“The past was alterable. The past never had been altered. Oceania was at war with Eastasia. Oceania had always been at war with Eastasia.” ― 1984

“The past was alterable. The past never had been altered. Oceania was at war with Eastasia. Oceania had always been at war with Eastasia.” ― 1984

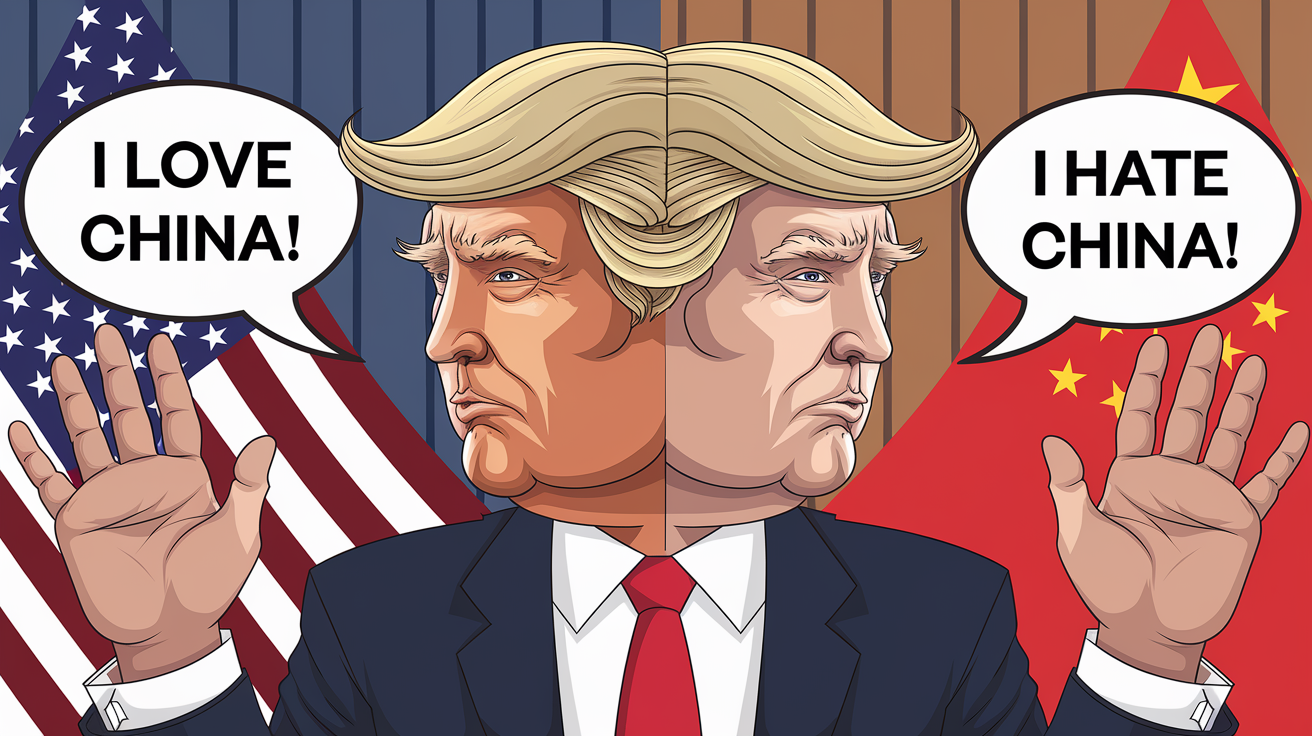

President Trump’s remarks on Tuesday about Jerome Powell and China tariffs and their “stark contrast” to his prior statements could be ripped straight from Orwell’s 1984, where “the past was alterable” and alliances shifted overnight. Here’s a breakdown of the reversals, contradictions, and historical airbrushing at play:

1. Jerome Powell: From “Major Loser” to “No Intention to Fire“

Original Stance (April 20–21):

-

Trump on Truth Social: “Powell’s termination cannot come fast enough!“

-

Public Criticism: Called Powell a “major loser” and blamed him for not cutting rates amid tariff-induced market chaos.

Revised Stance (April 22):

-

Trump in Oval Office: “I have no intention of firing him. Never did.“

-

Rationale: Claimed media misinterpreted his earlier comments, despite clear public threats.

“Oceania was at war with Eastasia. Oceania had always been at war with Eastasia.“

Trump’s narrative shifted from “Powell must go” to “I never considered it,” erasing his prior hostility as if it never existed.

2. China Tariffs: From 145% “Liberation Day” to “Substantial” Reductions

Original Stance (April 2–9):

-

April 2: Imposed 145% tariffs on China, vowing “no exemptions” and framing it as a “national emergency.”

