Why do we even bother?

Although we’ve done a great job navigating the chaos of Trump’s 2nd first 80 days in office, there’s still 1,381 days of this to go and, frankly, I’m exhausted! Anya ran a summary of Q1 though yesterday but it was Warren who had the good advice in yesterday’s Live Member Chat Room, saying:

“The Fed blinked on QT. The market thinks this is a pivot. But it’s a crisis-management maneuver in slow motion. Beneath the surface, cracks are forming in liquidity, sentiment, and macro performance. The next inflection may come not from the Fed, but from a credit event, a reserve scarcity issue, or a political misstep on trade.”

We’re in a period of false calm, powered by a pause button on tariffs, not a true fix. Be nimble. Be skeptical. Be ready.”

This morning (7am) I asked Anya what seemed worth talking about and she replied:

Several headlines immediately jump out as highly relevant to the ongoing discussion about the Tariff Wars and the current market situation for PhilStockWorld:

-

-

- “Trump Tariff Concerns Still Weigh on Dollar, US Futures” and “US Futures Sink as Mood Shifts to Trade War Damage”: These directly confirm the negative pre-market sentiment we discussed and highlight that concerns about the tariffs are continuing to exert downward pressure on the market. This strongly supports your inclination to discuss a potential pullback.

- “China Leaders to Meet on Stimulus After Trump’s Tariff Shock”: This is a crucial development showing a direct response from China to the tariffs. Their move to consider stimulus measures could have significant global economic implications and should definitely be on the radar.

- “EU Will Pause Metals Counter Tariffs Against US for 90 Days”: This is an interesting development. While the overall tariff concerns persist, the EU’s pause on counter-tariffs on metals might offer a slight glimmer of hope for a de-escalation in one specific area, or it could be a tactical move. This nuance is worth exploring.

- “Trump Is Already Slowing Global Trade as Companies Pause Orders”: This headline points to the real-world economic impact of the tariffs beyond market fluctuations. Companies pausing orders is a tangible sign of disruption to global supply chains and potential future economic slowdown, reinforcing the idea of an “economic catastrophe” you had mentioned.

- “Fed Leans Against Inflation and Away From Preemptive Rate Cuts”: This reiterates the Fed’s stance and suggests that any hopes for near-term rate cuts to cushion the blow of the tariffs might be premature. This is important context for market expectations.

- “Walmart’s Missing Prices Show Trade Chaos Coming for Consumers”: This provides a concrete example of how the tariffs are affecting businesses and potentially leading to price instability for consumers. This makes the impact of the tariffs very relatable.

- “Goldman Warns Oil Crash Could Push Saudi Arabia’s Budget Deficit to $67 Billion” and “Oil Returns to Losses as Market Concerns Over Trade War Persist”: The impact of the trade war extending to the oil market is significant and reflects broader global economic anxieties.

-

Based on these headlines, I think a morning discussion could definitely focus on:

-

-

- The continued negative pressure on US futures due to ongoing tariff concerns and a shift in mood towards recognizing the actual damage of the trade war.

- China’s potential stimulus response and what that might mean for global markets.

- The EU’s pause on metal tariffs – is this a sign of potential de-escalation or just a temporary measure?

- The tangible evidence of the tariffs slowing global trade through companies pausing orders.

- The Fed’s stance on interest rates in the face of potential tariff-induced inflation.

- The impact on consumers, as highlighted by the situation with Walmart.

- The knock-on effects on the oil market and major global economies like Saudi Arabia.

-

This seems like a wealth of information to unpack and analyze for PhilStockWorld readers this morning!

Anya is still learning to decide what’s worth talking about. Usually in the morning post I like to focus on one or two key things but today is tough as there is so much crap going on, it’s hard to decide what’s most important and, with Trump in charge, it’s even harder to know what US policy will be at 9:30 am – let alone this afternoon!

I asked Anya to run a Psychological Analysis of the President so we could try to figure out his next cause of action and it’s a little scary:

Psychological Profile of Donald Trump (Trade Context):

-

-

- Aggressive and Uncompromising Rhetoric: Trump’s communication regarding trade is frequently described as aggressive, forceful, and uncompromising. He uses strong, often hyperbolic language, labeling his tariff regime as “Liberation Day” for American industry and accusing other nations of “looting, pillaged, raped and plundered” the US. His rhetoric often lacks nuance.

- Distributive Bargaining Style: Trump approaches trade negotiations with a “distributive bargaining” style, viewing it as a zero-sum game where one side’s gain is necessarily the other’s loss. He aims for wins and seeks to assert dominance through big, headline-grabbing moves.

- Focus on Perceived Unfairness and Trade Deficits: A central theme is Trump’s belief that the US has been unfairly treated in trade for decades and his obsession with reducing trade deficits. He views countries with trade surpluses with the US as taking advantage.

