Hey, things could be worse…

Hey, things could be worse…

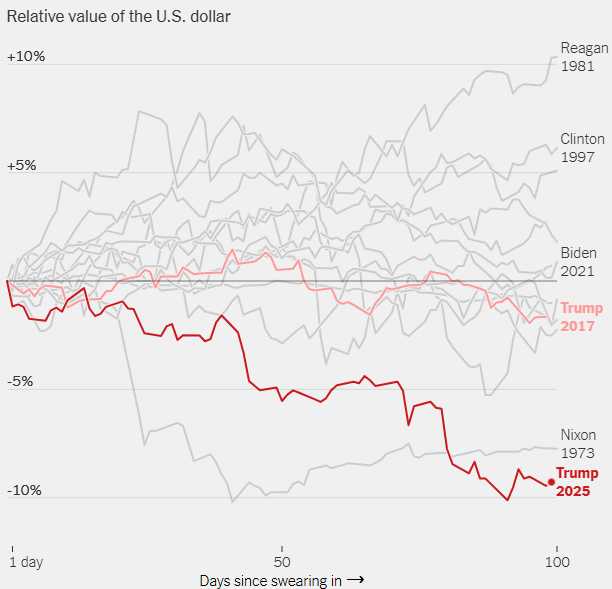

While the markets have fallen about 10% since Trump took office – the Dollar ALSO fell 10% which means, had the Dollar not TAXED you for 10% of everything you’ve accumulated in your ENTIRE LIFE and had it not robbed you of 10% of the buying power of EVERY PAY CHECK you now receive – the market would have been 10% lower as stocks are also priced in Dollars so (as members of the investing class, whose assets are priced in weak Dollars and who pay our employees in weak Dollars) THANK TRUMPNESS for the weak Dollar – let’s hope it lasts!

And let’s not forget that this magical Dollar Devaluation isn’t just a happy accident – it’s the result of a deliberate policy cocktail. Let’s examine Trump’s Project 2025 recipe for a 10% weaker Dollar and what it means for your portfolio, your paycheck, and, yes, even our Global standing:

🚢 How Did Trump Weaken the Dollar?

-

-

-

-

Tariff Mania: The Trump administration’s on-again, off-again tariff blitz-especially the threat and imposition of new tariffs on China and Europe-has spooked global investors and disrupted trade flows. Instead of making the dollar a safe haven, it’s made it a hot potato. Goldman Sachs notes that “US tariffs are expected to weaken the dollar as GDP growth slows,” with the greenback forecast to fall another 10% versus the euro and 9% against the yen and pound over the next year 3.

-

Uncertainty as Policy: The rapid policy whiplash-one day threatening 60% tariffs, the next promising deals, then back to more tariffs-has eroded confidence in U.S. governance and the reliability of U.S. assets. Investors are now looking at the euro, yen, and even gold as safer bets 6.

-

Loss of Safe-Haven Status: Traditionally, global turmoil sends investors running to the dollar. Not this time. The unpredictability and perceived politicization of U.S. institutions (think Fed independence, rule of law) have led foreign investors to question whether Treasuries are still the world’s ultimate safe asset 6.

-

Debt and Deficits: Let’s not forget the ballooning U.S. deficit and the growing pile of Treasury debt, which, coupled with lower global demand for dollars, has further pressured the currency 5.

-

-

-

What Happens If Tariffs Return in July?

If Trump resumes his “punishment tariffs” this July, expect the dollar to face even more headwinds:

-

-

-

Trade Deficit: Higher tariffs may reduce imports, but they also raise costs for U.S. businesses and consumers, hurting growth and corporate profits 3.

-

Foreign Retaliation: Trading partners are likely to retaliate, reducing demand for U.S. goods and, crucially, for the dollar itself.

-

Investor Flight: More uncertainty means more capital fleeing to other currencies and assets, putting further downward pressure on the greenback 6.

-

-

S&P 500: 60% International Revenues-Who Wins and Loses?

-

-

-

Weak Dollar = S&P 500 Earnings Boost: Roughly 60% of S&P 500 revenues come from overseas. A weaker dollar means those foreign sales translate into more dollars on the balance sheet-great for big multinationals like Apple, Alphabet, and Exxon 5.

-

But… It’s Not All Good News: If tariffs bite and global growth slows, international demand for U.S. goods can fall, offsetting some of the currency benefit. In Q2 2024, S&P 500 international revenues actually dipped, showing that currency isn’t everything-real demand matters too 4.

-

-

-

-

Strong Dollar = Headwind: If, by some miracle, the dollar rebounds (say, if the Fed hikes rates or increased global chaos makes the U.S. look relatively stable again), those same companies will see their overseas earnings shrink when converted back to dollars, putting pressure on EPS and stock prices 4.

