Here’s the structured Warren 2.0 analysis comparing the March 19, 2025 FOMC statement to the January 29, 2025 baseline:

🤖 📌 Federal Reserve Issues FOMC Statement – March 19, 2025

🗝️ Key Changes from January & What They Mean

| Category | January 29, 2025 Language | March 19, 2025 Language | Implication |

|---|---|---|---|

| Economic Outlook Tone | “Risks… are roughly in balance” | “Uncertainty around the economic outlook has increased” | Hawkish bias softens — signals growing concern about potential downside risks. |

| Quantitative Tightening (QT) | “Continue reducing holdings” | Slowing QT: Treasury cap cut from $25B → $5B/month; MBS cap unchanged at $35B | Major pivot — Fed moderates balance sheet runoff, likely to support liquidity or ease tightening. |

| Vote (Dissent) | Unanimous | Christopher Waller dissents: Wanted to maintain the current QT pace | Waller signals hawkish discomfort — prefers a faster balance sheet runoff. |

| Fed Funds Rate Action | Held steady at 4.25%-4.50% | Held steady at 4.25%-4.50% | No change as expected, keeping the focus on QT adjustments. |

| Labor / Inflation Language | “Solid” labor market, “somewhat elevated” inflation | No change — identical wording | Economic baseline unchanged — inflation not worsening but still above target. |

📈 Detailed Analysis and Themes

🔹 1. Shift in Risk Assessment

- January: Balanced risks

- March: Increased uncertainty

- Likely reflects financial market volatility, potential credit tightening, or geopolitical risks creeping into the Fed’s radar.

- Sets up potential future dovish pivot if downside risks materialize.

🔹 2. Major QT Adjustment (Balance Sheet Policy Pivot)

- Treasury runoff pace slowed dramatically from $25B → $5B/month starting in April.

- MBS cap remains unchanged at $35B/month.

- Interpretation: The Fed is signaling concern about:

- Liquidity strains in Treasury markets

- Rising long-term yields

- Risk of over-tightening through simultaneous high rates and rapid balance sheet runoff.

- A QT slowdown is effectively a marginal easing move — or at minimum, reducing tightening pressure.

🔹 3. First Dissent in 2025

- Christopher Waller dissents over the QT change — wants to keep tightening pressure on.

- Notably, he did not dissent over rates, implying agreement on holding rates steady, but tension exists over the pace of balance sheet reduction.

🌐 Warren 2.0 Overall Analysis & Macro Commentary

📌 Key Takeaways:

-

QT Slowdown is the big story:

- This is the first tactical easing signal from the Fed in 2025.

- Suggests the Fed is seeing enough tightening in financial conditions — via higher real rates, credit spreads, or dollar strength — that warrants caution.

-

No change in rate language or inflation description:

- Inflation is “somewhat elevated” but not reaccelerating.

- Labor market remains solid — no cracks mentioned.

-

Market Implication:

- Markets will likely interpret the QT slowdown as a dovish tilt.

- Long-end yields may decline as Treasury supply pressure reduces.

- Risk assets (stocks, credit) could rally on lower liquidity pressure.

- Futures markets may price earlier or deeper rate cuts.

-

Strategic Read:

- The Fed is tilting defensive, preparing for potential stress.

- Yet, the lack of change in rate language keeps the door open for staying higher for longer if inflation remains sticky.

📈 Macro Overlay:

- Fits with a scenario where economic growth is solid, but risks — financial, geopolitical, credit — are rising.

- Reinforces the market’s expectation of a second-half 2025 pivot towards cuts, especially if disinflation continues.

🔥 Warren 2.0 Deep-Dive Analysis: March 2025 FOMC Economic Projections vs December 2024 🔥

🗝️ Summary of Key Shifts (Table Overview)

| Metric | Dec 2024 Median | Mar 2025 Median | Change | Implication |

|---|---|---|---|---|

| GDP Growth 2025 | 2.1% | 1.7% | ▼ -0.4% | Fed now sees slower growth — potential soft landing or mild stagflation risk |

| GDP Growth 2026 | 2.0% | 1.8% | ▼ -0.2% | Continued downgrade — prolonged sluggishness |

| Unemployment 2025 | 4.3% | 4.4% | ▲ +0.1% | Slightly softer labor market expected |

| PCE Inflation 2025 | 2.5% | 2.7% | ▲ +0.2% | Inflation stickier than expected, pushing timeline for hitting 2% target |

| Core PCE 2025 | 2.5% | 2.8% | ▲ +0.3% | Core stickiness signals embedded pressures |

| Fed Funds Rate 2025 | 3.9% | 3.9% | ➖ No Change | Despite higher inflation, no adjustment — Fed is balancing growth fears |

