A trade deal with the UK!

A trade deal with the UK!

That’s right, the Futures are up over 1% (8:30) because Trump made a Trade Deal with the UK (and was that his big announcement?), who we had a $9.7Bn Trade SURPLUS with – so I guess we all have to buy more marmalade??? On this basis of idiocy (celebrating Trump fixing one of the hundreds of things he broke) if we make a Trade Deal with China, the market should gain 3,000% overnight, can’t wait…

Meanwhile, Continuing Weekly Jobless Claims fell by 29,000, indicating the Labor Market is still strong. How strong, well Unit Labor Costs are up 5.7% in Q1, which is EXTREMELY Inflationary and Productivity is DOWN 0.8% despite TRILLIONS of Dollars being spent on AI in an attempt to make us more productive – what gives? The sanity of Traders, apparently!

Powell JUST said he’s very concerned about Inflation and a 5.7% rise in Unit Labor Costs is MORE THAN DOUBLE last year’s average (2.1,3.4,2.3 and 1.7% in the last 4 Qs) and yet the market is celebrating this morning as if all our problems have been solved. Trump announced the US-UK trade deal WILL be revealed at 10am, describing it as “comprehensive” and “the first of many” agreements to come (and when has he ever lied to us?).

The Bank of England cut its main interest rate by 0.25 percentage points to 4.25% this morning, despite an unexpected three-way split among the Board Members over there. The decision came as the BoE acknowledged that Trump’s tariffs are weighing on Global Economic Growth. Two members were advocating for a more substantial half-point reduction, while two others preferred to maintain current rates.

BoE Governor, Andrew Bailey, emphasized caution, stating: “The past few weeks have demonstrated the unpredictability of the global economy. Therefore, we must adhere to a gradual and cautious approach regarding any future rate reductions“. The Central Bank now projects Inflation will return to its 2% target by Q1 2027, nine months earlier than previously forecast.

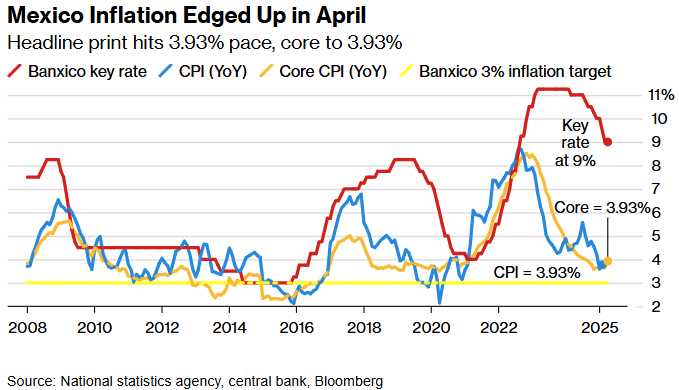

Meanwhile, in Mexico, annual Inflation ACCELERATED to 3.93% in April, up from 3.8% in March but still within the central bank’s more realistic target range. This development may allow Mexico’s Central Bank (Banxico) to continue its rate-cutting cycle, having already lowered rates by 50 basis points for two consecutive months to 9% – that’s right 9%! The core inflation rate, which excludes volatile Food and Energy Costs, rose 0.49% for the month (5.88% annualized), in line with market expectations.

Meanwhile, in Mexico, annual Inflation ACCELERATED to 3.93% in April, up from 3.8% in March but still within the central bank’s more realistic target range. This development may allow Mexico’s Central Bank (Banxico) to continue its rate-cutting cycle, having already lowered rates by 50 basis points for two consecutive months to 9% – that’s right 9%! The core inflation rate, which excludes volatile Food and Energy Costs, rose 0.49% for the month (5.88% annualized), in line with market expectations.

Back home, the chip sector is seeing significant movement this morning after reports that the Trump Administration plans to lift long-standing AI chip export restrictions. The Administration intends to rescind the Biden-era regulation known as the “AI Diffusion Rule,” which limited AI chip exports to prevent smuggling to China (so now we’re not doing that?). Nvidia shares are up 1.6% in premarket trading, while AMD has risen 1.5% but I’m sure Trump will be using the gap in regulations (that he just made) to cut individual deals with countries that “pay to play” the chip game.

Meanwhile, in earnings news:

-

-

AppLovin (APP): Shares surged 13% premarket after the company announced the sale of its mobile gaming division to Tripledot for $400 million and reported a 40% annual revenue increase.

-

Shopify (SHOP): Shares tumbled over 8% after issuing disappointing guidance for the current quarter, projecting revenue growth in the mid-twenties percentage range versus analyst expectations of 22.4%.

-

Warner Bros. Discovery (WBD): Fell nearly 2% premarket after missing revenue expectations for Q1, with revenue declining 10% despite box office successes.

