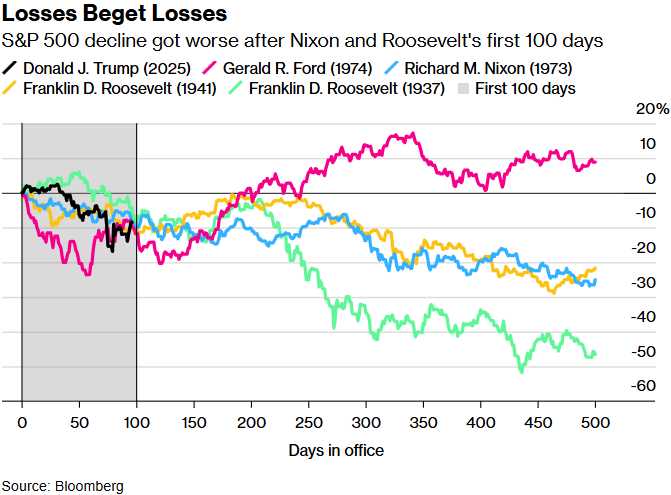

This is, so far, the worst 100-day start for the markets since Gerald Ford in 1974.

This is, so far, the worst 100-day start for the markets since Gerald Ford in 1974.

Trump promised Americans a “boom like no other” if they elected him president. But based on the stock market’s performance during his first 100 days in office, it depends on what you mean by “boom.” As noted by Bloomberg: “The action certainly has been explosive — just not in the way investors were hoping.”

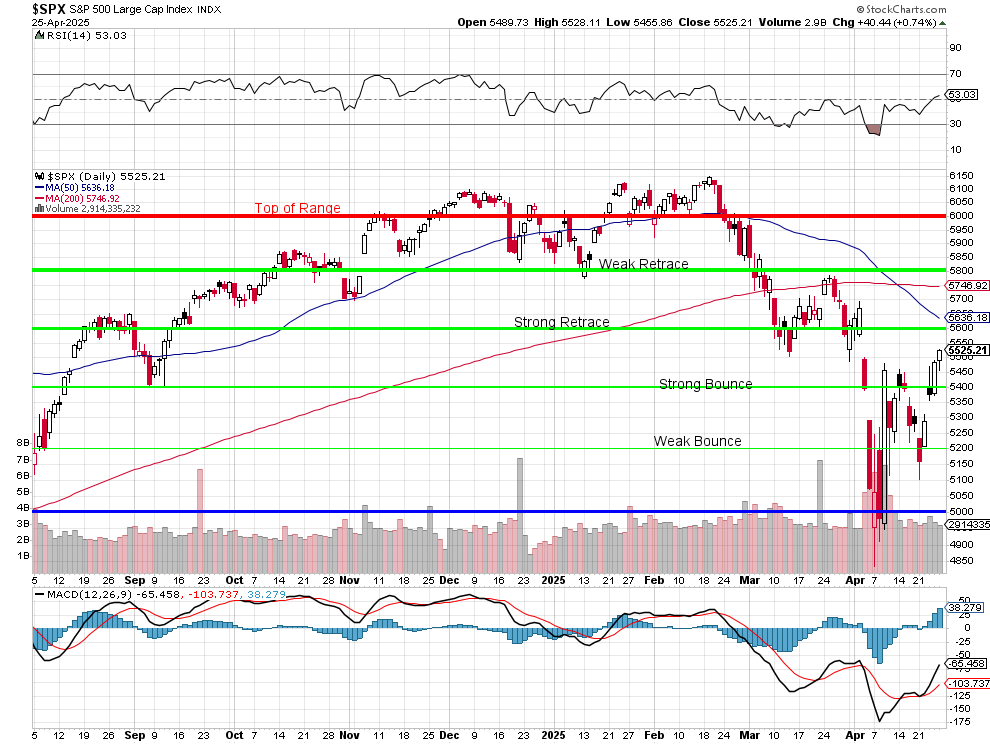

After a bruising first-hundred-days that left the S&P 500 roughly 8 percent below Inauguration-Day levels, last week’s broad “hammer” reversal put bulls back on their heels. The index closed above the March breakdown at 5,488 and is now homing in on the “Liberation-Day” gap at 5,670, a zone technicians flag as the next make-or-break level for the index. While earnings, so far, are holding up well(ish) at 7%, management commentary has been dominated by cost-cutting and tariff turmoil warnings, leaving a market that rallies on rumors and sells on every new headline or tweet from the White House.

