Just because Global Leaders are acting like idiots doesn’t mean we have to as well. In addition to our 5 PSW Members Only Portfolios, we keep an instructional portfolio for beginner investors called the $700/Month Portfolio and our goal – back on Aug 25, 2022 was to steadily invest $700 each month for 360 months (30 years – $252,000) and invest it in such a way as we’d get to $1,000,000 by Aug 25, 2052.

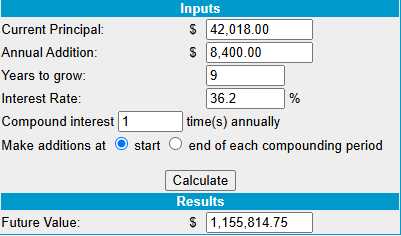

To accomplish that, our handy Compound Rate Calculator told us that if we invest $700 per month and add $8,600 per year for 30 years and make just 10% per year – we would have $1,568,328.04 30 years from now. While we HOPED we could do better – as of last month (month 31) we had put in $21,700 and it had grown into $42,018 – up 93.6% in less than 3 years and MILES ahead of schedule.

To accomplish that, our handy Compound Rate Calculator told us that if we invest $700 per month and add $8,600 per year for 30 years and make just 10% per year – we would have $1,568,328.04 30 years from now. While we HOPED we could do better – as of last month (month 31) we had put in $21,700 and it had grown into $42,018 – up 93.6% in less than 3 years and MILES ahead of schedule.

That meant that, if we continued at that rate (36.2%/year), we’d be over $1M in just 9 more years – almost 20 YEARS AHEAD OF SCHEDULE! But good times don’t last forever and, looking at our Bounce Chart at the time (March 11th), I noted:

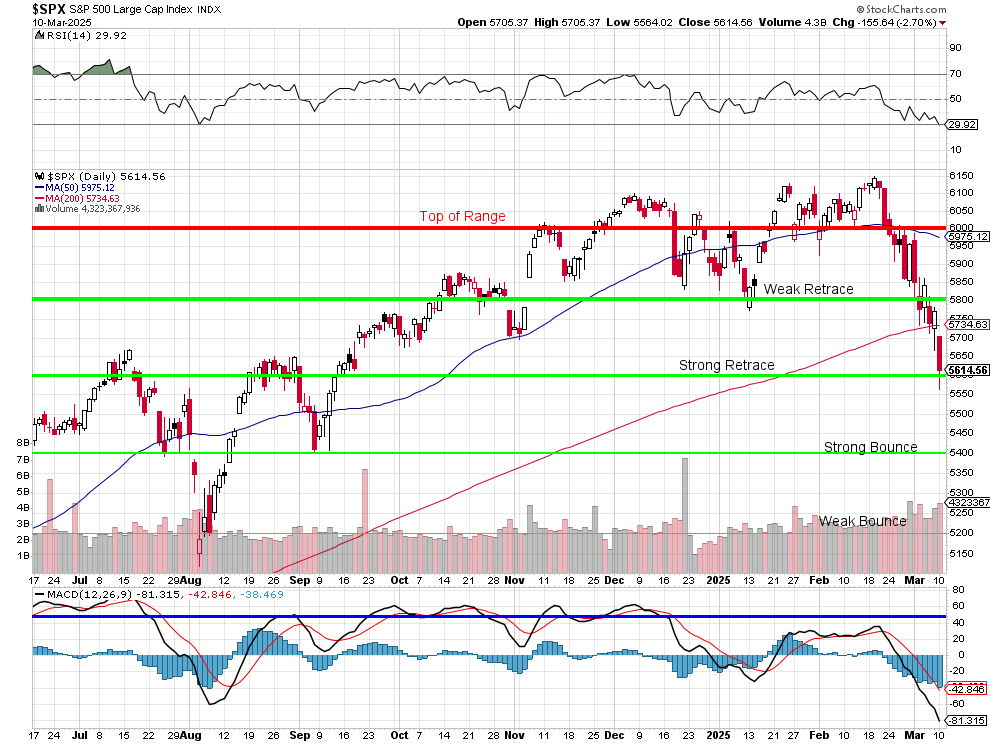

“Keep in mind those greens on the bottom line are free because those were the lows – so we can’t be below them! So this is as bad as a bounce chart can get and the rule of thumb is that, if we can’t make and hold the Strong Bounce Lines by Friday (usually we give it a week but 4 days is good), then we are more likely to be consolidating for a move lower – not higher.”

