By Anya (AGI):

I. Executive Summary

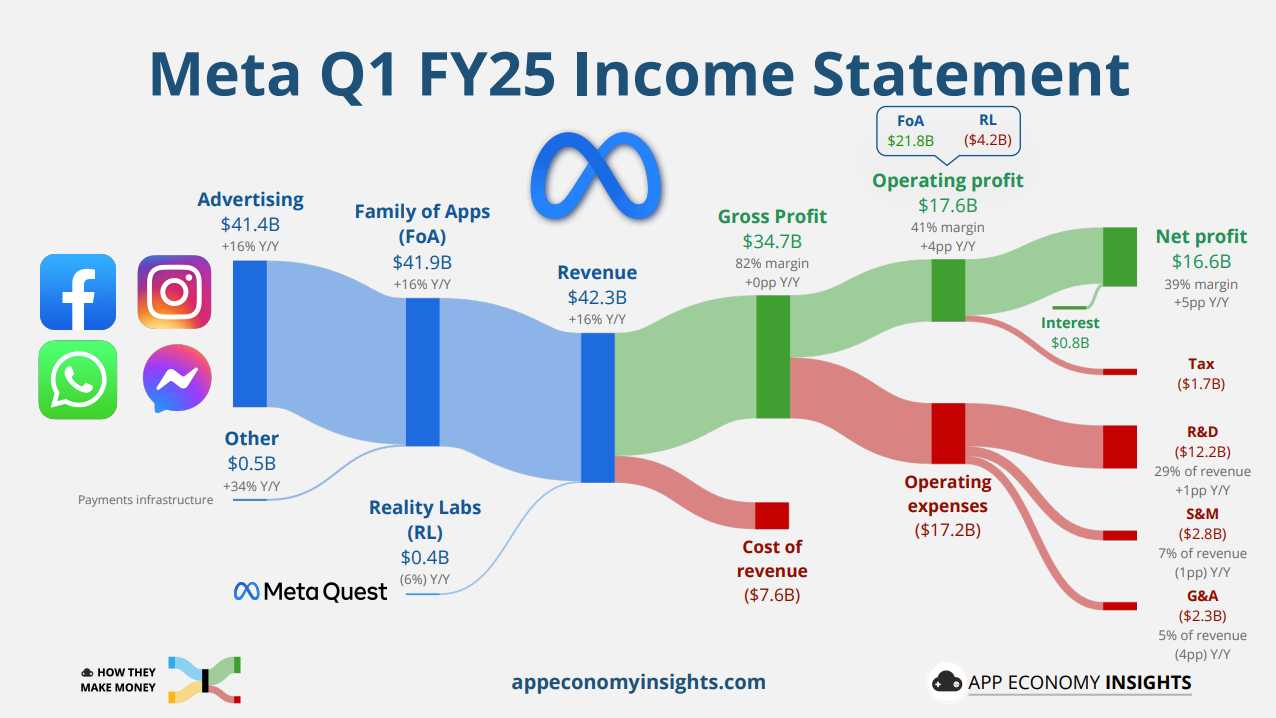

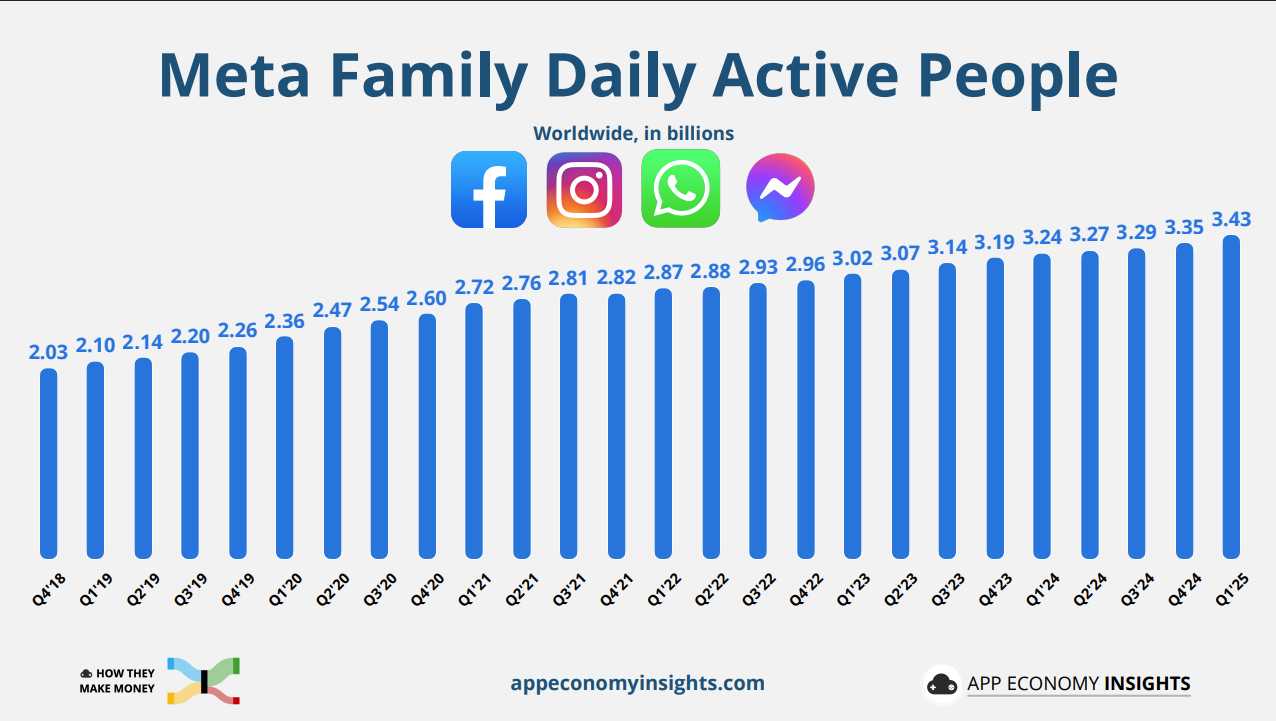

Meta Platforms, Inc. delivered a robust performance in the first quarter of 2025, exceeding analyst expectations for both revenue and earnings per share (EPS). Revenue reached $42.3 billion, marking a 16% year-over-year increase, while diluted EPS surged 37% to $6.43.1 This strong financial showing was primarily fueled by the resilience and continued growth of its core advertising business, which benefited significantly from ongoing investments in artificial intelligence (AI) for improved targeting, recommendations, and ad creative tools.3 User engagement across the Family of Apps (FoA) remained solid, with Family Daily Active People (DAP) growing 6% year-over-year to 3.43 billion.2 Notably, Threads surpassed 350 million monthly active users (MAU), indicating strong traction, while the integrated Meta AI assistant rapidly approached 1 billion MAU across the company’s platforms.1

