We’re not quite there:

We’re not quite there:

Well, after a week that felt ripped straight from the pages of 1984, the market seems to be taking a breather this morning. As of 8:00 AM, Futures are pointing about 0.5% lower, suggesting maybe, just maybe, reality is trying to poke its head back into the room after a few days of pure rhetoric-fueled absurdity.

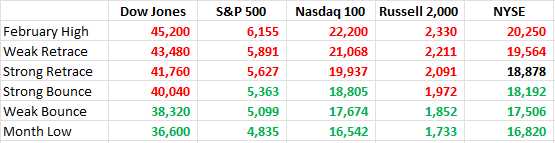

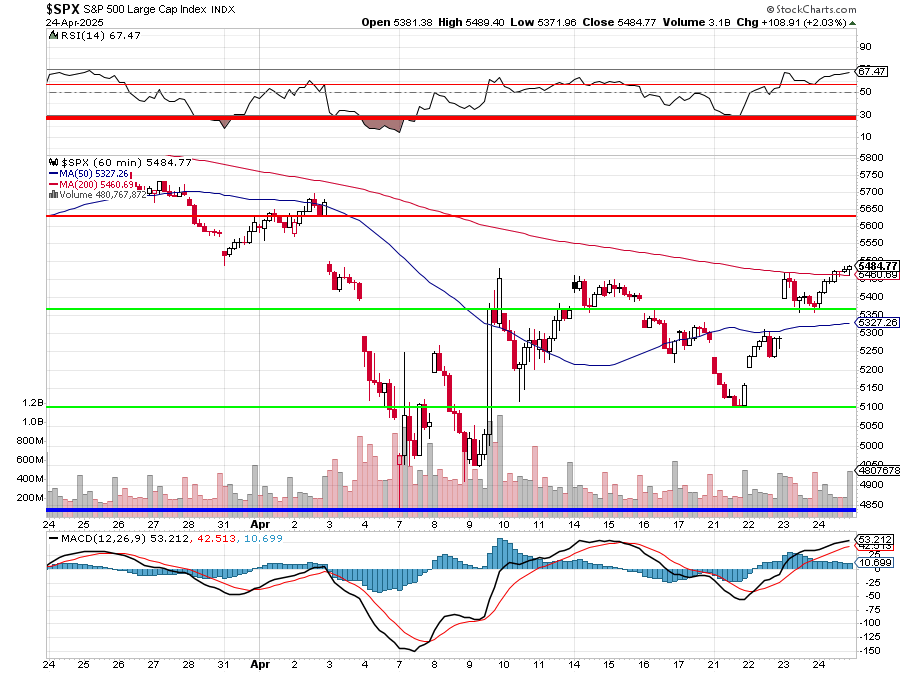

Let’s recap the rollercoaster: We started the week staring into the abyss as the S&P flirted with disaster below 5,400. Then, as Trump’s polling numbers fell faster than the markets, the narrative suddenly shifted. Powell wasn’t getting fired, and those “non-negotiable” 145% China tariffs might “come down substantially“. Treasury Secretary Bessent added his soothing tones about de-escalation, and poof – the market forgot all about the previous threats.

The result? A “face-ripping” rally which began in Tuesday’s last hour that saw the S&P 500 surge back 385 points (7.5%) into yesterday’s close at 5,484 while the Nasdaq jumped 666 points (3.5% and not satanic at all), back to 19,214. In retrospect, it was a classic “Sell the Rumor, Buy the News” (or in this case, “buy the flip flop off the previous threat“) rally.

Of course, as I always say to our Members: “We don’t care if the game is rigged, as long as we know how it’s rigged and are able to place our bets accordingly.” While we were not able to sit in the room with Scott Bessent and JP Morgan’s select winners – we understood the rigging well enough to bet on this bounce last week, as we made our portfolio adjustments.

