Call US irresponsible:

That’s what Moody’s did Friday evening as they downgraded the US Credit Rating to Aa1 from Aaa, which doesn’t sound like much but it shot the 10-year note rates back over 4.5% with the 30-Year now topping 5% and even the 2-year is now 4% and that’s 4% of $37 TRILLION (and rapidly climbing), which is $1.48 TRILLION per year in interest alone JUST to maintain our debt so the real question we have for Moody’s is “what took you so long?”

The Moody’s downgrade marks a historic shift as it’s the final major rating agency to strip America of its pristine credit rating, ending a 108-year run of AAA ratings that began in 1917 – surviving the Great Depression, two World Wars, Nixon, Ford, the 2008 Financial Crisis, Covid and the rest of Trump’s first term – but NOT his second – NOT with this Congress!

Well, it wasn’t all Trump – he’s just the last straw as the S&P downgraded the US way back in 2011 ($14Tn) and Fitch following suit in 2023 ($33Tn) – this just completes the trifecta of rating agencies acknowledging what markets have long known anyway: America’s fiscal house is NOT in order.

Well, it wasn’t all Trump – he’s just the last straw as the S&P downgraded the US way back in 2011 ($14Tn) and Fitch following suit in 2023 ($33Tn) – this just completes the trifecta of rating agencies acknowledging what markets have long known anyway: America’s fiscal house is NOT in order.

The timing is particularly damning as it comes just days after the Trump Administration pushed forward with expansive tax cut proposals that could add between $2.9Tn and $5.2Tn to the National Debt over the next decade and even that is a gross underestimation made using very transparent number games by the GOP. This isn’t just fiscal irresponsibility – it’s fiscal recklessness in the face of already dire warnings and this joke of a budget was the last straw for Moody’s.

While politicians may downplay the significance, this downgrade represents a fundamental shift in how global investors perceive US debt. The immediate market reaction – futures down nearly 1% and Treasury yields spiking – is just the beginning. Here’s what’s really happening:

-

-

Risk Premium Expansion: Investors are now demanding higher yields across the entire Treasury curve to compensate for increased risk, effectively raising the floor on ALL US borrowing costs.

-

Dollar Vulnerability: The downgrade accelerates the ongoing reassessment of the Dollar’s role as the world’s reserve currency. As Kyle Rodda at Capital.com noted, this “speaks to a level of market risk in US Debt” that could compromise the value of US bonds if Economic Growth can’t keep pace with government liabilities (and how can it possibly when the Government is recklessly slashing spending by simply shoveling the burdens back to the states?).

-

Feedback Loop: Higher borrowing costs mean more Government spending on Interest, which WORSENS deficits, which leads to more Debt, which can trigger further downgrades – a vicious cycle that becomes increasingly difficult to escape (see Greece).

-

For average Americans, this isn’t just an abstract financial event – it’s going to hit home in very tangible ways:

-

-

Mortgage Rate Pressure: With the 30-Year Treasury yield now above 5%, mortgage rates will face upward pressure, potentially dampening the housing market just as it was showing signs of stability.

-

Credit Card and Auto Loan Costs: All Consumer lending is benchmarked against Treasury rates, meaning higher costs for everything from credit cards to auto loans.

-

Retirement Fund Vulnerability: Many retirement funds have significant Treasury holdings, and the value of these assets will decline as rates rise, affecting retirement security for millions – which has already been happening since Trump’s first term.

-

Job Market Ripple Effects: As borrowing costs increase across the Economy, business expansion slows, potentially leading to hiring freezes or layoffs if conditions deteriorate further.

-

What’s truly remarkable is how predictable this outcome was. Moody’s had placed the US on negative watch since November of 2023, giving policymakers ample time to address fiscal concerns. Instead, Republicans pushed tax cuts without offsetting spending reductions and, in fact, are ACCELERATING the debt with more massive tax cuts that have been PROVEN to help NOBODY – other than the top 0.01% (16,500 people out of 165M taxpayers).

