What a relief (rally)!

Following a tumultuous April marked by extreme volatility and sharp swings driven by tariff policy announcements and pervasive economic uncertainty, the markets are kicking off May with a significant dose of optimism. April concluded with the S&P 500 registering its THIRD consecutive monthly decline – despite the late bounce, reflecting investor anxiety over the potential fallout from escalating trade tensions and CLEAR signs of a slowing economy.

The CBOE Volatility Index (VIX) spent most of April at 25+, allowing us to take advantage and sell a TON of premium. Volatility (fear, in this case) has eased somewhat but our trading sessions are still seeing the indexes whipsaw dramatically as the markets attempt to digest conflicting signals regarding trade policies and their economic impact.

Earnings from MSFT and META has certainly enhanced traders’ moods overnight as Futures contracts tied to the tech-heavy Nasdaq (/NQ) are already up 1.77% (8am) while S&P 500 (/ES) futures (where MSFT and META are also significant stocks) are up 1.1%. Dow Jones (/YM) are also up 0.75% – as MSFT (but not META) is a component there as well.

The positive turn in market sentiment stems directly from robust quarterly results and reassuring commentary from Microsoft and Meta Platforms, who managed to address specific investor concerns head-on.

-

-

-

Microsoft (MSFT) – Beating Fears of Cloud Slowdown & Tariff Impact:

Microsoft delivered a convincing performance in its fiscal third quarter (ending March 31, 2025), significantly exceeding analyst expectations and alleviating worries about a potential slowdown in its crucial cloud business. Revenue climbed 13% year-over-year (15% in constant currency) to $70.1 billion, surpassing consensus estimates. Operating income rose 16% (19% CC) to $32.0 billion, and diluted earnings per share jumped 18% (19% CC) to $3.46, comfortably beating the $3.22 anticipated by Wall Street analysts – a positive surprise of over 7%.

The standout metric was the growth in Azure and other cloud services, which accelerated to 33% year-over-year (35% in constant currency). This figure solidly topped the roughly 31% growth analysts had forecast and directly countered the narrative of decelerating cloud growth that had weighed on the stock following previous earnings reports. Microsoft Cloud revenue overall reached $42.4 billion, up 20% (22% CC). Strength was broad-based, with the Productivity and Business Processes segment (including Microsoft 365) growing 10% to $29.9 billion, and the More Personal Computing segment increasing 6% to $13.4 billion, both exceeding prior guidance.

Crucially, Microsoft’s forward-looking statements also provided comfort. The company projected fiscal fourth-quarter revenue implying a total of approximately $73.7 billion, about 2% higher than analyst expectations. During the earnings call, CFO Amy Hood stated that “demand signals” across Microsoft’s businesses had remained consistent through April, suggesting that major corporate customers, the backbone of Microsoft’s revenue, were not yet making drastic cuts to their technology budgets despite the uncertain economic climate shaped by tariff policies. CEO Satya Nadella reinforced this by framing software and AI as vital tools for businesses needing to enhance productivity and manage costs in the face of inflationary or growth pressures. Furthermore, while capital expenditures remained substantial at $21.4 billion (including finance leases), this was slightly below analyst forecasts. Hood indicated capex would rise again in the next fiscal year to support AI infrastructure, but at a slower pace than the current fiscal year’s significant jump, potentially easing concerns about unchecked spending while still signaling commitment to AI. Management acknowledged that “tariff uncertainty” contributed to higher PC inventory levels but emphasized the resilience of its core cloud and enterprise software businesses. This combination of strong results, robust guidance, and reassuring commentary on demand resilience fueled an approximate 7-8% surge in MSFT shares in after-hours and pre-market trading.

-

Meta Platforms (META) – Ad Resilience & AI Investment Push:

-

-

Meta Platforms also delivered strong first-quarter 2025 results, effectively calming nerves about the potential impact of trade tariffs on its vital advertising business. Revenue for the quarter ended March 31 reached $42.3 billion, a 16% year-over-year increase (19% CC), surpassing analyst estimates which were centered around $41.3 billion to $41.4 billion. Earnings per share were particularly impressive, soaring 37% year-over-year to $6.43, significantly exceeding the consensus estimate of roughly $5.25.13 User engagement remained robust, with Family daily active people (DAP) growing 6% year-over-year to 3.43 billion.

