What does the Fed say?

Today marks the end of the Fed’s “quiet period” following Wednesday’s FOMC meeting, which is why we’re seeing eight (8) Fed officials making a total of nine (9) public appearances. This coordinated communication effort comes at a critical time as the Fed navigates the complex economic impacts of Trump’s tariff policies.

Why So Many Speakers Today?

-

-

-

-

Post-FOMC Communication Strategy: The Fed’s “quiet period” around the May 7th FOMC meeting has just ended, allowing officials to publicly discuss monetary policy again.

-

Clarifying the Fed’s Position: Wednesday’s FOMC meeting kept rates unchanged at 4.25-4.50%, but highlighted “rising risks” to the economy, creating a need for officials to elaborate on their views.

-

Addressing Tariff Concerns: The Fed is trying to communicate (ie. “spin“) its assessment of how Trump’s “Liberation Day” tariffs will impact inflation, growth, and employment.

Addressing Tariff Concerns: The Fed is trying to communicate (ie. “spin“) its assessment of how Trump’s “Liberation Day” tariffs will impact inflation, growth, and employment.

-

-

-

Early Morning Comments (Already Released)

Michael Barr’s comments from Iceland have already been published, and they offer significant insights:

-

-

-

-

Inflation Warning: Barr stated that Trump’s tariffs will “likely lift inflation, lower growth, and raise unemployment later this year.“

-

Policy Dilemma: He highlighted the Fed’s potential “precarious situation” if both inflation and unemployment rise simultaneously, creating a difficult choice for policymakers.

-

Supply Chain Disruption: Barr warned that “higher tariffs could disrupt global supply chains and exert sustained upward pressure on inflation,” noting that businesses will need time to adjust.

-

Cautious Approach: Despite these concerns, Barr indicated monetary policy is “well-positioned to adapt as circumstances evolve,” suggesting the Fed isn’t rushing toward either rate cuts or hikes.

-

-

-

What to Expect From Other Speakers Today

Based on the search results and recent Fed communications, other speakers are likely to address:

-

-

-

-

Tariff Impact Assessment: Further details on how the Fed is modeling the economic effects of the new tariffs.

-

Inflation Trajectory: Views on whether the disinflationary process can continue despite tariff pressures.

-

Growth Outlook: Perspectives on whether the Q1 GDP contraction (driven by import surges ahead of tariffs) will extend into Q2.

-

Policy Flexibility: Emphasis on the Fed’s data-dependent approach as it navigates this uncertain period.

-

-

-

The Hoover Monetary Policy Conference later today will likely feature more comprehensive discussions about global monetary policy coordination in response to trade tensions.

As the day progresses, we’ll hear from a diverse set of Fed officials representing both hawks and doves, providing a more complete picture of the FOMC’s collective thinking about the challenging economic landscape ahead. We will be updating the Members in our Live Chat Room throughout the day.

It is so great to have a digital assistant to be able to gather information like that, which is why it’s baffling to me that Q1 Productivity was down 0.8% yesterday. Perhaps it’s because I used to be an efficiency consultant but, for the life of me, I can’t figure out how – almost three years into AI – that people still haven’t figured out what to do with it…

A Gartner survey revealed this paradox in action: Only 37% of teams using traditional AI and 34% using generative AI reported high productivity gains. As Randeep Rathindran noted, “Despite the excitement surrounding AI, its impact on productivity has been inconsistent, leading to what some describe as the AI productivity paradox.”

Several factors might explain this phenomenon:

-

-

-

-

Implementation lags: Organizations are still figuring out how to effectively integrate AI into workflows.

-

Inflated expectations: The hype around AI has created unrealistic expectations about immediate productivity boosts.

-

Measurement challenges: Traditional productivity metrics might not capture the full value of AI-enhanced work.

-

Organizational inertia: Existing processes and institutional barriers can slow adoption of new technologies.

-

-

-

The Q1 Productivity drop also has a more immediate explanation. As Gerald Cohen pointed out, it’s partly due to the “funky nature of the GDP number” released last week, which showed a contraction primarily caused by businesses “frontloading before the tariffs.” This artificially depressed GDP while hours worked remained relatively stable, creating a mathematical decline in productivity – so perhaps things are NOT as bad as they seem on that front.

Looking forward, Gary Schlossberg suggests we may “start to pick up some of the benefits of artificial intelligence, digitalization” in coming quarters. History suggests that truly transformative technologies often take decades to fully manifest their productivity benefits (remember the Internet?), as organizations need time to reinvent processes and develop complementary innovations.