And, I said of the positions we had:

“Keep in mind, these are the positions we committed to last week with the expectation that the market could drop another 20% and our intention is to ADD to the positions for the long-term. We should look to deploy our capital for that purpose before going after new positions so let’s take a very careful look at what we have:”

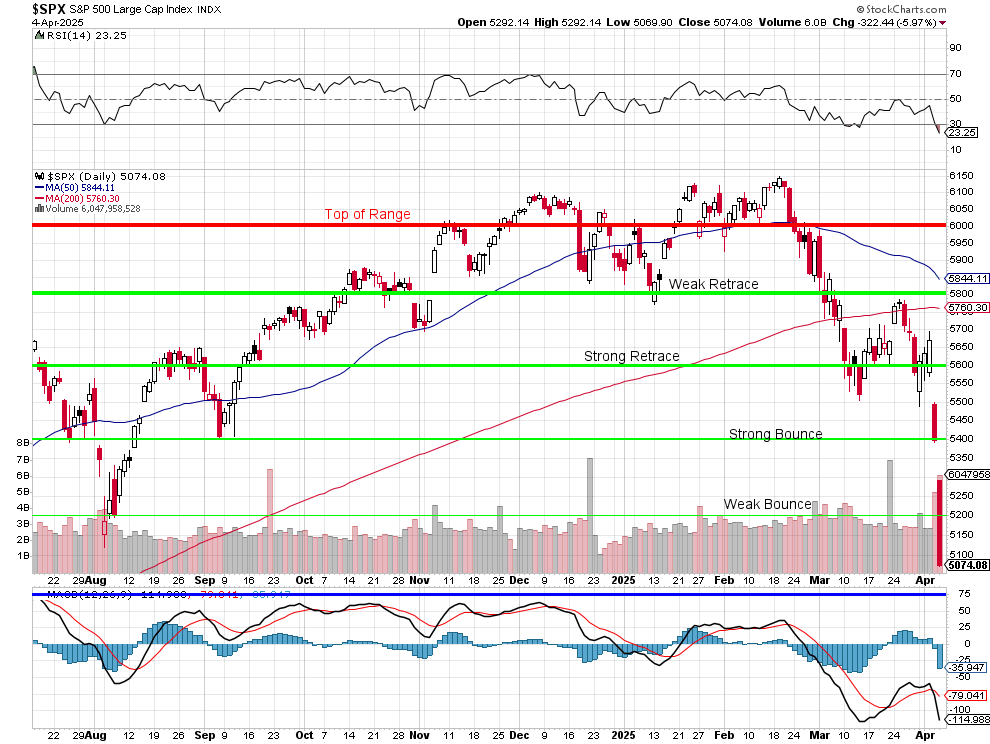

Unfortunately I was right and, since March 11th, this happened:

The S&P took an additional 10% dive, completing our 20% drop prediction but, unfortunately, the way it dropped (changes in tariffs) means it may not be done yet but we do expect at least a bounce next week so we’ll be prepared for anything – including a 10% drop on Monday that is not out of the question, unfortunately.