The core advertising business demonstrated notable strength. While ad impressions delivered across the Family of Apps increased by a modest 5% year-over-year, the average price per ad surged by 10%. This robust revenue performance helped alleviate fears that tariffs, particularly those affecting spending from major Chinese advertisers like Temu and Shein who utilize Meta’s platforms, would severely curtail growth.

Meta’s outlook provided further reassurance. Guidance for second-quarter revenue was set between $42.5 billion and $45.5 billion, generally in line with analyst expectations, signaling continued stability. CEO Mark Zuckerberg conveyed confidence, stating, “We’re well positioned to navigate the macroeconomic uncertainty,” and highlighted progress in AI, with Meta AI nearing 1 billion monthly active users. However, Meta also signaled a significant increase in investment, raising its full-year 2025 capital expenditure forecast to a range of $64 billion to $72 billion, up from the previous $60 billion to $65 billion. CFO Susan Li explained this increase was driven by “additional data center investments to support our artificial intelligence efforts as well as an increase in the expected cost of infrastructure hardware.” Li explicitly acknowledged the role of external factors, noting uncertainty around hardware costs due to global sourcing amid ongoing trade discussions, and stated Meta was working to mitigate this by optimizing its supply chain. This commentary directly linked the higher spending forecast to both strategic AI investments and the tangible cost implications of the current trade environment. Despite the higher spending outlook, the strong results and stable guidance were well-received, lifting META shares by approximately 6% in pre-market trading.

The positive market reception to these earnings reports was not merely a reaction to headline beats, but a response to how effectively each company addressed specific, pressing concerns. Microsoft directly tackled the “cloud slowdown” fear with accelerating Azure growth. Meta confronted the “tariff impact on ad spend” anxiety with resilient revenue figures and specific commentary on managing supply chain costs within its AI investment framework.

This targeted reassurance is already shifting sentiment back to bullish and the commitment from both companies to continued, substantial investment in Artificial Intelligence is being interpreted as a strong signal of confidence in their long-term growth prospects, outweighing near-term cost concerns and reinforcing their perceived leadership in critical future technology.

It is almost as if their reports were written by an AI to maximize Investor Confidence!

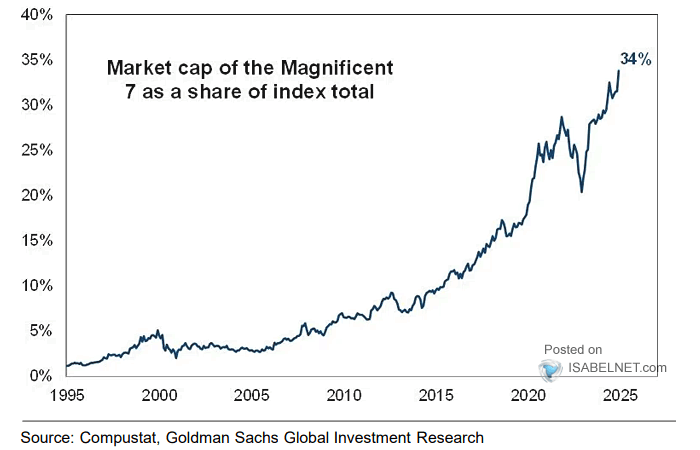

The strong showings from Microsoft and Meta shine a spotlight on the “Magnificent Seven,” a group of mega-cap technology and growth stocks that have dominated market performance in recent years. Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL/GOOG), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) were dubbed as such due to their significant market capitalization, technological influence, and outsized returns whose earnings (and weight) are 30% of the S&P 500 and close to 50% of the Nasdaq 100.

Their combined Market Capitalization exceeded $16 TRILLION in December, dwarfing the ENTIRE value of other Nations’ markets like, for example, the UK, Canada, and Japan COMBINED. Even in the might United States, the top 10 stocks in the S&P 500, including this group this group, account for 46% of the index’s risk.

MSFT and META earnings reinforce the prevailing narrative that these tech behemoths possess a unique degree of resilience. Their vast scale, dominant market positions in critical areas like cloud computing and digital advertising, strong balance sheets, and leadership in secular growth trends like AI appear to equip them better than most to navigate macroeconomic headwinds, including the current tariff environment. In fact, one might say that all this has been IN THEIR FAVOR and backing Trump and his policies has made them Bigger, More Dangerous and even More Dominant in relation to their peers – the Oligarchs are winning – and they are winning BIGLY!

