What a recovery!

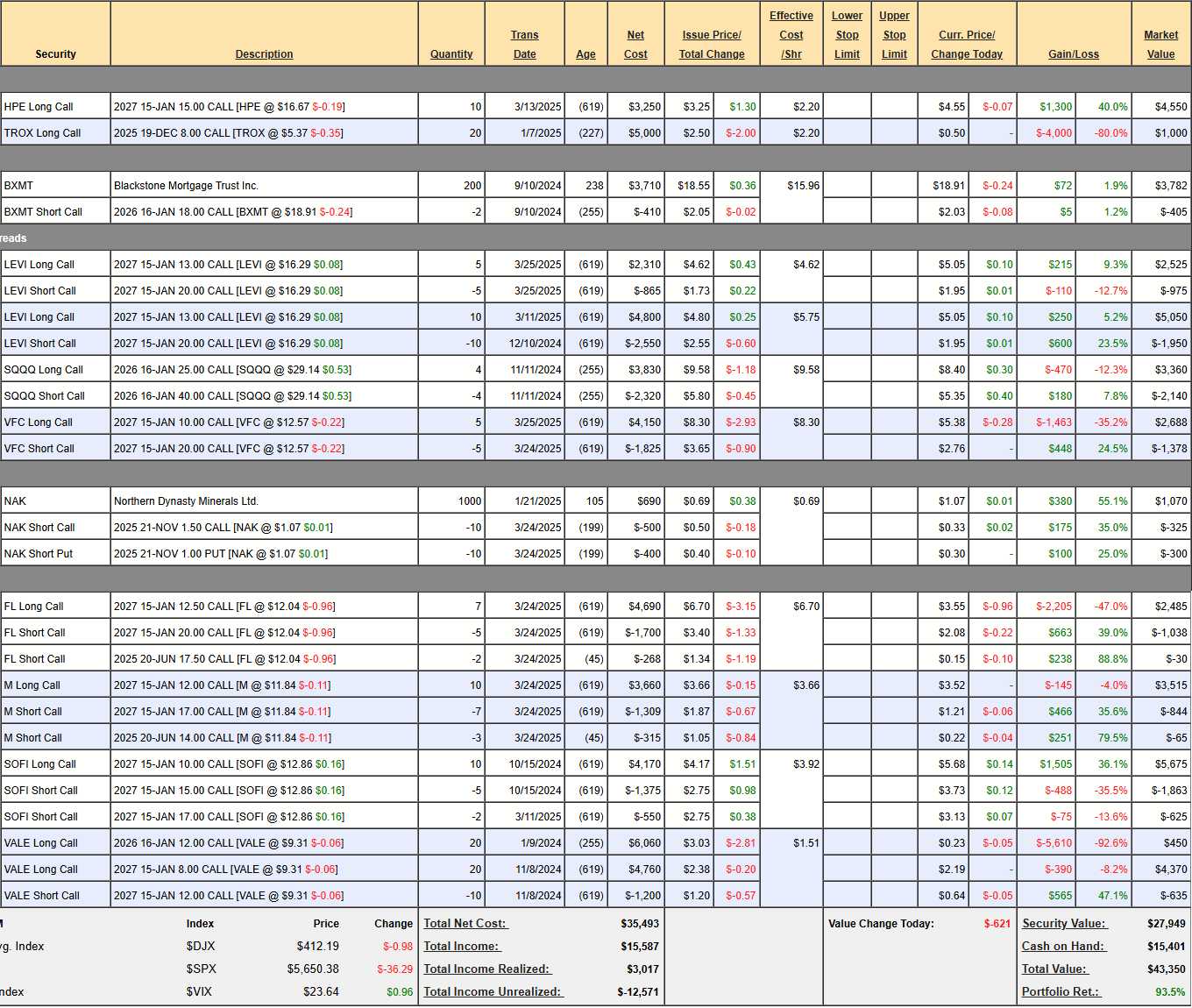

Last month I was frustrated as we had bought Macy’s (M), Foot Locker (FL), VF Corp (VFC) and Levi’s (LEVI) and they had yet to catch on and our portfolio stood at $39,723, with $15,401 in CASH!!! Fortunately, we had our SQQQ hedge, which was up $1,850 or things would have been much worse and here’s how we looked on April 5th:

At the time I said: “We lost another $1,735 and the market may drop 10% or rise 5% on Monday and, since we have no idea which – let’s just keep our remaining $15,401 in CASH!!! on the sidelines and wait for some clarity. As to the positions however – let’s make sure we still like them enough to ride out the storm with and add to if necessary.“

As it turned out, we made no changes at all but things did normalize and, exactly one month later, the portfolio closed back at $43,350 – UP $3,627 (9.1%) for the month and now up $20,950 (93.5%) in 33 months and that puts us just 9 years away from our $1M goal – still 18 years ahead of schedule!