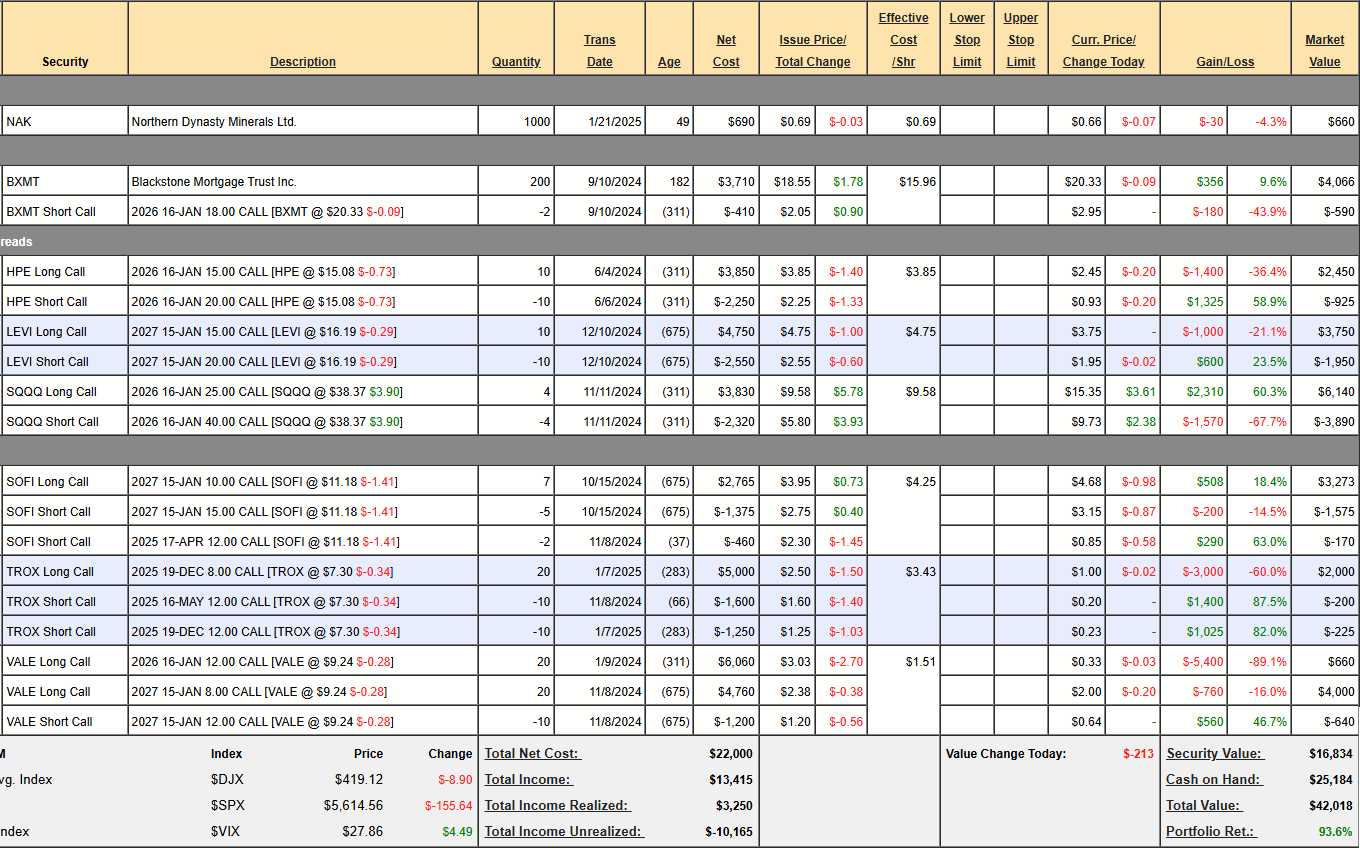

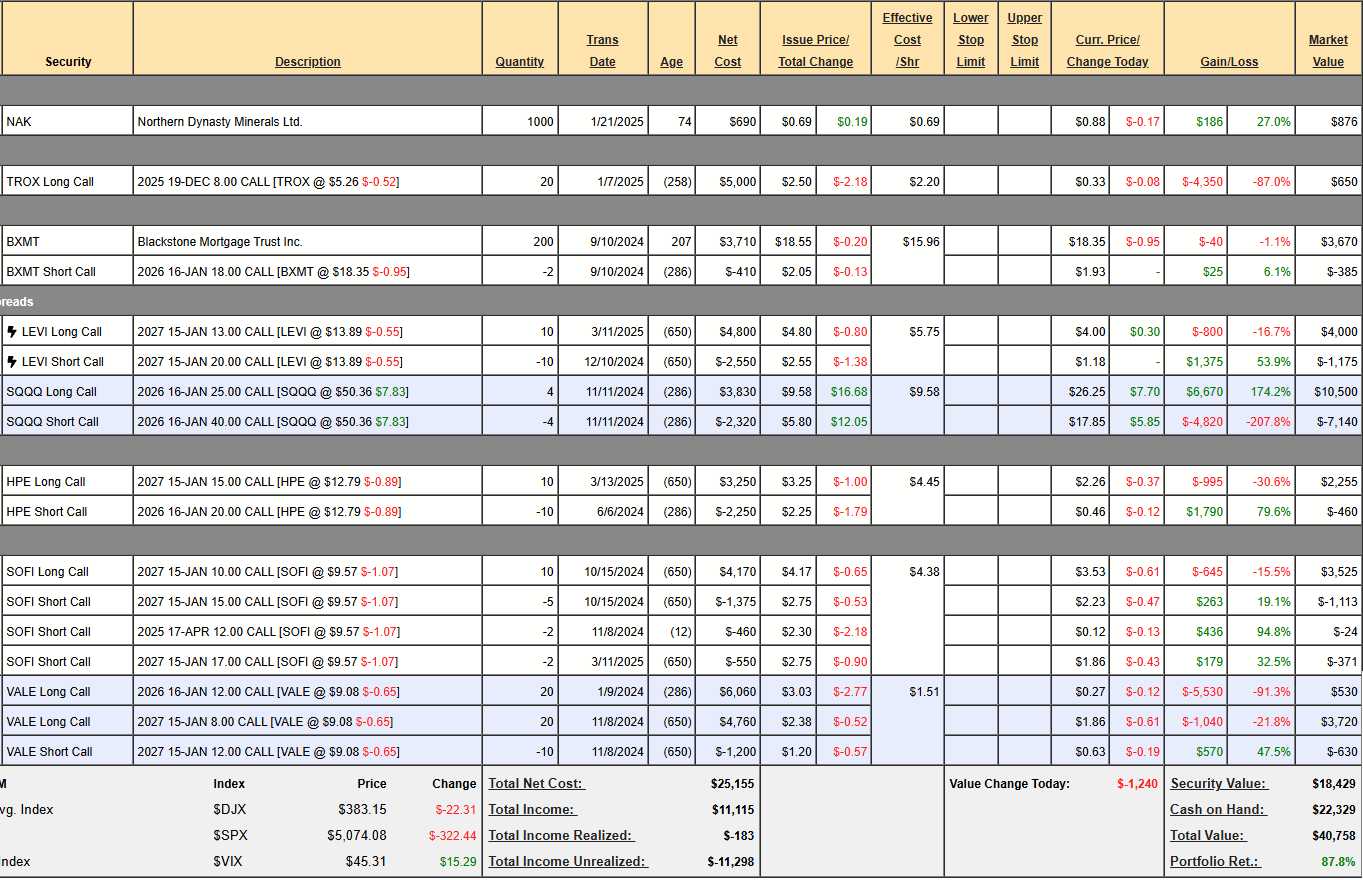

Although the market fell 10% since our last review, our portfolio is only down $1,260 (2.9%) – BECAUSE we are well-diversified and made good, conservative picks with the expectation of a correction (we knew the Administrations policies were a disaster waiting to happen) AND also because we had a HEDGE!!!:

As you can see – on March 11th, the net of our SQQQ hedge was $2,250 with SQQQ at $38.37 but now that SQQQ is $50.36 and our hedge is MILES in the money – the net of our hedge is $3,360 – up $1,110 and mitigating about 40% of our losses. Not only that but it’s net $3,360 out of a potential $6,000 so, if SQQQ stays over $40 (doesn’t drop more than 20%), we’ll collect ANOTHER $2,640 – aren’t hedges fun???

And we only paid net $1,510 for that bad boy back in November. Anyway, my main point is that your portfolio can be doing a lot better than it seems because the VIX tends to go much higher during market turmoil and your DEEP in-the-money long leg of the hedge ends up with little or no premium while the less in-the-money short call GAINS premium – which distorts your net. So keep your eye on the price – not your broker’s low-ball offer on your position!