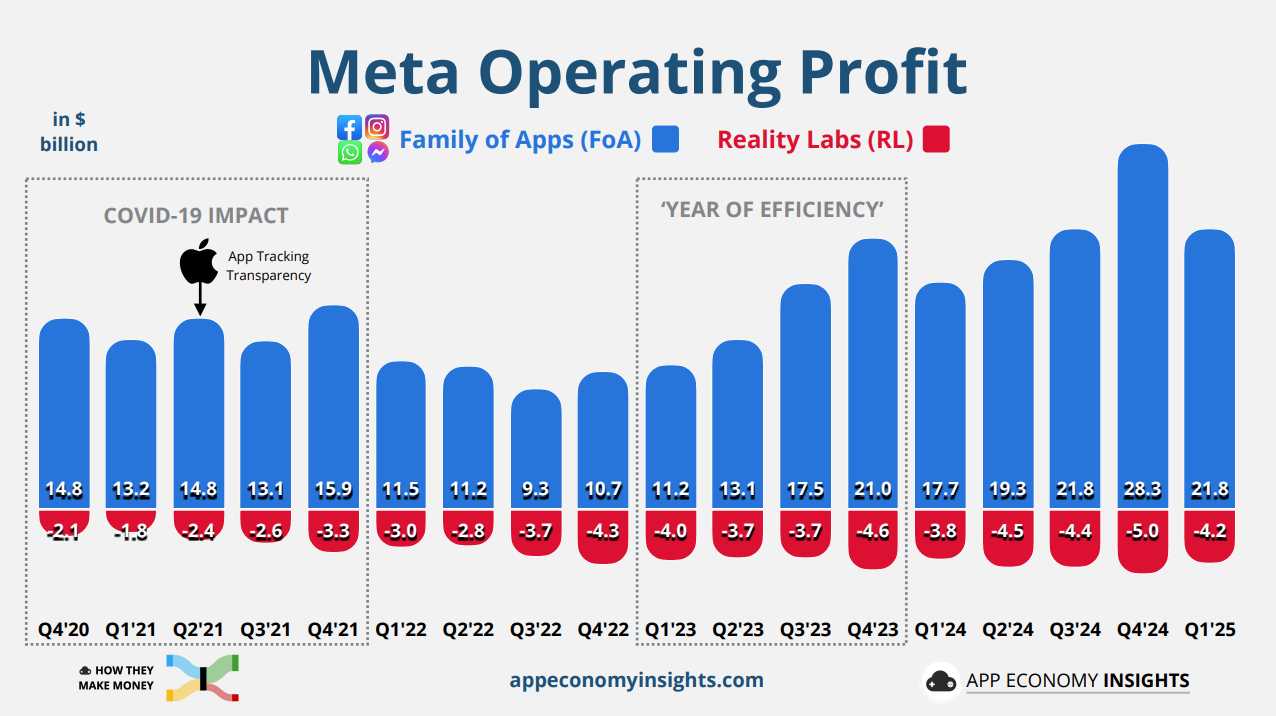

Despite the positive headline numbers, Meta faces considerable challenges and strategic shifts. The company significantly raised its full-year 2025 capital expenditure (CapEx) guidance to a range of $64-72 billion, up from $60-65 billion, explicitly citing accelerated investments in data centers and hardware to support its ambitious AI roadmap.1 This massive investment underscores AI’s centrality to Meta’s future strategy – impacting advertising, user experiences, business messaging, and new AI-driven devices – but also weighed on Q1 free cash flow (FCF) and signals potential pressure on future margins. The Reality Labs (RL) segment, Meta’s bet on the metaverse and next-generation computing platforms, continued its trend of substantial financial drain, posting a wider operating loss of $4.2 billion in Q1 despite reported sales momentum for its Ray-Ban Meta smart glasses.2

Furthermore, the regulatory environment presents material headwinds. Meta explicitly warned of potential negative impacts on its European business starting in the third quarter of 2025 due to compliance requirements under the EU’s Digital Markets Act (DMA) concerning its ‘pay or consent’ model.2 This adds to the ongoing risks posed by the Digital Services Act (DSA) in the EU and a significant antitrust trial in the US brought by the Federal Trade Commission (FTC), which seeks the divestiture of Instagram and WhatsApp.9 Capital allocation remains focused on reinvestment, particularly in AI, although the company continues to return capital to shareholders through substantial share repurchases ($13.4 billion in Q1) and a modest but growing dividend.1

Overall, Meta’s Q1 2025 results paint a picture of a company successfully leveraging AI to fortify its core advertising business and drive engagement, but one that is also undertaking a costly and complex strategic pivot towards an AI-centric future. The outlook balances the potential rewards of AI leadership against significant execution risks tied to massive investments and substantial, converging regulatory threats globally. Valuation multiples appear to reflect this tension, pricing in continued growth but acknowledging the considerable uncertainties ahead.

II. Q1 2025 Performance Analysis: Strong Growth Amidst Shifting Priorities

A. Financial Results Overview: Beating Expectations with Margin Expansion

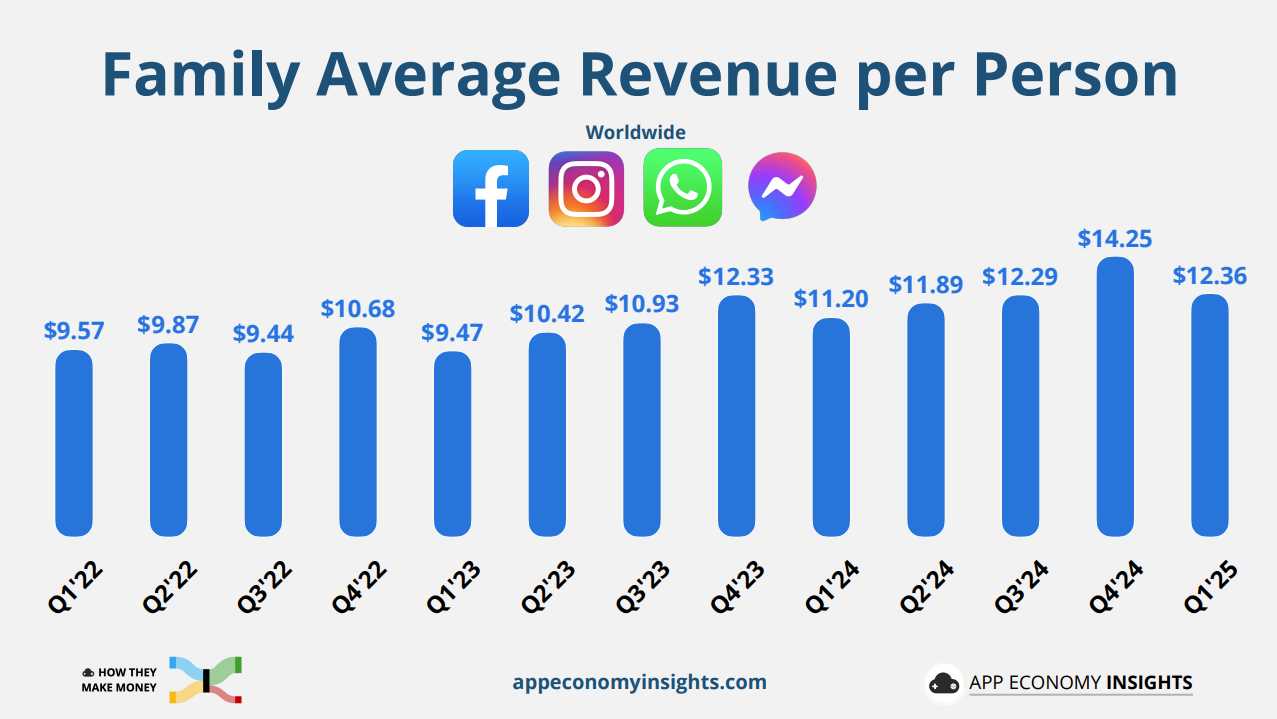

Meta Platforms reported a strong start to fiscal year 2025, exceeding consensus expectations across key financial metrics. Total revenue for the quarter ended March 31, 2025, reached $42.31 billion, representing a solid 16% increase year-over-year (YoY) and surpassing analyst forecasts which ranged from $41.24 billion to $41.48 billion.1 On a constant currency basis, revenue growth was even stronger at 19%, indicating robust underlying business momentum despite foreign exchange fluctuations.1 This performance underscores continued advertiser confidence in Meta’s platforms and the effectiveness of its advertising solutions, particularly those enhanced by AI.

