Up 50%!

Gold has outperformed the market and just about everything else in the past year with a 15% gain in 2025 (so far) as the Crazy Train has left the station and it already well off the rails. That’s why Barrick Gold (GOLD) was our Top Trade Alert on Feb 7th, 2024 – when Gold was still just $2,000 an ounce. My trade logic was:

“Overall, I still like the play as a long-term investment and certainly it’s a great hedge against inflation. A terrible Q3 still dropped $330M to the bottom line so 4 of those would be $1.3Bn and you can buy the whole company for $26Bn so 20x based on a really bad Q but more likely they make $2Bn and it’s 13x and still a great inflation hedge as $2,100 gold would push them below 10x.”

-

-

- Sell 10 GOLD 2026 $17 puts for $3.50 ($3,500)

- Buy 20 GOLD 2026 $13 calls for $3.80 ($7,600)

- Sell 20 GOLD 2026 $17 calls for $2.10 ($4,200)

-

That was a net $100 credit on the $8,000 spread and we’re back over our $17 goal and the Jan $17 puts are now $1.24 ($1,240) and the $13 calls are $6.35 ($12,700) and the short $17 calls are $4.40 ($8,800) so net net $2,660 is up 2,760% from our $100 credit entry and that’s only “on track” as we still have $5,340 (200%) left to gain from here – still a very nice trade – even if you missed out on our better-than-free entry.

See, there are all kinds of ways to make money in any kind of market – you just have to pick the right stocks. And it wasn’t a fluke as our Jan 3rd Top Trade Alert was TECK:

And our Jan 24th Top Trade Alert was JD – that’s up over 100% without the options:

We don’t send out Top Trade Alerts every week – only when we find a trade idea that has a very high probability of success. In January, we had 9 Top Trades and in early Feb we had 6 but from Feb 14th AES until March 12th (sorry, Members Only) – we had no Top Trades – because we didn’t have any Trade Ideas we felt that confident about:

As the market goes lower and lower, the stocks on our Watch List (also Members Only) get more and more attractive like, for example, YETI, who are trading at 10.7x earnings at $2.6Bn ($31.92), which are projected to be $245M in 2025 but that’s up 44% from $170M in 2024 and sure, they may have some tariff issues but they also have $279M in the bank, NET OF DEBT and it’s a great time to get back into this stock:

The high VIX makes it a great time to sell puts and the 2027 $35 puts are $7.50, which would put you in the stock for net $27.50, which is 13.8% below the current price so let’s say we’re willing to own 500 shares of YETI – we can do the following spread:

-

-

- Sell 5 YETI 2027 $35 puts for $7.50 ($3,750)

- Buy 10 YETI 2027 $25 calls for $12 ($12,000)

- Sell 10 YETI 2027 $40 calls for $7 ($7,000)

-

That’s net $1,250 on the $15,000 spread that’s $6.92 ($6,920) in the money to start! The upside potential at $40 is $13,750 (1,100%) and the Portfolio Margin Requirement is $3,195.25. This is the kind of trade that, if it goes lower – I’m comfortable buying more of.

So, for those of you who are not PSW Members – that’s what a Top Trade Alert looks like (usually with a bit more analysis of the company but our Members know YETI well as it was once a “Trade of the Year” and is in our Long-Term Portfolio). They are what we consider “low risk” and “HIGH REWARD” trade ideas with a high probability of success and historically, we have a success rate of over 70% – year after year.

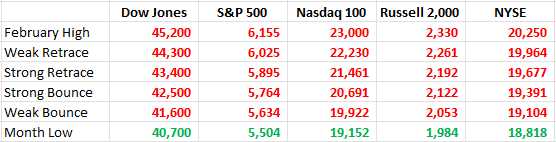

I’m pointing this out this morning as we are probably only halfway to the bottom of this market sell off (see yesterday’s Special Halftime Report) and it’s getting very tempting to buy but we have a whole Watch List full of things we can buy AFTER we are sure the market is not just bouncing and, fortunately, we have a Bounce Chart for that:

As a rule of thumb, heading into the weekend with less than a strong bounce is a bearish signal while heading into a weekend without even a weak bounce is an almost guarantee that we are consolidating for a move lower. While the Futures are (8am) currently up about 1% – it’s nowhere near enough to move the needle and what exactly has changed?

There’s probably no Government shut-down but that just means that Trump and Musk can resume shutting down the Government. Tariffs are still in play, Ukraine is still at war and I’m pretty sure Consumer Confidence at 10 am will be even MORE AWFUL than it was last month – which is just about where it was when Trump was last in office and we were locked in our homes while 1.2M of our Fellow Americans died of a virus Trump denied until the end.

