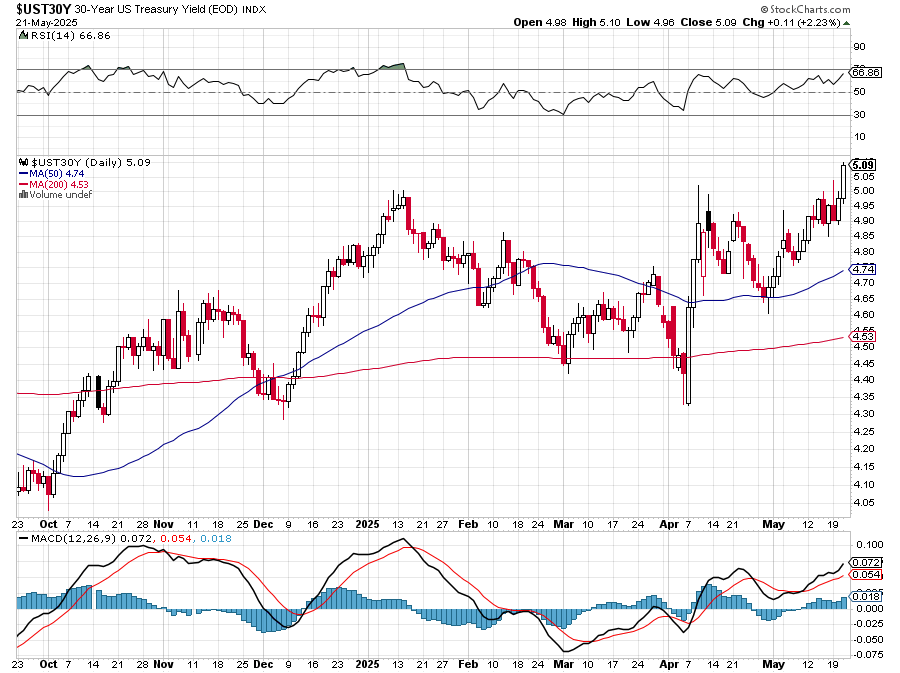

Rates are still rising:

The last time 30-Year (mortgage-length) Bonds were this high was at the height of the housing boom in 2005 – and we know how that ended. In 2025, it’s not housing that’s driving rates higher but Government Incompetency and Fiscal Irresponsibility. In fact, even more telling than the 30-Year Bond rate is the comparative rates of other countries on the 10-Year Notes – which indicates how risky International Investors feel about US:

The last time 30-Year (mortgage-length) Bonds were this high was at the height of the housing boom in 2005 – and we know how that ended. In 2025, it’s not housing that’s driving rates higher but Government Incompetency and Fiscal Irresponsibility. In fact, even more telling than the 30-Year Bond rate is the comparative rates of other countries on the 10-Year Notes – which indicates how risky International Investors feel about US:

Brazil, Russia and South Africa are worse than us and those rates – above 10% – would MURDER our Economy as servicing our $37Tn debt at that level would add $2.7Tn to our $3Tn annual deficit – and that’s BEFORE Congress passes Trump’s “Big Beautiful Bill“! And that’s in addition to the Housing Crisis that would inevitably follow such a rise.

