Where else are you going to put your money?

Where else are you going to put your money?

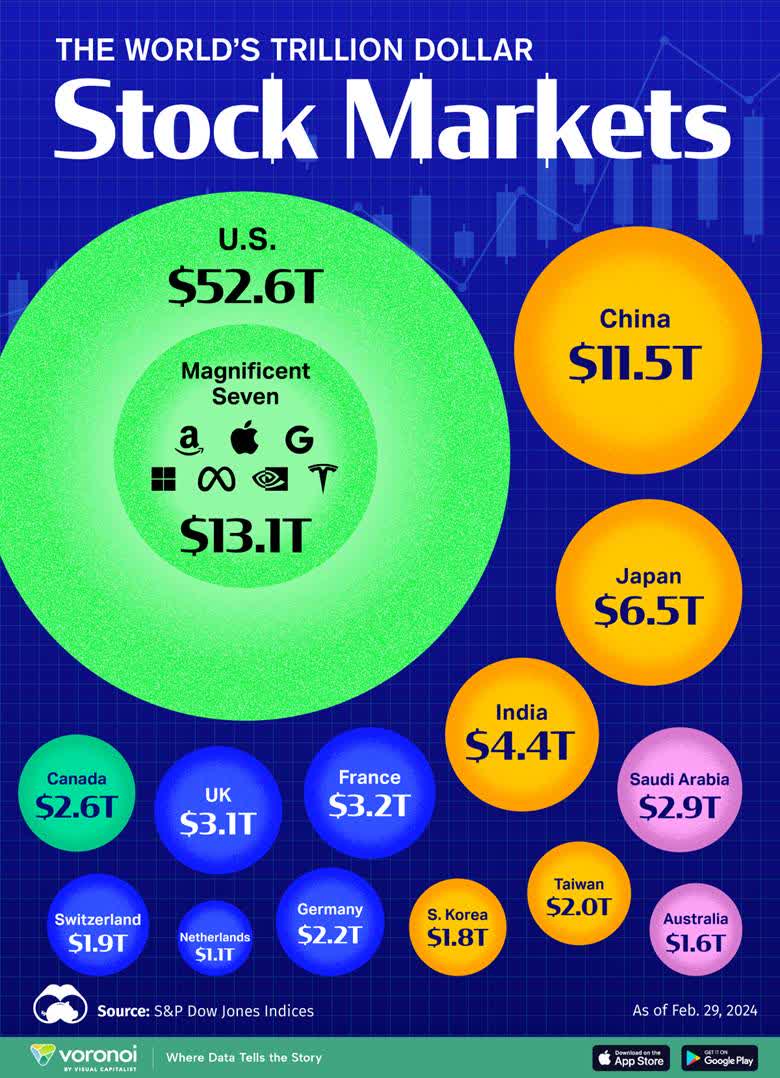

As you can see from this handy World Market Chart, the US was at $52.6Tn at the end of February, which was S&P 5,850 and now the S&P is at 5,150, down 700 points (12%) at $46.3Tn – a loss of $6.3 Trillion Dollars but where are those Dollars going to go? The ENTIRE rest of the World’s markets are only $44Tn so are we going to bloat them by 15%?

There’s $23Tn worth of gold in the World (6.7Bn ounces/208,874 tons) at $3,463/ounce and that’s up $863 (33%) since Trump took office so pretty much all the money ($8Tn) that came out of the market went into gold in the last few months but this is not a recession (yet) and people are still making money at work and putting some of it into IRA’s ($15Tn) and 401K’s ($9Tn) every week and that money STILL goes back into the market at a rate of $37.5Bn per month ($450Bn/yr) JUST from the working population.

And, of course, they don’t tend to switch to gold and they don’t tend to withdraw in a down market – that is what active traders, hedge funds and speculators do. The working people just invest – and it’s a fairly steady amount, week after week, into primarily index funds. That is the background noise that dominates the stock market universe…

Still, it would take 15 YEARS of inflows from the working public to make up for the $6.3Tn that has been drawn down by the investing class and that’s fine if you are a long-term investor but not so much if you are trying to rebuild a damaged portfolio. Of course, the Corporations themselves make $4Tn per year and that’s built-in 8.5% annualized growth – whether you invest in the companies or not.

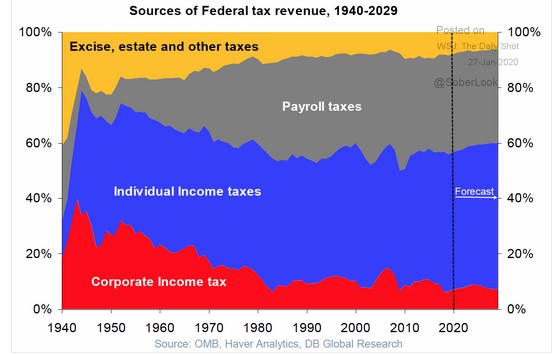

BUT that supposes Corporate Growth isn’t wrecked by something as reckless as tariffs and, unfortunately, that’s the path the Trump administration chose rather than, I don’t know, raising taxes by placing a minimum 25% tax on Corporate Profits. THAT would have taken Corporate Taxes from $500Bn to $1Tn, raising almost all of Trump’s $600Bn target WITHOUT causing massive inflation and WITHOUT destroying the market and wiping out all those IRAs and 401Ks – that’s all it would have taken…

THIS is why the Oligarchs seized power. The simple, obvious solution is to address their lack of contributions to our tax system, which is roughly 1/3 of what it was in the 50s and 60s – when America was “Great” the first time. Back then, Payroll Taxes were 10% of collections ($500Bn in today’s money but now $1.7Tn) and Corporate Taxes were 20% ($1Tn in today’s money but now $526Bn). In fact, the lack of $500Bn in Corporate Tax Collections since 1985 (40 years) accounts for $20Tn of our deficit – add in the interest on our debt caused by that shortfall and the lack of taxing corporations appropriately is pretty much THE ENTIRE PROBLEM!

