We’re waiting on today’s Jobs Data.

We’re waiting on today’s Jobs Data.

March had a relatively strong 228,000 jobs added and April is expected to fall to 130,000 but we had that in January and February so I’m not really sure what all the fuss is about. Payrolls USED to be a big indicator but, when you are at relatively Full Employment – it’s only a long-term trend that matters. Much more interesting is Corporate Earnings & Guidance and we just ran two Special Reports for our Members on Meta (META) and Apple (AAPL), both of who seem to be muddling through the Tariff Regime – so far.

🚢 Mag 7 Earnings & Guidance: The Real Story

The Magnificent 7 are navigating tariffs and economic uncertainty with mixed success. Here’s the breakdown:

1. Apple (AAPL)

-

-

-

Q2 2025: Revenue +4% to $95.4B, services hit record $25.9B.

-

Tariff Impact: Warned of $900M hit in June quarter but absorbed March costs via supply chain shifts (e.g., moving AirPods production to Vietnam).

-

Guidance: Vague (“low-to-mid single-digit growth”) due to tariff unpredictability. Verdict: Muddling through, but China risk looms.

-

-

2. Meta (META)

-

-

-

Q1 2025: Revenue +35% to $41.3B, ad sales resilient despite tariff warnings.

-

Tariff Impact: Investing $64–72B in U.S. data centers to offset hardware costs. Chinese advertisers (10% of revenue) are pulling back.

-

Guidance: Bullish on AI-driven ad targeting. Verdict: Betting on tech to outpace tariffs.

-

-

3. Alphabet (GOOGL)

-

-

-

Q1 2025: Revenue +15% to $89.3B, cloud growth offsetting ad headwinds.

-

Tariff Impact: “Slight wind” to ads from Asia-Pacific retailers hurt by de minimis rule changes.

-

Guidance: Cautious on H2 2025. Verdict: Diversification saves the day.

-

-

4. Amazon (AMZN)

-

-

-

Q1 2025: AWS growth (+17%) offsetting retail tariff prep costs.

-

Tariff Impact: Stockpiling Chinese goods ahead of July tariffs, raising logistics costs.

-

Guidance: Prioritizing Prime subscription hikes over price cuts. Verdict: Passing costs to consumers.

-

-

5. Microsoft (MSFT)

-

-

-

Q1 2025: Azure +21%, AI services now 25% of cloud revenue.

-

Tariff Impact: Minimal (software-focused), but hardware (Surface, Xbox) faces 10–15% cost hikes.

-

Guidance: All-in on AI, ignoring macro. Verdict: Untouchable… for now.

-

-

6. NVIDIA (NVDA)

-

-

-

Q1 2025: Data center revenue +38% to $22.1B, gaming +12%.

-

Tariff Impact: Chip exports to China down 8%, but global AI demand offsets.

-

Guidance: “No slowdown in sight.” Verdict: Tariffs? What tariffs?

-

-

7. Tesla (TSLA)

-

-

-

Q1 2025: Revenue -1%, deliveries -42% QoQ.

-

Tariff Impact: China-made EVs hit with 145% tariffs, forcing U.S. price cuts.

-

Guidance: Robotaxis or bust. Verdict: Not muddling-flailing.

-

-

Why Earnings > Jobs Data

-

-

-

Adaptability: Mag 7 are using pricing power (Apple), AI (Meta, Google), and global demand (NVIDIA) to offset tariffs.

-

Forward-Looking: Jobs reports tell us where we’ve been; earnings tell us where we’re going. Example: Meta’s capex surge signals confidence in ad tech despite macro risks.

-

Policy Proof: These companies are too big to fail… or at least too diversified to crater.

-

-

Bottom Line: The Mag 7 are the canaries in the coal mine for tariff impacts. So far, they’re singing a cautious tune-but not a dirge. Jobs data is background noise; earnings are the headline act.

Again, it’s a shame to have to keep harping on what just 7 stocks are doing but those 7 stocks are 1/3 of the S&P 500 and 1/2 of the Nasdaq 100. Unfortunately, as noted by Boaty, their business models are almost “Too Global to Fail” unless, of course, their CEOs go off to play Government Psychopath for a few months and destroy their brand’s reputation – that would be stupid, right?

The real problem is the Magnificent 7 distort our entire picture of how the market is doing because, without the earnings contributions of these 7 stocks – we would not be having this April market rally.

