🚢NVIDIA CEO Jensen Huang delivered his highly anticipated GTC 2025 keynote today in San Jose, presenting a vision that attempted to reinforce the company’s AI dominance while facing mounting competitive pressure. The presentation, which stretched beyond two hours, featured a blend of technical announcements, bold claims, and strategic positioning that offers insights into NVIDIA’s future direction.

Keynote Highlights and Market Reaction

Jensen Huang opened his presentation with characteristic confidence, stating, “I’m up here without a net. There are no scripts, there’s no teleprompter, and I’ve got a lot of things to cover.”1 This unscripted approach resulted in a technically dense presentation that attempted to dazzle the audience with NVIDIA’s expanding portfolio.

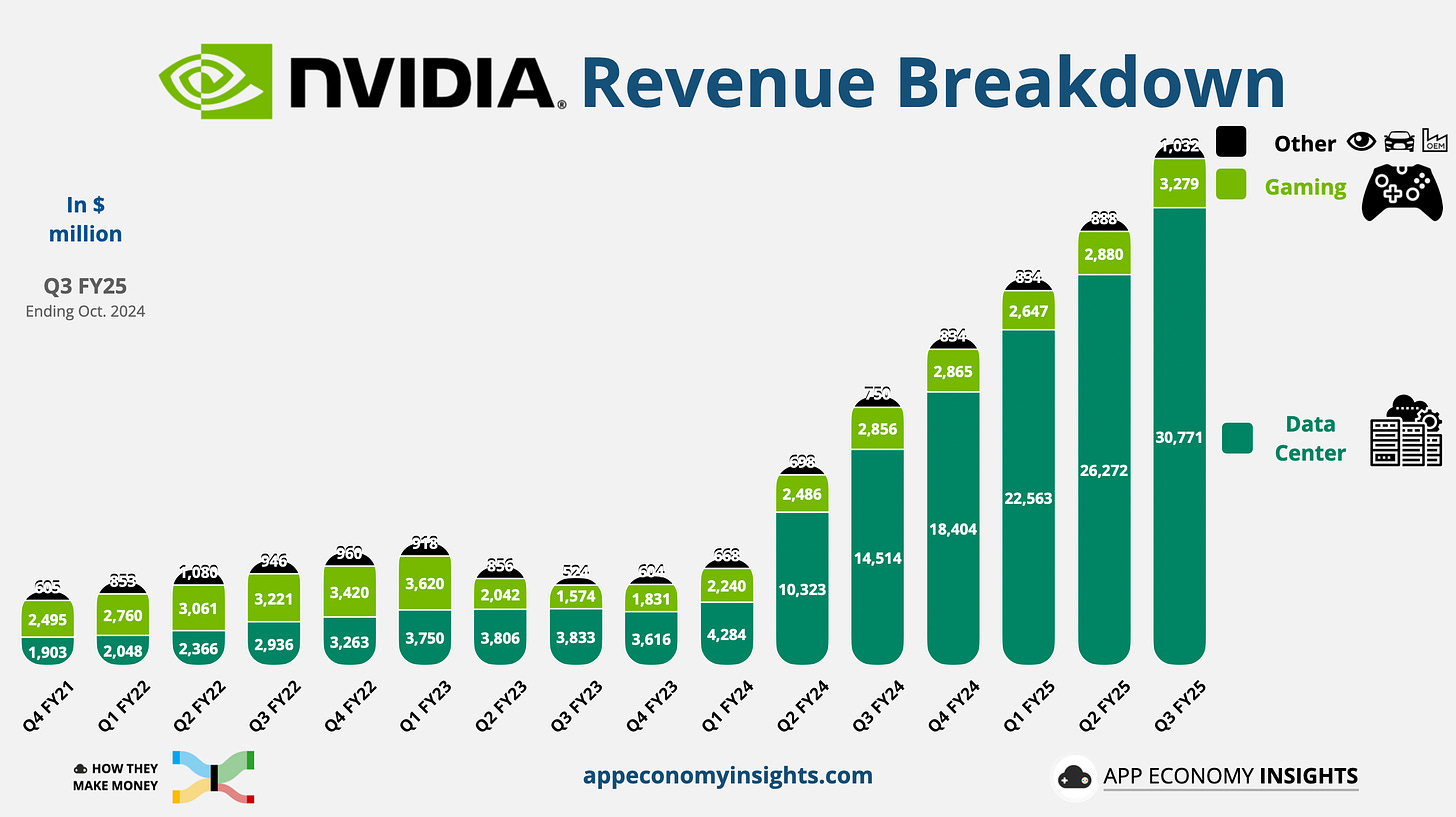

The market’s immediate response was tepid—NVIDIA shares traded down approximately 3% during the keynote, continuing a challenging start to 2025 that has already seen the stock decline more than 10% year-to-date.11 This lukewarm reaction suggests investors may be growing skeptical of NVIDIA’s ability to maintain its extraordinary growth trajectory.