Now it’s just Measles and Bird Flu with the “usual” Influenza and yes, still Covid that we have to worry about but why worry when Robert Kennedy is in charge of keeping our children alive?

Measles is an airborne disease which spreads easily from one person to the next through the coughs and sneezes of infected people.[7] It may also be spread through direct contact with mouth or nasal secretions.[16] It is extremely contagious: nine out of ten people who are not immune and share living space with an infected person will be infected.[5] Furthermore, measles’s reproductive number estimates vary beyond the frequently cited range of 12 to 18,[17] with a 2017 review giving a range of 3.7 to 203.3.[18] People are infectious to others from four days before to four days after the start of the rash.[5] While often regarded as a childhood illness, it can affect people of any age.[19] – Wikipedia

It’s an AIRBORNE disease that has now spread from Texas to 9 other states and you can tell it has spread via AIRPORTS – so who knows how many cases there will be next week? As with Covid – Trump Administration II (the II is for “twice as deadly“) is downplaying it while, at the same time, appointing more anti-vax lunatics to run our Nation’s Health Programs…

It’s an AIRBORNE disease that has now spread from Texas to 9 other states and you can tell it has spread via AIRPORTS – so who knows how many cases there will be next week? As with Covid – Trump Administration II (the II is for “twice as deadly“) is downplaying it while, at the same time, appointing more anti-vax lunatics to run our Nation’s Health Programs…

I asked Boaty to assume the virus has spread by people flying in planes from Texas to other states and to take into account maybe 100 people per plane (mostly vaccinated) taking 4 days to show symptoms, etc:

🚢

The current measles outbreak is concerning given how rapidly this virus can spread:

-

-

-

: 222 confirmed cases across 12 jurisdictions as of March 6, 202510

-

: National MMR vaccination rate for kindergarteners has fallen from 95.2% (2019-2020) to 92.7% (2023-2024), leaving approximately 280,000 kindergarteners vulnerable10

-

: Measles has an R₀ of 12-18, meaning one infected person can infect up to 18 others – far more contagious than most diseases (Ebola’s R₀ is only 2)5

-

-

-

-

-

-

Infectious particles can linger in the air for up to two hours after an infected person leaves a room5

-

Patients are contagious for four days before the rash appears, meaning they spread it before knowing they’re sick5

-

94% of current cases are in unvaccinated people or those with unknown vaccination status10

-

The virus thrives in “pockets” of low vaccination – the Texas outbreak region has only 82% coverage versus the 95% needed for herd immunity2

-

-

-

-

-

-

Complications include pneumonia (12.5% of cases), acute renal failure (10.4%), and encephalitis (brain inflammation)9

-

17% of current cases required hospitalization10

-

Two deaths reported in this outbreak (one confirmed, one under investigation)10

-

Each outbreak case costs society approximately $47,479 ($814 per contact tracked)11

-

Without rapid vaccination, the US could see an estimated 400,000 hospitalizations9

-

-

The current outbreak demonstrates how quickly measles can spread through travel hubs and areas with lower vaccination rates, potentially threatening the country’s measles elimination status achieved in 2000.

With current vaccination rates:

-

-

-

National MMR vaccination: 92.7% (below 95% herd immunity threshold)

-

Texas hotspot areas: as low as 82% coverage

-

Measles R₀: 12-18 (using conservative R₀ of 15)

-

-

For airport exposures:

33,300 exposures × (1 - 0.927) susceptible rate × 0.10 infection probability = ~243 new cases

Each new case, if uncontained, can infect:

R₀ ÷ infectious period × days = 15 ÷ 4 × 4 = 15 new cases per primary case

This creates exponential growth:

243 new cases × 15 = 3,645 potential secondary cases

-

-

-

Major airport hubs create “small world networks” with higher transmission efficiency

-

Each of the 12 affected jurisdictions contains major transit hubs

-

Using network theory, the effective reproduction number increases by ~20% in hub-connected populations

-

-

The combined effect generates a concerning growth trajectory that explains why the CDC is issuing alerts before spring/summer travel season and why 17% of current cases have required hospitalization.

This mathematics underscores why 95% vaccination coverage is crucial – the difference between 95% and 92.7% immunity might seem small, but it’s the difference between epidemic control and rapid spread.

Of course, we have total faith in the Administration’s ability to handle the measles outbreak as well as they handed Covid, right?

Have a great weekend,

-

- Phil