Where would we be if not for the weaker Dollar?

The best thing about flagrant fiscal irresponsibility is your cash becomes trash to the rest of the World and that makes US goods cheaper abroad (partially offsetting the trade war you started) and, best of all, since you buy stocks with Dollars – it makes your stocks LOOK more valuable – BECAUSE YOU NEED MORE DOLLARS TO BUY THEM!

In fact, this wonderful reciprocal illusion has worked so well that Investors THINK stocks have rebounded after coming back almost 20% since Feb when, in fact, 10% of that was because the currency the stocks are priced in DROPPED 10% – causing us to need 10% more Dollars to buy the same amount of stock as we were able to buy in February.

It’s like a magic trick and, if you look behind the curtain and see how it’s done you “won’t get fooled again” yet they never do explain this on TV or even in print because it’s “too complicated” for investors to understand. I know this because many times on TV I have said we should talk about the Dollar and that is what I’ve been told…

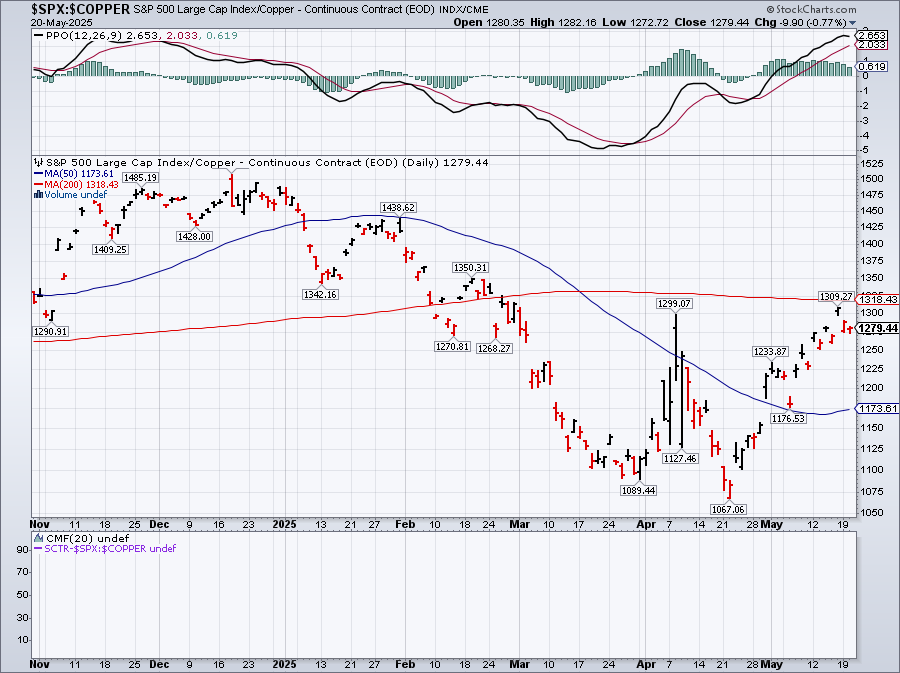

If, for example, we were to look at the S&P 500 priced in something tangible like Gold, Silver or Copper – we see a very different picture. Here’s the S&P priced in Copper, which itself is well off the highs but, trust me, it looks a lot better than Gold or Silver:

And, if you are wondering – against Bitcoin – we’re still at the lows! I think Copper is a good indicator to level things out and SPX/Copper is telling us that we fell from 1,500 to 1,000 (ignoring spikes) and now back to 1,279 – about halfway back but, MOST IMPORTANLY, the 200-Day Moving Average is 1,318 – which means we STILL haven’t cleared that critical point of resistance.

This is why TA is meaningless BS – it doesn’t take into account that the UNITS OF MEASUREMENT you are drawing the charts in is not steady from period to period – so how can the charts be right? That is the first thing they teach you in Science Class – to be consistent with your measurements!

Unfortunately, Americans are as bad at Science as they are at Math and I know, even now, your lizard-brain is thinking you’d rather ignore this nonsense and get back to “normal” but THIS IS NOT NORMAL – our currency doesn’t “normally” drop 10% in 3 months – or 3 years, for that matter so we CAN ignore the relatively small effects it has but this time IS different and you’d better pay attention…

Even now, Congress is about to pass a “Big, Beautiful Bill” and, to indicate how far down the rabbit hole we have already fallen – that is NOT me making fun of it – THAT IS THE OFFICIAL NAME OF THE BILL!!!

The “Big, Beautiful Bill” currently working its way through Congress represents perhaps the most significant fiscal gamble in modern American history. While markets have largely recovered from the April tariff shock, they’re now facing a potentially more serious long-term threat: Structural Fiscal Deterioration that could fundamentally undermine the Dollar’s global standing.