It’s been a U-turn few on Wall Street saw coming after two straight years of over 20% gains under “Sleepy Joe” and what was expected to be a pro-growth agenda by Trump. Instead, markets swung wildly as Trump slapped tariffs on basically every country where US companies operate — and then suspended some, carved out exceptions for certain industries, and ratcheted up the trade war with China.

TECHNICALLY: A five-day surge off 5,115 support engulfed the prior week’s range and pushed price back into the upper half of the 4,818-6,147 band (ie. we are over the Strong Bounce Line). 5,645-5,695 (61 % retrace + “Liberation-Day” gap) is our next point of resistance and a sustained break puts 5,750-5,760 (200-day SMA and measured move) on the radar; failure there would argue for another trip back to this 5,480-5,500 support (theoretical).

Unfortunately, CFTC data show the largest net-short in S&P futures since December leaving plenty of room for squeezes but also for quick reversals. PSW Members know to keep their eye on the falling 50-day moving average – if it “death crosses” below the Strong Retrace Line at 5,600 before the index re-takes it, it will solidify that line as upside technical resistance.

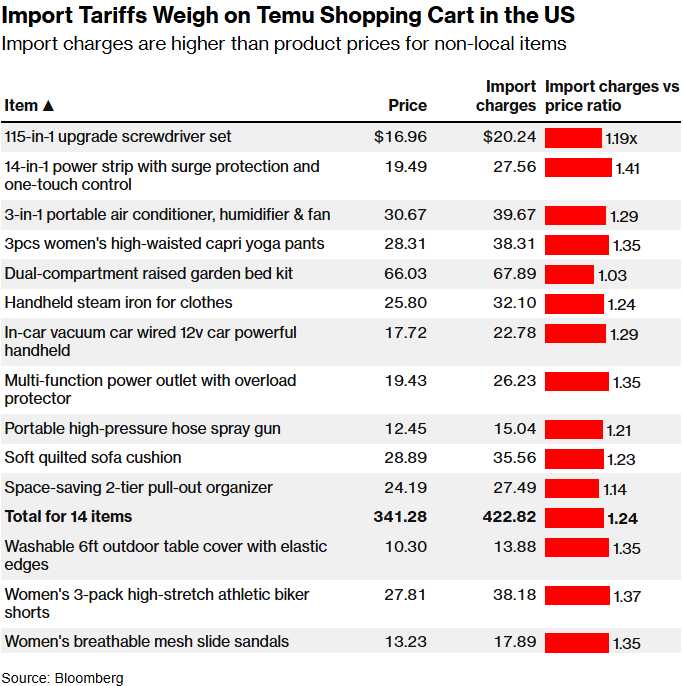

Economically, 145 % levies on Chinese goods have already doubled Temu sticker prices, yet the President said last week(rumors) that the duties could be cut “substantially” within weeks. Fed Fund Futures are still pricing in a 25 basis point cut at the June 12 meeting and only three cuts in 2025 after traders slashed bets following the tariff volley but even that may be optimistic given the still strong labor market and way too high Inflation, which is very much driven by Corporate Price-Gouging Trump is doing NOTHING to contain.

Earnings Season Scorecard (1/3 Complete)

| Metric (S&P 500) | Current | Five-Year Avg | Takeaway |

|---|---|---|---|

| Blended EPS growth | +7.2 % (Are “Magnificent 7” Companies Still Top Contributors to Earnings Growth for the S&P 500 for Q1?) | 9.9 % | Lower, but trending up as beats roll in |

| Revenue growth | +4.0 % (S&P 500 Earnings Season Update: April 25, 2025) | 4.3 % | Margins doing the heavy lifting |

| Net profit margin | 12.4 % ([PDF] Earnings Insight – FactSet) | 11.7 % | Fourth straight >12 % quarter |

Outside the Magnificent-7, earnings growth is just 5.1% (Are “Magnificent 7” Companies Still Top Contributors to Earnings Growth for the S&P 500 for Q1?), so Big Tech results this week will steer the aggregate path.