-

Axon Enterprise (AXON – old favorite): The Taser and body camera maker saw shares rise over 5% after beating both revenue and profit expectations.

-

Super Micro Computer: Declined about 5% after hours yesterday following disappointing Q3 results and a bleak forecast.

-

There actually are signs of potential thawing in US-China relations, with Treasury Secretary Bessent and Chief Trade Official Jamieson Greer scheduled to meet with Chinese counterparts in Switzerland this weekend for “ice-breaker” discussions. This comes after months of reciprocal tariffs which have raised grave concerns about Global Economic Growth and, as I noted yesterday, Trump is playing a game that can easily blow up in his face, which is what Bessent is trying to save.

Deutsche Bank noted: “Considering that comprehensive trade agreements typically require years to finalize, this is likely to serve as a framework. It will be intriguing to see whether the baseline tariff of 10% remains“.

The market’s enthusiasm this morning reflects HOPE (not a valid investing strategy) that Trump is shifting toward a more negotiation-driven approach in his tariff policy, potentially easing concerns about a full-blown trade war’s impact on the Global Economy. BUT as always, we’ll need to see the details before getting too excited about more marmalade imports.

More important than trade though was Apple’s senior VP, Eddy Cue, delivering BOMBSHELL testimony in the ongoing Google Antitrust Trial that sent shockwaves through Wall Street. Cue revealed that Google’s search traffic on Safari browsers declined in April for the first time in 22 years. This unprecedented revelation triggered a massive 7.51% plunge in Alphabet’s stock price on Wednesday, wiping out approximately $170Bn in Market Cap in yesterday’s trading session.

This is the reason we’ve stayed away from Google, which is STILL far above $100 – where it was in 2023. The testimony came during the critical Remedies Phase of the Antitrust Trial where Judge Mehta will determine consequences for Google’s previously ruled illegal search monopoly. At the heart of this case is the lucrative arrangement where Google pays Apple approximately $20 BILLION Annually to remain the Default Search Engine on Safari browsers and iPhones.

What makes this particularly Earth-shaking for the broader market is Cue’s attribution of this decline to users switching to AI alternatives like ChatGPT, Perplexity, and Claude. He went even further, suggesting that AI Services will eventually replace conventional search engines entirely (and, again, I TOLD YOU SO!), and that Apple will need to integrate these AI search options into Safari. Apple is reportedly already in discussions with Perplexity about browser integration.

This development threatens to upend Google’s core business model. Google’s lucrative advertising business relies significantly on iPhone customers using its search engine. If Apple moves forward with plans to offer AI-powered search alternatives in Safari, it could accelerate the erosion of Google’s search dominance and its primary revenue stream.

Google has attempted to counter these claims, issuing a rare public statement disputing Cue’s testimony. The company insists it “continues to see overall query growth in Search… including an increase in total queries coming from Apple’s devices and platforms”. This unusual public contradiction highlights how seriously Google views this threat.

Google has attempted to counter these claims, issuing a rare public statement disputing Cue’s testimony. The company insists it “continues to see overall query growth in Search… including an increase in total queries coming from Apple’s devices and platforms”. This unusual public contradiction highlights how seriously Google views this threat.

The potential remedies from this antitrust case could be severe. Government attorneys are pushing Judge Mehta to order Google to divest its Chrome browser. Alternatively, the judge might end Google’s default search agreements with Apple and others – a prospect that Cue admitted he was “losing sleep” over, as the revenue loss would impact Apple’s product development and operating system investment.

For the broader market, this represents a potential tectonic shift in the tech landscape. If one of the most profitable business arrangements in tech history, the Google/Apple Search Deal, is threatened, it could trigger significant volatility across the entire sector. Additionally, if AI search alternatives gain momentum at Google’s expense, we could see rapid valuation shifts as investors reassess future growth prospects for both established tech giants as well as the AI-focused newcomers.

This development also comes amid a broader Antitrust crackdown, with the Google case representing just one of five major tech Antitrust actions currently being pursued by the US Government. Meta, Apple, and Amazon are all facing similar scrutiny, creating additional uncertainty for tech investors in the World’s biggest companies – despite the fresh taste of Trump’s ass on their lips!

This development also comes amid a broader Antitrust crackdown, with the Google case representing just one of five major tech Antitrust actions currently being pursued by the US Government. Meta, Apple, and Amazon are all facing similar scrutiny, creating additional uncertainty for tech investors in the World’s biggest companies – despite the fresh taste of Trump’s ass on their lips!

There’s just no pleasing some tyrants, right?

The market’s reaction to these developments will be closely watched, as Google’s advertising model has been a cornerstone of Internet Economics for decades. Any fundamental disruption to this model could have far-reaching implications for Digital Advertising, Content Creation, and the broader Tech Ecosystem that has driven much of the market’s growth in recent years.