-

April 9: Threatened additional 50% tariffs if China retaliated, declaring “all talks will be terminated.”

Revised Stance (April 22):

-

Trump in Oval Office: “145% is extremely high. It will drop significantly, but it won’t be zero.“

-

New Tone: “We want their participation… I believe we can coexist peacefully.”

“The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.“

The “Liberation Day” tariffs—once non-negotiable—suddenly became flexible, with Trump acting as if the aggressive stance was merely a strategic feint.

3. Tech Tariffs: From “Bring Manufacturing Home” to Exemptions

Original Stance (April 9):

-

Trump’s Goal: “iPhones will be made in America!” via tariffs on Chinese tech imports.

-

Advisor Navarro: “No exemptions for smartphones or semiconductors.“

Revised Stance (April 11):

-

U.S. Customs Guidance: Exempted smartphones, computers, and semiconductors from tariffs.

-

White House Spin: “This was always part of the plan to negotiate.“

“Doublethink means the power of holding two contradictory beliefs in one’s mind simultaneously.“

Tariffs meant to reshore tech manufacturing were quietly reversed, yet framed as a deliberate strategy.

Market Impact: Rewriting Reality in Real-Time

-

Bond Yields & Stocks: The 10-year yield spiked to 4.57% on Trump’s tariff threats, then retreated to 4.32% after his “cool it” reversal.

-

Fed Independence: Powell’s job security whipsawed markets, with the S&P 500 swinging 3% in two days.

Key Quote from Treasury Secretary Bessent:

“This was his strategy all along.”

(Translation: Gaslighting the investing public into believing volatility was part of a masterplan.)

Trump’s reversals mirror Orwell’s “memory hole,” where inconvenient truths vanish. By reframing tariffs as negotiable and Powell as untouchable, he resets the narrative—a tactic that keeps allies and adversaries perpetually off-balance. For investors, this demands vigilance: Today’s dogma may be tomorrow’s heresy.

“The Party member, like the proletarian, tolerates present-day conditions because he has no standards of comparison. He must be cut off from the past, just as he must be cut off from foreign countries, because it is necessary for him to believe that he is better off than his ancestors and that the average level of material comfort is constantly rising.”

As Orwell wrote, “Who controls the past controls the future.” In Trump’s world, controlling the present narrative erases the past, making every policy pronouncement a provisional truth.

But so what? These are the hands we are being dealt and, as I often say to our Members:

“We don’t care IF the game is rigged – as long as we understand HOW the game is rigged and are able to place our bets accordingly.”

While we were not invited to the “closed door meeting” with Scott Bessent at JP Morgan for “a select group of Investors and Financial Executives” that was not open to the public or the media, we expected SOMETHING like it to happen and, LAST WEEK we aggressively added to our long portfolio positions in expectations of this magical turnaround.

While we could only guess that Trump would flip-flop, here’s what Bessent said to lay it out for people who are much richer than we are (perhaps because they get these little tips?):

-

-

On the Tariff Standoff:

“The tariff standoff with China cannot be sustained by both sides and the world’s two largest economies will have to find ways to de-escalate.” 3 5 8

-

On Negotiations:

“I do say China is going to be a slog in terms of the negotiations. Neither side thinks the status quo is sustainable.” 4 5 6 7

-

On the Current Situation:

He described the U.S.-China relationship as a “mutual embargo,” with neither party viewing the current 145% U.S. tariffs and 125% Chinese tariffs as viable long-term. 5 8

-

On the Path Forward:

Bessent expressed optimism that a de-escalation would occur in the “very near future,” providing “a sigh of relief” for financial markets, but cautioned that a comprehensive deal could take two to three years. 5 8

-

On U.S. Objectives:

He emphasized the Trump administration’s goal was not to sever ties but to achieve a “big, beautiful rebalancing,” encouraging China to increase domestic consumption and the U.S. to focus more on manufacturing.

-

White House Press Secretary Karoline Leavitt later referenced the remarks, reiterating that the administration was “doing very well” on potential trade with China, but confirmed that formal talks had not yet begun 4 8.