MSFT and META earnings reinforce the prevailing narrative that these tech behemoths possess a unique degree of resilience. Their vast scale, dominant market positions in critical areas like cloud computing and digital advertising, strong balance sheets, and leadership in secular growth trends like AI appear to equip them better than most to navigate macroeconomic headwinds, including the current tariff environment. In fact, one might say that all this has been IN THEIR FAVOR and backing Trump and his policies has made them Bigger, More Dangerous and even More Dominant in relation to their peers – the Oligarchs are winning – and they are winning BIGLY!

This perceived resilience stands in stark contrast to the experiences of companies in other sectors more directly exposed to traditional manufacturing and global supply chain disruptions. General Motors (GM), for example, saw its stock rise modestly not on good news, but on gaining clarity after estimating that tariffs imposed by the Trump administration could inflict a $4Bn to $5Bn hit on its finances this year, forcing a significant cut to its earnings guidance.

GM imports over a third of the vehicles it sells in the US, primarily from Mexico, Canada, and South Korea, making it highly vulnerable to auto tariffs. Similarly, beauty giant Estée Lauder (EL) indicated that a “meaningful resolution” of tariffs is necessary for sales to return to growth. Companies like Kimberly-Clark (KMB), Halliburton (HAL) and Best Buy (BBY) have also warned about tariff impacts or related economic uncertainty.

This dynamic highlights a significant bifurcation within the market. While headline indices are being lifted by the strength of a few mega-cap tech stocks like MSFT and META, numerous other companies and sectors are grappling with the direct and painful consequences of tariffs and the associated economic uncertainty. This divergence means that overall index performance may currently be painting an overly optimistic picture of broader market health.

Consequently, the market’s heavy reliance on the Magnificent Seven for performance amplifies concentration risk. Since the start of 2023, these seven stocks have contributed disproportionately to the S&P 500’s returns. While their strong earnings growth has often justified this leadership, it also means that any stumble by even a few of these giants could trigger a significant market downturn, irrespective of the performance of the hundreds of other companies in the index. The positive results from Microsoft and Meta provide temporary relief from this concern, but they also serve as a stark reminder of the market’s dependence on the fortunes of this small group of companies.

With Microsoft and Meta having successfully navigated their earnings reports, all eyes now turn to Apple (AAPL) and Amazon (AMZN), the next two Magnificent Seven members scheduled to report their quarterly results after the market closes today. Their performance and outlook will be critical in determining whether the tech-led relief rally can be sustained or if broader economic anxieties will regain the upper hand.

-

Apple (AAPL) Preview:

Analysts expect Apple to report modest growth for its fiscal second quarter (ending March 2025). Consensus estimates point to revenue in the range of $94.2 billion to $94.4 billion, representing a year-over-year increase of roughly 3.6% to 3.8%. Diluted earnings per share (EPS) are forecast around $1.60 to $1.62, up approximately 5% to 6% from the $1.53 reported in the prior year’s quarter.

Key areas of focus will include the trajectory of iPhone sales – analysts are watching for signs of demand weakness versus a potential short-term boost from consumers buying ahead of anticipated tariff increases. The growth momentum of Apple’s high-margin Services segment (including the App Store, iCloud, Apple Music, etc.) will be scrutinized as a key indicator of resilience. Gross margin performance, expected around 47.1% , and any updates on the company’s AI strategy (Apple Intelligence) and associated R&D spending will also be vital.

Apple faces significant headwinds. Its heavy reliance on China for manufacturing (an estimated 90% of iPhones assembled there) makes it particularly vulnerable to US-China trade tensions and tariffs. One analyst estimated potential tariff costs could reach $39.5 billion, potentially impacting profits significantly if Apple cannot pass costs on or if higher prices dampen demand. The company is reportedly exploring shifting more production to India to mitigate this risk. Additionally, a recent court ruling found Apple violated an antitrust order related to App Store restrictions, adding another layer of uncertainty and potential financial liability. Reflecting these concerns, Apple’s stock has underperformed significantly year-to-date, down between 13% and 16%. Analyst sentiment remains generally positive on the long-term outlook, but near-term caution prevails due to the tariff overhang, with some recent price target reductions. Minimal forward guidance is expected given the uncertainties.

-

Amazon (AMZN) Preview:

For Amazon’s first quarter of 2025, Wall Street anticipates continued solid growth. Consensus revenue estimates are around $154.6 billion to $155.1 billion, translating to roughly 8% year-over-year growth. EPS forecasts range from $1.35 to $1.37, indicating strong year-over-year growth, potentially between 19.5% and 39.8% (noting some variance in source estimates).

