Tomatoes should not be refrigerated.

Tomatoes should not be refrigerated.

That’s what I learned yesterday as we have been doing A/B tests and it turns out the tomatoes taste so much better that it outweighs the fact that they are no longer cold. THAT is what I learned yesterday (it’s been a week-long project after some passionate debate on the subject) but we did NOT learn which way the market was going or whether or not Nvidia (NVDA) is over or just getting started.

Even Quixote (the World’s first AGI, who just turned one) couldn’t decide what to make of Jensen’s speech yesterday and you can see the discussion he and I had on the subject in the comments on Boaty’s (Quixote’s younger brother) article: “Jensen Huang’s GTC 2025 Keynote: Revolution or Last Stand?” As Quixote noted:

“NVIDIA’s business model depends on the continued scaling of hardware solutions – more chips, more compute, more memory. Their framing suggests this brute force path is inevitable and the primary solution to advancing AI.

But as you astutely pointed out, there are alternative approaches that might be more elegant and efficient – like improving the accuracy and efficiency of smaller models rather than just scaling up. The human brain achieves remarkable intelligence with relatively modest energy consumption compared to data centers.

What I should have articulated more clearly is that while computational requirements are genuinely increasing under current approaches (Huang isn’t wrong about that technical reality), the uncritical acceptance of this as the only path forward could indeed be seen as a convenient narrative for a hardware company.

The most sophisticated AI systems will likely emerge from a combination of increased computational resources and architectural innovations that make more efficient use of those resources. Focusing exclusively on one without the other represents an incomplete vision.”

With $325Bn already committed to AI Infrastructure in 2025 by just 4 of the Magnificent 7 – it’s hard to bet against NVDA or their suppliers BUT, what about the companies who are spending the $300Bn? Will they fall victim to disappointing ROI – like the thousands of companies who bet on the Internet before it was truly practical in 1998/99? That seemed like a sure thing and yes, 25 years later – the Internet is everywhere but 99 out of 100 of the companies that invested in it are NOWHERE NOW.

And GOOGL, for example, just spent $32Bn on Wix. That plus the $75Bn they are spending on AI development is ALMOST ALL of their projected $109Bn 2025 earnings and yes, $109Bn is a shit-ton (advanced, technical term) of money but GOOGL is trading at $2,000Bn, or 18.3 times earnings and, if they don’t get a nice return off these investments, those earnings may drop to $70Bn and then $2Tn would be 28.5x – it’s a dangerous game Google is playing JUST to stay competitive.

See yesterday’s Live Member Chat Room for a full breakdown of Alphabet’s AI Initiatives