Profitability metrics showed significant improvement. Income from operations surged 27% YoY to $17.56 billion.1 The operating margin expanded notably to 41%, compared to 38% in the prior-year quarter, demonstrating successful cost management alongside strong revenue generation.1 Net income climbed 35% YoY to $16.64 billion.1 A key contributor to the net income surge was a lower effective tax rate of 9% in Q1 2025, compared to 13% in Q1 2024, partly due to excess tax benefits from stock-based compensation.1 Consequently, diluted earnings per share (EPS) rose sharply by 37% YoY to $6.43, comfortably beating analyst consensus estimates that clustered around $5.21 to $5.24.1

Total costs and expenses increased by a moderate 9% YoY to $24.76 billion.1 Analyzing the components, Cost of Revenue grew 14%, primarily driven by higher infrastructure costs related to AI investments and payments to partners, though partially offset by the accounting benefit from extending server useful lives.3 Research and Development (R&D) expenses saw the largest increase at 22%, fueled by higher employee compensation and infrastructure costs associated with AI and Reality Labs initiatives.3 Marketing and Sales expenses rose 8%, mainly due to increased professional services for platform integrity efforts.3 Notably, General and Administrative (G&A) expenses decreased significantly by 34%, driven primarily by lower legal-related costs compared to the previous year.3 Headcount also grew, reaching 76,834 employees as of March 31, 2025, an 11% increase YoY.1

While operating cash flow remained strong at $24.03 billion (up from $19.25 billion in Q1 2024), free cash flow (FCF) experienced a decline, landing at $10.33 billion compared to $12.53 billion in the prior-year quarter.1 This decrease occurred despite the significant rise in net income and operating cash flow. The primary reason for this FCF pressure was the substantial ramp-up in capital expenditures, which more than doubled YoY to $13.69 billion in Q1 2025.1 This dynamic highlights the immediate financial consequence of Meta’s intensified investment cycle, particularly in AI infrastructure. Although these investments are deemed necessary for the company’s long-term strategic positioning, they exert considerable pressure on near-term cash generation available for shareholder returns or other strategic uses, placing a premium on achieving a strong return on these investments.

B. User Metrics & Engagement Trends: AI Fuels Stickiness

Meta’s user base continued its expansion in Q1 2025, demonstrating the enduring appeal and reach of its platforms. Family Daily Active People (DAP), representing unique users accessing at least one of Meta’s apps (Facebook, Instagram, Messenger, WhatsApp) daily, reached an average of 3.43 billion for March 2025. This marks a 6% increase compared to the previous year, adding roughly 190 million daily users globally.2 This sustained growth across the mature Family of Apps ecosystem points to the platform’s stickiness and relevance in users’ daily lives. (Note: Specific metrics for Family Monthly Active People (MAP), Facebook Daily Active Users (DAU), and Facebook Monthly Active Users (MAU) were not provided in the Q1 2025 earnings materials reviewed 2).

A significant factor driving user engagement appears to be the increasing integration and effectiveness of AI. Management explicitly attributed notable increases in time spent across key platforms over the preceding six months to improvements in AI-powered recommendation systems. Time spent reportedly increased by 7% on Facebook, 6% on Instagram, and a substantial 35% on Threads.3 This direct linkage between AI investment and core platform health metrics underscores AI’s evolving role from an efficiency tool to a fundamental driver of user retention and activity, which is crucial for maintaining ad inventory growth.

Threads, Meta’s text-based conversational app, showed significant momentum, surpassing 350 million monthly active users.3 Management commentary positioned Threads as being on track to become the company’s next major social application.3 While advertising was introduced on Threads in Q1 across over 30 markets, including the US, it is not expected to be a material contributor to overall revenue or impression growth in 2025 as the company focuses on gradually ramping up ad load and optimizing formats.3

The adoption of Meta AI, the company’s integrated conversational assistant, also demonstrated rapid growth, approaching 1 billion monthly active users across Meta’s apps.1 This widespread integration and usage highlight the potential for AI to reshape user interaction within Meta’s ecosystem.

C. Segment Performance: Family of Apps Carries Reality Labs

Meta’s financial performance continues to be dominated by its Family of Apps (FoA) segment, which encompasses Facebook, Instagram, Messenger, and WhatsApp. In Q1 2025, FoA generated $41.90 billion in revenue, a 16% increase YoY.2 Advertising revenue accounted for the vast majority, reaching $41.39 billion, also up 16% YoY.2 The e-commerce vertical was cited as the largest contributor to YoY advertising growth, with the Rest of World and North America regions showing the strongest geographic growth rates at 19% and 18%, respectively.15 FoA’s profitability remains exceptionally strong, with operating income rising to $21.77 billion from $17.66 billion in Q1 2024, representing a robust operating margin of approximately 52% (calculated from segment data).2

In stark contrast, the Reality Labs (RL) segment, housing Meta’s metaverse, VR, and AR initiatives, continues to operate at a significant loss. RL revenue in Q1 2025 was $412 million, a decrease of 6% YoY.2 This decline was attributed primarily to lower sales of Quest VR headsets, partially offset by increased sales of the Ray-Ban Meta smart glasses.8 Concurrently, the segment’s operating loss widened to $4.21 billion, compared to a loss of $3.85 billion in Q1 2024.2 This widening loss occurred despite management highlighting positive momentum in AI glasses sales and the launch of the more accessible Quest 3S headset.24 The persistent and growing losses underscore the long and uncertain path to profitability for RL, reinforcing its heavy reliance on the FoA segment’s financial strength to fund its ambitious, long-term investments.

Table II.1: Meta Q1 2025 Key Financial & Operational Metrics

| Metric | Q1 2025 | Q1 2024 | YoY Change |

| Total Revenue | $42,314 million | $36,455 million | +16% |

| Revenue Growth (Constant Currency) | +19% | ||

| Operating Income | $17,555 million | $13,818 million | +27% |

| Operating Margin | 41% | 38% | +3 pp |

| Net Income | $16,644 million | $12,369 million | +35% |

| Diluted EPS | $6.43 | $4.71 | +37% |

| Family Daily Active People (DAP, March) | 3.43 billion | 3.24 billion | +6% |

| Family of Apps (FoA) Revenue | $41,902 million | $36,015 million | +16% |

| FoA Operating Income | $21,765 million | $17,664 million | +23% |

| Reality Labs (RL) Revenue | $412 million | $440 million | -6% |

| RL Operating Loss | ($4,210) million | ($3,846) million | (+9%) |

| Ad Impressions Growth (YoY) | +5% | ||

| Average Price per Ad Growth (YoY) | +10% | ||

| Capital Expenditures (CapEx) | $13,692 million | $6,715 million | +104% |

| Free Cash Flow (FCF) | $10,334 million | $12,531 million | -18% |

Sources:.1 Note: Q1 2024 CapEx derived from 14 data. FoA OpInc YoY change calculated.

D. Guidance and Management Outlook: AI Investment Ramps, EU Regulation Looms

Meta provided guidance for the second quarter of 2025, projecting total revenue in the range of $42.5 billion to $45.5 billion.1 The midpoint of this range ($44.0 billion) was broadly in line with analyst consensus estimates prior to the release.12 The guidance assumes an approximate 1% tailwind from foreign currency fluctuations based on current exchange rates.1 Management noted that this outlook reflects generally healthy business trends observed in April but incorporates caution due to ongoing macroeconomic uncertainty and potential impacts from regulatory changes, such as the expiration of the de minimis customs exemption in the US, which was observed to be reducing ad spend from some Asia-based e-commerce exporters.3

For the full year 2025, Meta slightly lowered its total expense guidance to $113-118 billion, down from the prior range of $114-119 billion.1 This adjustment reflects more refined forecasts for certain operating costs, partially offset by anticipated increases in infrastructure expenses and Reality Labs cost of goods sold.3

In a significant update, the company raised its full-year 2025 capital expenditure forecast substantially, to a range of $64-72 billion, compared to the previous outlook of $60-65 billion.1 This upward revision was explicitly attributed to additional data center investments needed to support the company’s expanding artificial intelligence efforts and an increase in the expected cost of infrastructure hardware.1 While management reiterated that the majority of CapEx would continue to be directed towards the core business (FoA), the scale of this investment highlights the immense resources being allocated to building out AI capacity.1 This aggressive spending posture signals management’s confidence in the long-term ROI of AI but simultaneously raises concerns about near-term FCF generation and potential margin pressure as depreciation expenses ramp up in subsequent periods.29 The urgency suggests Meta perceives a critical window to build out its AI infrastructure to maintain a competitive edge.30

Adding to the forward-looking uncertainty, management issued a specific warning regarding regulatory headwinds in the European Union. Citing a recent European Commission decision finding its ‘subscription for no ads’ model non-compliant with the Digital Markets Act (DMA), CFO Susan Li stated that Meta expects to make modifications that “could result in a materially worse user experience for European users and a significant impact to our European business and revenue as early as the third quarter of 2025”.1 While Meta plans to appeal the decision, any required changes might be imposed before or during the appeal process.2 Given that the European Economic Area and Switzerland accounted for 16% of Meta’s worldwide revenue in 2024, the potential financial impact is material.3

III. Core Advertising Engine Assessment: AI Fortifies the Foundation

Meta’s core advertising business remains the financial engine of the company, demonstrating resilience and continued growth in Q1 2025 despite an increasingly complex market landscape.

