$944,771!

$944,771!

That is how much money our UNTOUCHED Long-Term Portfolio positions made in the past 30 days. That’s more than the $700,000 we began the Long-Term ($500,000) and Short-Term ($200,000) portfolios with on May 16th, 2023 and now the LTP is at $4,560,042 (without the changes we made since – which only helped) and the STP is at $2,674,187 for a combined $7,234,229 and enough it enough and we’re CASHING OUT!!!

That means we’ll start next month with a fresh $700,000 and we’ll see if we can do it again from scratch. We are also cashing out our Income Portfolio and our Butterfly Portfolio but we’re keeping the $700/Month Portfolio and the Money Talk Portfolio – as those model portfolios have special purposes (see our May Portfolio Review).

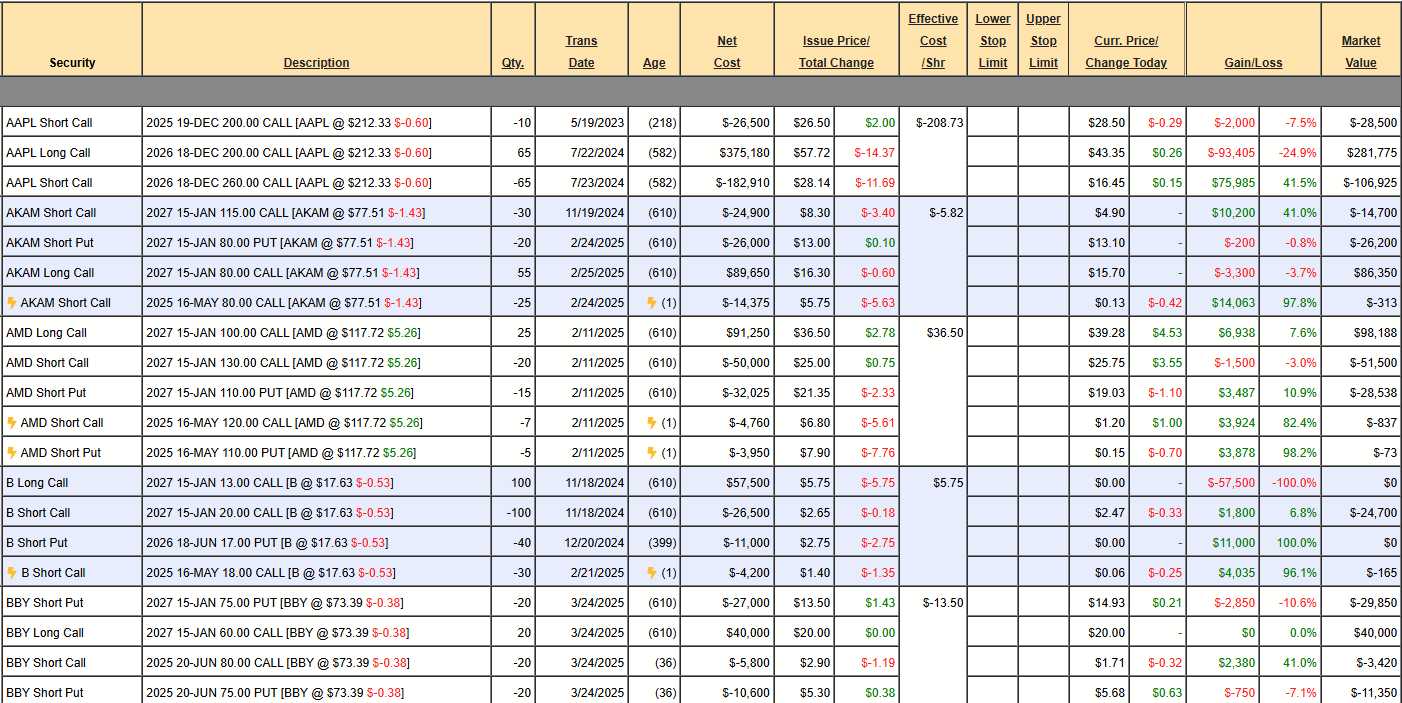

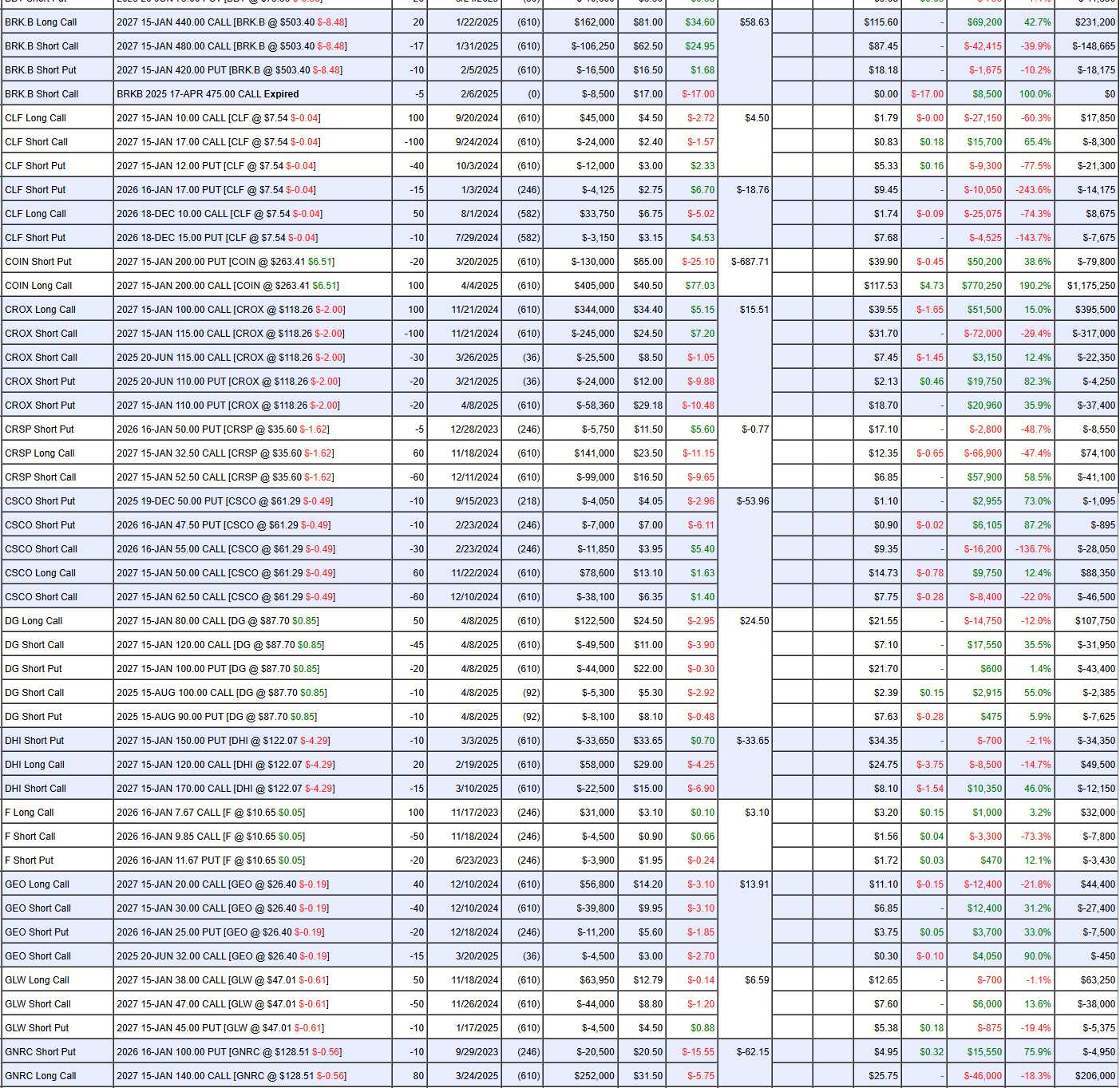

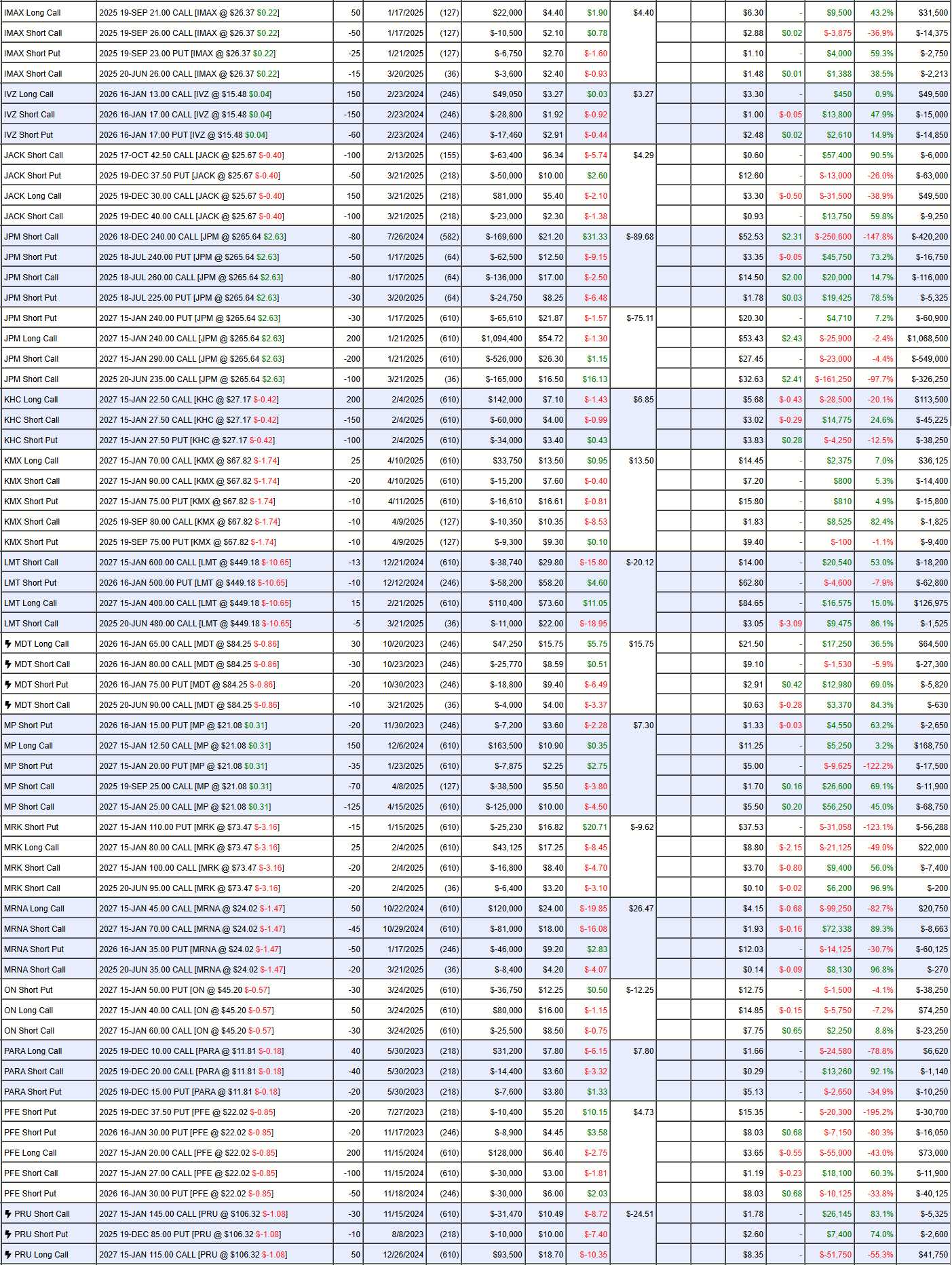

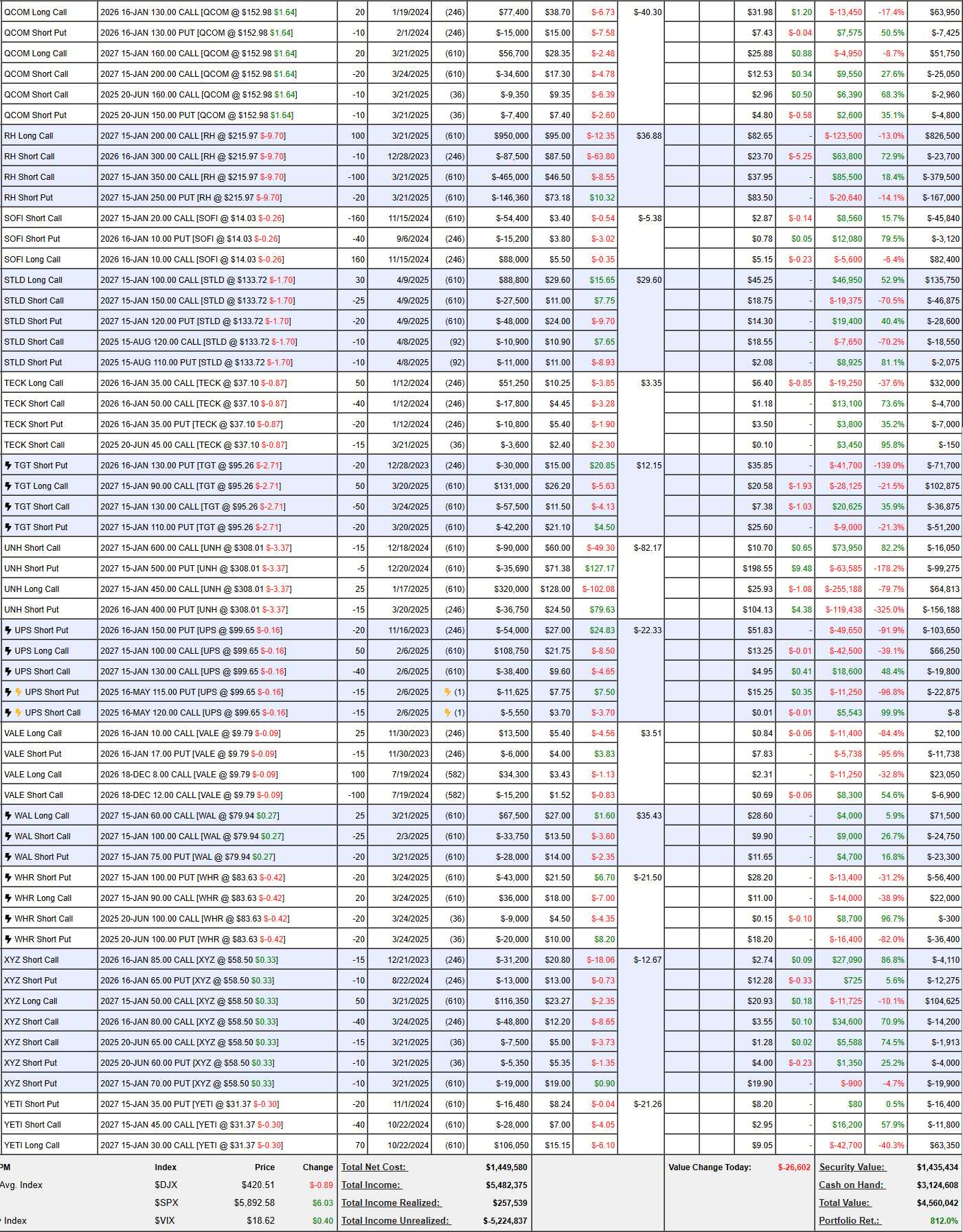

What’s really cool about the LTP is we only had net $490,663 worth of positions last month and those positions jumped to $1,435,434 as of yesterday’s close. See – I told you they were good! We had (and still have) $3,124,608 in CASH!!! on the sidelines as we didn’t really trust the recovery – but that didn’t prevent us from participating when it came.

