This is SO crazy!

The S&P 500 has blasted up 3.1% overnight as the US and China drop tariffs against each other by 115% for at least 90 days to 30% on Chinese imports (still ouch!) and 10% on US exports to China.

“We are in agreement that neither side wants to decouple,” Treasury Secretary Scott Bessent said, adding that “we had a very robust and productive discussion on steps forward on fentanyl” and that talks might lead to China buying more American-made products. “Just like with all our other trading partners, as long as there is good faith effort, engagement and constructive dialog, then we will keep moving forward.”

Jamieson Greer is the hero of this story. He was the Chief of Staff to the US Trade Rep under Trump’s first term and now he is the US Trade Representative and his previous relationship with Chinese negotiators allowed Scott Bessent (the Trump Administrations “adult in the room” to pull off a miracle this weekend.

Although the tariffs are still high and may still cut US imports from China by 70% over the next year or so – China has already set up other trading partners (they had huge exports last month despite far less to the US) to offset US decline because they are nothing if not adaptable.

So, where does that leave things? This stunning development has already triggered a massive market reaction, with S&P futures up 3.1% and Nasdaq futures surging even higher at 3.5%. As we are ALREADY HALFWAY through Q2, here’s how this tariff truce is likely to reshape markets:

Immediate Market Winners

-

-

Export-Dependent Sectors: Companies with significant China exposure that have been beaten down will see the strongest rebounds. The gap between domestic-focused and export-oriented stocks should narrow considerably.

-

- NKE (down 14.7% since tariff announcement), LEVI (down 10.6%), and GPS (down 14%) should see significant rebounds as their Asian manufacturing bases face reduced tariffs. FAST (showing stable industrial demand with 3.4% YoY revenue growth) should benefit from improved supply chain conditions.

-

-

Tech Hardware: With semiconductor and electronics manufacturing heavily dependent on China supply chains, expect companies like Apple and chip manufacturers to outperform. The sector had been pricing in worst-case scenarios.

-

-

AAPL stands to gain substantially as it heavily depends on Chinese manufacturing and was facing potential disruption despite temporary exemptions. NVDA, which relies on Chinese components for its graphics cards and AI chips, should see relief from supply chain concerns. Companies producing gaming consoles (90% of which come from China to the US) will also benefit from the tariff reduction.

-

-

-

Luxury Goods: Brands with significant Chinese consumer exposure should see relief rallies as fears of retaliatory consumer boycotts fade.

-

-

LVMH (Louis Vuitton), Richemont (Cartier), and Hermès may benefit more than American luxury brands, as they can now better compete in both US and Chinese markets with reduced tariffs. Companies like LULU and NKE that were taking a hit from tariffs should see improved margins and sales potential.

-

-

-

The Dollar has also strengthened significantly on this news (Euro down 1.2%, Yen down 1.6%), reflecting renewed confidence in US economic prospects and, if you can believe it – holding back the index rally! This represents a catch-up move, as the Dollar had been priced for a long-term trade war that lowered Dollar transactions globally.

Bond markets will now likely reprice lower recession risks, potentially pushing yields higher and steepening the Yield Curve – a positive for financial stocks like JPM, which already reported strong Q1 results (EPS of $5.07 vs $4.63 consensus).

With Q2 already halfway complete, companies that issued conservative guidance (or NO guidance) due to tariff concerns may now be positioned for positive surprises. The Banking Sector, which kicked off earnings season with mostly strong results, could see continued momentum.

While this 90-day pause provides significant relief, several factors will determine market direction through the remainder of Q2:

-

-

Negotiation Progress: Markets will closely monitor statements from both sides for signs that talks are “constructive” enough to extend beyond the 90-day window.

-

Baseline Tariffs Remain: The 10% baseline tariff on all imports remains in place, and the 30% rate on Chinese goods is still substantial – meaning supply chain diversification will continue, albeit at a less urgent pace.

-

Fed Policy Implications: With inflation pressures potentially easing due to lower tariffs, the Fed may have more flexibility. This could push back rate cut expectations, supporting financial stocks but potentially creating headwinds for rate-sensitive sectors.

-

The market’s reaction suggests investors are viewing this as more than just a temporary pause… As Deutsche Bank noted, “Today’s announcement exceeds even our optimistic expectations.” However, with the 90-day clock now ticking, volatility could return as the deadline approaches unless substantial progress is made in negotiations.

