whatever makes him look good at the moment and – for God’s sake – DON’T use the Mainstream Media to get to the bottom of it:

All this is a huge distraction from the FUNDAMENTALS of whether or not the companies we invest in are able to make a reasonable return on investment given the likely market conditions they will be facing down the road IN COMPARISON to other investment alternatives – THAT is what matters!

Trump is only extending his 2017 tax cuts – those have been baked into Corporate Profits for 8 years now and, as Trump did say in January of 2025 – the anticipation of a Trump comeback DID send the Dow from 38,000 to 45,000 but now we’re back to 41,500 because there are no additional tax breaks and now there are tariffs, which function as a new tax.

There is also no break for the US Consumer, who is running out of money to spend and Consumer Spending is 60% of the Economy and Government Spending is 20% of the Economy so, when Trump says he’s going to cut Government Spending by 20% – that’s 4% of our Economy GONE!

When Trump and Musk says they have proudly cut $500Bn of “wasteful” distributions on programs for less-fortunate Americans, like the Student Lunch Program that used to provide healthy food to schools by subsidizing local farmers to give them healthy produce which was long considered a huge “Win/Win” program from the Obama Administration. 2M children in 24,000 schools will now have to bring their own lunches 200 days a year so let’s say it’s just $2 per student – that’s a $400 per student cost to low-income parents and that’s $800M per year they don’t have to spend in the economy – which has a 3.2 multiplier so the $660M that Trump/Musk are “saving” is costing the economy $2.56Bn a year.

When Trump and Musk says they have proudly cut $500Bn of “wasteful” distributions on programs for less-fortunate Americans, like the Student Lunch Program that used to provide healthy food to schools by subsidizing local farmers to give them healthy produce which was long considered a huge “Win/Win” program from the Obama Administration. 2M children in 24,000 schools will now have to bring their own lunches 200 days a year so let’s say it’s just $2 per student – that’s a $400 per student cost to low-income parents and that’s $800M per year they don’t have to spend in the economy – which has a 3.2 multiplier so the $660M that Trump/Musk are “saving” is costing the economy $2.56Bn a year.

Not ALL money is misspent – a lot of what the Government spends has an excellent return on investment. $30Bn worth of vaccinations prevents $500Bn in medical bills fighting diseases but that’s $470Bn that doesn’t end up going to the US Health Care system and THAT lobby has lots and lots of money to promote disease while the disease PREVENTION lobby – not so much…

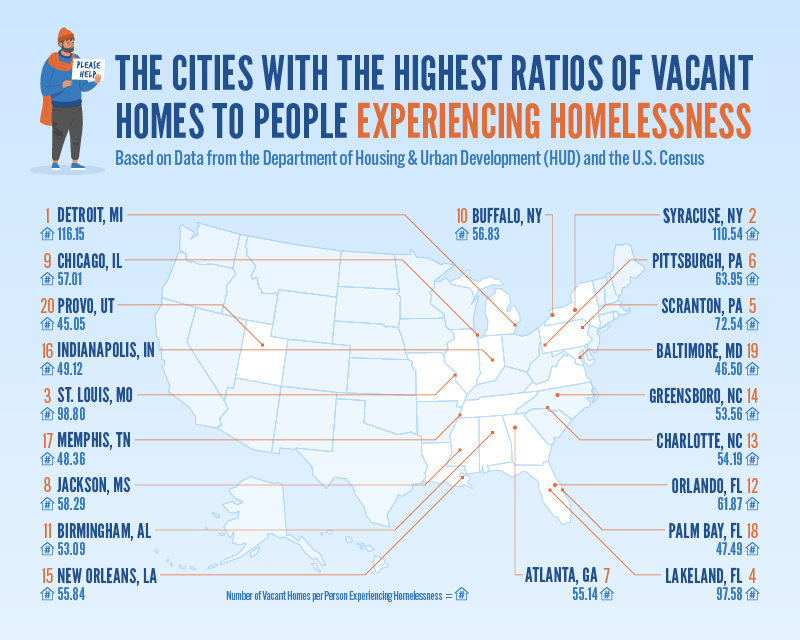

There are 771,480 homeless people in the US and there are 16 MILLION empty homes – you would think someone in Government would have a better solution than “sweeping” the people out of temporary shelters like they are garbage and sending them to shelters or prisons that end up costing the Government far, far more than a long-term housing solution would. But that causes a “moral hazard” because then “everyone would want to be homeless,” right?

8:30 Update: CPI and Core CPI came in at 0.2% for February, down from 0.5% and 0.4% in January and that is very much exciting the Futures as it puts the Fed back on the table for maybe a June rate cut. Here’s Boaty’s breakdown of the changes:

-

-

-

: -4.0% MoM (post-holiday demand drop + fuel cost relief).

-

: -1.0% MoM (global oil prices stabilized despite Middle East tensions).

-

: Rent growth decelerated to +4.2% YoY (weakest since 2021).

-

: +0.9% MoM (still up 11.1% YoY, but wildfire-related supply chain fixes helped).

-

: Post-January “New Year effect” (gyms, streaming services) faded.

-

-

That’s right, the LA fires slowed the economy in January so it’s hard to say that these numbers are a trend. Energy and Transportation costs are volatile, Airlines are already rebounding in March and Shelter Inflation remains sticky but cooling somewhat. On the other hand 25% tariffs are expected to add 0.5% to CPI over time and severe (and getting worse) Labor Shortages are still driving Wage Inflation.

Tariffs may also trigger the same sort of supply-chain disruptions that got the inflation ball rolling the last time Trump was President. Still, DESPITE the FACT that Core CPI is still 3.1% and the Fed’s target is 2% and 3.1% is 55% HIGHER than 2%, traders are pricing in a 90% chance of a June 18th rate cut and THAT is rally fuel.

We’ll just have to see what kind of bounce this rally will give us.