Just like it never happened.

As soon as the markets re-opened last night, at 6am, the indexes erased 2 days of losses on news that the US and China are going to meet in Switzerland – as if that’s going to fix anything. Still, things are so bad that even the fact that our trade representatives have to go to a “neutral” country to simply discuss trade is considered a positive compared to the poop-throwing contest our two great nations have engaged in recently.

Meanwhile, just to piss Trump off, China’s Central Bank Governor Pan Gongsheng announced across-the-board rate cuts and other easing measures aimed at pumping $2.1Tn Yuan (don’t get excited – that’s only $291Bn) into the Chinese Economy. Xi snapping his fingers and getting what he wants out of the Central Bank makes Trump look weak as he is unable to exert any control over Powell and our own Federal Reserve.

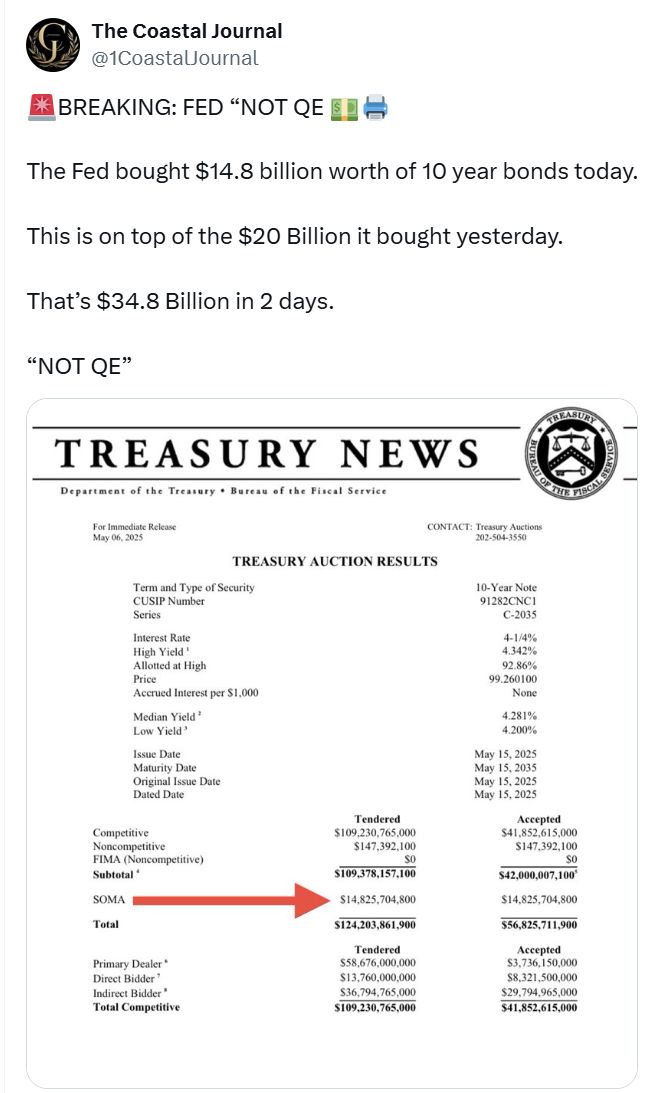

Well, let’s not say “any” as the Fed did sneakily buy $34.8Bn worth of 3-year and 10-year notes this week in a COMPLETE reversal of their stated Quantitative Tightening policy that they dropped from $25Bn a month to $5Bn a month to now -$34.8Bn a week? That puts China’s stimulus to shame and it also makes it look like people actually want to buy our bonds – when they clearly do not.

Well, let’s not say “any” as the Fed did sneakily buy $34.8Bn worth of 3-year and 10-year notes this week in a COMPLETE reversal of their stated Quantitative Tightening policy that they dropped from $25Bn a month to $5Bn a month to now -$34.8Bn a week? That puts China’s stimulus to shame and it also makes it look like people actually want to buy our bonds – when they clearly do not.

It is, of course, the mark of any great Dictatorship when the Government attempts to manipulate the private markets in order to make things seem better than they actually are. I caught the shenanigans and pointed it out to our Members in the Live Chat Room right after yesterday’s auction (1:16) but, other than The Coastal Journal, I waited all day to see if anyone else would notice or comment on this bullshit and – nothing – Financial Journalism is truly a joke!

Anyway, if people kept complaining about Vladimir Putin seizing absolute control of every aspect of Soviet life after his first 100 days (back in 1999), they’d never get anything else done. Just to review, however:

🚢 Vladimir Putin’s first 100 days began when he became Acting President of Russia on December 31, 1999, following Boris Yeltsin’s resignation, and continued after his official election in March 2000. During this critical period, Putin implemented several strategies to consolidate power that bear striking similarities to Trump’s recent actions:

Putin’s Early Power Consolidation (2000-2003)

-

-

Centralizing Regional Control

-

Putin divided Russia’s 89 regions into seven federal districts, each overseen by a presidential appointee, effectively centralizing power away from regional governors.

-

He removed regional governors’ right to sit in the Federation Council (upper house of parliament) and gained the power to dismiss them directly.