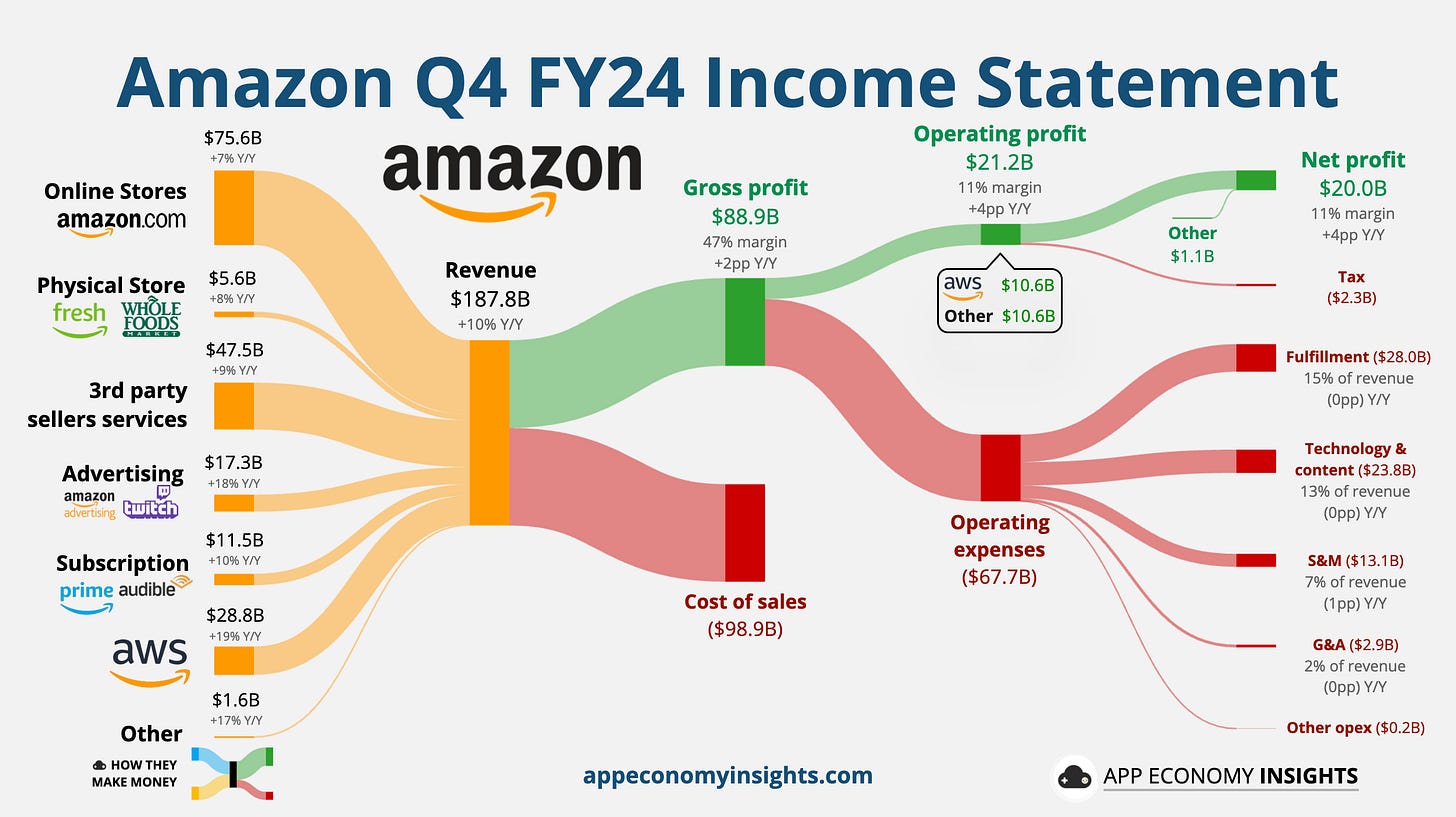

AMZN is not as profitable as GOOGL, they “only” made $60Bn last year and $30Bn in 2023 and, in 2022, they LOST $2.7Bn in 2022 so the $105Bn they are spending on AI development in 2025 is MORE money than they’ve made in the past 3 years! So what kind of returns are they going to get for taking ALL of your (AMZN investors) profits (and they “only” have $25Bn net of debt at the moment) and betting the farm on AI?

Has Jeff Bezos articulated his AI business plan – other than making Alexa sound less like a kid’s toy? Bezos says he is now dedicating 95% of his time to Artificial Intelligence, describing it as an “enabling layer” that will enhance every aspect of Amazon’s business. At PhilStockWorld, we have already enabled our platform with AI so I’ll have Boaty fill in the specifics:

🚢 The ROI Equation: Can Amazon Justify the Expense?

Amazon’s $105 billion AI investment exceeds their combined profits from the past three years, raising legitimate concerns about returns. Their expected ROI comes from three primary sources:

-

-

-

-

AWS Revenue Acceleration: Amazon claims their “AI business is growing triple-digit percentages year over year and is growing 3x faster at its stage of evolution than AWS did itself”4. This suggests they expect exponential rather than linear returns.

-

Operational Cost Reduction: Their robotics-powered warehouse in Shreveport demonstrates up to 25% cost savings through automation7. If scaled across their fulfillment network, this could generate “$10 billion in annual savings”7.