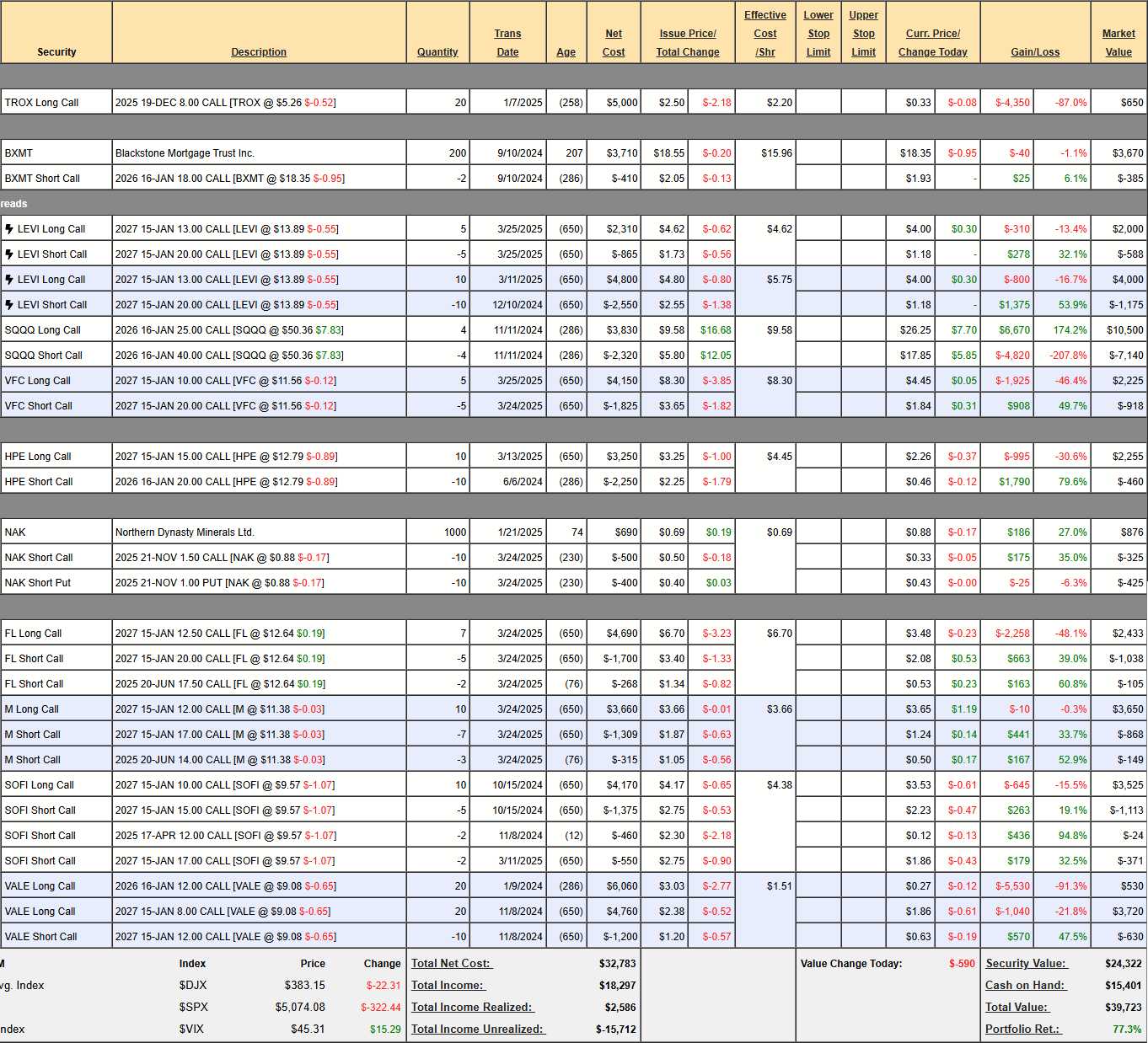

Knowing that things were going well, we were emboldened to add a few new positions as the market tanked (and we also added our usual $700) as we were more than 50% in cash and holding up during the drop-off. We added M, FL, VFC and LEVI and we covered NAK and so far, no good on our new additions but what did we expect with a crash like this?