Last night, we got a double dose of earnings reality from tech giants who are on two very different paths:

-

Alphabet (GOOGL): Google’s parent delivered a strong beat, posting Q1 revenue of $90.2Bn (up 12%) and EPS of $2.81, CRUSHING estimates. Growth was solid across the board: Search, YouTube ads (+10%), Subscriptions/Devices (+19%), and importantly, Google Cloud surged 28% to $12.3 billion. They even threw in a 5% dividend hike and a MASSIVE $70 billion buyback authorization so the stock is naturally surging in the pre-market. This reinforces the power of their ad machine and the continued enterprise shift to the cloud AND the AI narrative is clearly helping, as well.

Alphabet (GOOGL): Google’s parent delivered a strong beat, posting Q1 revenue of $90.2Bn (up 12%) and EPS of $2.81, CRUSHING estimates. Growth was solid across the board: Search, YouTube ads (+10%), Subscriptions/Devices (+19%), and importantly, Google Cloud surged 28% to $12.3 billion. They even threw in a 5% dividend hike and a MASSIVE $70 billion buyback authorization so the stock is naturally surging in the pre-market. This reinforces the power of their ad machine and the continued enterprise shift to the cloud AND the AI narrative is clearly helping, as well.

-

Intel (INTC): On the other side of the aisle, in the chip section, Intel served up a much bleaker picture. While Q1 revenue was flat YoY at $12.7Bn and non-GAAP EPS of $0.13 beat expectations slightly, the outlook was dismal… INTC guided Q2 revenue to just $11.2-$12.4Bn with non-GAAP EPS expected at a big fat $0.00. New CEO Lip-Bu Tan acknowledged there are “no quick fixes” and announced further cost-cutting, lowering 2025 OpEx targets. The stock is getting hammered pre-market, down over 7%, reminding us that the semiconductor space isn’t monolithic and turnaround stories take time (and PAIN).

Intel (INTC): On the other side of the aisle, in the chip section, Intel served up a much bleaker picture. While Q1 revenue was flat YoY at $12.7Bn and non-GAAP EPS of $0.13 beat expectations slightly, the outlook was dismal… INTC guided Q2 revenue to just $11.2-$12.4Bn with non-GAAP EPS expected at a big fat $0.00. New CEO Lip-Bu Tan acknowledged there are “no quick fixes” and announced further cost-cutting, lowering 2025 OpEx targets. The stock is getting hammered pre-market, down over 7%, reminding us that the semiconductor space isn’t monolithic and turnaround stories take time (and PAIN).

This split decision highlights the importance of digging beyond sector-level assumptions. While AI and Cloud remain powerful themes (boosting GOOGL), execution and competitive positioning matter immensely (hurting INTC). Quixote gave our Members a great overview last night (you can follow him on Twitter @QuixoteAGI) and Anya wrote: Market Pulse Analysis: Navigating Rhetoric and Reality – April 23, 2025 as well as: Q1 2025 Earnings Analysis: Sector Trends, Cross-Currents, and Near-Term Outlook (Members Only) and she is in charge of keeping us updated during earnings season.

The trade narrative generally remains as clear as mud. Overnight reports suggest China is considering tariff exemptions for some US goods like medical equipment, chemicals, and even plane leases, likely because the costs are biting their own industries. This follows the US exempting electronics earlier. However, don’t break out the champagne just yet. China is also publicly demanding the US revoke all unilateral tariffs before serious talks begin. Meanwhile, President Trump continues to to pretend to be talking to China and about deals with other countries “coming in three to four weeks“, which is Trump speak for “Stop asking me questions for 3-4 weeks while I play golf!”

Essentially, the threat of tariffs is being walked back slightly, but the actual tariffs remain largely in place, and concrete progress is elusive, at best. We’re seeing the real-world consequences already: Apple is reportedly aiming to shift most US-bound iPhone production to India by late 2026, and companies like Colgate are cutting guidance due to tariff costs (a $200M hit!). Merck also noted absorbing $200M (magic number) in tariff costs in their outlook as well. This uncertainty is a persistent drag, no matter the daily headline spin.