🚢 The Budget Battle: Where Things Stand

As of this morning (May 21, 2025), the House Republicans are making a final push to advance their reconciliation bill before the Memorial Day recess. After initially failing in committee last Friday, the bill was revived Sunday night when four conservative holdouts changed their votes from “no” to “present,” allowing it to advance by a razor-thin 17-16 margin 13.

The bill’s key provisions include:

-

-

-

-

Making permanent the 2017 Trump tax cuts that are set to expire

-

Eliminating taxes on tips and overtime pay

-

Increasing military spending and border security funding

-

Partially offsetting these costs with cuts to Medicaid, food stamps, and clean energy subsidies

-

-

-

However, the legislation faces significant challenges:

-

-

-

-

The Penn Wharton Budget Model estimates it would increase primary deficits by $3.3 trillion from 2025 to 2034, exceeding even the generous $2.8 trillion target maximum in the reconciliation instructions 11

-

House Republicans from high-tax states are threatening to withhold support unless the bill increases the state and local tax (SALT) deduction 4

-

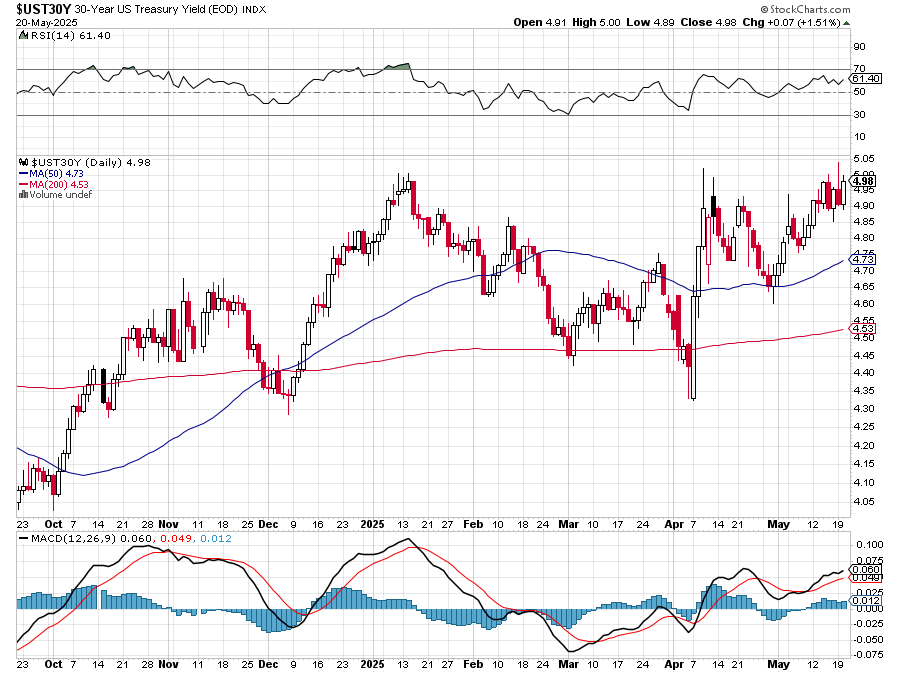

The 30-year Treasury yield has spiked above 5% as bond traders express concern about the deficit-expanding effects 3

-

-

-

The Dollar’s Precarious Position

The dollar has already fallen approximately 10% against a basket of world currencies since Trump returned to the White House 6. This decline isn’t necessarily unwelcome by the administration, as President Trump has previously suggested he would like to see the dollar soften to boost U.S. manufacturing.

However, the combination of tariffs and deficit-expanding tax cuts creates a potentially dangerous dynamic for the dollar:

-

-

-

-

Fiscal Deterioration: Moody’s downgrade last week means that not one of the major rating agencies still considers U.S. debt pristine, with the Peterson Foundation noting that foreign ownership of publicly held U.S. debt had climbed to approximately 30% of the total by the end of last year 7

-

Capital Flight Risk: Goldman Sachs has estimated that foreign investors divested approximately $63 billion in stocks during the two months preceding April 25, with strategist David Roche predicting this outflow is likely to persist 17

-

Interest Rate Pressure: The Committee for a Federal Budget estimates that a sustained 10-year Treasury rate of 4.8% would contribute an additional $1.8 trillion to the debt beyond current forecasts for the upcoming decade 7

-

Inflationary Concerns: While consumer prices remained relatively stable in April, economists warn that the trade war could soon contribute to inflation, with UBS projecting consumer price inflation could rise to approximately 3.3% over the coming year 9

-

-

-

The Self-Reinforcing Cycle

What makes this situation particularly dangerous is the potential for a self-reinforcing negative cycle:

-

-

-

-

Higher deficits lead to more Treasury issuance

-

Foreign investors demand higher yields to compensate for dollar risk

-

Higher yields increase debt servicing costs

-

Increased debt servicing worsens deficits

-

Rinse and repeat

-

-

-

Bank of America economist Stephen Juneau warns that the reconciliation bill is expected to “worsen the deficit and heighten the likelihood of a ‘bond-buyer-strike,'” cautioning that “introducing more supply to the market while demand is weakening could lead to a surge in borrowing rates, a decline in the dollar, and a drop in stock prices“ 14.

