How crazy is this?

How crazy is this?

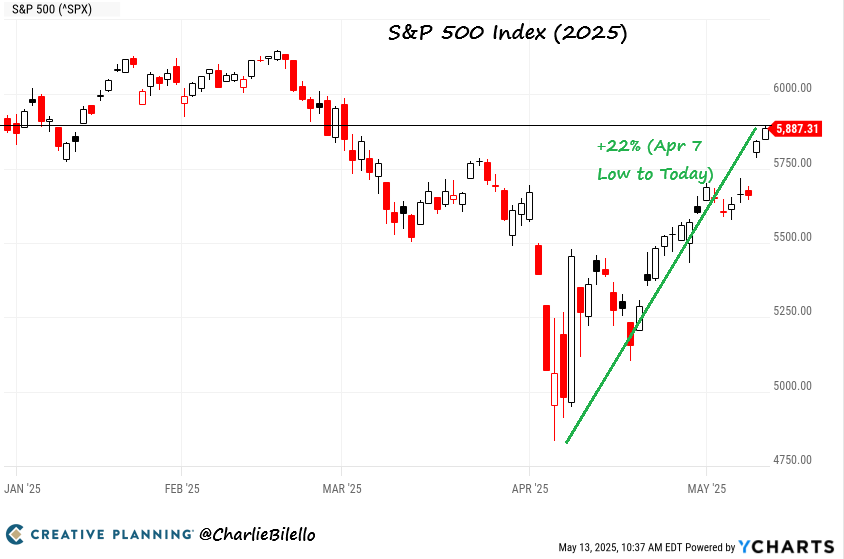

Donald Trump has proven you can stab yourself, then take out the knife and everything is fine – right? Well, not really but if feels good to thing so and that is certainly what traders are thinking as we put our heads back in the sand and pretend a pause in tariffs is the same thing as no tariffs – even though there ARE, IN FACT, tariffs that are just now starting to take effect in Q2.

The market’s euphoric reaction to the U.S.-China tariff reduction agreement announced Monday perfectly illustrates this cognitive dissonance. Global stocks rallied and Wall Street analysts quickly pivoted from recession warnings to optimistic forecasts. JPMorgan’s Michael Feroli, who had been among the first to predict a recession based on Trump’s tariff policies, has now scaled back his recession probability to “still elevated, but below 50%“.

But let’s examine what actually happened: The U.S. merely reduced its ADDITIONAL tariffs on Chinese imports from 145% to 30% (PLUS 30%!) for a 90-day period, while China dropped its retaliatory tariffs from 125% to 10% (PLUS 10%). This isn’t elimination – it’s a temporary reduction that still leaves SIGNIFICANT trade barriers in place.

But let’s examine what actually happened: The U.S. merely reduced its ADDITIONAL tariffs on Chinese imports from 145% to 30% (PLUS 30%!) for a 90-day period, while China dropped its retaliatory tariffs from 125% to 10% (PLUS 10%). This isn’t elimination – it’s a temporary reduction that still leaves SIGNIFICANT trade barriers in place.

According to Yale’s Budget Lab, even after these reductions, Consumers face an overall average effective tariff rate of 17.8% – the highest since 1934. The current tariff structure is still projected to increase consumer prices by 1.7% in the short run, equivalent to an average household loss of $2,800 annually. For households at the bottom of the income distribution, that’s a $1,300 annual hit.

Analysts are treating this as a “dream scenario,” with Wedbush’s Dan Ives suggesting this is “clearly just the beginning of broader and more comprehensive discussions“. But we’ve seen this movie before – temporary Trade Truces that fail to resolve the underlying FUNDAMENTAL issues.

Meanwhile, Q1 Earnings Reports from major Financial Institutions show mixed signals. While JPMorgan (JPM), Morgan Stanley (MS), and BlackRock (BLK) posted strong results with significant YoY revenue growth (8.0%, 17.2%, and 11.6% respectively), Wells Fargo (WFC) reported a 3.4% revenue decline. These numbers largely reflect pre-tariff economic conditions, NOT the environment we’re entering.

The reduction in tariffs has indeed lowered the estimated effective U.S. tariff rate from approximately 24% to 14%, saving consumers about $300 in “tax“.BUT, make no mistake, this is still a tax increase compared to pre-2025 levels – one that disproportionately impacts low-income households!