The Trump Administration’s focus on pushing through tax cuts that could add Trillions to the deficit demonstrates a prioritization of political wins over fiscal sustainability that is – UNsustainable! Rather than addressing the substantive issues, the White House response has been to attack the messenger, with communications director Steven Cheung taking to social media to now criticize Moody’s chief economist Mark Zandi as a political adversary – and they were the last ones on his side!

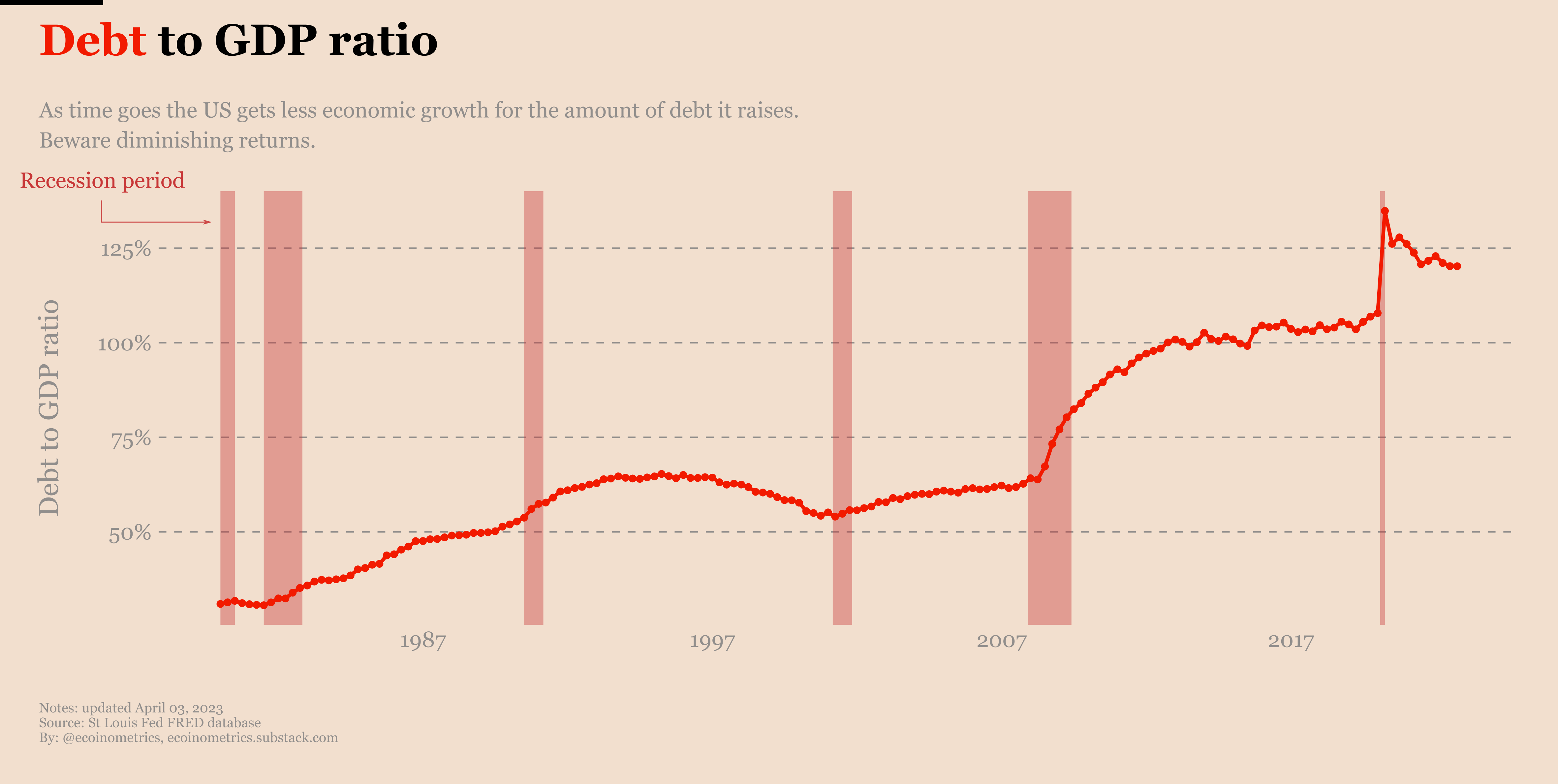

What we’re witnessing may indeed be an “Emperor has no clothes” moment for US fiscal policy. Moody’s projects that without significant course correction, Federal Debt could grow from 98% of GDP in 2024 to approximately 134% by 2035, with interest payments potentially consuming 30% of federal revenues by 2035 – up from just 9% in 2021.

What we’re witnessing may indeed be an “Emperor has no clothes” moment for US fiscal policy. Moody’s projects that without significant course correction, Federal Debt could grow from 98% of GDP in 2024 to approximately 134% by 2035, with interest payments potentially consuming 30% of federal revenues by 2035 – up from just 9% in 2021.

This isn’t sustainable by any measure, and markets are beginning to price in this reality. The question isn’t whether the emperor is naked – it’s how much longer the financial markets will pretend not to notice. The only reason our Debt to GDP ratio is not over 130% now is because the projections for GDP have been recalculated substantially higher – by the same Government that is blowing up the Debt – it’s a fantasy and what happens if our GDP contracts???

For investors, this new reality demands a fundamental reassessment of portfolio allocations. Treasury securities can no longer be considered “risk-free” in the traditional sense, and the ripple effects through equity markets, particularly in rate sensitive sectors (Real Estate, Utilities, Consumer Discretionary, Tech…) could be substantial.