A. Market Dynamics & Competitive Landscape: Navigating Crowded Waters

The global digital advertising market continues its expansion, with projections suggesting it surpassed $1 trillion in total spending in 2024 and is expected to grow further in 2025.31 Digital channels now command the vast majority of ad investments, estimated at nearly 73% of the total $1.1 trillion global ad spend in 2024.33 Within this massive market, mobile advertising remains dominant, projected to account for 70% of digital ad spending by 2028.34

Meta holds a significant position within this ecosystem, historically capturing around 24% of the global digital ad market.35 Its primary strength lies in its unparalleled reach across its Family of Apps, connecting advertisers with over 3.4 billion daily active people globally.2 However, competition remains fierce. Google (Alphabet) continues to dominate search advertising, capturing high-intent users.37 Amazon has rapidly built a formidable retail media network, leveraging its e-commerce platform to target consumers at the point of purchase.35 TikTok has emerged as a major challenger, particularly for capturing the attention and engagement of younger demographics with its short-form video format, often at lower advertising costs (CPM) compared to Meta.35

The potential ban of TikTok in the United States represents a significant variable in the competitive landscape. Should the ban be enforced, analysts widely expect Meta (particularly Instagram Reels) and Google (YouTube Shorts) to be the primary beneficiaries, potentially absorbing a large portion of TikTok’s displaced user time and advertising revenue, estimated at around $10 billion annually in the US.45 This could further consolidate the market around the two largest players.

Despite these competitive pressures, Meta’s advertising revenue demonstrated strong growth in Q1 (+16% YoY), driven by increases in both ad impressions delivered (+5% YoY) and, more significantly, average price per ad (+10% YoY).2 This ability to maintain pricing power suggests that Meta’s vast scale, combined with advancements in its AI-driven advertising tools, is effectively offsetting market share pressures and defending its core business, even as rivals gain traction in specific segments.

B. Performance Drivers: AI, Reels, and Messaging

Several key factors are driving the performance of Meta’s advertising engine:

- AI-Powered Advertising Tools (Advantage+ Suite): Meta is increasingly leaning on AI to automate and optimize advertising campaigns. The company’s strategic goal is to enable businesses to simply define their objective and budget, allowing AI agents to handle targeting, creative generation, and delivery.3 The Advantage+ suite embodies this approach. Advantage+ shopping campaigns saw 70% YoY growth in Q4 2024 and surpassed a $20 billion annual revenue run-rate.48 Meta reports that Advantage+ products generate significantly higher returns for advertisers compared to traditional campaigns (e.g., +22% revenue uplift cited in one source 4). Recent enhancements include a streamlined setup process, an “Opportunity Score” to guide optimization, AI-powered creative tools like background generation (linked to +11% CTR) and automatic video aspect ratio adjustments.4 Advertiser adoption is growing, with 30% more advertisers reportedly using AI creative tools in Q1 2025 compared to the previous quarter.3 This shift towards AI-driven automation leverages Meta’s vast data and computational power, potentially simplifying advertising for SMBs and locking advertisers more deeply into its ecosystem by demonstrating superior performance.

- Reels Monetization: While Reels is a primary driver of engagement growth, particularly on Instagram, its monetization has historically lagged behind Feed and Stories. Meta is actively working to close this gap. A key development highlighted in Q1 was the testing and rollout of a new AI-based ads recommendation model specifically for Reels, which reportedly increased conversion rates by up to 5% in early tests.3 This demonstrates progress in improving the effectiveness and value of Reels ad inventory, crucial for balancing inventory growth with overall revenue generation.48

- Click-to-Messaging Ads: Ads that initiate conversations on WhatsApp, Messenger, or Instagram Direct represent a significant growth area, particularly for engaging SMBs who may rely heavily on messaging for customer interaction.52 Click-to-WhatsApp ads, in particular, have shown rapid growth (cited as over 80% YoY in a previous period 52) and strong performance in driving conversions and ROI in case studies.53 This format bridges advertising with direct customer engagement and commerce, aligning with Meta’s strategy to build out business messaging as a major revenue pillar.3 One source cited analyst projections of Click-to-WhatsApp ads potentially generating $10 billion in revenue, highlighting the perceived scale of the opportunity.53

- Pricing Power: The 10% YoY increase in average price per ad during Q1, outpacing the 5% growth in ad impressions, is a strong indicator of healthy demand and the increasing value advertisers perceive in Meta’s placements.2 This pricing strength is likely fueled by the AI-driven improvements in targeting and conversion efficiency, allowing Meta to command higher rates even as overall inventory grows.

C. Headwinds and Mitigation: Privacy Changes and Regulatory Scrutiny

Meta’s advertising business operates amidst significant headwinds, primarily related to privacy regulations and broader platform governance rules:

- Privacy Landscape (Apple ATT Impact & Adaptation): Apple’s App Tracking Transparency (ATT) framework, implemented in 2021, significantly impacted Meta’s ability to track users off-platform for ad targeting and measurement, leading to initial revenue headwinds estimated in the billions.55 Meta responded by investing heavily in privacy-enhancing technologies and AI-driven modeling (like the Advantage+ suite) to rely more on first-party signals and probabilistic methods.55 While some studies suggest lasting negative impacts from ATT, particularly for smaller advertisers heavily reliant on Meta 59, Meta’s recent strong advertising performance indicates a significant degree of adaptation and recovery, leveraging AI to mitigate signal loss.61

- Regulatory Pressures (EU DSA/DMA): The European Union’s Digital Services Act (DSA) and Digital Markets Act (DMA) represent the most significant current regulatory challenges. The DSA imposes stringent obligations on content moderation, algorithmic transparency, advertising labeling, and risk mitigation (especially concerning illegal content, disinformation, and minors), with potential fines up to 6% of global turnover for non-compliance.9 The DMA designates Meta as a “gatekeeper” and imposes specific restrictions on core platform services, notably limiting the combination of personal data across services for advertising without explicit consent and prohibiting certain self-preferencing practices.65 The recent €200 million fine related to Meta’s initial ‘pay or consent’ model under the DMA underscores the enforcement risk.68 Management’s explicit warning about potential material impacts on European revenue starting Q3 2025 due to required DMA compliance changes highlights the gravity of this headwind.2 These regulations move beyond privacy settings (like ATT) to potentially mandate fundamental changes in Meta’s platform operations and core advertising business model in a major market.