The reduction in tariffs has indeed lowered the estimated effective U.S. tariff rate from approximately 24% to 14%, saving consumers about $300 in “tax“.BUT, make no mistake, this is still a tax increase compared to pre-2025 levels – one that disproportionately impacts low-income households!

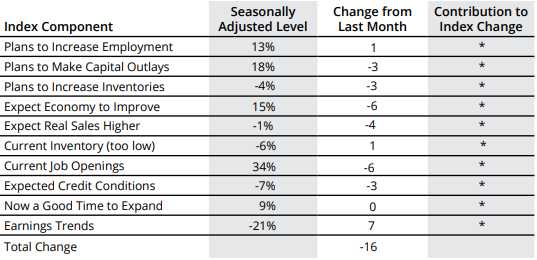

So while Leading Economorons at Goldman Sachs (GS), Barclays (BCS), and elsewhere are scaling back Recession calls and raising GDP forecasts, the Fundamental issues remain unaddressed. This 90-day window simply postpones the reckoning, and Businesses still face significant uncertainty about future trade policy. In fact, just yesterday, we got a Small Business Optimism Report for April that came in at 95.8, down from 97.4 in March with a whopping 34% of Business Owners reporting job opening that could not be filled – a very strong indication of more wage inflation down the road.

The market’s relief rally reflects hope over substance. We are NOT out of the woods – we’ve just seen a few breadcrumbs along the path, with the same destination (a witch who will eat us) potentially waiting for us three months down the road, instead of this month, as feared.

Speaking of bullshit – you’ve gotta love Trump and Musk competing for who can tell the tallest tales in the Middle East and I’m not even going to begin to get into Trump’s nonsense or that plane thing – it’s just too much, really but Musk turned his speaking opportunity into a Tesla Robot commercial, intimating TSLA had a $5Tn opportunity when, in fact, the Morgan Stanley report he referred to called it a $3Tn opportunity and that is for ALL manufacturers in the World – not just Tesla.

Speaking of bullshit – you’ve gotta love Trump and Musk competing for who can tell the tallest tales in the Middle East and I’m not even going to begin to get into Trump’s nonsense or that plane thing – it’s just too much, really but Musk turned his speaking opportunity into a Tesla Robot commercial, intimating TSLA had a $5Tn opportunity when, in fact, the Morgan Stanley report he referred to called it a $3Tn opportunity and that is for ALL manufacturers in the World – not just Tesla.

This is what’s wrong with, well EVERYTHING, these days – FACTS are so out of favor that they don’t even matter. The CEO of TSLA gets up at a conference and exaggerates the global market potential by 66% and then indicates he expects to get 100% of that market and he acts like this is all going to happen NEXT QUARTER – as opposed to 2050, which was indicated in the actual study that no one read – because reading too is no longer a thing!

Also riding in Trump’s Middle East tailwind is NVIDIA (NVDA), who are getting permission to sell chips to countries who were previously banned as Trump keeps making exceptions for them and, after all, as the President claims, NVDA has “99% of the chip market.” Again, facts are completely meaningless – even if they check, no one is held accountable – that’s just the way things are now – lie back and enjoy it…

In reality, Huawei (boo! hiss!) is doing very well, again, as the US tried to derail them in 2019 by accusing them of spying but the company is now supplying the Ascent AI Chips to Chinese companies and Deep Seek is now the World’s second-most used AI system and Huawei’s Mate 60 Phone is running neck and neck with the iPhone in China.

Huawei’s ambitions now reach beyond hardware. Its homegrown operating system HarmonyOS — aimed at getting around a US ban on the use of Google’s Android — has connected more than 800 million devices. It’s also expanded into electric vehicles, clinching patent deals with top auto brands including Mercedes-Benz and BMW.

Trump’s attempts to rein Huawei in might have worked if he didn’t also cut off China’s access to US-made chips, which forced China to consider Huawei a critical infrastructure company – favoring them for Government contracts and granting them research Dollars (or Yuan) and stimulus money to make sure China had a steady supply of home-grown chips.

As we’ve been pointing out – all of these moves have consequences and it’s an utter tragedy if the Commander in Chief doesn’t understand the bigger picture…