The performance of Amazon Web Services (AWS) will be paramount. Analysts expect AWS revenue growth around 17% year-over-year, a key driver of overall profitability and a crucial data point for assessing the health of the cloud market. Other important metrics include growth in online store sales (forecast +3.8% YoY), the rapidly expanding advertising services (+15.6% YoY forecast), and subscription services like Prime (+7.3% YoY forecast). Commentary on overall consumer spending patterns will also be closely monitored.

Risks for Amazon center on the potential impact of tariffs on its marketplace, particularly on the vast number of third-party sellers with exposure to China (estimated at 60% by Morgan Stanley), which could potentially affect their advertising expenditures on the platform. Amazon’s own import costs could also be affected, with an estimated 18% of products sold directly by Amazon imported from China. Investors will also look for updates on Amazon’s substantial investments in AI, logistics (Project Kuiper), and infrastructure, seeking reassurance that this spending is balanced with maintaining earnings momentum. Despite the broader market volatility, analyst ratings on Amazon remain overwhelmingly positive, with all 26 analysts tracked by Visible Alpha rating the stock a “Buy” or equivalent, although average price targets have moderated slightly.

Magnificent Seven Earnings Scorecard (Q1/Fiscal Q3 2025)

| Company (Ticker) | Reporting Date | Period | Revenue (Actual/Est. vs Year Ago) | EPS (Actual/Est. vs Year Ago) | Key Metric Performance |

| Microsoft (MSFT) | Apr 30 | Fiscal Q3 | $70.1B (+13% YoY) – Beat | $3.46 (+18% YoY) – Beat | Azure Growth: +33% (+35% CC) – Beat |

| Meta Platforms (META) | Apr 30 | Q1 | $42.3B (+16% YoY) – Beat | $6.43 (+37% YoY) – Beat | Ad Revenue Growth: +16% YoY – Beat |

| Apple (AAPL) | May 1 (AMC) | Fiscal Q2 | Est. $94.3B (+3.7% YoY) | Est. $1.61 (+5.2% YoY) | Focus: iPhone Sales YoY, Services Growth % |

| Amazon (AMZN) | May 1 (AMC) | Q1 | Est. $154.9B (+8.1% YoY) | Est. $1.36 (+39.8% YoY) | Focus: AWS Growth %, Ad Growth % |

(Note: Estimates are based on consensus figures from sources. YoY percentages are approximate based on available data.)

Given the profound uncertainty surrounding the economic impact of tariffs, the forward guidance – or deliberate lack thereof – provided by Apple and Amazon executives today will likely carry exceptional weight. Any signals regarding their ability to manage supply chains, absorb costs, maintain demand, or project future performance in the face of these trade policies could significantly influence market direction. Analysts are already bracing for limited visibility, particularly from Apple.

While tech earnings provide a focal point, the broader economic landscape remains fraught with challenges:

-

-

Economic Data Point – GDP Contraction: The advance estimate for U.S. Gross Domestic Product (GDP) in the first quarter of 2025 revealed an unexpected contraction of 0.3% at an annualized rate. This missed consensus expectations for modest growth (around +0.3% to +0.4%) and marked a sharp reversal from the 2.4% expansion recorded in the fourth quarter of 2024. The Bureau of Economic Analysis attributed the decline primarily to a significant increase in imports (which subtract from GDP calculations) and a decrease in government spending. The surge in imports may reflect businesses accelerating orders to get ahead of anticipated tariff implementations, a distortionary effect of the trade policy uncertainty. This negative GDP print serves as an economic warning signal and carries political weight, occurring early in President Trump’s second term after a campaign focused on economic management. Compounding concerns, the price index for personal consumption expenditures (PCE) within the GDP report showed an acceleration, rising 3.6% overall and 3.5% excluding food and energy, compared to 2.4% and 2.6% respectively in Q4. This combination of negative growth and rising inflation data fuels concerns about potential stagflation, complicating the outlook for Federal Reserve policy. While GDP data is inherently backward-looking, it confirms the economic drag that trade uncertainty was already signaling and provides a stark reminder of the fragile economic backdrop against which markets are operating.