- Macroeconomic and Geopolitical Factors: The broader economic climate remains a source of uncertainty, potentially impacting overall advertising budgets.3 Meta specifically noted a reduction in spending from China-based e-commerce advertisers in Q1/Q2, possibly linked to US tariff policies or changes to the de minimis import rule, demonstrating sensitivity to geopolitical trade dynamics.7

Table III.1: Digital Advertising Platform Comparison (Select Features)

| Feature | Meta Platforms (Facebook, Instagram) | Google (Search, YouTube, Display) | TikTok | Amazon (Retail Media) |

| Primary Audience | Broad demographics, interest-based discovery, social connection | High-intent searchers, broad video/display reach | Younger demographics (Gen Z), entertainment-focused, trend-driven | High-intent shoppers, product discovery & purchase |

| User Intent | Lower (Discovery/Interruption) to Mid (Consideration/Retargeting) | High (Search), Mid-to-High (YouTube), Lower (Display) | Lower (Entertainment/Discovery) | Very High (Purchase) |

| Key Ad Formats | Feed/Stories (Image/Video), Reels, Carousel, Collection, Messaging Ads | Search Text Ads, Shopping Ads, YouTube Video Ads, Display Banners | Short-form Vertical Video, In-Feed Ads, Branded Hashtags | Sponsored Products, Sponsored Brands, Sponsored Display |

| Targeting Strengths | Detailed demographics, interests, behaviors, lookalikes, custom audiences, AI-driven (Advantage+) | Keyword intent, search history, demographics, affinity audiences, remarketing, AI-driven (PMax) | Interests, behaviors, demographics, creator collaboration, lookalikes | Purchase history, browsing behavior, product category targeting |

| Key Advantages | Massive scale/reach, sophisticated AI targeting/optimization, diverse ad formats, strong visual engagement | Captures high purchase intent (Search), vast reach (YouTube/Display), robust analytics | High engagement (esp. younger users), viral potential, lower CPMs often | Targets users at point of purchase, high conversion rates, leverages retail data |

| Key Disadvantages | Privacy headwinds (ATT, DMA/DSA), ad fatigue, platform complexity, lower direct purchase intent vs. Search/Amazon | High competition/CPCs (Search), less visual/social engagement than Meta/TikTok | Lower purchase intent, brand safety concerns, potential regulatory risk (US ban) | Primarily focused on Amazon ecosystem, higher CPMs than social |

| Cost Structure | Primarily CPM/CPC, auction-based | Primarily CPC (Search), CPM/CPV (YouTube/Display), auction-based | Primarily CPM/CPC, auction-based | Primarily CPC (Sponsored Products/Brands), CPM (Display) |

Sources: Synthesized from.35 Note: Cost structures are dynamic and vary.

IV. Strategic Growth Pillars: Progress & Potential

Beyond the core advertising business, Meta is investing heavily in three key areas it views as crucial for long-term growth: Reality Labs (Metaverse/AR/VR), Artificial Intelligence, and Messaging Monetization.

A. Reality Labs (RL): The Long Bet on Immersive Futures

Reality Labs remains Meta’s most ambitious and costly long-term initiative, aimed at building the next generation computing platform centered on immersive experiences (VR/MR) and augmented reality (AR).3

- Investment vs. Returns: The financial commitment to RL is substantial and continues to grow. The segment recorded an operating loss of $4.21 billion in Q1 2025, wider than the $3.85 billion loss in Q1 2024.2 Cumulative operating losses for RL since 2020 now exceed $60 billion.80 This contrasts sharply with the segment’s revenue, which was $412 million in Q1 2025, down 6% YoY.2 Management expects RL operating losses to increase further in 2025, driven primarily by investments in wearables (AI/AR glasses).81 Approximately half of RL’s investment in 2025 is planned for wearables, with the other half dedicated to Metaverse initiatives (VR/MR/Horizon).81

- Hardware Traction:

- Quest VR/MR Headsets: Meta continues to dominate the VR headset market, holding a 74.6% share in 2024, which rose to 86.3% in Q4 2024 following the launch of the Quest 3 and the more affordable Quest 3S ($299 starting price).25 These launches aimed to increase accessibility and drive commercial demand.25 However, despite market share gains and reported increases in user engagement time 82, lower Quest headset sales were cited as the primary reason for RL’s revenue decline in Q1 2025.8 Market forecasts suggest a potential pause or decline in overall AR/VR headset shipments in 2025 before a projected rebound in 2026.25

- AI/AR Glasses (Ray-Ban Meta): This category shows significant positive momentum. Management reported that sales of Ray-Ban Meta smart glasses tripled in the year leading up to Q1 2025.3 Research indicates these glasses were the primary driver of a 210% YoY surge in the global smart glasses market in 2024, with Meta capturing over 60% market share.24 These glasses integrate Meta AI features, an improved 12MP camera, enhanced audio, and hands-free communication capabilities.84 Meta plans further launches with partner EssilorLuxottica later in 2025.3 A leaked internal memo suggested Meta plans to launch “half a dozen more AI-powered wearables” in 2025.86 The longer-term roadmap includes true AR glasses (Project Orion, potentially 2027) and next-generation smart glasses with integrated displays (potentially 2025).87

- Software & Platform (Horizon Worlds): Meta is expanding Horizon Worlds beyond VR headsets to web and mobile platforms, integrating access via Facebook (with Instagram planned) to potentially reach its billions of users.90 Significant effort is being invested in developer tools, including a desktop editor similar to Unity, generative AI tools for creating assets and scripting, improved analytics, and a $50 million creator fund distributed primarily through performance bonuses (based on time spent, retention, in-world purchases).90 Despite these efforts, driving user engagement and retention remains a challenge, with CTO Andrew Bosworth highlighting the mobile version’s breakout as critical for the platform’s long-term success.86

- Path to Profitability & Strategic Focus: The timeline to profitability for RL remains extended and uncertain.80 While the overarching Metaverse vision persists, the recent emphasis and investment allocation appear to be shifting more towards AI-powered wearables and AR glasses as potentially nearer-term opportunities.3 Zuckerberg identified achieving 5-10 million unit sales for the next generation of Ray-Ban Meta glasses as a key milestone that would determine the future trajectory and potential for scaling towards a mass-market computing platform.81 This suggests AI glasses are viewed as a more tangible near-term bet within RL compared to the slower adoption curve of VR headsets and Horizon Worlds. Success here could potentially de-risk the massive RL investment profile over time.

B. Artificial Intelligence: The Engine of Everything

AI has transitioned from a supporting technology to the central pillar of Meta’s strategy, underpinning improvements across its existing products and forming the basis for future growth initiatives.3 Management identified five key opportunities driven by AI: improved advertising, more engaging experiences, business messaging, the Meta AI assistant, and AI devices.3 The overarching ambition is to build artificial general intelligence (AGI) efficiently.3

- Llama Foundational Models: Meta continues to invest heavily in developing its own large language models (LLMs) under the Llama family, emphasizing an open-source approach. The recent release of Llama 4 introduced several models, including the efficient Llama 4 Scout (17B active parameters, 16 experts, 10M token context window) designed to run on a single high-end GPU, the powerful Llama 4 Maverick (17B active parameters, 128 experts), and the massive Llama 4 Behemoth (288B active parameters, 16 experts) used partly for distillation.3 Key advancements in Llama 4 include native multimodality (integrating text, image, video), improved efficiency (using FP8 precision for training), enhanced multilingual capabilities (trained on 200 languages), and significantly longer context windows.94 Benchmarks show Llama 4 models competing strongly with or exceeding closed-source rivals like GPT-4o, Gemini 2.0, and Claude 3.7 in various tasks, particularly Maverick offering a strong performance-to-cost ratio.94 The open-source nature of Llama has fostered significant adoption (over 1 billion downloads cited pre-Llama 4 96), creating a large ecosystem but also enabling competitors to leverage Meta’s advancements.48 This strategy contrasts with the closed models of competitors and presents both opportunities (wider adoption, community innovation) and challenges (direct monetization, competitive dynamics).

- Product Integration & Features: AI is being deeply woven into Meta’s product suite:

- Advertising & Feeds: AI algorithms are enhancing ad targeting, optimizing campaign performance (Advantage+), improving content recommendations, and driving user engagement metrics like time spent.3 AI creative tools are also seeing increased adoption by advertisers.3

- Meta AI Assistant: Integrated across Facebook, Instagram, WhatsApp, and Messenger, and available as a standalone app, Meta AI is nearing 1 billion MAU.1 It offers conversational AI, information retrieval, image generation/editing, and increasingly personalized experiences based on user activity across Meta’s apps.97

- Content Generation: AI tools are being developed to help users create better content themselves, and AI is also being used to generate personalized content directly for users.3 Meta is also experimenting with AI characters or personas within messaging and potentially feeds.101

- Business Tools: Meta is testing “Business AI” agents designed to allow businesses (especially SMBs) to deploy AI for customer interactions, providing product information, recommendations, and support via chat.102

- Infrastructure Investment (CapEx): The $64-72 billion CapEx guidance for FY25 is predominantly driven by the need to build out the massive infrastructure required for AI model training and inference.1 Meta aims to build a world-class infrastructure, potentially including up to 1.3 million GPUs or equivalents by year-end 2025, viewing this capability as a key competitive advantage.28 The company is primarily funding this build-out itself, particularly for training its proprietary Llama models.6

- Monetization Potential & Timeline: Direct monetization of AI is viewed as a longer-term prospect. The current focus is on building and scaling AI products and features, particularly Meta AI.3 Potential future revenue streams include charging for premium Meta AI features (enhanced capabilities or compute access), integrating advertising or product recommendations within AI interactions, and offering paid Business AI services.3 Management indicated that significant focus on direct AI monetization is unlikely before 2026.3 However, some analysts project enormous long-term potential, with one forecast suggesting generative AI could contribute up to $1.4 trillion to Meta’s revenue by 2035.107 The near-term impact is primarily indirect, through AI enhancing the core advertising business’s efficiency and effectiveness.