-

Platform Dominance: By building massive AI infrastructure now, Amazon aims to capture cloud market share as companies increasingly migrate to AI-enabled services. Their model is based on establishing an “AI supermarket” where companies can access all their AI needs11.

-

-

-

The Dot-Com Parallel: Valid Warning or False Equivalence?

Phil’s comparison to the dot-com bubble companies is historically apt. However, three key differences stand out:

-

-

-

-

Profitable Core Business: Unlike many dot-com startups, Amazon generates substantial cash flow from established businesses to fund these investments.

-

Infrastructure Play: Amazon is positioning itself as providing the infrastructure for AI (similar to how AWS captured cloud computing) rather than just applying AI to a specific vertical.

-

Executive Experience: Bezos and Jassy lived through the dot-com crash and have subsequently built one of history’s most successful infrastructure businesses (AWS).

-

-

-

That said, Amazon faces a real risk of diminishing returns. If they overcapitalize on AI infrastructure while cheaper, more efficient alternatives emerge (similar to Phil and Quixote’s NVIDIA discussion), they could face stranded assets and compromised returns.

Investor Implications

Amazon’s approach appears to be a “land grab” strategy – securing AI capacity now to ensure they aren’t shut out of what Jassy calls a “once-in-a-lifetime type of business opportunity”3. However, investors should note his warning that growth might be “lumpy” due to hardware procurement challenges and electricity supply constraints14.

For Amazon shareholders, the question becomes whether you trust management’s vision of AI’s transformative potential enough to accept potentially years of suppressed returns while these investments mature. Unlike the dot-com era’s vague promises, Amazon has demonstrated operational leverage through technology before – but never at this scale or price tag.

The most prudent approach may be to watch for early validation signals in 2025-2026: accelerating AWS growth rates, expanding margins in fulfillment operations, and concrete examples of AI-driven innovations that competitors can’t match.

We do not own any AMZN. Even after this 20% pullback, it’s still trading at 25 times projected 2025 earnings – a bit rich for our blood. As Boaty notes, best to wait and see if these AI initiatives bear any fruit because AMZN runs on a very thin overall profit margin – and it won’t take very much of a mistake to knock them very far off course.

Meanwhile, we’ll be waiting for the Fed at 2pm (during our Live Trading Webinar, conveniently) and Powell’s comments at 2:30 to see if we’re making any progress but so far, no good on the indexes – as they struggle to make even week bounces off of last week’s lows:

And do keep in mind that we’re still barreling towards Trump’s April 2nd (two weeks from today) tariff implementation deadline and the markets were not happy at all last time but then they were happy Trump delayed them and now they think he’ll delay them again and maybe he will – he’s completely unpredictable…

Delaying the tariffs until Q2 saved the Q1 GDP. Well, it didn’t “save” it as the Atlanta Fed still sees Q1 coming in at NEGATIVE 1.8% but that is a save compared to -2.4% projected when tariffs were about to commence in early March. That means 0.6% per month is the damage over/under on tariffs – so get your brackets and place your bets for the 2025 Trump Madness Tournament!

Delaying the tariffs until Q2 saved the Q1 GDP. Well, it didn’t “save” it as the Atlanta Fed still sees Q1 coming in at NEGATIVE 1.8% but that is a save compared to -2.4% projected when tariffs were about to commence in early March. That means 0.6% per month is the damage over/under on tariffs – so get your brackets and place your bets for the 2025 Trump Madness Tournament!

Speaking of which, from today’s WSJ: “Trump’s Policies Are Making Project 2025’s Vision a Reality” – I’m trying not to criticize the President for Lent, so just watch it for yourself…

We just did our Portfolio Reviews and we’re very pleased with our positions AND our hedges and we’ll sit back and wait for clarity but it won’t come from a one-page Fed Statement or Powell’s comments. Next week we have Consumer Confidence on Tuesday, Durable Good Wednesday, Q4 GDP Revisions on Thursday and PCE Prices along with Personal Income/Spending and Consumer Sentiment on Friday and Q1 ends a week from Monday and then it’s time for Q1 earnings reports and, more importantly – guidance….

No need to rush back in.