The temporary nature of the agreement means uncertainty hasn’t disappeared – it’s merely been postponed.

Meanwhile, earnings reports are still coming in and I feel bad for the Monday morning companies as they must be scrambling to rewrite their outlooks but we’re feeling very good about the dozens of longs we’ve picked up for our Member Portfolios since March 24th (“PSW Top Trade Alerts- March Madness! – 15 Trade Ideas!!!“) and what a great lesson on WHY we manage our portfolios with hedges – which allowed us to ride out the market uncertainty with our longs in place – and even allowed us to add new trades WHILE we were at the lows – which IS where we should be buying our stocks, right?

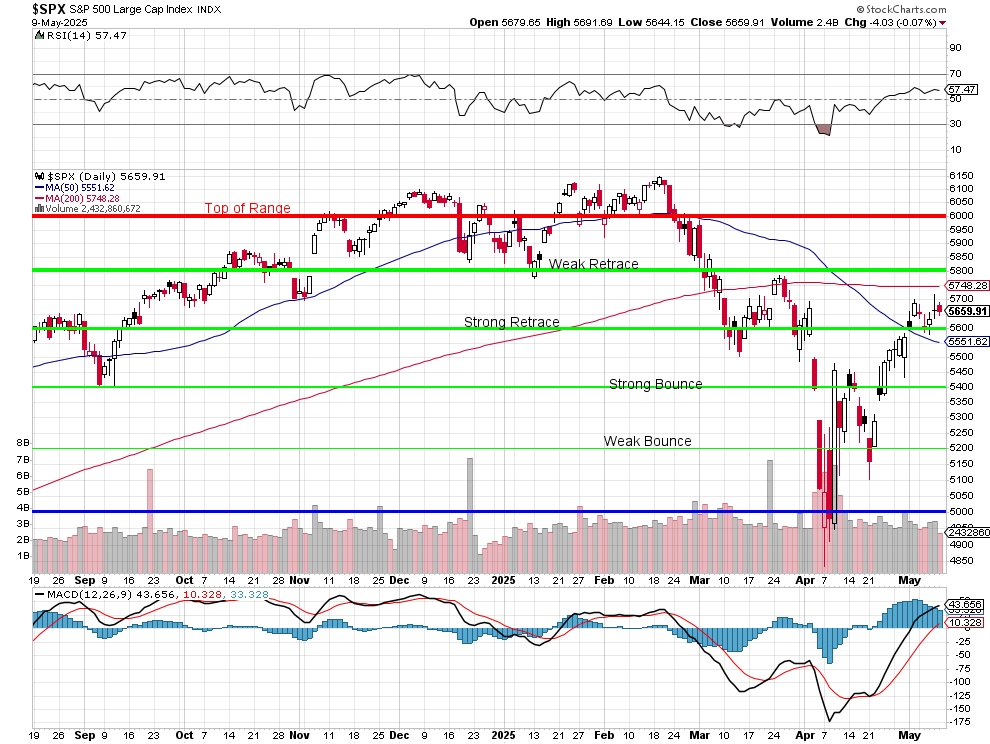

On March 24th, the S&P 500 was at 5,750 and that was the 200 dma and we felt that was likely to hold up once things calmed down (6.5% off the top) and now we’re at 5,850 as the S&P 500 gains over 100 points this morning which both punches us over the 200 dma and begins to bend the 50-day moving average up from 5,551 BUT will it hold???

That’s up to Team Trump as earnings have certainly been strong enough to give us confidence to spend our sideline money this Earnings Season, DESPITE the tariffs and now, if they stay off – our predicted range for the year is likely to continue but that doesn’t give us much upside potential from here. As I said, we’ll have to see how things play out but I feel optimistic for the first time since Jan 20th!