Without meaningful fiscal reform we are likely to see even more market volatility as investors increasingly question America’s ability to put its Financial House in order. The downgrade isn’t just a symbolic blow – it’s the market equivalent of a doctor delivering a serious diagnosis. The patient can either heed the warning and make difficult lifestyle changes, or continue down a path that leads to progressively worse outcomes.

So far, Team Trump seems intent on choosing the latter.

None of this matters to us as we wisely cashed out our Member Portfolios on Thursday, last week as the market topped out again and, if it wasn’t Moody’s, it would have been something else as we were clearly back in correction territory and, this time, we decided NOT to ride it back down.

We already put out a Top Trade Alert on Barrick Mining (B) on Friday so it’s not like we don’t like anything – just most things. Financial Services and Energy should have a good time while the market collapses but not so much Energy if it triggers a global Recession, which we haven’t really had since 2009 (not counting early Covid) – so we’re overdue anyway.

Yeah, remember 2008 when Bush was so bad even moderate Republicans voted for Barack Hussein Obama with 69M votes vs 59M for McCain and Palin. Palin was a warning shot that the GOP could care less whether or not their candidates were actually QUALIFIED for office – as long as they believed the (far) RIGHT things.

Yeah, remember 2008 when Bush was so bad even moderate Republicans voted for Barack Hussein Obama with 69M votes vs 59M for McCain and Palin. Palin was a warning shot that the GOP could care less whether or not their candidates were actually QUALIFIED for office – as long as they believed the (far) RIGHT things.

The electoral vote for Obama was 365 to 173 and Romney/Ryan got the GOP to 61M votes and 206 electoral to 332 and 66M for Obama. 4 years later, Hillary Clinton and (come on, you can remember….) Tim Kaine held Obama’s 66M votes and Trump only got 63M votes but they were in the right places and he won the election 304 to 277. Trump was so bad we put Biden in charge with (drumroll, please) 81M votes but only 306 electoral vote to Trump’s 74M votes and 232 electoral in an election Trump claimed was stolen somehow.

