Wow, what a run!

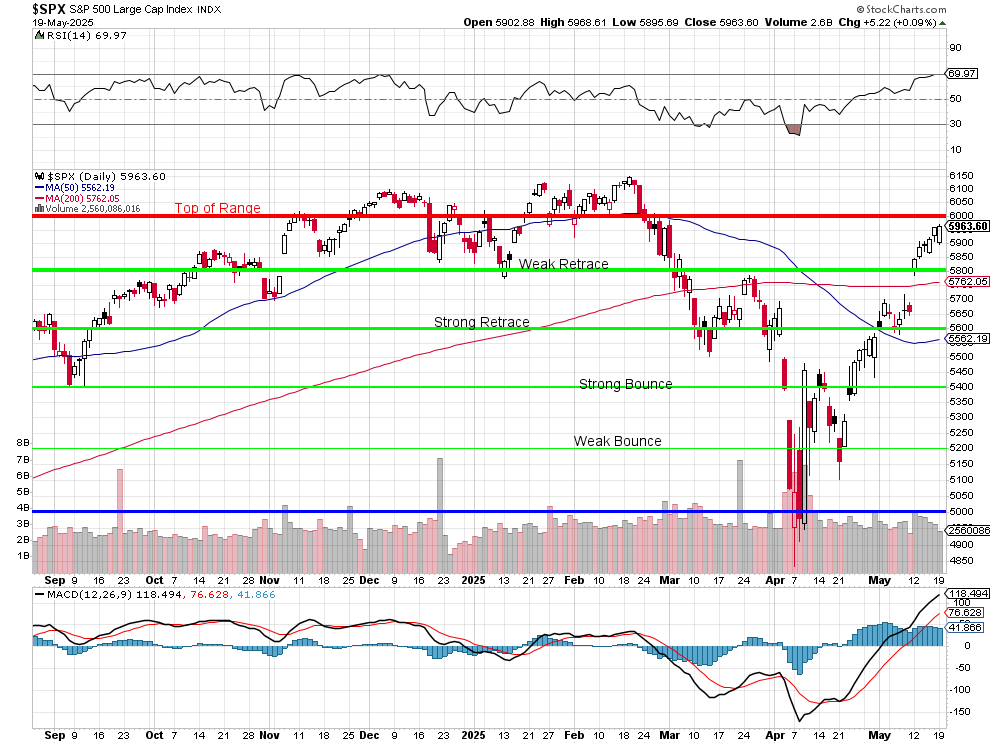

The S&P 500 overcame a poor start yesterday to close up for the 6th consecutive session, finishing at 5,963 – just a good day’s work below 6,000, which is where we were before Trump was elected in November. Since then, we’ve been as low as 4,835 on April 7th but have since regained 1,128 (23.3%) in the 6 weeks since. Or, from our “Must Hold” line at 5,000 – we’re up just under 20%.

Of course, April 2nd was “Liberation Day“, when investors were liberated from all of 2024’s market gains and, fortunately, we were very well-hedged for the event and our Members were able to ride out the dip and enjoy the crazy-swift recovery but NOW we’ve cashed out (last Thursday) for the following reasons:

The Tariff Landscape: Before and After “Liberation Day”

Before April 2nd, the U.S. already had significant tariffs in place from Trump’s first term, including Section 301 tariffs on China, Section 232 tariffs on Steel and Aluminum, and tariffs related to the “fentanyl national emergency” hype. These were substantial but targeted measures that markets had largely adjusted to over time.

Then came “Liberation Day“, when Trump unleashed what he called a “Discounted Reciprocal Tariff” system that sent markets into a tailspin. This included:

Then came “Liberation Day“, when Trump unleashed what he called a “Discounted Reciprocal Tariff” system that sent markets into a tailspin. This included:

-

-

A universal 10% tariff on ALL imports (effective April 5th)

-

Country-specific tariffs ranging from 20% for the EU to 54% for China (including previous tariffs)

-

A rapid escalation with China that saw combined tariffs skyrocket to 145% by April 9th

-

While Trump announced a 90-day pause on April 9th for most countries (reverting to the 10% Universal tariff), China remained under severe pressure until May 12th, when a temporary truce reduced Chinese tariffs from 145% to 30% for 90 days. This is still TRIPLE the pre-April rate and represents a significant cost increase that will inevitably flow through to Consumers.

Tariffs Still in Place Today

Despite the market’s euphoric recovery, several substantial tariffs remain in effect:

-

-

The universal 10% tariff on virtually all imports

-

The 30% tariff on Chinese goods (down from 145% but still significant)

-

The elimination of the de minimis exemption for Chinese goods, meaning even small shipments under $800 now face 30% additional tariffs

-

The 25% tariffs on imported vehicles and auto parts

-

Continued Section 301 and Section 232 tariffs from Trump’s first term

-

The White House has explicitly stated that the 10% Universal Tariff “continues to set a fair baseline that encourages domestic production” and “ensures that American trade policy supports American workers first“. In other words, these tariffs are intended to be permanent.