If you fix that and fix the undertaxing of Estates (just about as bad as Corporations) – we’d have a friggin’ SURPLUS to play with! Simple, obvious, easy to fix and THAT is what Biden/Harris were working towards when the Oligarchs spent over $1Tn to remove them from power and replace them with the Tariff King, who believes our problems will be solved by a 25%+ tax on the goods we consume instead.

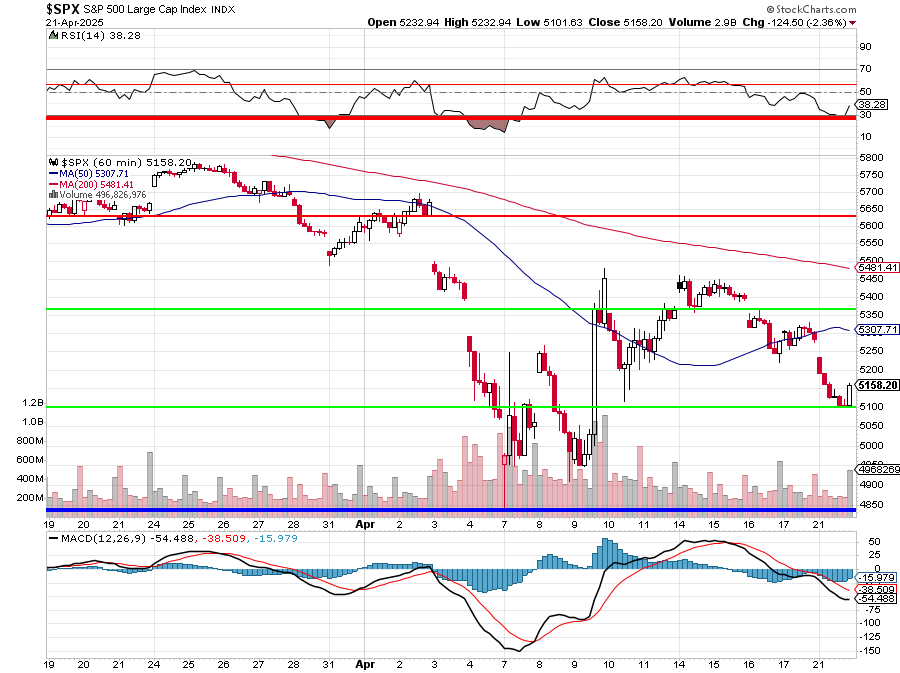

Meanwhile, if we are going to stick it out with US Markets – what can we invest in?

I was being interviewed yesterday and we were discussing earnings and I noticed AGNC reported yesterday and they are an old favorite of ours – a Mortgage REIT that pays a $1.44 (17.65%) dividend and is priced at book value at $8.25. Earnings were 10% over consensus (0.44). Declining rates are a positive for them and the Fed should be lowering rates EVENTUALLY and here’s the way we’ll play it for our Income Portfolio:

-

-

- Buy 3000 shares of AGNC at $8.25 ($24,750)

- Sell 30 AGNC 2027 $8 calls for 0.85 ($2,550)

- Sell 30 AGNC 2027 $8 puts for $1.80 ($5,400)

-

That’s net $16,800 or $5.60 per share, which is a 32% discount to the current price. Our plan is to get called away at $8+ in Jan 2027, collecting $24,000 (we are limited and protected by the short calls) for a $7,200 profit but also collecting 7 0.36 dividends x 3,000 shares = $7,560 for a total profit of $14,760 (87.8%) in 21 months.

If AGNC is below $8 in Jan 2027, we would be assigned 3,000 more shares at $8 ($24,000), leaving us with 6,000 shares at $40,800 less the $7,560 in dividends we collected = net $33,240/6,000 = $5.54 per share – still 33% less than the current price. That’s our WORST case (unless they cut the dividend)!

When your worst case sounds good – make the trade!

PHM just announced earnings this morning and they were just fine and guidance was maintained at $2.35Bn for the year yet you can buy the whole company and all their land for $18.7Bn so they are trading at a RIDICULOUS 8 time current earnings – despite the challenging environment (they made $3Bn last year!).

They don’t pay much of a dividend, so there’s no point in owning the stock but we can promise to own it at a discount by selling puts and then we can put that money towards a bull call spread for our Long-Term Portfolio (LTP) as follows:

-

-

- Sell 10 PHM 2027 $75 puts for $8 ($8,000)

- Buy 20 PHM 2027 $90 calls for $23 ($46,000)

- Sell 20 PHM 2027 $115 calls for $13 ($26,000)

-

That’s net $12,000 on the $50,000 spread that’s $10,000 in the money to start. Even if we’re wiped out and lose $12,000 and have to buy 1,000 shares at $75, that’s still net $89 – 6.8% below the current price as our worst case! Upside potential is, of course $38,000 (316%) at $115 or above and that’s about 10x earnings – which I consider very fair once things settle down.

Join us inside in our Live Member Chat Room, where we’ll be picking out some more bargains. When stocks are priced this cheaply – we don’t have to guess what earnings are going to be – we simply wait PATIENTLY for good earnings reports from stocks that are down in the dumps (AGNC is 21% off it’s recent highs, PHM is 36% off) and then we just let nature take its course!

If the World doesn’t end – we’ll want to be holding a few stocks, right? Since a lot of companies are already priced like the World is going to end – why not go shopping – especially when they are telling us, LIVE, that they expect to make good money this year.

This is not a complicated trading proposition…