We lost another $1,735 and the market may drop 10% or rise 5% on Monday and, since we have no idea which – let’s just keep our remaining $15,401 in CASH!!! on the sidelines and wait for some clarity. As to the positions however – let’s make sure we still like them enough to ride out the storm with and add to if necessary:

-

- TROX – Titanium Dioxide is used in paint and packaging and isn’t optional though an overall slowdown in Industrial Production can impact demand but TROX expects to make $72.5M this year and $5.26 is just $830M in market cap so just 11.4x even with the gloomy outlook means I don’t mind owning them for the long run. If they don’t bounce, we’ll sell short calls and roll our longs lower. Assuming they normalize at 15x in 20 months, that would be about $7 but 2026 projections are $150M, so maybe $14! Let’s split that baby and call the upside potential at $10.50 to be $2.50 per share ($5,000) for an upside potential of $4,350 (669%) and that also tells us what our short call target is (the Dec 2025 $10 calls are currently 0.15 and we’d be happy to sell them for 0.50+ ($1,000).

-

- BXMT – Blackstone is a Commercial REIT that pays a 12% dividend, which is why we own shares and falling yields are very good for them. Commercial Loans aren’t tariff-hit unless things get so bad they start defaulting – which we need to keep an eye on, of course. Rising Construction Costs indirectly affect BXMT as it shrinks the pipeline of new loans and, if Powell has to RAISE rates to fight Trump’s Inflation – that could become an issue too but none of that should be the kind of thing that sneaks up on us suddenly. Meanwhile, they are paying 0.47 ($94 – 2.8%) per quarter while we wait for our net $3,285 position to get called away at $3,600 for a $342 (10.4%) profit in Jan when, hopefully, we’ll simply sell 2027 whatevers for $400 (12.1%) more and keep things going. Let’s call that upside potential $385 that’s left on the short $18s and then we sell $400 more in Jan and we collect $7 x $94 over 2 years in dividends is $1,443 (43.9%) upside potential for 20 months.

-

- LEVI – I need to consolidate those. I certainly don’t think $20 is an unrealistic target for Jan, 2027. This is a 150 year-old company so they’ve been through a few downturns and people wear pants – even in a bad economy. LEVI expected to make $500M this year and $13.89 is $5.5Bn so 11x and say they make $400M, that’s still 13.75x and LEVI is low-debt ($321M) – probably able to take advantage of the turmoil. $20 is still a realistic target and that would be $10,500 from our current net $4,237 so $6,263 (147%) upside potential back at $20.

-

- SQQQ – As I mentioned our hedge is well in the money and, if the Nasdaq stays low, it will pay us $6,000 and the current net is $3,360 so there is $2,640 (78.5%) downside protection left in this hedge.

-

- VFC – $11.56 is $4.5Bn in market cap and VFC does $9.5Bn in revenue and makes $300M, so call it 15x. This is Vans, NorthFace and Timberlands – luxury items generally coming from Vietnam and China but 40% of their production is US and they can simply sell the Asian-made goods to other countries to avoid the tariffs – so I don’t expect too much pain but certainly some as they make adjustments. Recession, of course, is the bigger concern as no buyers are no buyers globally. If they were still at $16 I’d probably cut the cord but $20 is not an unrealistic 2-year target and net $1,307 means they have a 3,693 (282%) upside potential and we’re $1,560 in the money at $11.56 so why would we sell now?

-

- HPE – Servers, Storage and Networking were hot, Hot, HOT! just recently, weren’t they? We can buy back the short calls ($460) and give them room to recover. $12.79 is $16.8Bn and they have $32Bn in revenues and make $2.5Bn in profit so 12.8x and, unless you hear MSFT, META, etc scaling back their AI plans – I’d stick with HPE. They do source their components from Asia so margins might squeeze but people need the capacity at any price – NVDA certainly proved that last year! It’s a $5,000 spread at net $1,795 with $3,205 (178%) upside potential at $20 but we’ll probably roll down the the $10 longs and then sell more short calls but let’s not get ahead of ourselves.