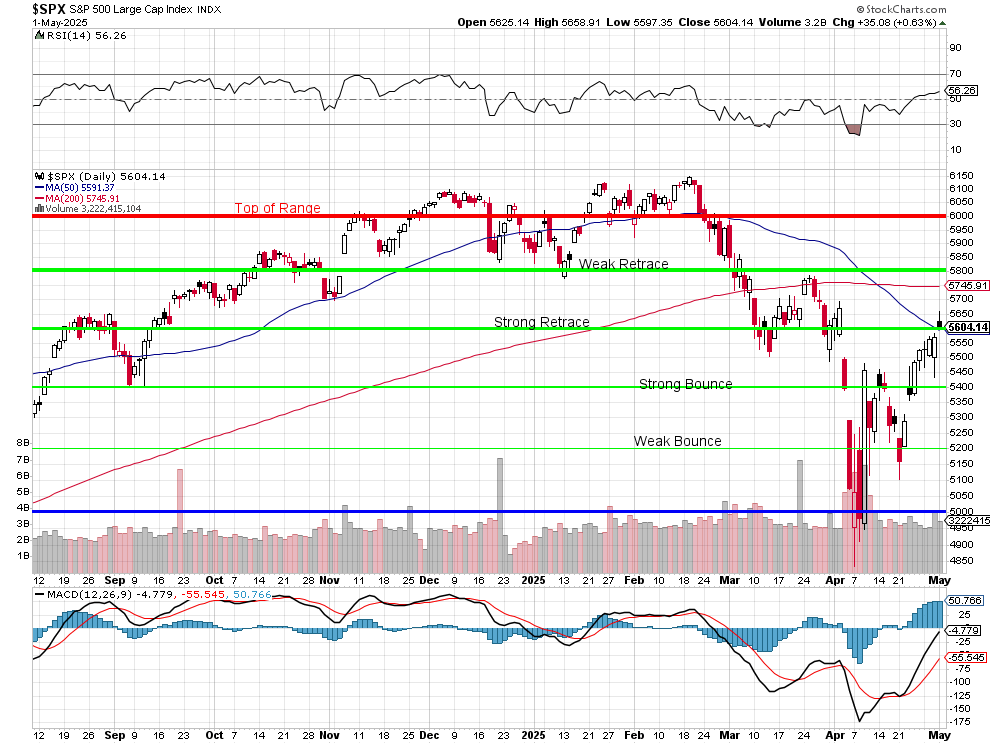

Yesterday, the S&P 500 closed over our Strong Retrace Line and over the 50-day Moving Average for the first time since late February when we were at 6,000 and we’re up from 5,000 in early April so 5,600 is up 12.5% in less than 30 days – VERY IMPRESSIVE:

But do we DESERVE to be here? December 31, 2024 earnings for the S&P 500 were an aggregate $200/unit and we’re trending to $215 (+7.5%) for 2025 but that’s, so far, without the serious tariffs that Trump had delayed (but not cancelled) to July 1st. That would still put the S&Ps p/e ratio at 26, miles above it’s historical average of 18.