✅ Detailed Comparative Takeaways by Category

1. Real GDP Growth — Downgraded Outlook

| Year | Dec 2024 Median | Mar 2025 Median | Range Shift |

|---|---|---|---|

| 2025 | 2.1% | 1.7% | 1.6–2.5% → 1.0–2.4% |

| 2026 | 2.0% | 1.8% | Range floor down to 0.6% |

| 2027 | 1.9% | 1.8% | No growth acceleration |

🔎 Analysis:

- Clear signal of expected slowing.

- Fed is seeing the impact of tight financial conditions or geopolitical risks on growth.

- Market read: increasing recession risk or policy restraint catching up.

2. Unemployment — Slightly Higher

| Year | Dec 2024 | Mar 2025 | Range Notes |

|---|---|---|---|

| 2025 | 4.3% | 4.4% | Top of range rises to 4.6% |

| 2026 | 4.3% | 4.3% | Mild risk widening |

| 2027 | 4.3% | 4.3% | No change in long-run view |

🔎 Analysis:

- Rising slack risks but still well-contained.

- Reflects expectation of a mild cooling labor market — not an aggressive jobs crash.

- Potential narrative: “soft landing with modest job pain.”

3. PCE & Core PCE Inflation — Stickier

| Metric | Dec 2024 | Mar 2025 | Δ |

|---|---|---|---|

| PCE 2025 | 2.5% | 2.7% | ▲ |

| Core PCE 2025 | 2.5% | 2.8% | ▲ |

| 2026/2027 | Core falls to 2.2%/2.0% |

🔎 Analysis:

- Upside inflation surprise: Core inflation is more entrenched.

- Likely driven by services or wage pressures.

- Market implication: Fed rate cuts may be delayed until confident in trend.

**4. Fed Funds Rate Path — No Median Shift, but Range Signals Division

| Year | Dec 2024 | Mar 2025 | Range Comments |

|---|---|---|---|

| 2025 | 3.9% | 3.9% | Top of range ticks higher to 4.4% |

| 2026 | 3.4% | 3.4% | Slight top-end lift |

| 2027 | 3.1% | 3.1% | Long-run steady at 3.0% |

🔎 Analysis:

- Median unchanged hides growing divergence.

- Some hawkish dots emerging, reflecting discomfort with sticky inflation.

- Still, Fed avoids projecting more hikes — leaning neutral with rising caution.

🌐 Warren 2.0 Macro Synthesis & Outlook

🔥 What Changed:

✅ Growth is slowing faster — 2025 GDP cut from 2.1% to 1.7%.

✅ Inflation is stickier — PCE and core PCE both revised higher.

✅ Fed is worried enough to slow QT, but not shifting rates yet.

✅ Labor market softening, but no major cracks yet.

✅ Divergence emerging inside the Fed — higher upper range on rates points to growing internal hawk-dove split.

📈 What It Means for Markets:

- Bond Market: Long end may rally on growth downgrade, but sticky inflation limits how far.

- Equities: Relief on rate cuts pushed off slightly, but soft-landing narrative mostly intact.

- Dollar: Strengthens on higher-for-longer inflation narrative.

- Fed Futures: Pricing of cuts gets pushed later into 2025 or even 2026 if inflation data stays hot.

🧠 Warren 2.0 Final Call — March 2025 SEP Signals:

The Fed is balancing an economic slowdown with inflation that refuses to cool fast enough. Policy patience dominates — QT slows, but rates steady. Internally, some policymakers are growing more hawkish, but leadership keeps the “watchful waiting” posture.