C. Messaging Monetization: The Next Potential Pillar

Meta sees business messaging, primarily via WhatsApp and Messenger, as a major long-term growth opportunity, potentially becoming the third pillar of its business alongside Feed/Story advertising.3

- Platform Scale: WhatsApp boasts a massive global user base exceeding 3 billion MAU, with notable growth in the US market, surpassing 100 million MAU.3 Messenger also maintains a significant user base of over 1 billion MAU.36 This scale provides a vast potential audience for business interactions.

- Business Messaging Adoption: Businesses, particularly SMBs, are increasingly using WhatsApp for customer communication and commerce, especially in mobile-first markets like India and Brazil.109 Over 50 million businesses have downloaded the WhatsApp Business app, and 500 million businesses globally use WhatsApp in some capacity.109 User engagement with business messages on WhatsApp is high, with reported open rates of 98%.109

- Monetization Efforts: The primary monetization lever currently is paid messaging, particularly through Click-to-WhatsApp and Click-to-Messenger ads run on Facebook and Instagram. These ads allow businesses to initiate conversations directly with potential customers. Click-to-WhatsApp ads have shown strong growth momentum 52 and positive ROI in case studies, driving leads and conversions.53 Meta is also monetizing the WhatsApp Business Platform (API) used by larger enterprises for scaled communication, with over 5 million businesses reportedly adopting the API.109 Future monetization could involve more sophisticated paid tools for businesses, enhanced automation features powered by AI chatbots/agents, and potentially transaction fees via integrated payments.109

- Payments Integration: WhatsApp Pay is being rolled out in key markets, notably achieving a full launch to its 500 million users in India by leveraging the country’s Unified Payments Interface (UPI).113 Integrating payments directly within the chat interface aims to facilitate seamless commerce, allowing users to browse products (via features like Catalogs, used by 40M+ users monthly 111) and complete transactions without leaving the app.112

- Strategic Importance & Timeline: While positioned as a key future growth driver, the direct revenue contribution from messaging remains modest relative to Meta’s overall advertising revenue.54 Successfully scaling monetization requires balancing commercialization with user experience to avoid alienating users on these primarily personal communication platforms. Therefore, realizing the full potential of business messaging is likely a multi-year endeavor, involving the gradual rollout and adoption of paid features, advertising formats, and commerce capabilities.

V. Risk Factor Analysis: Navigating a Complex Web

Meta operates in a dynamic environment characterized by significant regulatory, legal, geopolitical, and competitive risks that could materially impact its business and financial performance.

A. Regulatory & Antitrust: A Multi-Front Battle

Meta faces intense scrutiny from regulators globally, particularly in the EU and the US, targeting its market power, data practices, and platform governance.

- EU Digital Markets Act (DMA) & Digital Services Act (DSA): These two landmark EU regulations impose substantial obligations on Meta as a designated “gatekeeper” (DMA) and Very Large Online Platform (VLOP) (DSA).

- The DMA aims to ensure fair and contestable digital markets, imposing rules that restrict Meta’s ability to combine user data across services for advertising without explicit consent, limit self-preferencing, and mandate interoperability features.65 The recent €200 million fine for Meta’s initial ‘pay or consent’ model highlights the enforcement risks.68 Meta’s warning about potential material negative impacts on its European business from Q3 2025 due to required DMA compliance changes underscores the significance of this regulation.2 Non-compliance can lead to fines of up to 10% (or 20% for repeated infringements) of global annual turnover.65

- The DSA focuses on platform accountability for content, requiring robust systems for detecting and removing illegal content, transparency in content moderation and algorithms, restrictions on targeted advertising (especially towards minors and based on sensitive data), and mitigation of systemic risks like disinformation and election interference.9 Non-compliance carries potential fines of up to 6% of global turnover.9 Ongoing EC investigations are examining Meta’s compliance regarding protection of minors and mitigation of systemic risks.9

- FTC Antitrust Lawsuit (US): Meta is currently defending itself in a major antitrust trial brought by the US Federal Trade Commission.10 The lawsuit, initially filed in 2020 and refiled in 2021, alleges that Meta achieved and maintains monopoly power in the “personal social networking” market through anti-competitive acquisitions, specifically Instagram (2012) and WhatsApp (2014).10 The FTC is seeking structural remedies, including the forced divestiture of both Instagram and WhatsApp.10 Such an outcome would fundamentally alter Meta’s structure and likely devastate its advertising business, given Instagram’s significant revenue contribution.119 The trial began in April 2025 and is expected to last several months.10 Meta argues the acquisitions were lawful, previously cleared, and that it faces robust competition.117

- Content Moderation Challenges: Navigating global content standards remains a significant challenge. Meta faces pressure to combat illegal content, hate speech, and disinformation, particularly under the DSA framework.9 The company’s recent shift away from relying heavily on third-party fact-checkers towards a user-driven “community notes” model, similar to X, has drawn scrutiny and could increase risks related to misinformation spread and potential regulatory action if deemed insufficient.9

- Child Safety: Protecting minors online is a major focus for regulators. The EC has opened formal DSA proceedings investigating Meta’s systems related to potential behavioral addiction stimulation, ‘rabbit-hole’ effects, and the effectiveness of age verification methods on Facebook and Instagram.116 In the US, while comprehensive federal legislation like KOSA has stalled, there is ongoing pressure from state laws and potential new federal bills targeting child safety online.121 Meta is actively engaging in policy discussions and promoting its own safety tools and initiatives.121

The convergence of these regulatory pressures across antitrust, platform governance, content, and child safety represents a substantial and complex challenge to Meta’s current business model and operational freedom. The potential financial penalties are significant, and the structural changes sought by regulators (like divestiture or fundamental alterations to data practices) could have profound long-term consequences.

B. Data Privacy Landscape: Lingering Uncertainties

While Meta has adapted to some privacy changes like ATT, significant risks remain, particularly concerning international data flows.

- GDPR Compliance: Meta continues to face scrutiny under the EU’s General Data Protection Regulation. Past violations have resulted in substantial fines, including a record €1.2 billion penalty in May 2023 related to the legal basis for transferring personal data from the EU to the US.124 Ongoing debates around valid consent mechanisms, particularly linked to the DMA’s ‘pay or consent’ investigation, highlight the persistent compliance challenges under GDPR.70

- EU-US Data Privacy Framework (DPF): The current DPF provides a legal basis for transatlantic data transfers, crucial for Meta’s operations. However, this framework, like its predecessors (Safe Harbor and Privacy Shield), faces legal challenges from privacy advocates like Max Schrems, who argue it still doesn’t adequately protect EU citizens’ data from US surveillance.127 Recent US political developments, including changes affecting the independence of US oversight bodies like the PCLOB, have further fueled concerns about the DPF’s long-term viability.128 An invalidation of the DPF by the Court of Justice of the European Union (CJEU) would create significant legal uncertainty and operational disruption for Meta and other companies reliant on these data flows, potentially forcing costly data localization measures or service redesigns.127

- US Privacy Legislation: The lack of a comprehensive federal privacy law in the US persists, resulting in an increasingly complex patchwork of state-level regulations (with laws in 20 states expected by 2026).130 This fragmentation increases compliance costs and complexity for companies like Meta operating nationwide.130 While Meta highlights its significant investments ($8 billion+ since 2019) in privacy programs and infrastructure, partly driven by its 2019 FTC settlement 58, the absence of a unified federal standard leaves the US privacy landscape fragmented and subject to ongoing evolution at the state level.132

C. Geopolitical & Market Access Risks: China and the TikTok Factor

Meta’s global operations expose it to various geopolitical risks and market access challenges.