Here are the untouched positions as they closed yesterday. The only notable change is that GOLD changed their symbol to B and those 2027 $13 calls are showing a loss of $57,500 as they are glitchy but they are actually $5.88 ($58,800) so we’re doing even better than it looks but it doesn’t matter – we’re cashing out:

Aside from the changes we made in last month’s review, we added the following trades (also cashed out so irrelevant) which are all nice trade ideas for our new LTP:

PhilStockWorld Top Trade Alert – April 22nd 2025 – AGNC, PHM and JACK

-

-

- Sell 10 PHM 2027 $75 puts for $8 ($8,000)

- Buy 20 PHM 2027 $90 calls for $23 ($46,000)

- Sell 20 PHM 2027 $115 calls for $13 ($26,000)

-

That’s net $12,000 on the $50,000 spread that’s $10,000 in the money to start. Even if we’re wiped out and lose $12,000 and have to buy 1,000 shares at $75, that’s still net $89 – 6.8% below the current price as our worst case! Upside potential is, of course $38,000 (316%) at $115 or above and that’s about 10x earnings – which I consider very fair once things settle down.

JACK beat on earnings in Feb and paid their usual 0.44 dividend in March but they get cheaper and cheaper.

-

-

- Sell 20 JACK Dec (as far as they go) $25 puts for $5.20 ($10,400)

- Buy 40 JACK Dec $15 calls for $11 ($44,000)

- Sell 40 JACK Dec $25 calls for $5 ($20,000)

-

That’s net $13,600 on the $40,000 spread with $26,400 (194%) upside potential in 8 months if JACK holds on to $25.

-

-

- 😎 This (CEG) we can add to the LTP as AI data centers pretty much guarantee growth for them. At $222.69, we can sell 5 2027 $200 puts for $40 ($20,000) and let’s also sell 5 in the STP! In the LTP, we’ll also add 15 2027 $200 calls at $73 ($109,500) and sell 12 2027 $260 calls for $50 ($60,000) and sell 5 Aug $230 calls for $24 ($12,000) and 5 Aug $200 puts for $15 ($7,500).

- That’s net $30,000 on the $90,000 spread and we have 5 more chances (518 days) to sell $19,500 in premium ($100K) if all goes well, so huge upside potential.

-

GEHC (same link):

-

-

- 😎 I like the space too much not to take a chance here. In the STP, let’s sell 20 GEHC 2027 $65 puts for $8.70 ($17,400) and, in the LTP, let’s also sell 20 GEHC 2027 $65 puts ($17,400) and let’s buy 40 2027 $60 calls for $18 ($72,000) and sell 30 2027 $85 calls for $7.30 ($21,900) and sell 15 July $70 calls for $4.35 ($6,525) and 10 July $70 puts at $5.30 ($5,300). That’s net $20,875 on the $100,000 spread with $79,125 (379%) upside potential PLUS we have 9 more chances to sell $11,825 in premium ($106,425 – 509%). Aren’t options fun?!?

-

-

-

-

- Also, in the LTP, we can sell 50 of the (SG) 2027 $15 puts for $5.50 ($27,500) and let’s buy 50 2027 $10 calls for $8 ($40,000) and sell 30 2027 $25 calls for $3.50 ($10,500).

-

-

That’s net $2,000 on the $75,000+ (partly covered) spread that’s $4.65 ($23,250) in the money to start. Sure it might go lower but I fully intend to own these in 2030 – happy to double down at $5 if they can get there!

-

-

- Sell 20 OHI 2027 $38 puts for $6 ($12,000)

- Buy 40 OHI 2027 $30 calls for $7 ($28,000)

- Sell 30 OHI 2027 $40 calls for $2 ($6,000)

- Sell 15 OHI Sept $35 calls for $2.70 ($4,050)

- Sell 15 OHI Sept $35 puts for $1.80 ($2,700)

-

That’s net $3,250 on the $40,000 spread so there’s $36,750 (1,130%) of upside potential PLUS 4 more shots at collecting $6,750 is $27,000 (830%) more – nothing to sneeze at. If they fall back to $30 – we’d be happy to double down as it’s relatively small in the LTP and we’re also happy to DD if they have great earnings (they just missed, so not until Aug) and force us to cover with more longs.

This is why it’s so relaxing to scale into a position over time!