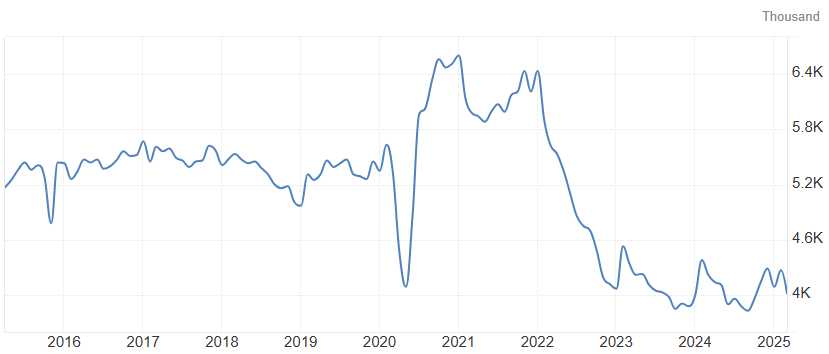

In fact, Existing Home Sales (to be updated at 10am) are also at 20-year lows and of course they are as who can afford a 7% Mortgage (5.13% base rate PLUS Bank Profits)? Certainly not most Americans and the ones that THINK they can afford their mortgages now are going to have to think twice as Government Spending Cuts trickle down to become Local Tax Increases because, unlike our beloved Federal Government – State and Local Governments have to balance their budgets!

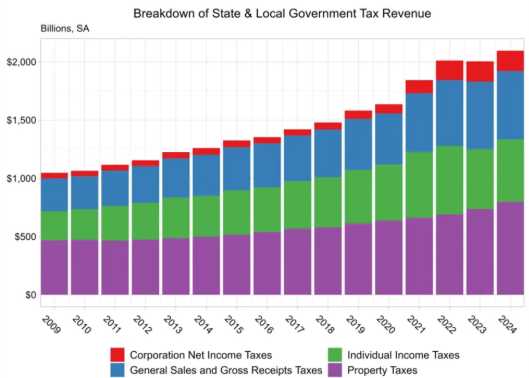

In fact, State and Local Tax Revenues have already DOUBLED since 2009 as states scramble to cover cutbacks from the Federal Government and, of course, Inflation. As we spoke about yesterday in our Webinar, every Dollar of Federal Spending that is cut is a Dollar not sent to Local Governments so all these “cutbacks” are nothing more than a shift of the burden from Federal to Local Taxes – we will just end up paying them somewhere else.

Notice that State and Local Governments have drastically increased taxes on Corporations in order to balance their budgets – this is something the Federal Government simply refuses to do and, also as discussed in yesterday’s webinar, this is why we are in this $37Tn Deficit in the first place!

Many states have responded by raising Corporate Income Taxes. For example, New Jersey reimposed a 2.5% additional surtax on Corporations with Taxable Income exceeding $10M, on top of their existing 9% top Marginal Rate. Pennsylvania Corporations now face a flat 7.99% Income Tax in 2025, down slightly from 8.49% in 2024 but still substantial.

As Federal support diminishes and economic headwinds intensify, we can expect more states to follow this pattern of increasing Corporate Taxation to maintain essential services and balance their budgets. This stands in stark contrast to Federal policy, which continues to prioritize tax cuts for Corporations and Billionaires DESPITE our mounting Deficits.

After two years of relative stability, 2025 marks an inflection point for many State Budgets. Although Tax Revenue increases have declined Nationwide since the record highs of 2021 and 2022 (Covid costs), most states HAD large surpluses and leftover federal aid that helped lawmakers pass budgets with minimal disruption in 2023 and 2024.

State budget stresses are more widespread than they have been at any time since at least 2020. General Fund Revenues are projected to grow just 1.9% in FY 2025, reflecting recently enacted tax cuts. $350Bn per year – about half of all county-level spending comes from selling Municipal Bonds – those will also go into crisis if rates keep rising.

While Stock Investors like to put their heads in the sand and ignore storm clouds on the horizon – Bond Investors are generally the adults in the room – looking further down the road to the consequences of current political actions and we are currently hearing their concerns VERY CLEARLY. Well, those of us who don’t have our heads buried too deeply, that is…

From a support standpoint, watch 21,000 on the Nasdaq 100 because, if we lose that, then the Strong Retrace Line at 19,937 is our next support and we’ve already lost 2,100 on the Russell – now testing 2,000, which REALLY needs to hold before it Pied Piper’s the rest of the indexes over a fiscal cliff.

The real problem is the “Big Beautiful Tax Bill” and the fact that it looks like it WILL pass – that is what the Bond Market is freaking out about – the Government Policy IS the problem – NOT the solution!

Good luck to us all – we’re going to need it!