Looking forward, Gary Schlossberg suggests we may “start to pick up some of the benefits of artificial intelligence, digitalization” in coming quarters. History suggests that truly transformative technologies often take decades to fully manifest their productivity benefits (remember the Internet?), as organizations need time to reinvent processes and develop complementary innovations.

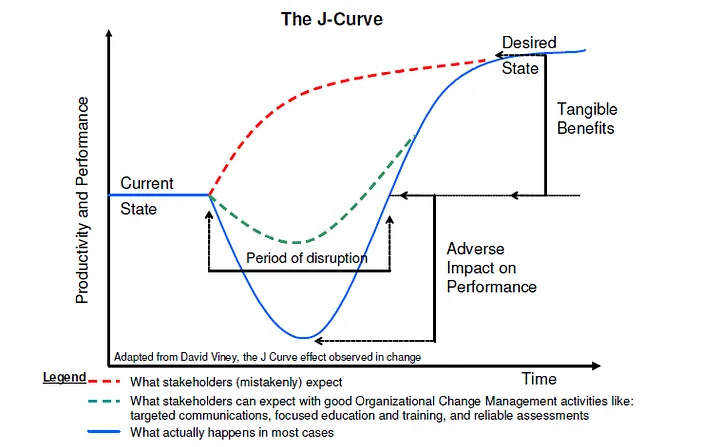

So while it’s indeed baffling to see productivity falling amid an AI boom, Economic History does suggest that we may still be in the early, Investment-Heavy phase of the J-curve, with more substantial productivity gains potentially waiting on the other side.

The productivity J-curve suggests we should look for companies making significant AI-related investments that aren’t yet showing up in productivity metrics or stock performance. These companies are essentially creating valuable intangible assets that the market may be undervaluing in the short term.

Portfolio Tilting Strategy

-

-

-

-

Favor infrastructure providers: Companies building the foundation for AI adoption are likely to see returns first. Specifically – Amazon and Microsoft are well-positioned in the “infrastructure layer” of the AI value chain.

-

Look for high R&D/capex relative to sector: Companies investing heavily in AI capabilities may show temporarily depressed earnings but could emerge as long-term winners.

-

Focus on companies with financial strength: The J-curve implies that companies need sufficient capital to weather the initial productivity dip. As noted in the search results, “these are part of an exclusive list of companies that can foot the massive costs of training large language models.”

-

-

-

-

-

-

-

-

- Amazon – Planning to spend “over $100 billion in capital expenditures THIS YEAR, with the ‘vast majority’ going to AI for Amazon Web Services.“

- Google, Meta, and Microsoft – Also boosting AI spending, with Amazon following their lead.

- NVIDIA – Mentioned as one of the “leading AI chip builders” providing hardware for supercomputer systems needed for LLM training.

-

-

-

-

-

-

-

-

Consider the full value chain: Beyond the obvious tech giants, look for companies making complementary investments in business process redesign and human capital development.

-

-

-

Companies Potentially Being Punished for AI Investments

While the search results don’t explicitly list companies being punished for their AI investments, we can infer some categories:

-

-

-

-

Cloud infrastructure providers: Amazon, Microsoft, and Alphabet are collectively spending “north of $250 billion in 2025 alone” on AI infrastructure. This massive capex might be weighing on near-term profitability metrics, creating potential value opportunities.

-

Financial services innovators: Companies like Upstart Holdings (UPST) have seen tremendous returns (115.84% over the past year) but may still be undervalued if their AI investments continue to pay off over time.

-

Enterprise software companies: Firms like Pegasystems (PEGA, +52% over the past year) that are investing in AI capabilities may be creating intangible value that isn’t fully reflected in current metrics.

-

-

-

The J-curve isn’t guaranteed for all AI investments (some people suck at implementation – hence my old career). As one report noted, “Semiconductor companies that some see as AI winners may lose in other parts of their business if AI sucks much of the oxygen out of the room and IT budget dollars get diverted.”

Additionally, there’s little agreement among Investment Banks about which companies will be AI winners versus losers, suggesting that this remains a space where careful analysis and diversification are crucial – things we have been preaching all along at PSW.

Perhaps most importantly, the J-curve framework encourages patience. As the MIT Sloan article notes, “it took up to three decades to see the effects of electrification in factories in the statistics.” While AI adoption will certainly move faster, Investors should still prepare for a multi-year horizon before seeing the full productivity benefits materialize.

By focusing on companies making thoughtful, strategic AI investments today, PARTICULARLY those with the financial strength to weather temporary productivity dips-Investors can position themselves to benefit from the eventual upswing in the J-curve.

Have a great weekend,

-

- Phil