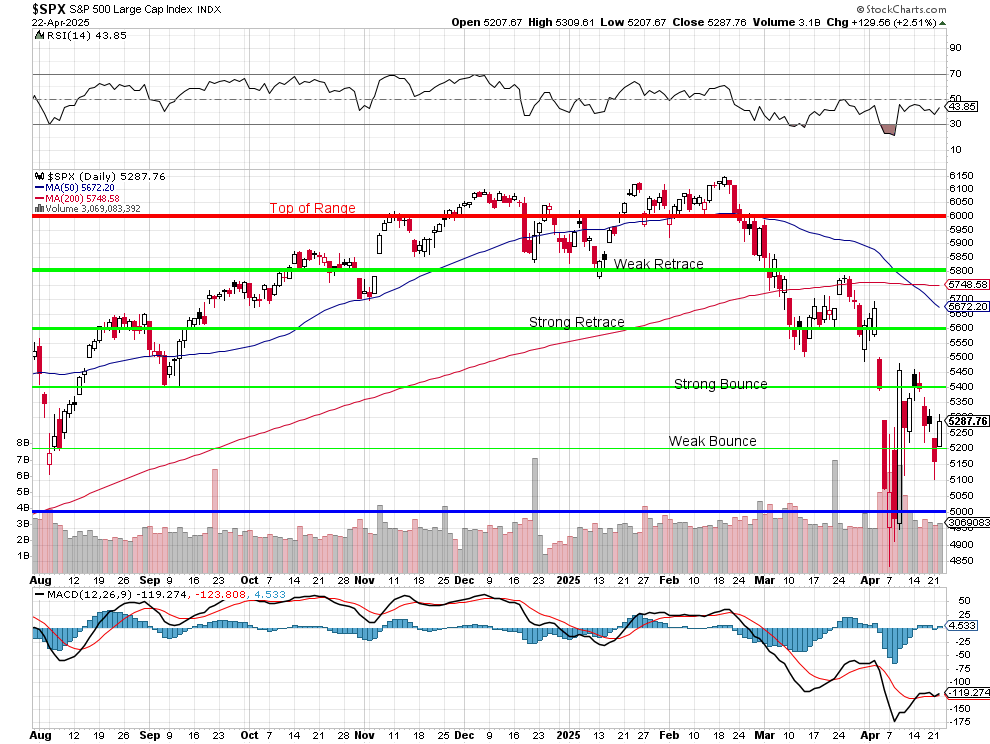

As you can see, the S&P 500 leaped forward after the Bessent meeting as the privileged guests began hitting the “BUY” buttons on their algorithms and then, as the news “leaked” out to the general public and was ultimately confirmed by the Administration – the S&P 500 climbed 300 points (and counting) in the past two sessions – that’s 5.8%!

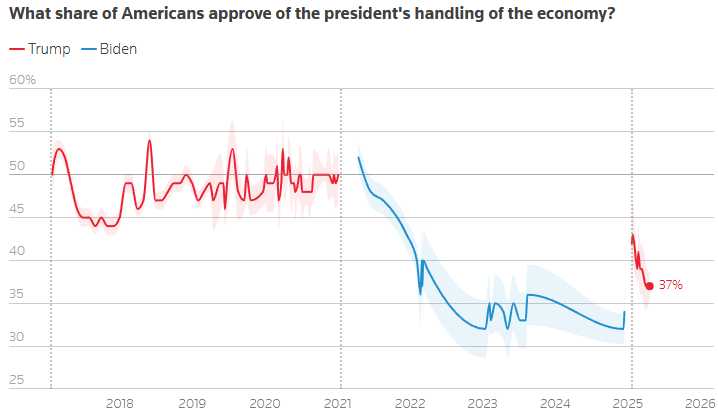

While nothing has actually changed, the change in rhetoric allows analysts to take the worst-case scenario off the table and the 70% chance of Recession in July is back down to 50% and Companies reporting Earnings are not forced to give pessimistic guidance (by reality) and our Bond Auctions were saved from disaster AND, most importantly Trump’s approval rating is off his record lows – Dear Leader triumphs again (he ALWAYS triumphs, right?)!

The Dollar is back to a less-disastrous 99 – still 11% lower than when Trump was sworn in so we’re all 11% poorer than we were and the S&P 500 was 6,150 on Jan 20th and now, even with this morning’s boost, 5,400 is down 750 (12%) so we’re 23% worse off than we were 100 days ago (only 93 days, actually) as our stocks are priced in “worth less” Dollars, right?

Oil is back to $63 this morning and Gold is back to $3,331 and Copper is back to $4.90 as we make nice with China and Natural Gas (/NG) is $2.99 and that’s a great long over $3 with tight stops below and those of you who can’t play the Futures can pick up the UNG June $17 calls for $1, which have a 0.45 delta so a 10% move in UNG ($1.60) x the 0.45 delta should bump your option by 0.72 (72%) so let’s set a conservative target of $1.50 for a 50% per contract gain as a short-term, Swing Trade:

We added a few new long positions yesterday (as promised) and we will continue to bargain hunt the laggards from our Watch List but we’re not getting rid of our hedges until we see a more solid base building in our indexes because – despite the violent change in rhetoric – S&P 5,400 is only a Strong Bounce and we need to hold it for two full sessions – which is an eternity in Trump World and then it will be the weekend anyway – and we’re sure not going to be unhedged into the weekend!