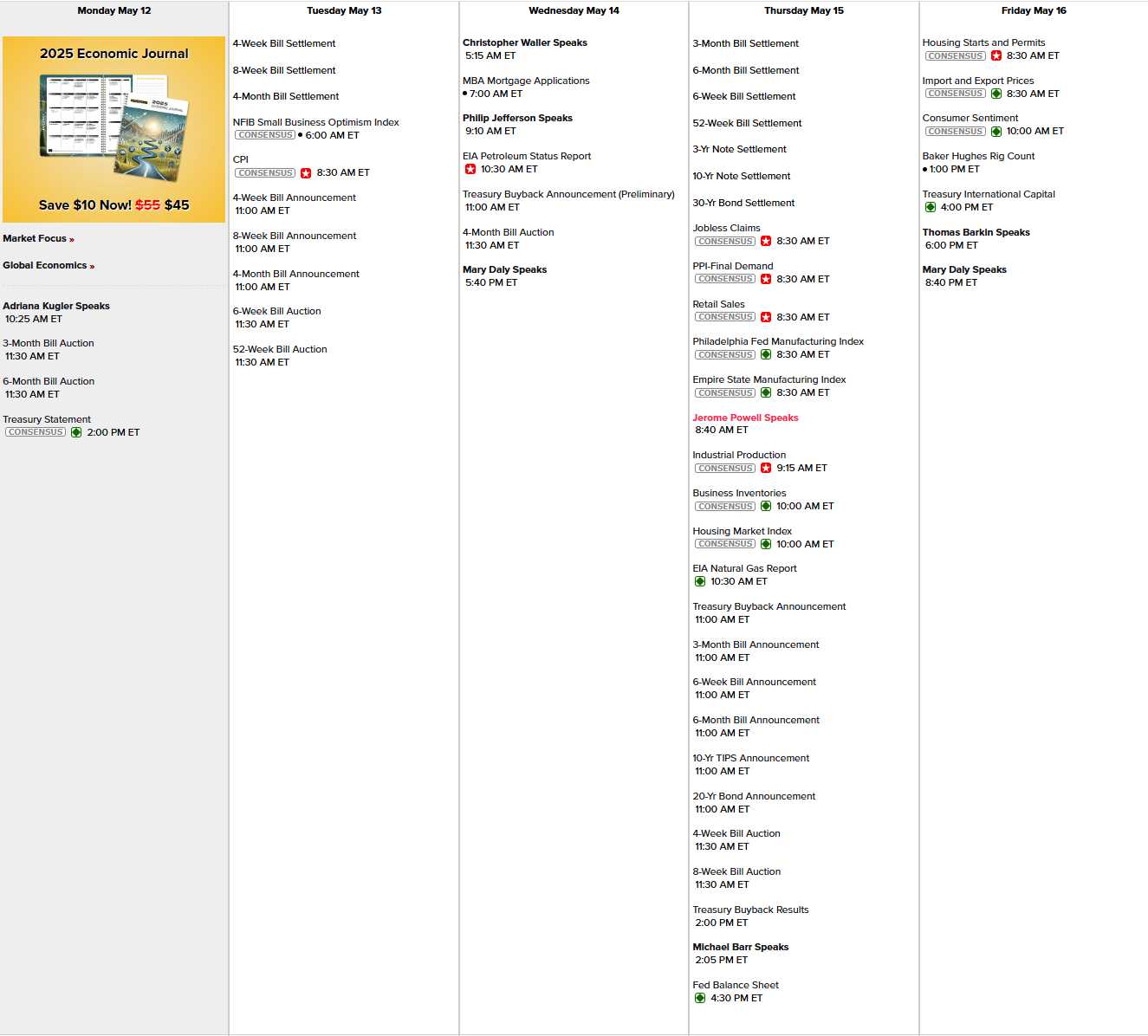

“Only” 7 Fed speakers this week but we are selling a ton of short-term notes and the 10-Year is back to 4.4% (it’s always something!) – so let’s pay attention to that. Tomorrow we get Small Business Optimism (before today’s news) and CPI and just Mortgage Applications on Wednesday but Thursday is busy with PPI, Retail Sales, Philly Fed, NY Fed, a Powell Speech, Industrial Production, Business Inventories and, after the close – a very embarrassing Fed Balance Sheet (after last week’s BS bond intervention) – so saddle up for Thursday! Friday is Housing Starts, Import/Export Prices and Consumer Sentiment (pre-tariff relief, so bad).

On top of all this, we’re going to be reviewing our 6 Model Portfolios for our Members and we’ll see how tempted I am to cash out on this sugar-high as we were SO WORRIED last month and what an amazing turnaround this has been – let’s enjoy the ride while it does last!