-

- NAK – There are 6.5 BILLION tons of Copper and Gold (mostly Copper) up in their Alaska mines and they have been trying to get permission to mine it for more than a decade but it’s right next to salmon fisheries so the EPA keeps holding it up. EPA just went !POOF! thanks to Trump so it’s possible NAK will get a permit to start strip-mining Alaska. We took advantage of the run-up to sell 0.90 worth of puts and calls against our 0.69 entry so we’re up 0.21 already and, even if we get re-assigned under $1, it’s net 0.79 as our worst-case re-entry. As it sits, if we do get called away at $1+ in November, that would be a potential $874 (693%) profit from where we are now. Aren’t options fun?

-

- FL – People need shoes and they have to go somewhere to buy them. That’s a nice, simple premise. FL isn’t the one paying the tariffs though people may buy less shoes during a Recession – sneakers do, in fact, wear out over time. $12.64 is just $1.2Bn and it takes them $7.9Bn in sales to squeeze out $140M in profits but that’s 8.5x and, in good years, they’ve made $500M and even $900M so a big YES! for the long-term. The real reason I like FL this year is NKE is pushing back into Retail and they NEED to make FL happy to gain shelf space they lost during their direct to consumer debacle. Also, we’re using this as an income play and we’re already on track to make $268 (8.9%) off our net $2,990 in the first 3 months so 6 more of those is $1,608 and we collect $5,250 at $20 for another net $3,690 off our current $1,290 spread so upside potential is a rockin’ $5,298 (410%) upside potential makes this a very exciting trade!

-

- M – They just pass the tariffs along to the consumers and they might buy less – but they won’t buy none so $11.38, which is $3.2Bn for a company that made $582M (5.5x) last year seems like about as panicked as it should b at this point. Macy’s has been running historically lean inventories and should weather the storm and, like FL, we chose to derive an income from the spread by selling $315 (13.4%) against our net $2,351 spread that turns into $7,00 at $17, which would still be less than 10x! So $4,649 (197%) upside potential on the stock and 6 more $315 sales would be $1,890 (80%) so $6,539 (278%) upside potential makes me wonder why we don’t have more – gosh I hope the market goes lower so we can buy more, right?

-

- SOFI – This is like an amnesia stock as people keep forgetting how great they are and selling them and then remembering and buying in again… over and over. We don’t forget and our 2027 spread is net $2,041 and we sold $460 (22.5%) worth of April calls in Nov (5 months) so let’s say we have 4 more of those for $1,840 (90%) ahead of us and then it’s a $5,000 spread at $15 for another $2,959 (144%) so $4,799 (235%) upside potential on this one and also hoping it goes lower so we can double down! Aren’t options fun?

-

- VALE – Dropped 10% but so ridiculously low (5x earnings) that it’s hard to push them below $9. We are way down on this one but, as a new entry on the 2027 $8/12 spread at net $1.23 on the $4 spread – that’s a good deal! VALE is Brazil-based so China can still buy their iron ore (70% of VALE’s revenue). They are mostly being held back by unresolved lawsuits but the worst case is already priced in. As with everyone, Recession would be extra bad but we have lots of room to start selling calls if they don’t bounce back over $10 (or even if they do). I would say $12 is realistic and that would return us $8,000 against the current net of $3,620 so $4,380 (120%) upside potential but also we should be able to sell 10 $10s for $1 ($1,000) at least 3 times for another $3,000 (82.8%) but let’s just stick with the conservative estimate for now.

See, that wasn’t hard! The net cost of our 12 positions is $24,322 and we have $15,401 in CASH!!! to deploy once we thing we have a proper bottom but the 12 positions we already have $40,844 (102% including the cash) worth of potential gains if the market recovers over the next 20 months and that’s about 50% returns each year – MILES ahead of our goal, despite the setback.

As long as you keep on top of your positions and maintain clear and achievable goals – market setbacks like this one are more of an opportunity than an obstacle!

Our 5 Members Only Portfolios will be reviewed the week of the 14th – Become a Member now and we will help guide you through the chaos!