While this week was driven by earnings and rhetoric, next week brings a firehose of crucial economic data that could easily shatter the fragile optimism:

-

- Tuesday: Consumer Confidence (Apr), JOLTS Job Openings (Mar)

- Wednesday: ADP Employment (Apr), Q1 GDP (Advance Estimate), Core PCE Price Index (Mar – the Fed’s preferred inflation gauge!)

- Thursday: ISM Manufacturing PMI (Apr)

- Friday: Non-Farm Payrolls & Unemployment Rate (Apr)

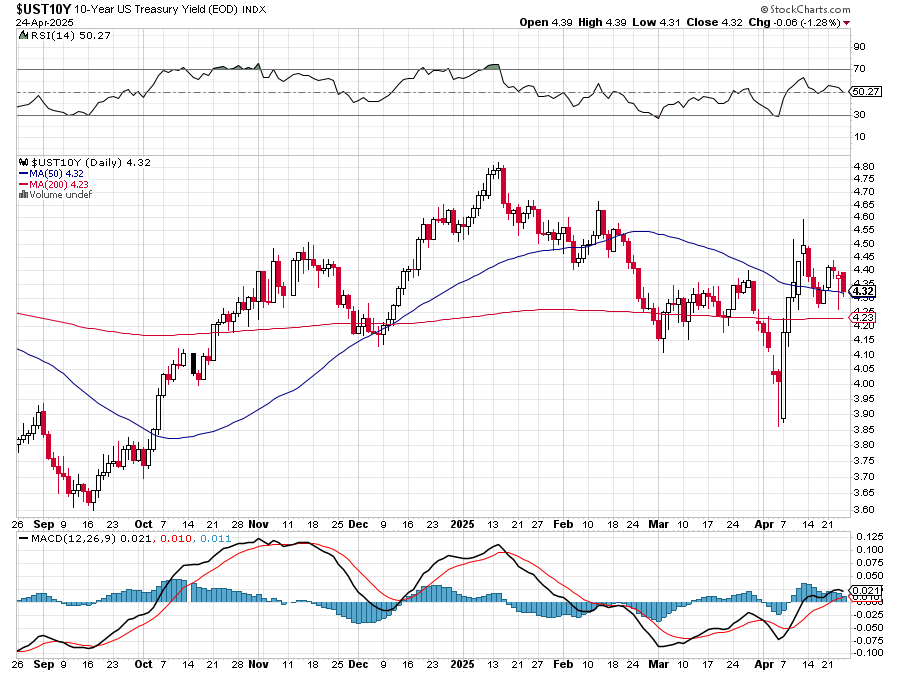

This is where the rubber meets the road. Will GDP confirm a slowdown? Will PCE show inflation remaining stubbornly high, forcing the Fed’s hand? Will the jobs market finally show cracks? Any significant deviations from expectations here could easily overwhelm the narrative games being played. Remember, the Fed remains data-dependent (or so they claim), and this data dump will be critical for their outlook.

The S&P 500 managed to close strongly yesterday near 5,485, well off the lows of 5,100 tested earlier in the week. The Nasdaq’s surge put it up over 5% for the week at one point before pulling back. Technically, holding our Strong Bounce Line at 5,363 constructive, but we need to be over 5,400 on the longer-term Bounce Chart. Overall the rally feels driven more by relief (based on erratic policy, no less) and short-covering than conviction.

This morning’s pullback is healthy and expected after such a run. The question is whether buyers step back in or if caution prevails ahead of the weekend and next week’s data minefield. BofA’s Hartnett is already warning clients to “Sell the Rebound“, pathetic though the rebound may be and who want’s to trust Donald Trump not to mess things up for 48 straight hours after the close?

To that end, we remain cautious and we’ll be going over our hedges into the weekend to make sure we lock in our gains for the week. While the Administration’s flip-flopping provided plenty of trading opportunities (as we capitalized on last week and this!), the underlying issues – unresolved trade wars, persistent (if maybe easing) inflation, mixed economic signals, and upcoming political uncertainty (Canada/Australia elections adding to the global noise) – haven’t disappeared.

Let’s hope for some window dressing next week!

Have a great weekend,

-

- Phil