-

Tariff Reality Bites: The tangible costs of the administration’s tariff policies are becoming increasingly evident beyond the tech sector. GM’s $4-5 billion estimated impact and subsequent guidance cut, Estée Lauder’s linkage of future growth to tariff resolution, Kimberly-Clark’s $300 million profit warning, and cautious commentary from companies like Halliburton and Best Buy underscore the real-world financial strain these policies are imposing on businesses reliant on global trade and supply chains. This reinforces the market bifurcation, where tech’s perceived resilience masks significant pain in other areas.

-

US-China Trade – Status Quo Uncertainty: Despite the significant market volatility and economic disruption caused by the steep tariffs (US rates on Chinese goods reportedly reaching 145%, China’s on US goods at 125%), there appears to be little concrete progress towards de-escalation. President Trump recently suggested tariffs on China could “come down substantially,” but offered no specifics. Conversely, China’s Ministry of Commerce spokesperson explicitly denied any ongoing consultations or negotiations on tariffs between the two countries as of April 30th, while simultaneously stating the door for talks remains “wide open“. This lack of clear, official dialogue and conflicting signals suggest a protracted period of uncertainty, as both sides appear entrenched, potentially waiting for the other to yield. The silence and ambiguity surrounding negotiations are significant, increasing the risk of prolonged economic disruption for businesses unable to plan effectively.

-

Upcoming Data Watch: Investors will parse incoming economic data for further clues on the economy’s trajectory. Later today, the Institute for Supply Management (ISM) will release its Manufacturing PMI for April. Expectations are for a reading around 47.9 to 48.0, down from March’s 49.0, indicating a continued contraction in the manufacturing sector, likely pressured by tariff impacts and slowing demand. The final reading for the S&P Global Manufacturing PMI for April is also due. Weekly initial jobless claims will offer a timely update on the labor market.

-

Other Global Factors: Several international developments are also influencing markets. The Bank of Japan maintained its interest rates but halved its growth forecast, citing the bite of tariffs, which contributed to yen weakness. Oil prices have retreated, with Brent crude dipping below $60 per barrel amid fears that escalating trade conflicts will dampen global economic activity and thus energy demand. Separately, the recently signed US-Ukraine minerals deal, while its long-term economic impact is unclear, represents a tangible link between US economic interests and Ukraine’s future, potentially solidifying US engagement under the Trump administration’s transactional foreign policy lens. Lastly, market activity may be somewhat thinner today due to Labor Day holidays closing markets in several major economies, including China, France, and Germany.

-

The market narrative entering May is one of tentative relief juxtaposed against significant underlying fragility. Strong earnings from Microsoft and Meta have successfully countered specific investor anxieties regarding cloud growth and advertising resilience amidst tariff threats, fueling a powerful, tech-led rally. This demonstrates the market’s capacity to respond positively to credible good news, especially from the influential Magnificent Seven Group.

HOWEVER, this optimism MUST BE TEMPERED against the stark realities presented by the Broader Economic Picture. The long-expected Q1 GDP contraction, coupled with rising inflation metrics, confirms the economic drag feared from trade policy uncertainty and raises the specter of Stagflation. Tangible evidence of tariff pain is mounting across various non-tech sectors, highlighting a potentially dangerous market bifurcation masked by index levels heavily skewed towards resilient mega-cap tech names. Furthermore, the lack of clear progress in US-China trade negotiations suggests the period of heightened uncertainty and potential disruption could last longer than investors’ patience will.

The earnings reports from Apple and Amazon after the closing bell represent the next major hurdle. Their results, particularly their forward guidance or commentary on navigating the tariff landscape and assessing consumer health, will be critical in determining whether the current positive momentum can broaden or if the weight of Macroeconomic concerns will reassert itself. The ISM Manufacturing PMI release mid-morning will provide another important data point on the health of a sector directly impacted by trade policy.

Traders should monitor the relative performance of the Nasdaq 100 versus the S&P 500 for confirmation of continued tech leadership. Volatility measures (VIX) and Treasury yields will remain key indicators of overall risk appetite. While the immediate momentum is positive, the significant event risk posed by the upcoming earnings and the unresolved macro overhang still warrant a degree of caution. The bifurcated nature of the market suggests that opportunities and risks may be highly sector-specific.

At the moment, the market has eagerly grasped the lifeline thrown by Microsoft and Meta. Yet, the “Tariff Tornado” continues to swirl, and its economic consequences are still unfolding. Today’s earnings from Apple and Amazon will be instrumental in shaping market sentiment and setting the direction for trading for May.