-

-

Media and Oligarch Crackdown

-

Putin moved against powerful media tycoons and oligarchs, closing several media outlets and launching criminal proceedings against figures like Boris Berezovsky and Vladimir Gusinsky.

-

He systematically replaced business leaders with allies, particularly in strategic sectors like energy (e.g., Gazprom’s board was stacked with Putin loyalists).

-

-

Legislative Control

-

By 2002, Putin’s United Russia party conducted what was called a “Portfolio Putsch,” stripping opposition parties (particularly Communists) of committee roles and taking control of the legislative agenda.

-

This consolidated one-party dominance in the legislature, similar to how Trump has secured Republican compliance in Congress.

-

-

Security Services Empowerment

-

Putin elevated former KGB colleagues and security service personnel (siloviki) to key government positions, creating what advisor Andrey Illarionov called a “Corporation of Intelligence Service Collaborators.“

-

These security-oriented officials seized control of key agencies including tax authorities, defense, and foreign affairs.

-

-

Parallels to Trump’s Second Term First 100 Days

The similarities between Putin’s early moves and Trump’s recent actions are notable:

-

-

Bureaucratic Purges: Just as Putin installed loyalists across government, Trump has removed over 100,000 federal workers and replaced officials at the DOJ, FBI, and Pentagon with loyalists.

-

Executive Power Expansion: Both leaders used executive orders to bypass legislative processes-Putin through presidential decrees, Trump through a “battery of orders and memoranda.”

-

Targeting Political Opponents: Putin moved against oligarchs who opposed him; Trump has “weaponized his control of the Justice Department” to investigate political enemies.

-

Media Control: Putin closed opposition media outlets; Trump has launched a war against media institutions.

-

Legislative Compliance: Putin secured a compliant Duma; Trump benefits from “congressional Republicans who have abdicated legislative powers and long-held beliefs.”

-

Immigration as Control: While Putin focused on Chechnya as a security threat, Trump has mobilized multiple agencies for mass deportations, even threatening to send people to foreign prisons without due process.

-

The key difference is that Putin operated in post-Soviet Russia with weaker democratic institutions, while Trump is working within America’s established constitutional system-though his actions suggest an attempt to test its boundaries in ways reminiscent of Putin’s early consolidation of power.

My point is that it doesn’t matter what Trump is doing – there are going to be ways of making money while he’s doing it, so let’s concentrate on that and not worry about all the crazy things the President is doing. After all, the Russian people have managed to survive 25 years of Putin (well most of them, so far) and this is only our 5th year of Trump and only 1.1M people died of Covid in his first term – so I think our chances are decent…

For instance, in Monday morning’s PSW Report, I said:

For instance, in Monday morning’s PSW Report, I said:

“Speaking of Global Market Manipulation – OPEC+ agreed to accelerate Oil production increases for June, fueling concerns of oversupply, sending our /CLU25 long contracts back to $55 at the open but now back to $56.50 while front-month /CL contracts (May) are $57.38 and Brent (/BZ) is $60.50.”

As you can see from the chart, we’ve already popped back to our $58.50 goal and that’s up $2,000 PER CONTRACT from Monday’s note and, for our Members, who were in the trade from last week’s Live Trading Webinar (and we’re having one today at 1pm, EST), our net entry point is $55.50 so up $3,000 per contract and our goal is $60 ($4,500 per contract) but we have a stop at $58 to lock in a $2,500 per contract gain – you’re welcome!

Trump, of course, took full credit for oil prices dropping on Monday but they are up $3 (5.4%) in two days and I’m sure that will be Biden’s fault, right? See, we just need to get used to the way things work now and, once we’re used to all of Trump’s gimmicks and start making consistent money off them – we’re going to miss him when he’s gone…