The Tariff-Tax Contradiction

Perhaps the most glaring contradiction in the administration’s economic policy is the simultaneous pursuit of income tax cuts and import tax hikes. As Bloomberg reported this morning, “Trump Import-Tax Hike Counters Income-Tax Relief” 8.

This creates a situation where any benefit consumers might receive from income tax relief is likely to be eroded by higher prices on imported goods. Companies across various sectors have already announced price increases:

-

-

-

-

Walmart has warned it might need to raise prices soon, with CEO Doug McMillon stating the company might not be able to “absorb all the pressure” from tariffs9

-

Ford plans to raise prices on new gas and electric cars starting this month 15

-

Best Buy CEO Corie Barry has stated that “price increases for American consumers [are] highly likely” 15

-

Stanley Black & Decker CEO Donald Allan confirmed “there would be price increases associated with tariffs” 15

-

-

-

The State-Federal Fiscal Squeeze

The State-Federal Fiscal Squeeze

An often-overlooked aspect of the current budget battle is its impact on state finances. As Governor Wes Moore of Maryland noted after implementing the most significant budget reductions in his state in 16 years, the drastic cuts proposed in Washington could be “deeply harmful“ 1.

Republicans frame their perspective as one of fiscal responsibility and federalism, contending that states should bear a larger part of the financial responsibility for their citizens. However, the National Association of State Budget Officers warns that many states are already experiencing slower-than-anticipated growth and “will not be able to absorb the federal cuts” that Republicans are advocating 1.

The Dollar’s Future Trajectory

Looking ahead, several scenarios could unfold for the dollar:

-

-

-

-

Continued Gradual Decline: The most likely scenario is a continued gradual weakening as markets price in higher structural deficits and reduced foreign demand for U.S. assets.

-

Crisis-Driven Collapse: A more severe scenario could emerge if the January 2025 debt ceiling deadline approaches without a credible fiscal plan, potentially triggering a more dramatic reassessment of dollar assets.

-

Policy Reversal and Stabilization: The administration could pivot toward fiscal restraint if market pressures intensify, though this appears unlikely given current political dynamics.

-

-

-

Strategist David Roche predicts the dollar could decrease by approximately 15% to 20% in the next five to ten years, warning that “there could be a crisis surrounding the current budget when the market realizes that the figures won’t be supported by tariffs, and that foreign investments into the US are declining” 17.

The Emperor’s New Fiscal Clothes

The Emperor’s New Fiscal Clothes

What we’re witnessing is a dangerous experiment in fiscal policy that relies on the continued willingness of global investors to fund America’s growing twin deficits. Treasury Secretary Scott Bessent acknowledged this risk, telling lawmakers that “the debt numbers are indeed scary,” adding that a crisis could involve “a sudden stop in the economy where credit would freeze“ 7.

The combination of tariffs, tax cuts, and spending increases represents a triple threat to dollar stability. While the weaker dollar has indeed created an illusion of stock market recovery, as Phil correctly points out, this mask could slip if foreign investors continue to reduce their exposure to U.S. assets.

As the House prepares for a potential vote on the “Big, Beautiful Bill” before Memorial Day, the stakes couldn’t be higher. The market’s reaction to this legislation could determine whether the dollar’s recent weakness is merely a temporary adjustment or the beginning of a more fundamental reassessment of America’s fiscal sustainability.

In this environment, measuring market performance in nominal dollar terms is indeed misleading. Phil’s copper-denominated chart of the S&P 500 provides a more accurate picture of where we truly stand – still well below previous highs and struggling to break through key resistance levels when measured in something more tangible than our rapidly depreciating currency.

Ultimately, it’s the Bond Market that gets to point the finger at the US Economy and declare us wanting but the main reason I wanted to get back to CASH!!! last week, DESPITE it’s declining value, is the DANGER of this “Big Beautiful Bill” actually passing as it is likely to push the US into $3,000,000,000,000 of ANNUAL Debt Increases which means our debt will pass $40Tn next year and $46Tn by the time Trump leaves office – adding $11Tn (31%) in his second 4-year term. And that’s if we DON’T have any additional crises!

So forgive us for standing on the sidelines while Congress decides if they are going to destroy the US Economy quickly or slowly – while our Dollar gently weeps.

How to unfold your love

I don’t know how someone controlled you

They bought and sold you

And I notice, it’s turning

While my Dollar gently weeps

We must surely be learning

Still my Dollar gently weeps

You were perverted too

I don’t know how you were inverted

No one alerted you”