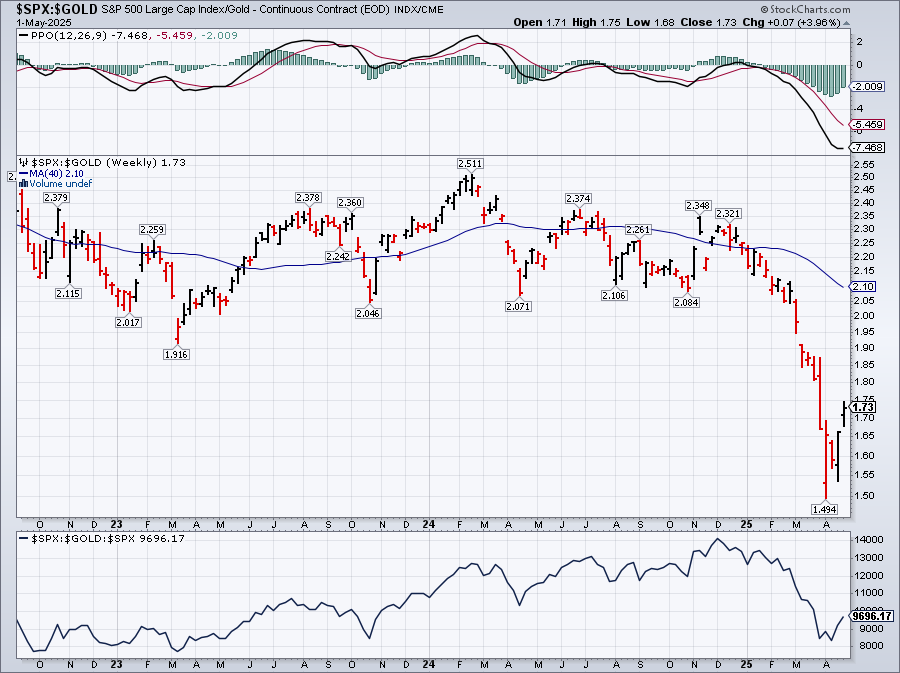

What’s holding us up, so far, is the WEAKNESS of the Dollar, which is down 10% and, since everything is priced in Dollars, the number of Dollars you need to buy the same things – LIKE STOCKS – is 10% more than it was on January 20th. So, in REAL DOLLAR TERMS, the S&P 500 is still at 5,000 – it’s just been repriced to the weaker Dollar and that is something that is not accounted for in the charts unless, of course, you could magically price the S&P 500 in something else – like gold:

Not as pretty, is it? The fall from 2.32 to 1.5 was 0.82 so 0.16 bounces make 1.66 the Weak Bounce Line, 1.82 is the Strong Bounce Line and 1.98 (let’s call it 2) would be the Strong Retrace. We know what makes the S&P stronger – EARNINGS! That is beyond a doubt but earnings are also inflated by the weak Dollar as 60% of the S&P’s earnings come from overseas (maybe not anymore in a trade war?) so a 10% reduction in the Dollar inflates the overseas earnings (in other currencies) by 10% and that adds 6% to Corporate Profits and Corporate Profits are up 7.5% total or 1.5% NET!

So, if we do solve trade and the Dollar rises, that will act as a cooler for the indexes and a cooler for Corporate Profits so it is going to VERY HARD to make progress during Q3. Either the trade war makes things worse and the weaker Dollar supports sagging profits (while our personal assets are devalued on the World stage) or things get better but we tread water while our currency normalizes.

And, by the way, lower Fed Funds Rates = WEAKER DOLLAR TOO!

This is why people hate math, science and facts in general – it’s no fun to run the actual numbers or do the actual experiment (like tariffs) when the results end up being a very far cry from the anticipated outcome (being “Great Again“). But a good scientist knows when to end the experiment, log the results, move on and try something new while a BAD scientist ignores the data and keeps running the same experiment – hoping to get different results to fit their clearly flawed thesis.

This is why people hate math, science and facts in general – it’s no fun to run the actual numbers or do the actual experiment (like tariffs) when the results end up being a very far cry from the anticipated outcome (being “Great Again“). But a good scientist knows when to end the experiment, log the results, move on and try something new while a BAD scientist ignores the data and keeps running the same experiment – hoping to get different results to fit their clearly flawed thesis.

8:30 Update: Jobs came in hot at 177,000 and that is BAD for people who wish for the Fed to cut rates. Average Hourly Earnings were up 0.2% and the Average Workweek is now 34.3 hours from 34.2 and that doesn’t sound like much but that’s 165M people working 0.1 more hours is 16.5M more hours divided back by 34.3 hours is 481,049 more workers worth of hours were put in for April and THAT is what we call a LABOR SHORTAGE!!!

What this is really telling us though is that the economy is SO STRONG that not even Trump’s idiotic policies have, so far, been able to derail it. Of course the tariffs are not in effect and we can go right back into a crisis by July 1st but it’s only May 2nd – so let’s enjoy the ride while it lasts!

Our longs, which we pressed much more bullish during our April 15th Portfolio Review along with 10 Stocks we highlighted on April 8th and 10 Other Stocks We Featured on April 3rd and 15 More We Picked on March 24th so our Members are VERY WELL POSITIONED to take advantage of this rally and today, in our Live Member Chat Room (you can join us here) we’ll make sure our hedges are in position to lock in our gains.

Next week it’s back to the Fed, with their rate decision (nothing) on Wednesday and very little data – so expect earnings to dominate the narrative – unless Trump says something crazy – but what are the chances of that happening?

“Anyone can do anything if they hold the right card

So, I’m thinking about my life now

I’m thinking very hard

Deal me another hand, Lord, this one’s very hard” – The Who

Have a great weekend,

— Phil