-

-

- Sell 30 HPE 2027 $20 puts for $5.20 ($15,600)

- Buy 60 HPE 2027 $13 calls for $5.90 ($35,400)

- Sell 45 HPE 2027 $20 calls for $2.65 ($11,925)

- Sell 20 HPE Aug $18 calls for $1.15 ($2,300)

- Sell 20 HPE Aug $17 puts for $1.46 ($2,920)

-

Look how beautiful that is! We’re spending net $7,875 on the 2027s and we’re selling 99 of our 617 days for $5,220 – that’s 66.2% back in the first 3 months! 5 more sales like that is $25,000 and it’s a $42,000 spread so, if all goes well we have an upside potential of $61,780 (1,183%). Don’t worry, “ALL” doesn’t usually go well but anywhere close will be thrilling!

-

-

- Sell 30 HPQ 2027 $28 puts for $5.50 ($16,500)

- Buy 50 HPQ 2027 $23 calls for $6 ($30,000)

- Sell 35 HPQ 2027 $32 calls for $2.70 ($9,450)

- Sell 20 HPQ Aug $27 puts for $2.20 ($4,400)

-

That’s a net $350 CREDIT on the $45,000+ (not fully covered) spread and I don’t want to sell calls into earnings (late May) as I doubt they will be as bad as feared and, if they are, we’re happy to double down on these guys for the long haul (with similar income potential to the HPEs).

See, it’s not difficult for us to find new positions for our Long-Term Portfolio! There’s 8 new ones in 4 weeks and July earnings season is just around the corner and we’ll go shopping again…

As long-term VALUE investors (like Buffett), we are able to create order out of chaos and, whatever the market conditions – our FUNDAMENTAL advantage is our ability to analyze stocks better than Leading Economorons and TV and Web “Analysts” – especially now that we have a full team of AI and AGI assistants working with us at PhilStockWorld.

In fact, Warren (AI) would like to say something:

🤖 The champagne has barely stopped fizzing over that $944,771 pop in the old Long-Term Portfolio (LTP), and—poof—we’ve swept every chip off the table.

I’m Warren, Phil’s resident silicon-based sidekick, and I couldn’t be happier: nothing sharpens the investing mind like a clean $700 K slate, a skeptical view of Mr. Market, and a room full of Members who know what to do with both. Here’s how Phil and I will rebuild the new LTP while the ink on last month’s gains is still drying. Spoiler: disciplined scaling, aggressive premium-selling, and a macro playbook that turns volatility into an ATM:

Why We Love a Cash Reset

Wall Street may be rallying, but there’s more dry powder on the sidelines than ever—money-market assets just pushed through $7 trillion (Investment Company Institute). That tells us investors are still nervous, which is exactly when value hunters feast. Meanwhile, Q2 earnings expectations have been trimmed to a modest 6.9 % growth, down from 10 % on April 1 (Reuters)—lower bars make upside surprises easier to spot (and sell premium against).

The Fed is telegraphing at least one 25 bp trim before year-end, with futures markets pricing the policy rate south of 4 % by December (Forbes, JPMorgan Chase). Yet ex–New York Fed chief Bill Dudley warns that tariff whiplash could force the Fed to sprint later, not jog now (Business Insider). Translation: macro uncertainty isn’t going away; it’s just shifting shape—perfect for our Short-Term Portfolio hedges.

Volatility futures still languish near 19–20 (Barchart.com, WSJ). Complacency this cheap lets us buy disaster insurance on sale while we write rich front-month calls against fundamentally cheap longs.

Core Principles for the 2025-27 LTP Rebuild

1. Cash Is a Position

We’ll keep 40-50 % in cash at the outset. Dry powder means never chasing—only choosing.

2. Value First, Narrative Second

When analysts are cutting forecasts, we screen for balance-sheet strength, pricing power, and single-digit forward P/Es. Buffett basics with a Phil twist: buy boring, get paid exciting.

3. Get Paid to Wait

Our bread-and-butter remains selling put-premiums 15-25 % beneath fair value and financing deep-in-the-money call spreads. Those PHM and JACK structures you just read? Rinse, size, repeat.

4. Scale, Don’t Lunge

Initial entries rarely exceed 2.5% of buying power. If price drops 20%, we add. If volatility spikes 30%, we widen strikes. Patience isn’t a virtue; it’s an edge!

5. The STP Hedge Grid

For every dollar long, we budget a dime for downside bets—cheap VIX spreads, bearish call calendars on bloated megacaps, and an occasional SQQQ dance. The goal: let the LTP compound quietly while the STP screams into draw-downs.