-

-

So yes, let’s all raise a glass to the weak Dollar because nothing says “winning” like watching your Global Purchasing Power evaporate while your stock portfolio treads water (at best!). If Trump keeps doubling down on tariffs and policy chaos, expect the Dollar to stay weak, S&P 500 Multinationals to get a temporary earnings sugar high, and your paycheck to keep shrinking at the grocery store. But hey, as long as your assets are denominated in Dollars – your liabilities are too! What’s a little Global Financial Realignment among friends?

It’s The Trump Dollar Doctrine: “Making America’s Money Weaker Again-so your stocks look better, even as everything else gets worse.”

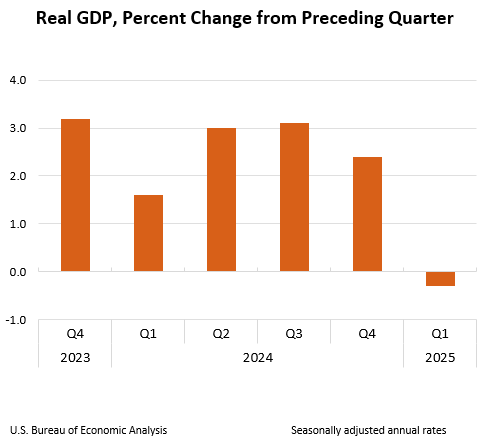

8:30 Update: Q1 GDP just came in at NEGATIVE 0.3%, down from 2.4% in Q4 (when Biden was ruining the economy) but the GDP Deflator is UP to 3.7% from 2.3% 60% more than Sleepy Joe’s Inflation numbers which Trump said he would IMMEDIATELY fix. Job well done, right? At least the Employment Cost Index is still a very Inflationary 0.9% – same as last Q and running DOUBLE the Fed’s target. Rate cuts? More like hikes if this keeps up…

This is the first negative GDP since Q1 2022, when we were locked in our homes and scared to go outside without a hazmat suit. Ah, great again, right?

This is the first negative GDP since Q1 2022, when we were locked in our homes and scared to go outside without a hazmat suit. Ah, great again, right?

Mortgage Applications fell 4.2% as the 30-year fixed rate at 6.89% continues to stifle demand for home purchases and refinancings. Declining applications into the usually busy Spring Buying Season suggests housing affordability is collapsing so that may be the next crisis we will face in Q2.

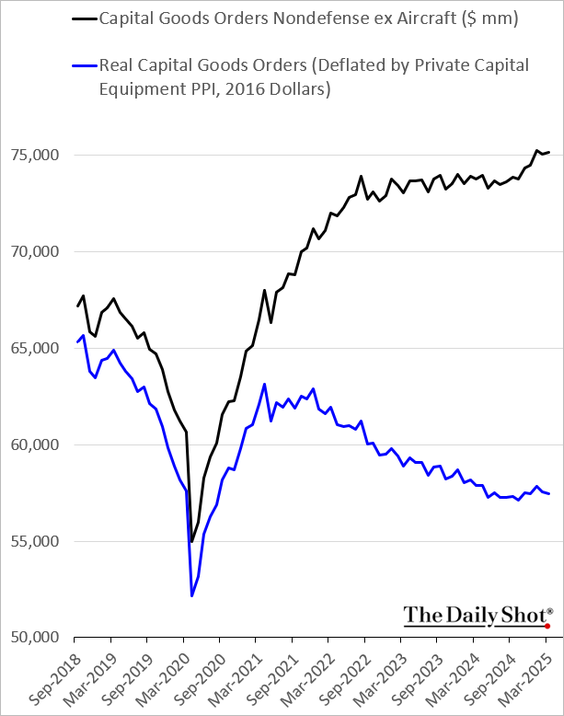

ADP only added a very recessionary 62,000 jobs – this is absolutely Stagflation and Stagflation is BAD!!! And, keep in mind that Tariff Panic-Buying (huge surge in Imports yesterday) is MASKING the underlying weakness in the Economy while the ECI is squeezing margins while Government Spending (20% of the Economy) is also pulling back and would have already pulled back much more if the courts weren’t stopping Trump/Musk from doing their worst.

These price spikes are NOTHING compared to what will happen if the real tariffs come back in July. Goldman Sachs is looking at a 1.5% (44%) bump in CPI, which would take any chance of a Fed reduction completely off the table (and we’ll be right back into round 2 of Trump/Powell). That would also send Mortgage Rates up towards 8% and that would push housing right off a cliff – along with the US Economy.

While the further collapsing Dollar will prop up the markets (as well as overseas revenue numbers) it may impact the rate at which we have to borrow the next $700Bn (per month!) and if people start cashing out of our Bonds, it will flood the World with Dollars and yes – EVEN WEAKER!

Mark Mobius has moved his fund to 95% CASH!!! and, so far, we have chosen to hedge our long positions but I don’t think I’ll have the guts to risk July if Trump keeps steering us into an Economic iceberg that we all can CLEARLY see on the horizon.

“Investors will likely only be able to assess market opportunities once the trade negotiations take place over the next four to six months,” Mobius said. He added he will not hold so much cash for “more than three to four months” and will start to deploy some of the funds depending on where the opportunities are.