Wow! What a month it has been (again)!

Wow! What a month it has been (again)!

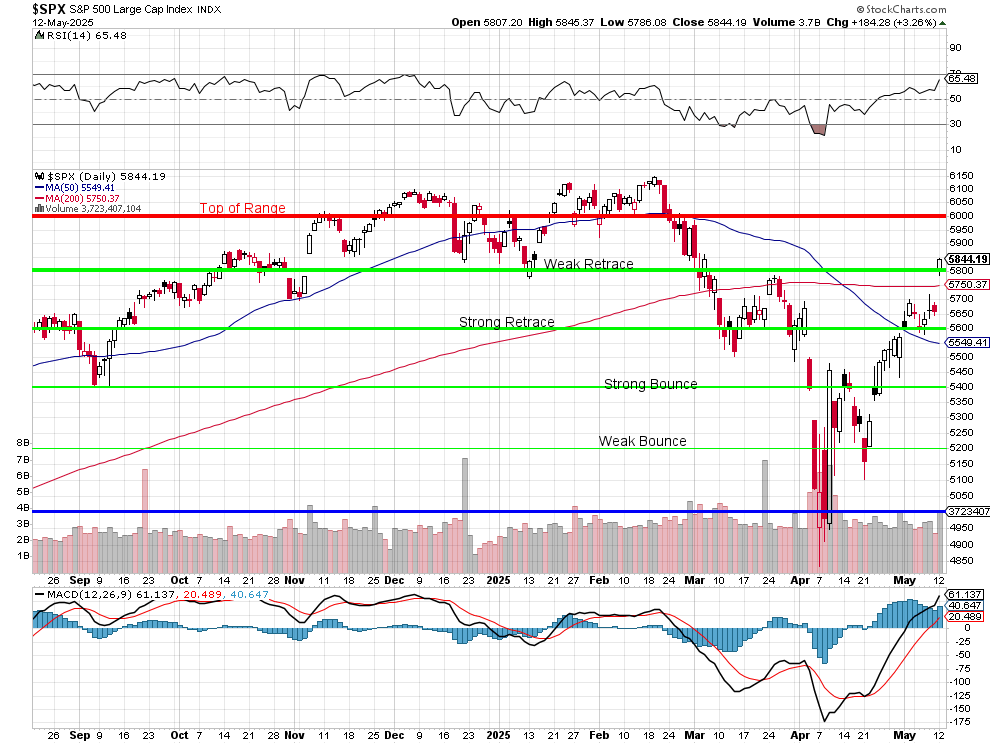

Last month I reiterated "Thank God for hedges" as the S&P 500 had bounced back to over our Strong Bounce Line at 5,400 - from all the way back at 5,000 (ignoring the spike below), which was the exact bottom of our predicted range. Our first round of buying (March 24th) had not gone well but we were far more confident on April 15th and we deployed a lot of our sidelined CASH!!! into first improving our existing positions and then adding dozens of new positions in what has turned out (so far) to be a PERFECT PIVOT!

Now we've sailed back to 5,844 - up another 444 (8.2%) from our bottom and we're over the Strong Retrace Line (5,800) - as if the whole sell-off had been just a bad dream. This is, of course, what hedging is all about - despite the 20% drop in the S&P, we were able to maintain our longs (less the 1/3 we cut at the Top as a strategy to raise CASH!!!) and then we were able to go shopping while things were on sale BECAUSE we had CASH!!!

On April 15th, we were worried that "With looming Tariffs (90 days), a Stagnant Economy, Inflation and uncertain Corporate Earnings – I can’t say I’m enthusiastic about getting back to our highs" but we also felt we had proven our lows (5,000) and that plus our ability to hedge (battle-tested) against a 20% drop (which we no longer felt would happen) allowed us to have the confidence to get more bullish - even with the Political and Economic uncertainty.

Over the past 30 days, we've seen enough earnings reports to be less worried about Corporate Earnings and, at least for 90 days, the Tariffs are off the table (for now) and that SHOULD alleviate the Stagnant Economy, which leaves us with Inflation - which the Fed seems determined to fight - no wonder the market rallied back!