Last year, Trump came back with 77M votes to Harris’ 75M, which Trump calls a “mandate” and he has said it often enough that even the Democrats believe it. Electorally, Trump got 312 votes to Hariss’ 226 – FAR less than Obama had in 2008 and 20 less than Trump got in 2016 and Trump got barely more electoral than he had in 2016 – when he served one term and was tossed out of office with 81M votes against.

Last year, Trump came back with 77M votes to Harris’ 75M, which Trump calls a “mandate” and he has said it often enough that even the Democrats believe it. Electorally, Trump got 312 votes to Hariss’ 226 – FAR less than Obama had in 2008 and 20 less than Trump got in 2016 and Trump got barely more electoral than he had in 2016 – when he served one term and was tossed out of office with 81M votes against.

The point is, things change and the people are able to speak and all if all those factory jobs Trump promised the Rust Belt don’t materialize (especially if we, instead, have a Recession) – neither will all those states that swung his way in the last election – no matter who the GOP runs in 2028 – or 2026 for that matter. Why does this matter – because there’s another election in 18 months but funds have to be raised starting in 6 months so things can change very rapidly in America and we have to consider that for our long-term positioning.

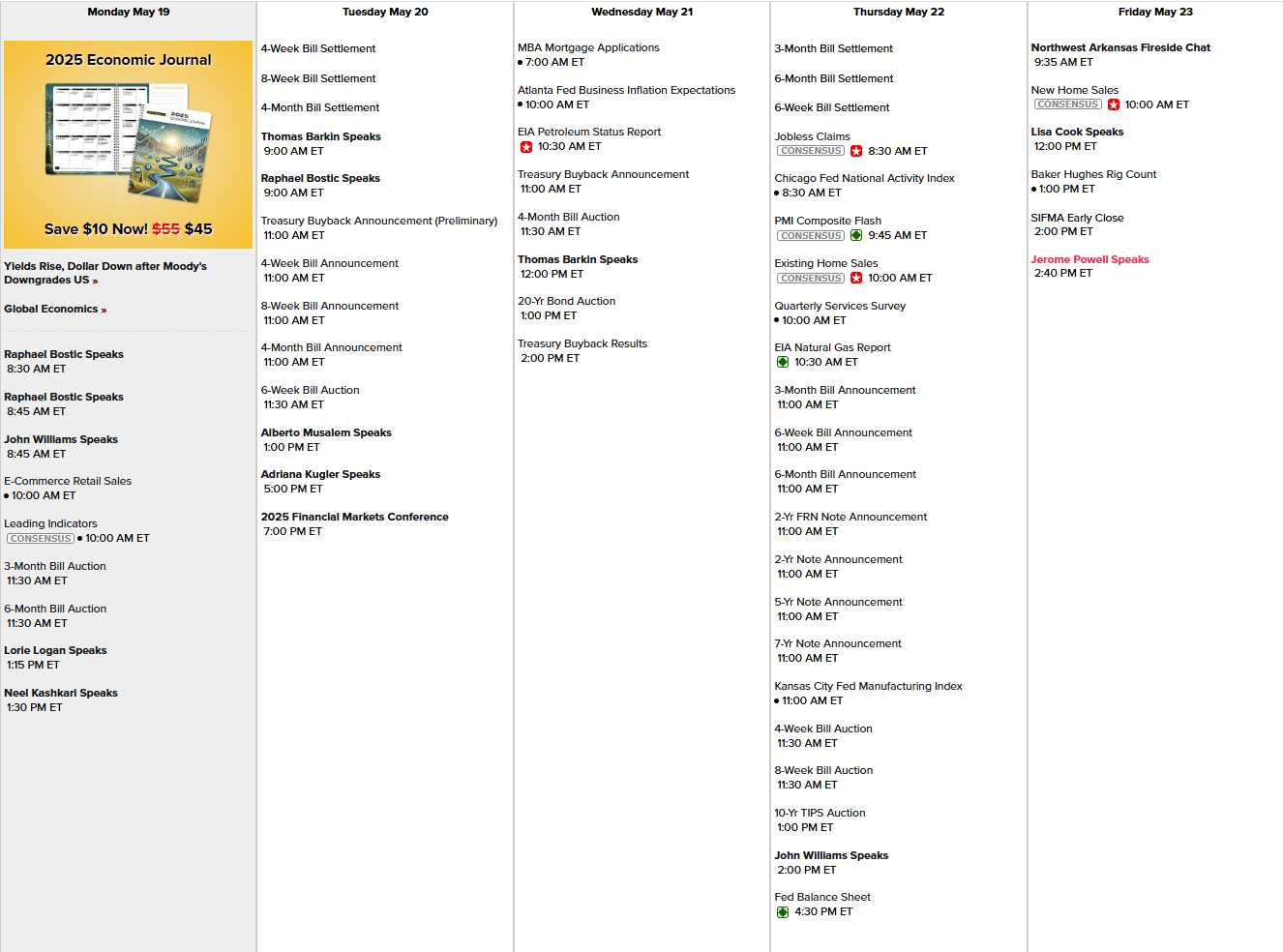

The Economic Calendar is busy this week starting with Leading Economic Indicators at 10 along with 5 Fed speeches today and 5 more tomorrow and then 3 more and Powell wrapping it up on Friday with lots and lots of Bond Auctions in a very scary week for note-selling. Nothing exciting tomorrow, Atlanta Fed Wednesday, Chicago Fed Thursday with Existing Home Sales (anemic) and New Home Sales Friday so pretty much all about the Fed and the auctions this week.

And, of course, earnings ain’t over until they’re over and I see HD, PANW, TGT, LOW, BIDU, TJX, MDT, SNOW, ZOOM, TD, WSM, INTU, ADSK, AMD, BJ and DECK coming up and we’ll see what they think about rising rates.