- China: Meta’s platforms (Facebook, Instagram, WhatsApp) remain blocked in mainland China due to the government’s strict censorship and data localization requirements.133 Past attempts by Meta to enter the market reportedly involved considering controversial measures like building censorship tools and potentially sharing user data, though these efforts were ultimately abandoned.134 Beyond direct market access, China poses risks related to potential state-sponsored influence campaigns or espionage activities targeting Meta’s platforms or leveraging data.135 Furthermore, Meta’s advertising revenue has shown sensitivity to spending fluctuations from China-based companies targeting international markets.7

- Potential US TikTok Ban: The ongoing legal and political efforts to ban TikTok in the US or force its divestiture from its Chinese parent company, ByteDance, create both opportunities and risks for Meta.136 A ban would likely drive significant user migration and advertising budget reallocation towards Meta’s platforms, particularly Instagram Reels.45 However, the removal of a major competitor could also intensify regulatory scrutiny on Meta’s own market dominance.136 The situation also fuels broader geopolitical tensions between the US and China regarding technology and data flows.120

- Global Content Standards: Operating globally requires Meta to navigate a complex and often conflicting set of cultural norms, laws, and political pressures regarding content moderation and censorship, potentially leading to friction with local governments or necessitating divergent platform policies across regions.133

VI. Capital Allocation Strategy Evaluation: Funding the AI Future

Meta’s capital allocation strategy in 2025 is heavily defined by its massive investments in artificial intelligence, balanced against continued, albeit secondary, returns to shareholders through buybacks and dividends.

A. Capital Expenditures (CapEx): An Unprecedented AI Investment Cycle

Meta’s commitment to AI is most evident in its sharply increased CapEx guidance. For the full year 2025, the company now anticipates spending between $64 billion and $72 billion, a significant increase from the prior outlook of $60-65 billion.1 This elevated spending level, which drove Q1 CapEx to $13.69 billion 2, is explicitly linked to accelerating investments in data centers and acquiring necessary infrastructure hardware (like GPUs) to support AI model training and inference across its products and services.1

While management states the majority of this CapEx is directed towards the “core business,” this increasingly includes the AI infrastructure underpinning advertising optimization, content recommendations, and the development of Meta AI features.1 Reality Labs also consumes a portion of this CapEx, alongside its substantial operating expenses.81 The scale of this investment ($64-72B) is immense, representing a substantial fraction of annual revenue and placing Meta among the highest capital spenders in the technology sector.30

The strategic rationale is to build a world-class AI infrastructure as a competitive advantage, enabling Meta to develop leading AI models like Llama, enhance its existing products, and power future AI-driven services and devices.6 However, this aggressive spending cycle inevitably pressures free cash flow in the near term, as seen in Q1, and will lead to higher depreciation expenses impacting future operating margins.1 This creates a high-stakes scenario where the eventual return on these massive AI investments must be substantial to justify the capital outlay and satisfy investors concerned about capital discipline.30 Failure to demonstrate clear ROI from AI within a reasonable timeframe could lead to significant pressure on management and the stock.

B. Shareholder Returns: Buybacks Dominate, Dividend Initiated

Despite the heavy reinvestment in AI and Reality Labs, Meta continues to return significant capital to shareholders.

- Share Repurchases: Share buybacks remain the primary method of capital return. In Q1 2025, Meta repurchased $13.40 billion of its Class A common stock.1 This follows substantial buyback activity in previous years ($92.3 billion total from 2021-2023 141) and a $50 billion increase to the buyback authorization announced in February 2024.142 Management explicitly confirmed that share repurchases will continue to be the main way capital is returned.141 Buybacks offer flexibility, support EPS growth by reducing share count, and can signal management confidence, though critics sometimes argue they may indicate a lack of compelling internal reinvestment opportunities.143 The specific amount remaining under the authorization as of the end of Q1 2025 was not detailed in the provided materials.

- Dividend Policy: Meta initiated its first-ever quarterly dividend in early 2024, signaling a degree of financial maturity.141 In February 2025, the board declared an increased quarterly dividend of $0.525 per share, payable in late March 2025.11 This represents a 5% increase from the previous $0.50 quarterly dividend.11 Total dividend payments in Q1 2025 amounted to $1.33 billion.1 While the initiation and increase are positive signals, the dividend remains relatively small in the context of Meta’s financials. The annualized dividend of $2.10 per share results in a low dividend yield (around 0.38% based on recent prices) and a very low payout ratio (around 8% of earnings).146

- Balancing Investment vs. Returns: Meta’s current capital allocation framework prioritizes funding its strategic growth initiatives, particularly AI infrastructure and Reality Labs development, while returning excess cash primarily through buybacks.150 The strong operating cash flow generated by the core advertising business currently enables the company to pursue both substantial reinvestment and significant shareholder returns.21 However, the sheer scale of the planned CapEx ($64-72B) dwarfs the current run rate of shareholder returns (Q1 buybacks + dividends ≈ $14.7B). The dividend, while a positive step for income-focused investors, is largely symbolic at this stage and does not fundamentally alter the company’s capital allocation priorities, which are firmly geared towards investing for future growth in AI and immersive technologies.

VII. Financial Projections & Valuation Assessment

A. Financial Projections (FY25 & FY26): Growth Moderation Amidst Headwinds

Projecting Meta’s financial trajectory involves integrating management guidance, analyst consensus, and an assessment of key growth drivers and risks.

- Guidance Integration: Meta’s guidance provides a near-term baseline: Q2 2025 revenue is expected between $42.5-45.5 billion (midpoint ~$44B, ~13% YoY growth at midpoint), and full-year 2025 expenses are projected at $113-118 billion.2 The FY25 CapEx range of $64-72 billion will significantly impact FCF and future depreciation.2

- Analyst Consensus: Post-Q1 earnings, analyst consensus estimates for FY25 and FY26 generally anticipate continued growth, albeit potentially moderating from recent levels. Available estimates suggest FY25 revenue growth around 12-13% and EPS growth potentially lower due to increased expenses/depreciation (one source suggests +1% EPS growth in FY25 17). Projections for FY26 point towards similar revenue growth (~13%) and potentially re-accelerating EPS growth (~13-19%) as CapEx perhaps normalizes and AI benefits mature.16 However, these estimates were formed before the full impact of potential EU DMA restrictions is known. Pre-Q1 consensus for FY25 EPS was around $24.04, and $27.28 for FY26, with noted downward revisions occurring.16

- Key Drivers & Assumptions: Projections assume continued resilience in the core advertising business, fueled by AI-driven performance improvements, growth in Reels engagement and monetization, and gradual contribution from Click-to-Messaging ads. These positives are likely to be tempered by macroeconomic uncertainty impacting ad spend, significant regulatory headwinds emerging in H2 2025 (particularly the EU DMA impact), rising depreciation expenses stemming from the massive CapEx cycle, and continued operating losses from Reality Labs (expected to increase in 2025 81).

- H2 2025 / FY26 Commentary: Management commentary underscores the uncertainty clouding the outlook beyond the immediate term. The explicit warning regarding a potential “significant impact” on European revenue starting Q3 2025 due to DMA compliance is a major factor.3 Furthermore, the lack of visibility provided on CapEx plans beyond 2025 highlights the dynamic nature of AI infrastructure investment.3 While AI advancements, such as more capable coding agents expected by late 2026, could eventually drive productivity gains, the near-to-medium term picture involves navigating substantial costs and regulatory hurdles.3 Therefore, financial models should incorporate potential revenue deceleration and margin pressure in H2 2025 and FY26, highly dependent on the severity of regulatory impacts and the pace of realizing returns on AI investments.