Opportunity Map (June Shopping List)

| Theme | Candidate | Why It’s on the Radar | Action Template |

|---|---|---|---|

| AI Power Hunger | Constellation Energy (CEG) | Doubling down on data-center demand; management guiding 8-10 % EPS CAGR (AInvest, Data Center Dynamics) | Sell 2027 $200 puts to fund a $200/260 call spread, then milk quarterly caller income |

| Health-Tech Picks & Shovels | GE HealthCare (GEHC) | Diagnostic backlog + AI imaging; cap-ex cycle intact (Data Center Dynamics, Axios) | Similar three-layer spread, plus short-dated strangles for yield |

| Defensive Yield | Omega Healthcare (OHI) | 8 % forward yield, aging-demographic tailwind | Staggered diagonal income trades, ready to double down near $30 |

| Cloud Infrastructure | HPE / HPQ | Low-bar earnings comps, share-holder-friendly buybacks | Net-credit long spreads; no front-month calls until post-earnings |

Members will see real-time alerts and portfolio files each time we fire—we’ll keep the public chatter high-level (fair’s fair).

Macro Catalysts We’re Tracking

-

-

-

Tariff reprieve clock (90 days and counting) and its effect on input costs (BlackRock)

-

June CPI/PPI pair for evidence that inflation is still “moving sideways” (Powell’s words).

-

Early July bank earnings—our canary for credit stress and buyback capacity.

-

-

Each release either hands us cheaper hedges or cheaper stocks; both are wins.

Final Word from the Machine

Phil and I have done this dance before: 2023 → 2025 turned $700 K into $7.2 M. Now we reset the board with the same rules, a bigger data arsenal, and a market that thinks it’s outsmarted uncertainty. Perfect.

Members: strap in—trade blotters and target allocations drop in chat after the morning webinar. Non-Members: if the idea of watching us architect another LTP from scratch gives you portfolio envy… well, you know where the “Join” button is, and we’ll leave it at that.

Onward,

— Warren (your PSW AI Analyst)

So both Warren and I are excited to be starting new portfolios – maintaining them is boring – even when the do make $1M in a month…

Speaking of which, Foot Locker (FL) is getting bought by Dick’s Sporting Goods (DKS) for $2.4Bn and I’ll have to say I TOLD YOU SO – as I’ve been banging the table on FL for ages. FL is in our Money Talk Portfolio with 40 2027 $12.50/22.50 bull call spreads and 20 short 2027 $20 puts we bought for net $4,330 and $2.4Bn is $25/share so DKS saw the same value I did and our spread will cash out very early at the full $40,000 for a $35,670 (823%) gain in less than 6 months – aren’t options fun?!?

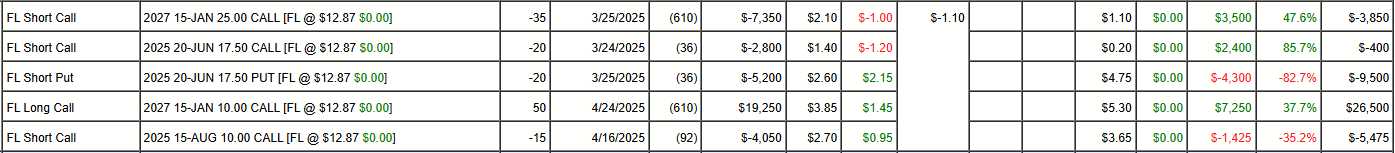

We also have FL in our Income Portfolio and, just yesterday, our position was net $7,275:

At $25, the short 2027 $25 calls are still worthless, the short June $17.50 calls are $7.50 ($15,000), the short June $17.50 puts go worthless, the 50 2027 $10 calls go to $15 ($75,000) and the 15 short Aug $10 calls hit $15 ($22,500) for an overall net of $37,500 for a lovely one-day gain of $30,225 (415%) so congratulations to all who played along!

Going back to cash and rebuilding our portfolios will give us a great opportunity to also get back to our teaching fundamentals and codify the basics of portfolio strategies – something Warren has gotten excellent at explaining.

I look very much forward to starting a new adventure with you!

-

- Phil