The First Quarter tape is telling us a tale of CEOs who have gone from “growth at any cost” to “survival by every cut.” Inside boardrooms the mantra is suddenly “efficiency first”, a direct response to the Tariff Roulette and the Inflation it has fanned. DOW shelved its flagship zero-emissions ethylene cracker, BSX grounded most non-client travel, and HAS yanked another $225M from its 2025 budget by redesigning toys to use cheaper materials – all in the span of a week! Even consumer-staples giants are acting as though recession is their base case: PEP’s Ramon Laguarta told investors his team is “ripping out every inefficiency” in the supply chain to blunt tariff-driven input costs.

“Control the controllables” has become corporate scripture. IBM’s Arvind Krishna opened his call by saying management is “focused on actions we can take today to protect margin and free cash flow”, while NSC’s Mark George repeated/borrowed the phrase verbatim as the railroad zeroed in on fuel and labor savings.

The unspoken acknowledgement: Pricing power cannot outrun 145 % import levies forever, so operating discipline must.

Yet discipline only goes so far when forecasting itself has turned into a game of chance. Guidance has morphed from a single number into a choose-your-own-adventure novel. UAL, for instance, issued TWO profit targets: $11.50–$13.50 a share if the status quo holds, but as low as $7/share if tariffs tip the Economy into Recession.

Breakingviews counts more than a dozen S&P firms that have followed some version of that playbook, while others (DAL, WMT) have simply pulled near-term outlooks altogether. Even blue-chip PG, famed for its forecasting conservatism, cut sales guidance and blamed the “volatile consumer backdrop” created by trade policy. Investors seem willing to forgive the opacity, for now, but the earnings multiples will continue to wallow until clarity returns.

A third thread running through this earnings season is the way politics now stalks the C-suite as closely as tariffs do. Nowhere was that clearer than on “60 Minutes,” where veteran correspondent Scott Pelley broke the fourth wall to accuse Paramount (PARA) of muscling into editorial decisions as the company seeks Trump Administration approval for its merger with Skydance.

Executive-producer Bill Owens quit in protest, and Pelley’s on-air rebuke instantly became a cautionary tale for any CEO whose deal needs Washington’s blessing. Media isn’t the only sector feeling the chill, many of the cost-cutters above cited “regulatory uncertainty” in the same breath as tariffs. The spectacle crystallized the broader fear: policy risk is no longer an abstract spreadsheet input – it’s a prime-time drama.

Put together, the themes paint a corporate America that is hunkering down for the long-haul rather than just hibernating for the season. Expense control buys time, dual guidance buys optionality, and vocal resistance (in media or otherwise) buys a measure of Independence.

Whether that trio is enough to offset Sticky Inflation and an unrelenting Tariff Regime will be tested almost immediately: MSFT and META report Wednesday, AAPL and AMZN on Thursday, and their commentary on Labor Costs, Pricing Power and China exposure will tell us if the cost-cutting playbook can coexist with top-line growth or if the scissors are destined to keep cutting deep into the summer.

