The week is off to a good start!

With the month ending on Saturday, there’s no time to start dressing windows better than the present and our Dear Leader, who tanked the markets on Friday with his 50% EU tariffs and his Apple Tax has pushed back the EU date to July 9th and that, somehow, has sparked a Global Relief Rally that has exceeded the drop – with 1.5% index gains to kick-start the last week of May.

We are happy to embrace the insanity, especially as this is once again making hedges much cheaper to buy with SQQQ way down at $23.88 – new lows for the Nasdaq Ultra-Short because what could possibly ever go wrong in Tech (said everyone in 1999)?

The trick to a good hedge is MATH and math tells us that a 20% drop in the Nasdaq (to 16,800 – the April low) would pop the 3x Ultra-Short ETF 60% – from $23.88 to $38.20 – not as high as it just was but much higher than it is. But let’s just hedge for a 10% drop, to about $31… Now we have a target range and we can set up a hedge like:

-

- Buy 50 SQQQ 2027 $23 calls at $8.25 ($41,250)

- Sell 50 SQQQ 2027 $30 calls for $7 ($35,000)

That’s net $6,250 on the $35,000 spread so we gain $28,750 (460%) on a 10% drop in the Nasdaq – that’s a good start. The cost of our insurance policy is $6,250 but we can hedge our hedge by finding a stock we’d love to buy if it were 20% cheaper – like Microsoft (MSFT) at $454.94 and 80% of that is $363 and we can sell the MSFT 2027 $360 puts for $18.60 so selling just 5 of those for $9,300 gives us a net $3,050 CREDIT on the $35,000 spread.

Now we make $38,050 if the Nasdaq falls 10% and MSFT holds $360 (-20.8%) and, if the Nasdaq goes up and MSFT holds $360, we STILL make $3,050 (our credit) so – FREE INSURANCE! The short put can be any stock you REALLY want to own, but I’m sure I don’t need to explain MSFT to you, right?

And, just like that, we have a $38,050 hedge which uses about $15,000 in margin and is very good protection for a $100,000 portfolio with $200,000 in buying power and don’t get stuck on the $100,000 – if we begin a new portfolio with $500,000, this will protect the FIRST $100,000 we invest and it allows us to move forward with our initial long picks.

We have not planned to initiate our new Long-Term and Short-Term Portfolios until next week but we’ll keep an eye on this spread as it’s a great way to launch our new $200,000 STP, which holds the hedges that will protect the $500,000 LTP going forward. This is a classic adaptation of Market Strategy 101: “Buy low, sell high” only we’re hedging when the market is high while waiting to buy low…

We will see how far Trump’s tariff flip-flop can take us this morning as the S&P once again makes a run at 6,000 but HOW do we deserve to be there? That’s anyone’s guess. Perhaps we’ll find some clues examining this week’s data, which includes 11 Fed speakers in 4 days surrounding Wednesday’s Fed Minutes. Also exciting this week will be tons of Note Auctions (yes, AGAIN) and today we have Durable Goods, Home Prices and the Dallas Fed, tomorrow kicks off with the OPEC Meeting, the Richmond Fed and Business Uncertainty. Thursday will be the GDP Report and Friday it’s International Trade, Personal Income & Outlays, Consumer Sentiment and Farm Prices – busy, busy!

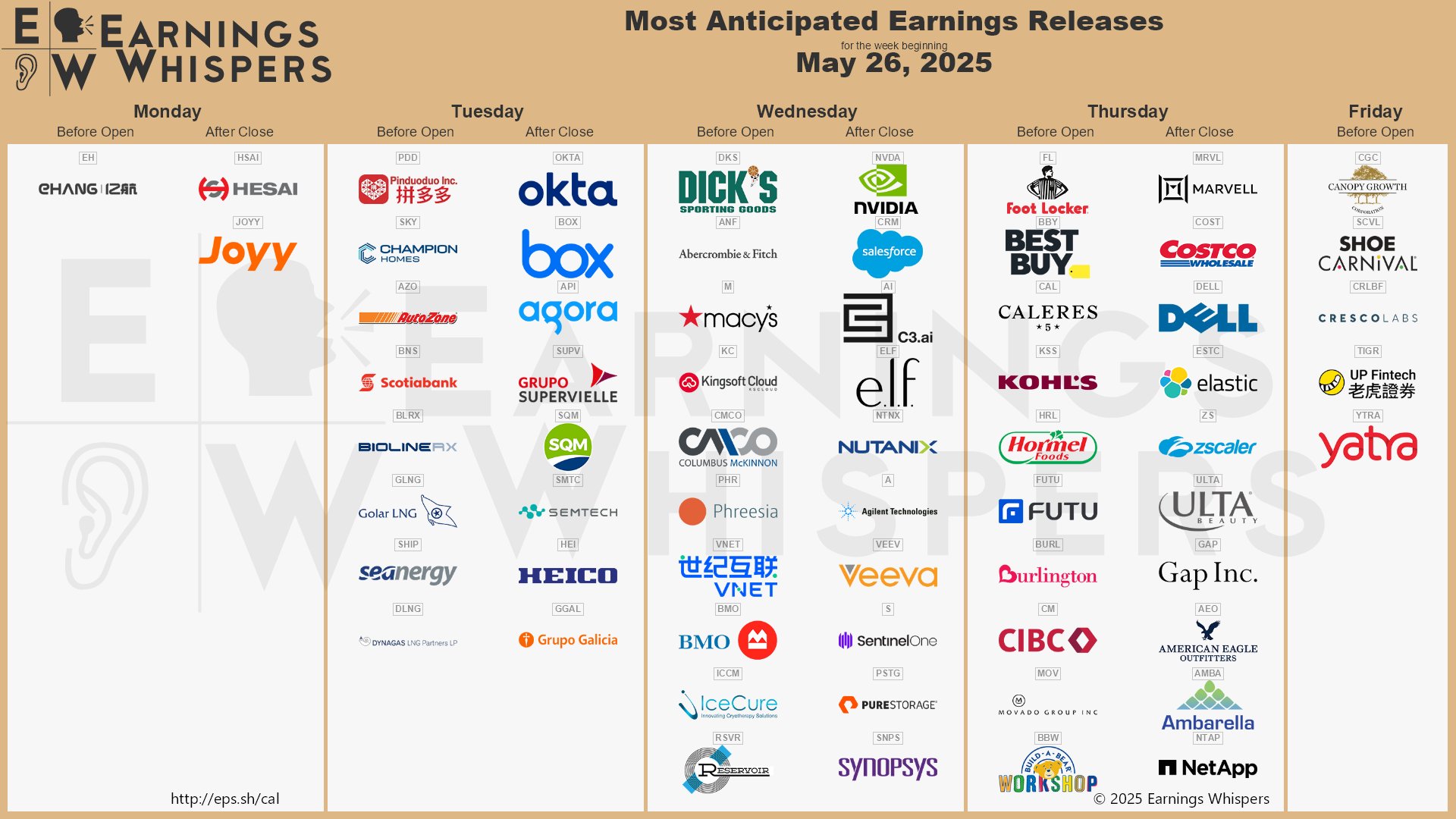

AND, in case that gets boring – it’s time for Retail Earnings starring DKS, ANF, NVDA, CRM, FL, BBY, KHS, BBW, MRVL, COST, ULTA, GPS and AEO – not all retailers but plenty to keep us entertained as we wind May down and head into the home stretch of Q2, 2025.