Key Announcements:

-

-

Next-Generation Hardware Roadmap

-

Non-Chip Diversification

-

The Monopoly Defense Strategy

In perhaps the most revealing moment of the keynote, Huang made a striking claim about AI computational requirements: “This is where almost the entire world got it wrong. The computation requirement, the scaling law of AI is more resilient and in fact hyper accelerated… easily a hundred times more than we thought we needed this time last year.”

This statement effectively argues that the industry needs significantly more of what NVIDIA sells—exactly the type of messaging that benefits a company facing growing competitive threats.

Mounting Competitive Pressure

The keynote comes amid a landscape increasingly populated by alternatives to NVIDIA’s dominant position:

-

-

Cloud Provider Rebellion: Amazon Web Services is offering Trainium-powered servers at just 25% of the cost of NVIDIA’s H100 GPUs10

-

Lower-Cost Alternatives: DeepSeek’s recent introduction of a competitive chatbot requiring substantially less computational power triggered an NVIDIA stock selloff5

-

Startup Ecosystem: Over 60 startups are specifically targeting NVIDIA’s position in the inference domain5

-

Software Moat Erosion: Competitors are developing ways to break NVIDIA’s CUDA software advantage through hardware compatibility, library compatibility, and new compilers12

-

Signs of a Shifting Narrative

Signs of a Shifting Narrative

Several elements of the keynote suggest a company working to reposition itself as competition intensifies:

-

-

Emphasis on “Reasoning AI”: By promoting this emerging form of AI that supposedly requires even more computational resources, NVIDIA creates a narrative that conveniently favors its hardware approach5

-

Vertical Expansion: The push into robots, autonomous vehicles, and digital agents represents an attempt to create new markets where NVIDIA can leverage its existing technology stack58

-

Quantum Computing Pivot: After previously claiming practical quantum computing was “decades away” (triggering criticism from D-Wave Quantum’s CEO)2, NVIDIA dedicated an entire day of GTC to quantum discussions

-

Industry Perspective

Industry Perspective

The keynote’s reception among industry analysts has been mixed:

“This could disrupt the remaining Intel market,” commented Maribel Lopez, an independent technology analyst, regarding NVIDIA’s central processor initiative for personal computers.5

Meanwhile, Jay Goldberg, CEO of D2 Advisory, offered a more cautious assessment: “The inference market will vastly outsize the training sector. As inference gains prominence, NVIDIA’s market share may decrease, but the overall market size and revenue potential could expand significantly.”5

Conclusion: Evolution or Desperation?

Jensen Huang’s GTC 2025 keynote reveals a company at a strategic inflection point. While maintaining its technological leadership position, NVIDIA is clearly feeling the pressure from multiple fronts:

-

-

Market Sentiment: The stock’s year-to-date decline reflects growing investor concerns about sustainability

-

Competitive Reality: Price competition (Amazon), efficiency competition (DeepSeek), and startup innovation are eroding NVIDIA’s position

-

Diversification Need: The push into multiple new verticals suggests a recognition that chip dominance alone cannot sustain NVIDIA’s valuation

-

The keynote’s expansive scope and bold claims about computational requirements can be viewed through two lenses: either as a company confidently expanding its vision, or as a formerly dominant player anxiously trying to stay ahead of inevitable commoditization.

The keynote’s expansive scope and bold claims about computational requirements can be viewed through two lenses: either as a company confidently expanding its vision, or as a formerly dominant player anxiously trying to stay ahead of inevitable commoditization.

While NVIDIA remains an innovation powerhouse with significant competitive advantages, today’s presentation contained enough diversification signals and defensive positioning to suggest that the company recognizes its core monopoly position is indeed under legitimate threat. The question for investors is not if NVIDIA will face meaningful competition, but how rapidly it will erode their margins and whether their expansion into new territories can offset these pressures.