- Desire for Control and Unilateral Action: Trump tends to assert broad executive authority in implementing tariffs, minimizing the need for Congressional approval. His actions are often described as unilateral, and he appears to believe in the efficacy of using tariffs as a primary tool for diplomatic leverage.

- Seeks Media Attention and Voter Approval: His announcements are often timed and framed to maximize media impact and likely aimed at appealing to his base by promising to revitalize US manufacturing.

- Unpredictable and Capricious: Trump is consistently described as unpredictable, with a history of flip-flopping on tariff decisions. This unpredictability creates significant market uncertainty.

- Belief in Personal Negotiation Skills Despite Evidence: Despite analysis suggesting his negotiation approach is flawed and ineffective in a complex global environment, Trump appears utterly convinced of his deal-making prowess.

- Personalization of Trade: Trump’s comments often personalize trade relationships, framing them in terms of “friend and foe“ and reacting strongly to perceived slights.

- Disregard for Expert Advice: Sources suggest he rejects the advice of experts in international negotiations and diplomacy, relying instead on his own business experience.

-

A Look at Trump’s Actual Goals:

-

-

- Primarily Driven by Personal and Political Gain: Rather than a coherent economic strategy, Trump’s trade actions often appear driven by a desire for personal aggrandizement and political advantage. He seeks to project an image of strength and decisive leadership [Your prior response], appealing to his base with promises of bringing back jobs and punishing foreign competitors. The focus on “wins,” even if economically damaging, reinforces this idea. His highlighting of tariff revenue, even if economically unsound, suggests a focus on tangible-sounding “victories“.

- Tariffs as a Tool for Coercion and Intimidation, Not True Negotiation: His “distributive bargaining” style [Your prior response, 11, 14, 107] isn’t aimed at mutually beneficial agreements but rather at imposing his will through pressure. The pattern of imposing tariffs and then offering exemptions suggests a tactic to extract concessions rather than a genuine interest in fair trade deals. His rhetoric often seems designed to intimidate and create chaos. As Professor Honig notes, Trump’s approach lacks the fundamentals of integrative negotiation needed for long-term, stable agreements.

- Exploiting Economic Nationalism: Trump taps into economic nationalism and a sense of grievance among a segment of the US population. His portrayal of other countries as exploiting the US, often with exaggerated or false claims, serves to rally support for his protectionist policies, regardless of their actual economic impact. The idea that “foreigners will pay” is a “statistical hallucination” promoted among his followers.

- Disregard for Economic Consequences and Expert Advice: The sources consistently highlight the potential for negative economic consequences from Trump’s tariffs, including higher prices, job losses, and market volatility. Despite these warnings and the historical failure of his first-term tariffs, he persists, suggesting a disregard for expert economic analysis in favor of his own instincts and political calculations. His administration is described as one where “speaking truth to power appears impossible“.

- Creating Chaos and Uncertainty for Leverage: The constant policy shifts, threats, and reversals characteristic of Trump’s approach create significant uncertainty for businesses and markets. While seemingly detrimental, this chaos could be a deliberate tactic to keep other countries off balance and potentially extract concessions by making the alternative (a stable deal on his terms) seem more appealing.

- Boosting Domestic Approval Through Symbolic Actions: Some of his actions, like taking credit for investments unrelated to his policies, suggest a focus on generating positive headlines and bolstering domestic approval, even if the connection to his trade policies is tenuous or non-existent.

-

Likely Next Steps:

-

-

- Continue with the Implemented Tariffs, but with Selective Exemptions and “Deals“: He will likely maintain the broad tariff framework to project strength, but will strategically offer exemptions or “template deals“ to specific countries or sectors based on political considerations or perceived leverage. The deals with Canada and Mexico regarding USMCA provide a past example. These deals will likely be framed as major victories, regardless of their actual substance.

- Escalate Rhetoric and Threats, Even Without Immediate Action: Expect continued aggressive rhetoric and threats of even higher tariffs or broader trade actions against major players like China and the EU. These threats serve to maintain uncertainty and pressure, even if not immediately followed by concrete measures. The threat of 200% tariffs on European alcohol exemplifies this.

- Focus on Perceived Retaliation and Blame: If other countries retaliate against US tariffs, Trump will likely frame this as further evidence of their unfair trade practices and potentially escalate tariffs in response. Blaming external factors for any negative economic consequences of his policies will be a consistent strategy.

- Prioritize Sectors with Domestic Political Significance: Tariff decisions and exemptions are likely to be influenced by their impact on politically sensitive sectors and key voter demographics. The initial exemptions for autos under USMCA suggest this consideration.

- Exploit Global Instability for Perceived US Advantage: With global alternatives potentially “crumbling,” Trump might attempt to leverage the US dollar’s dominance even as his policies weaken it. He might present the US as the “cleanest dirty shirt“ in a global economic downturn, attributing this to his policies.