The Looming 90-Day Cliff

The Looming 90-Day Cliff

The market appears to be ignoring the temporary nature of the tariff reductions. Both the universal country-specific pause and the China-specific reduction are set to expire in mid-July and mid-August respectively. What happens then?

Analysts at Bloomberg surveyed 22 respondents who believe the 30% tariff on Chinese products will likely hold through late 2025. But there’s significant risk of further escalation if negotiations stall, especially as we approach the 2026 election cycle. Small business owner Luis Prior of Meavia Toys captured the sentiment perfectly: “It’s still a very unpredictable and unsettling situation… I don’t know what tomorrow holds“.

Companies Already Feeling the Pain

Despite the market’s recovery, numerous major companies have already warned about tariff impacts:

-

- Walmart announced it will raise prices on various products later this month and throughout summer, with CFO John David Rainey stating, “The pace and scale at which these prices are reaching us is somewhat unprecedented in history“.

- Ford informed dealers of price increases of up to $4,000 on three models manufactured in Mexico, with CEO Jim Farley warning of “Industry-wide price increases” by summer.

- General Motors projects a staggering $5 billion hit this year from tariffs.

- Apple expects $900 million in higher costs just in the current quarter.

- Nvidia is taking a $5.5 billion charge related to new export controls.

- Stanley Black & Decker has already raised prices on tools and products and plans to do so again later this year.

- Adidas warned that increased tariffs would inevitably lead to higher costs for American consumers.

- Procter & Gamble indicated it would likely raise prices on some items to offset tariff impacts.

- Hasbro noted that the toy manufacturer would “have to raise prices” though they would try to “minimize the impact“.

- Evenflo and Cybex have already increased prices between 10-40% for most of their products.

Even companies manufacturing in America aren’t immune. Avocado Green Mattress, which produces all its mattresses in Los Angeles, plans to increase prices by approximately 6% on mattresses and 7.5% on other products due to tariffs on imported materials like wool and cotton.

The Broader Economic Impact

The European Union has already scaled back its forecast for growth in 2025 by nearly half a percentage point due to trade uncertainties stemming from Trump’s tariffs. Germany, Europe’s largest economy, is now expected to experience stagnation as exports are projected to decline by 1.2% in 2025.

Domestically, economists at UBS anticipate Consumer Price Inflation could rise to approximately 3.3% over the coming year, up from 2.3% in April, assuming current tariff levels persist. This inflation spike could force the Fed to maintain higher interest rates for longer, potentially choking off US Economic Growth.

Why We Cashed Out

Aside from the fact that we’ve just had the best two years in PSW history, we got a real shock at how quickly the markets sold off so, recovering quickly back to our highs was an opportunity we didn’t want to ignore. While the market has recovered impressively, it appears to be ignoring several critical factors:

-

- The significant tariffs still in place are already forcing companies to raise prices

- The temporary nature of the tariff reductions creates ANOTHER market cliff risk in July/August

- The impact on Corporate Earnings is just beginning to materialize

- The potential for Inflation to accelerate could limit the Fed’s ability to cut rates

- The bond market is on the verge of a crisis – this was not an issue in April but it certainly is now

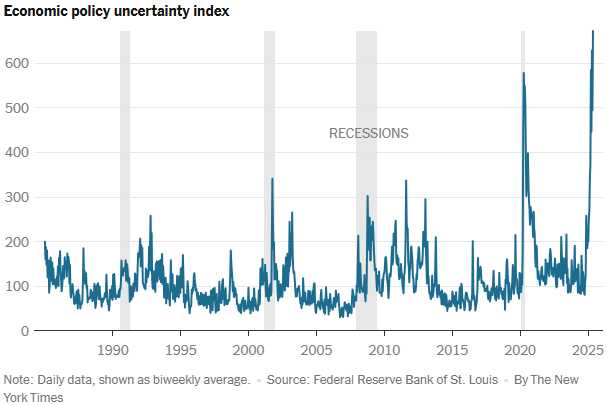

The Economic Policy Uncertainty Index reached an unprecedented high THIS month, surpassing levels seen during the 2008 Global Financial Crisis and the 2020 Coronavirus Pandemic. Research indicates such extreme uncertainty discourages businesses from hiring and investing.

This is NOT a healthy investing environment and, as we have often noted on the way up in this market – it’s a very low-volume rally and that means a high-volume sell-off is unlikely to find buyers and THAT is how markets can make very rapid 20-40% drops. Just because the Administration ratcheted things up to TERROR and has now toned it down to HORROR doesn’t mean it’s now safe to go back to the attic. As Jason Furman, Harvard Economics Professor and former Obama Advisor noted regarding Walmart’s price increases: “This isn’t Walmart exploiting a global scenario; this is Walmart being compelled to raise prices“ (see yesterday’s Member Chat for my explanation of WMT’s situation).

The market’s remarkable recovery has created an excellent opportunity to take profits and rebuild our hedges before the next round of tariff uncertainty hits. We’ll be looking for strategic re-entry points as the situation develops, but for now, prudence dictates moving to the sidelines while maintaining our core long-term positions with appropriate protection.