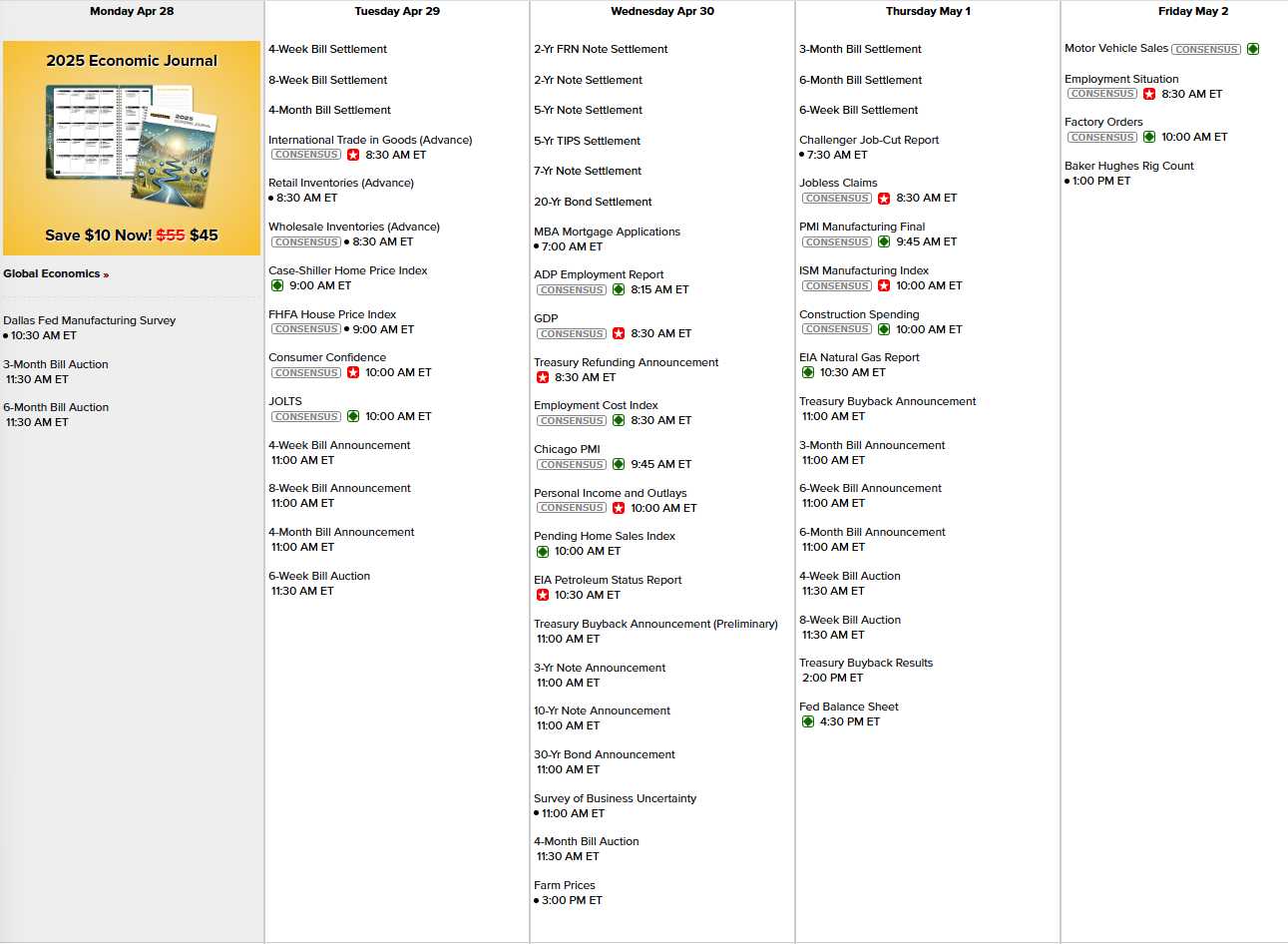

On the Economic Calendar, it’s the week before the FOMC meeting so NO FED SPEAK to spin things, which makes the Data Reports all the more important (though not as important as Earnings Reports). Highlights for the week are Dallas Fed today, Wholesale and Retail Inventories, Case-Shiller, Consumer Confidence and JOLTs tomorrow, GDP, Employment Costs, PMI, Personal Income & Spending AND Farm Prices on a busy Wednesday. Thursday it’s PMI, ISM, Construction Spending and don’t forget all the small auctions this week. And Friday it’s the Big Kahuna – Non-Farm Payrolls along with Factory Orders – busy, busy….

We are looking to make some earnings plays, particularly in names that already front-loaded efficiency (e.g., PEP, IBM), who could outperform if the tone shifts from “slash” to “steady.” AI hype trades are intact but CapEx questions are looming. Selling premium into elevated volatility may make sense and, by Thursday, we may have some clarity as AAPL and AMZN report.

We tilted a tiny bit more bearish into the weekend but the opening looks flat and our hedges should let us add more longs if all goes well. VIX is down at 23.40 but we’d like to see Russell 2,000 (1,957) and Nasdaq 20,000 (19,432) to feel more comfortable with our longs.

In our Live Member Chat Room, we will be reviewing stocks we feel good about adding to our Member Portfolios – join us inside!