As it turned out, we made no changes at all but things did normalize and, exactly one month later, the portfolio closed back at $43,350 – UP $3,627 (9.1%) for the month and now up $20,950 (93.5%) in 33 months and that puts us just 9 years away from our $1M goal – still 18 years ahead of schedule!

That’s right, the $700/Month Portfolio started with just $700 33 months ago (Aug 25th, 2022) with a goal of teaching our beginner traders the kind of slow, steady, VALUE investing favored by Warren Buffett and I and we traded it with NO MARGIN – like an IRA or 401K – to make sure it was suitable for all who participated.

If you missed out on our first 93.5% worth of gains, don’t worry, you can still start now with $43,350 and we still plan to make another $956,650 (2,206%) over the next 9 years – that will still be fun, right?

The way this portfolio works is every month, we add another $700 and, so far, in 32 months, we have put in $22,400. Whether you put in $700, $70 or $7,000 – the idea is to CONSISTENTLY invest your money – in good times and bad. Tempting though it was, we did not want to over-extend ourselves last month – we expected to be happy enough if the markets bounced and that’s where we are now so let’s look over our current positions:

-

- HPE – We bought back the short calls last month as they were up 79.6% ($1,790) and had served their purpose as we felt $12.79 was a good bottom and we nailed it! The key to value investing is KNOWING the VALUE of the stocks in your portfolio – not just pretty words… The Jan $15 calls were down $995 and now they are up $1,300 and, guess what? We’re going to cover them again by selling 10 Aug $17 calls for $1.45 ($1,450) which adds 10% to our CASH!!! While the spread is tight, we are essentially taking $1,450 off the table by selling 101 days worth of premium and the Jan (255 days) $20 calls are $1.25 and I’m confident we can roll to the $5 spread if HPE goes higher so there’s no reason not to take $1,450 now for better protection in what is still an uncertain market.

-

- TROX – This has been painful – even with the profits on the short call we bought back and they are too low to sell calls against so we are just waiting for longer-term options to come out so we can hopefully roll these out in time.

-

- BXMT – They paid a nice $94 dividend on March 31st so the next one is June. The net of the spread is $3,377 and 4x $94 is $376 so we’re collecting 11.13% while we wait to get called away at $3,600 (up $223 – 6.66%) in January.

-

- LEVI – We liked this one so much we bought it twice! We are right on track at net $4,650 on the $10,500 spread so we have $5,850 (125%) more to gain if LEVI hits our $20 goal in Jan of 2027. That’s still great for a new trade! It’s especially nice that earnings saved us – a very positive indication.

-

- SQQQ – We dropped from +$1,850 to -$290 and that’s a -$2,140 swing but that’s what hedges do and the important thing is that your longs more than make up for what the hedges lose in a recovery – and they did! Last month, the $25 calls were $26.25 and now they are $8.40 and the short $40 calls were $17.85 and now $5.35 so, if we were to buy back 1 of the short $40 calls for $5.25, we would have $1,230 more protection. Since LEVI alone will make $5,850 in a good market – I think it’s worth spending some money but, rather than buy back a short call, let’s spend net $2.20 ($880) to roll our 4 2026 $25 calls at $8.40 to 4 2027 $25 calls at $10.60. That gives us another year of protection and another year to sell short calls (so we’re very likely to get that $880 back!).

-

- VFC – Earnings are on the 21st so fingers crossed. It will be more about guidance.

-

- NAK – Benefitting from deregulation and we’re at net $445 on the $1,500 spread so we have a potential $1,055 (237%) left to gain at $1.50.

-

- FL – Not moving much for us so far but earnings are May 29th and they beat last Q by 20% so I think expectations are way too low on this one. It seems like it would be wasteful to buy back the short June $17.50 calls – even at $30 – so we’ll just wait and see.

-

- M – Earnings are on the 19th and last Q was a 17% beat but tariff uncertainty spooked traders out of the stock. We sold June $14 calls for $315 (13.3%) for the quarter – as long as we can do that, what’s not to like?

-

- SOFI – This stock is WILD! Just had good earnings and I feel good about our targets.

-

- VALE – Another one that is hurting us and earnings were NOT good but $9 is holding so yes, I think there is hope we get back to $12 by Jan, 2027.

I’m certainly not going to jump on new trades ahead of the Fed. In the April 5th review, we calculated $40,844 of upside potential and we realized $3,627 of that in the past 30 days so we still have a solid $37,000 (85%) upside potential over the next 2 years and that’s BETTER than we’ve been doing (34% per year) so we’re going to hold on to our CASH!!! for the moment and see how earnings season plays out.

This is not a gambling portfolio, this is a VALUE portfolio and we like to be sure of the soil before we plant our seeds.

Our 5 Members Only Portfolios will be reviewed the week of the 14th – Become a Member now and we will help guide you through the chaos!