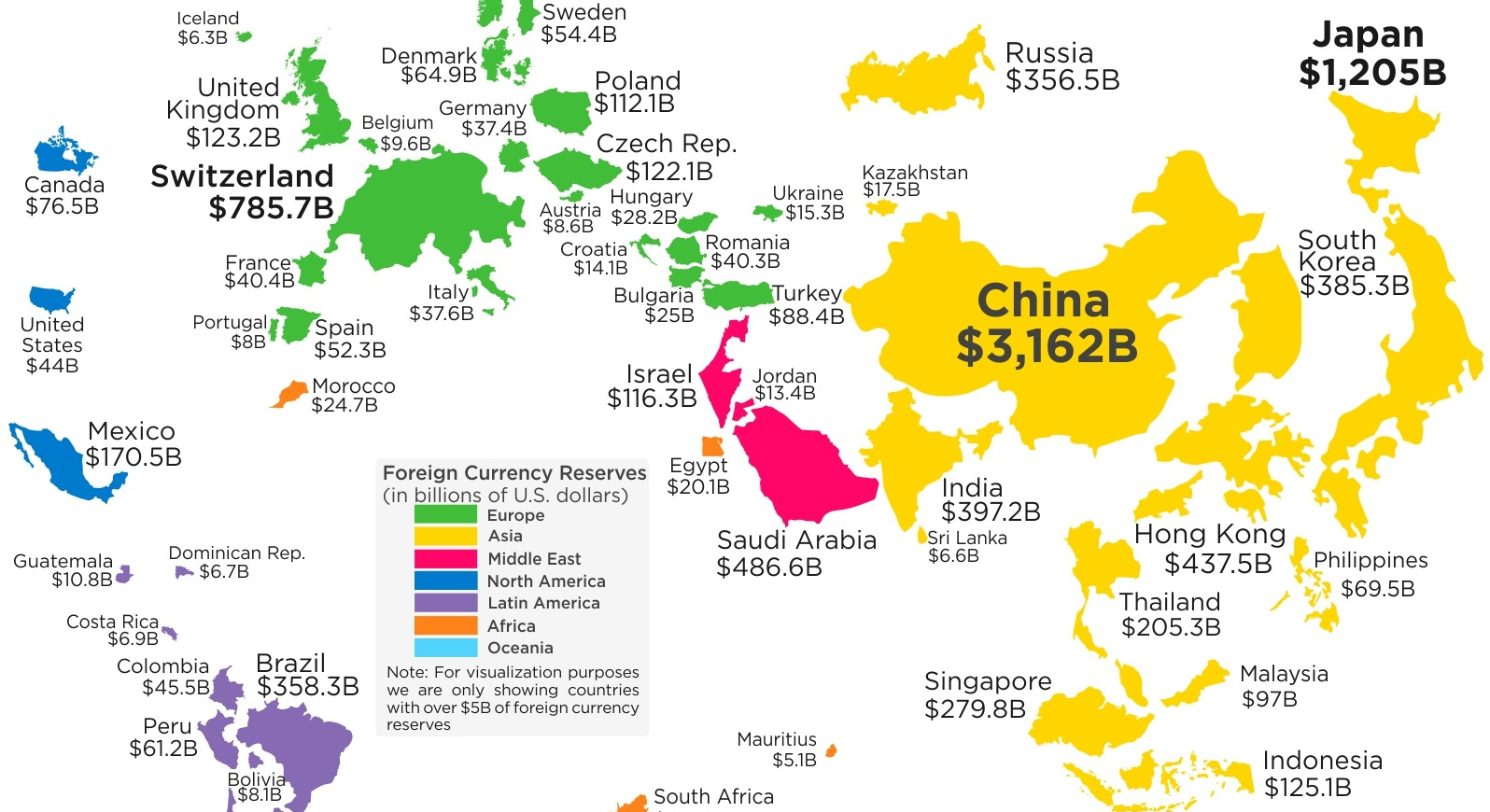

One of the reasons Oil is up is because the Dollar is weaker and that too is a reflection of our President and his policies on the World Stage. Asian Exporters and Investors are sitting on over $2,500,000,000,000 worth of Dollars and, if Trump does not come to an agreement with China – they will have no need for them and will begin unwinding them in favor of currencies from countries they are still doing business with. This is Econ 101 but, unfortunately, it’s a class the President did not pass at Wharton.

So the Dollar is no longer needed to buy US exports by Asian countries and, on top of that, Trump wants the Fed to offer lower interest rates to people who hold Dollars – making them even less attractive – what could possibly go wrong?

Well, according to Bloomberg: Accelerating the multi-trillion dollar flows may be “naked long-Dollar positions” prevalent among Asian countries that run large external surpluses, he wrote, referring to positions that are not hedged against fluctuations in the dollar. Some of these countries include China, Taiwan, Malaysia and Vietnam.

There is an “important imbalance in the world that puts the dollar in a vulnerable position,” SJ Capital’s Stephen Jen wrote in his latest report. There are, in fact, $8.28Tn worth of Dollars in the ENTIRE World and more than half of them are held by just China and Japan so DO NOT dismiss their ability to completely destabilize the formerly United States, we only have about $2Bn circulating in our own country – this is the folly of running up $37Tn in debt!

THAT is what we have been getting in exchange for running those trade deficits Trump keeps whining about – a free pass on our massive debt. If we aren’t going to buy good from foreign countries – then we are like a customer who has been late paying his invoices who you’ve been giving a pass to but now he’s not even shopping here anymore – time to call the collection agency!

While this is obvious to non-MAGA Economists (not you, Heritage Foundation!), as Trump’s Wharton Professor William Kelly noted, “Donald Trump was the dumbest goddam student I ever had” making him the perfect guy to preside over the de-Dollarization of the Global Economy – because anyone who had a clue would understand the repercussions of what they were doing, if they had a soul or even a SHRED of human decency, would stop doing it – now!

So that’s what’s at stake in today’s Fed Meeting. Their decision will be announced at 2pm, EST and Powell will spin it at 2:30 as always – during our Live Webinar, where we will dissect it but expect the Futures to sell down from this morning’s pump as talking to China is likely to be as pointless to talking to Canada was yesterday and Trump is slowly realizing that, on the International Stage, he doesn’t have the sort of power he thinks he has.