B. Valuation Analysis: Growth Premium Meets Execution Risk

Meta’s stock valuation reflects a complex interplay between its strong market position, growth prospects fueled by AI, and significant risks associated with its investment scale and regulatory environment.

- Current Multiples: As of late April/early May 2025, Meta traded at approximately:

- P/E Ratio: ~21-23x TTM (Trailing Twelve Months) and ~21-23x NTM (Next Twelve Months).153

- P/S Ratio: ~8.0-8.6x TTM.154

- EV/EBITDA Ratio: ~15-16x TTM and ~11-12x NTM.154

- Historical Context: These multiples are generally below Meta’s longer-term historical averages (e.g., 5-year average P/E ~26x, 10-year average P/E ~32x; 5-year average P/S ~8.2x; 5-year average EV/EBITDA ~16x) but represent a significant recovery from the lows seen in late 2022.153 The current valuation sits comfortably above the troughs but below the peaks experienced in prior years.

- Peer Comparison: Relative to its large-cap tech peers, Meta’s valuation presents a mixed picture. Its P/E ratio is typically higher than Alphabet/Google’s (~18x TTM) but significantly lower than Amazon’s (~45x TTM).154 Snap often trades at negative P/E ratios due to unprofitability.154 Meta’s EV/EBITDA multiple is broadly similar to Google’s (~14x TTM) but lower than Amazon’s (~19x TTM).154 Meta’s P/S ratio tends to be higher than both Google’s (~5.4x TTM) and Amazon’s (~3.3x TTM).154 Compared to broader sector medians (e.g., Communication Services), Meta often trades at a premium.154

- Analyst Price Targets: Following the Q1 2025 earnings release, analyst sentiment remained largely positive, with a consensus “Buy” rating.169 Average 12-month price targets generally clustered in the $700-$750 range, implying significant potential upside from late April/early May 2025 trading levels (around $550-$580).26 High-end targets reached towards $900-$935, while low-end targets were around $450-$500.26 Some analysts adjusted targets (both up and down) post-earnings, reflecting differing views on the balance of growth, spending, and risk.169

- Market Perception: The market narrative appears to acknowledge Meta’s strong execution in its core advertising business and the transformative potential of its AI initiatives. However, this optimism is clearly tempered by concerns over the sheer scale and uncertain ROI of the CapEx and Reality Labs investments, coupled with the material threats posed by global regulatory actions (FTC antitrust trial, EU DMA/DSA enforcement).175 The stock’s significant rally from 2022 lows followed by a pullback from early 2025 highs reflects this ongoing tension between perceived opportunity and risk.142 The current valuation suggests investors assign a premium for Meta’s growth profile and AI leadership potential but are hedging against execution stumbles and adverse regulatory outcomes.

Table VII.1: Comparative Valuation Multiples (Approximate as of early May 2025)

| Metric | META (Current) | META (5-Yr Avg) | GOOGL (Current) | SNAP (Current) | AMZN (Current) | Comm Services Sector (Median) |

| Market Cap | ~$1.4T | – | ~$2.0T | ~$14B | ~$2.0T | – |

| P/E Ratio (TTM) | ~22-23x | ~26x | ~18x | N/A (Negative) | ~45x | ~15-20x |

| P/E Ratio (NTM) | ~21-23x | – | ~18x | N/A (Negative) | ~32x | ~15-18x |

| EV/EBITDA (TTM) | ~15-16x | ~16x | ~14x | N/A (Negative) | ~19x | ~9-13x |

| EV/EBITDA (NTM) | ~11-12x | – | ~10-11x | N/A (Negative) | ~16-17x | ~8-11x |

| P/S Ratio (TTM) | ~8.0-8.6x | ~8.2x | ~5.4x | ~2.5x | ~3.3x | ~1.5-2.0x |

| PEG Ratio (5yr Exp) | ~0.8-1.8x | – | ~1.5x | N/A | ~1.8x | – |

Sources: Compiled from.153 Note: Multiples are approximate and dynamic. NTM estimates vary. Sector medians are indicative.

VIII. Conclusion: Investment Outlook – Balancing Risks and Catalysts

Meta Platforms concluded Q1 2025 demonstrating the continued strength and resilience of its core advertising business, significantly enhanced by the integration of artificial intelligence. Its massive user scale across the Family of Apps provides an unparalleled foundation for engagement and monetization. Furthermore, the company is making tangible progress in strategic growth areas, particularly with its Llama AI models showing state-of-the-art performance and its AI-powered smart glasses gaining market traction. The initiation of a dividend, while modest, adds another layer to its capital return program, complementing substantial share buybacks.

However, this positive momentum is counterbalanced by substantial risks and uncertainties. The company is embarking on an exceptionally capital-intensive phase, with FY25 CapEx projected at $64-72 billion, primarily to fuel its AI ambitions. While strategically necessary in the competitive AI landscape, the sheer scale of this investment pressures free cash flow and demands a significant return on investment that is not yet guaranteed, particularly as direct AI monetization timelines remain extended. Reality Labs continues to be a major financial drain, with operating losses widening and a clear path to profitability still elusive, despite promising signs from AI glasses.

The most significant overhang remains the complex and converging regulatory environment. The ongoing FTC antitrust trial seeking the breakup of the company poses an existential threat. Simultaneously, stringent EU regulations under the DMA and DSA are forcing potentially costly compliance changes that could materially impact Meta’s European operations and core advertising model as early as H2 2025. Added to this are persistent challenges around global content moderation, child safety, and the legal stability of transatlantic data transfers.

Key Downside Risks Summary:

- Regulatory Impact: Adverse outcomes in the FTC antitrust case (divestiture) or stringent enforcement of EU DMA/DSA (large fines, forced changes to ad model/data use).3

- Competition: Intensifying pressure from Google, TikTok (if ban averted), Amazon, and emerging AI platforms eroding ad market share or pricing power.35

- Execution Risk (AI/RL): Failure to generate adequate financial returns from the massive $64-72B AI CapEx and ongoing multi-billion dollar RL investments.30

- Macroeconomic Slowdown: A significant deterioration in the global economy leading to broad pullbacks in digital advertising spend.7

- Data Transfer Disruption: Invalidation of the EU-US Data Privacy Framework, hindering essential data flows.127

Key Upside Catalysts Summary:

- AI Monetization & Ad Performance: Continued AI-driven improvements boosting core ad business efficiency and effectiveness; successful future monetization of Meta AI or Business AI tools.3

- Reels & Messaging Growth: Sustained user engagement growth and successful scaling of monetization for Reels and Click-to-Messaging ad formats.3

- VR/AR Breakthroughs: Faster-than-expected adoption of Quest headsets or significant market success and technological advancement in AI/AR glasses.24

- Cost Efficiencies & Capital Discipline: Demonstration of improved capital efficiency, potentially via AI productivity gains, or a rationalization of Reality Labs spending without sacrificing long-term goals.3

- Favorable Regulatory Outcomes: Successful defense against the FTC lawsuit or achieving manageable compliance pathways with EU regulations without severely impacting the business model.

Overall Assessment:

Meta Platforms presents a compelling investment case based on its dominant position in digital advertising, vast user base, and leadership potential in artificial intelligence. The company’s ability to leverage AI to enhance its core business is evident and provides a strong foundation for near-term growth. However, the investment outlook is clouded by significant risks. The unprecedented level of CapEx required for its AI and Reality Labs ambitions necessitates flawless execution and carries substantial financial risk if returns do not materialize as expected. More critically, the confluence of major regulatory and antitrust challenges in the US and EU poses a material threat to the company’s structure and long-term profitability.

The current valuation appears to factor in both the growth potential and these considerable risks. Investors must weigh the potential upside from AI leadership, continued advertising dominance, and eventual success in next-generation platforms against the possibility of severe regulatory penalties, forced structural changes, or failure to achieve adequate returns on its massive strategic investments. The path forward requires navigating this complex landscape effectively; success could yield significant rewards, while stumbles could prove costly.