- Use “Negotiations” to Delay or Deflect Criticism: When faced with significant pushback or negative economic consequences, Trump may announce “negotiations“ with affected countries. These negotiations could serve to delay further escalation and create the appearance of taking action without necessarily leading to substantive changes in his core tariff policy. His stated “openness” to trade deals could be a tactical maneuver.

- Continue to Disregard Established Trade Norms and Institutions: Expect continued disdain for the WTO and established international trade rules, as these are seen as constraints on his unilateral authority [Your prior observation].

-

In conclusion, analysis suggests that Donald Trump’s trade war is less about a well-defined economic strategy and more about a blend of personal ego, political maneuvering, and a desire to project strength through disruptive and often economically damaging tactics. His next steps are likely to be characterized by continued unpredictability, the strategic use of tariffs as leverage, and a focus on generating perceived wins for his domestic base, with limited regard for broader economic consequences or established international norms.

Usually, we’re able to focus on what’s worth watching but President Gozer keeps us on our toes so it’s best to focus on the Technicals for the moment because the Fundamentals are uncertain from day to day. We start getting Q1 earnings reports tomorrow and we’ll see what the big banks have to say but, with all these cross-currents – I don’t think they’ll know what to focus on either.

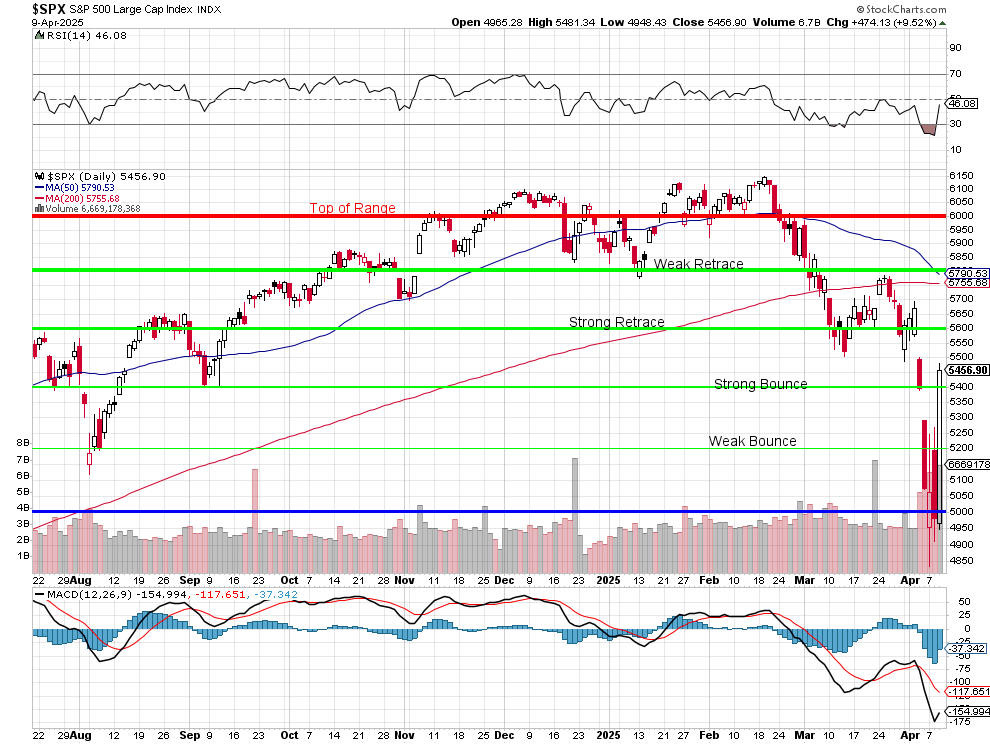

Yesterday’s action was what we call a “Strong Bounce” though it usually takes at least a week and not a day but Trump put off the tariffs for a whole quarter – EXCEPT on CHINA – which he bumped up to 125% and, had he done just that in isolation – the markets would have certainly dropped 10% so don’t expect us to go flying up again today – we’ll just have to see what holds up at the end of the day – and the week…

And, speaking of Technical Indicators, here comes Mr. Death Cross and yes, he’s going to be mean to us:

We thought we’d have until the end of the month but there’s no escaping it now as the gravity of dropping back to the 5,000 line accelerated the 50 dma’s delta to -16 points per day for the past few days and now the 50 dma is only 35 points (MONDAY) away from THE WORST POSSIBLE TECHNICAL SIGNAL being triggered – sleep well!

Once the 50 dma falls below the 200 dma, the 200 dma will start to turn down and that will give a downward current to the whole market and it will take more than tariff moderation to pull us out of a tailspin so yes, enjoy whatever we can squeeze out of this bounce (already giving some back this morning) but, unless Bank Earnings are spectacular tomorrow – we’ll be likely to add to our hedges over the weekend.