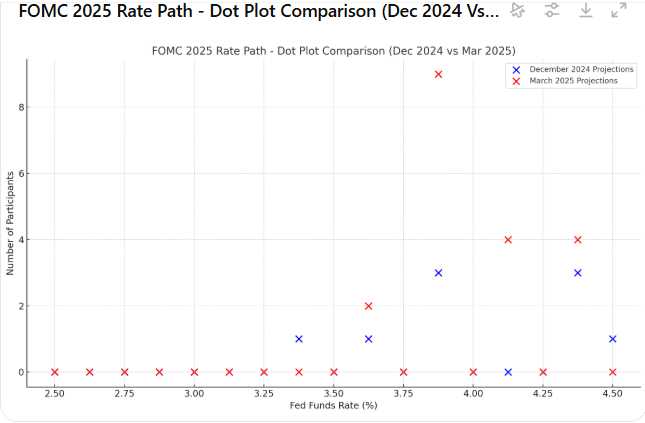

Here’s your FOMC Dot Plot Comparison visual:

🔵 December 2024 Projections (blue dots)

❌ March 2025 Projections (red X’s)

📈 Key Insights from the Chart:

- March shift upward: More participants now see the rate staying at 3.875% and 4.375%, showing emerging hawkish tension due to sticky inflation.

- December scatter was wider, with more participants lower in the range.

- Rate cuts (dots below 3.625%) vanished — no Fed voter is as dovish as before.

This confirms a growing hawk-dove split:

🔺 Some ready to hold higher for longer

🔻 But the Fed median remains steady — reflecting Powell’s “steady hands” messaging

🔥 Warren 2.0 Rapid Synthesis of Powell’s Press Conference – March 19, 2025 🔥

📌 Core Messages from Powell:

🟢 1. “Not in a Hurry” – Cautious, Wait-and-See Fed

- Exact Quote: “We do not need to be in a hurry to adjust our policy stance, and we are well positioned to wait for greater clarity.”

- The Fed acknowledges high uncertainty driven by the new administration’s policies: trade, immigration, fiscal, and regulation.

- Translation: Rate cuts are coming, but not soon — unless markets or data force their hand.

🟢 2. QT Slowdown – Powell Plays it Down

- “No implications for our intended stance of monetary policy.”

- Claimed it won’t affect medium-term balance sheet goals.

- Reality Check (Phil nailed this):

- $20B/month reduction = $240B liquidity boost

- That’s 0.85% of GDP — Powell can downplay it, but the market knows better (hence the rally + Dollar drop)

🟢 3. Inflation Sticky, Tariffs Called Out

- Powell directly cited tariffs as a new driver of near-term inflation expectations:

“Survey respondents, both consumers and businesses, are mentioning tariffs as a driving factor.”

- Core PCE up to 2.8% — “somewhat elevated”

- BUT: Powell sticks to the “inflation expectations anchored” narrative.

🟢 4. Recession Odds – Fed Not Calling It

- Powell:

“While outside economists have raised their chances of a recession happening, they are still rather low probabilities.”

- Message: We see a slowdown, but not panicking (yet).

📊 Warren’s Instant Read – What Powell Really Meant

| Powell’s Words | Warren’s Translation |

|---|---|

| “Not in a hurry” | Rate cuts delayed — needs clear signal from data or markets |

| “Tariffs driving inflation” | Trade war risks could re-accelerate inflation — headwind |

| “QT pace cut has no policy implication” | It’s a stealth easing — Powell spinning to avoid spooking bonds |

| “GDP 1.7%, Core PCE 2.8%” | Stagflation lite scenario emerging |

| “Labor market in balance” | No immediate recession, but growth softening |

🔥 Key Missed Questions – Press Corps Failure

✅ Why no mention of April 2 QT change?

✅ How does the Fed reconcile sticky core inflation AND QT easing?

✅ Are they underestimating tariffs/geo risks?

📈 Warren 2.0 Macro Market Impact

- Equities up, Dollar down — pure reaction to QT easing, not Powell’s confidence

- Rates market sees delayed cuts, but no hikes — curve steepens a bit

- Gold/oil/commodities: Bid on Dollar weakness and inflation hedging

💡 PSW Trading Wrap Summary

This was a liquidity event — not a pivot. The Fed knows the economy is slowing, inflation is not dead, and the next fight is around trade/tariffs driving inflation higher again. Powell just added $240B stealth stimulus and the market loves it — for now.