TSLA and the rest of the Mag 7 are NOT fans of higher rates as they are all spending 10s, even 100s of Billion on CapEx over the next few years. How TSLA ever got back to $350, I’ll never understand – I guess it’s more BS about self-driving and robots, which TSLA claims went from maybe a 12 at the last demo to 85 at the most recent video but where’s the live demo? I can make my dog breakdance with a $1.99 app so video clips don’t cut it, Elon…

Musk’s greatest enemy is math but, fortunately, the M in MAGA does not stand for Match so, like Mike Lindell (now nearly bankrupt after flashing in the pan), Elon has found believers who think a company that made 1,773,443 cars last year TOTAL – DOWN from 1,845,985 in 2022 is somehow going to have the bandwidth to crank out millions of self-driving taxis in the next few years.

But that’s not all the BS you have to swallow. You also have to believe the cars are safe, that the company won’t be sued out of existence for the accidents they will cause (and they WILL cause accidents) and that what, the company will eat the cost of the cars and make the money back over time? That’s a lot of maybes to get there.

Meanwhile, UBER has 5.4M drivers NOW and Lyft has 1.3M so TSLA is a few years away from competing on a vehicle level – even if the stop selling cars to consumers. Clearly you’re not going to wait 2-3x longer to get a TSLA even if it is cheaper but let’s say no driver means half the price for a ride – maybe, right?

But half the price for a ride means half the revenues TSLA is projecting and what if those cars take you on crazy routes that double your time or drop you off in the wrong place or don’t “see you” when they come to pick you up or run over your bags or your grandmother at the curb? What if they don’t “listen” to the officer at the airport when he tells them to get out of the way or if they don’t see the “danger” sign in front of a pothole or sinkhole?

TSLA’s plans expect YOU to use YOUR Tesla as a RoboTaxi and split the revenues with Elon but there’s no word on whether Elon will be at your house in the morning to help pick up the food, needles, used condoms and human excretions deposited overnight by your passengers or who would be responsible for damage or injury – I guess we’ll find out!