NVDA is a $3.3Tn company.

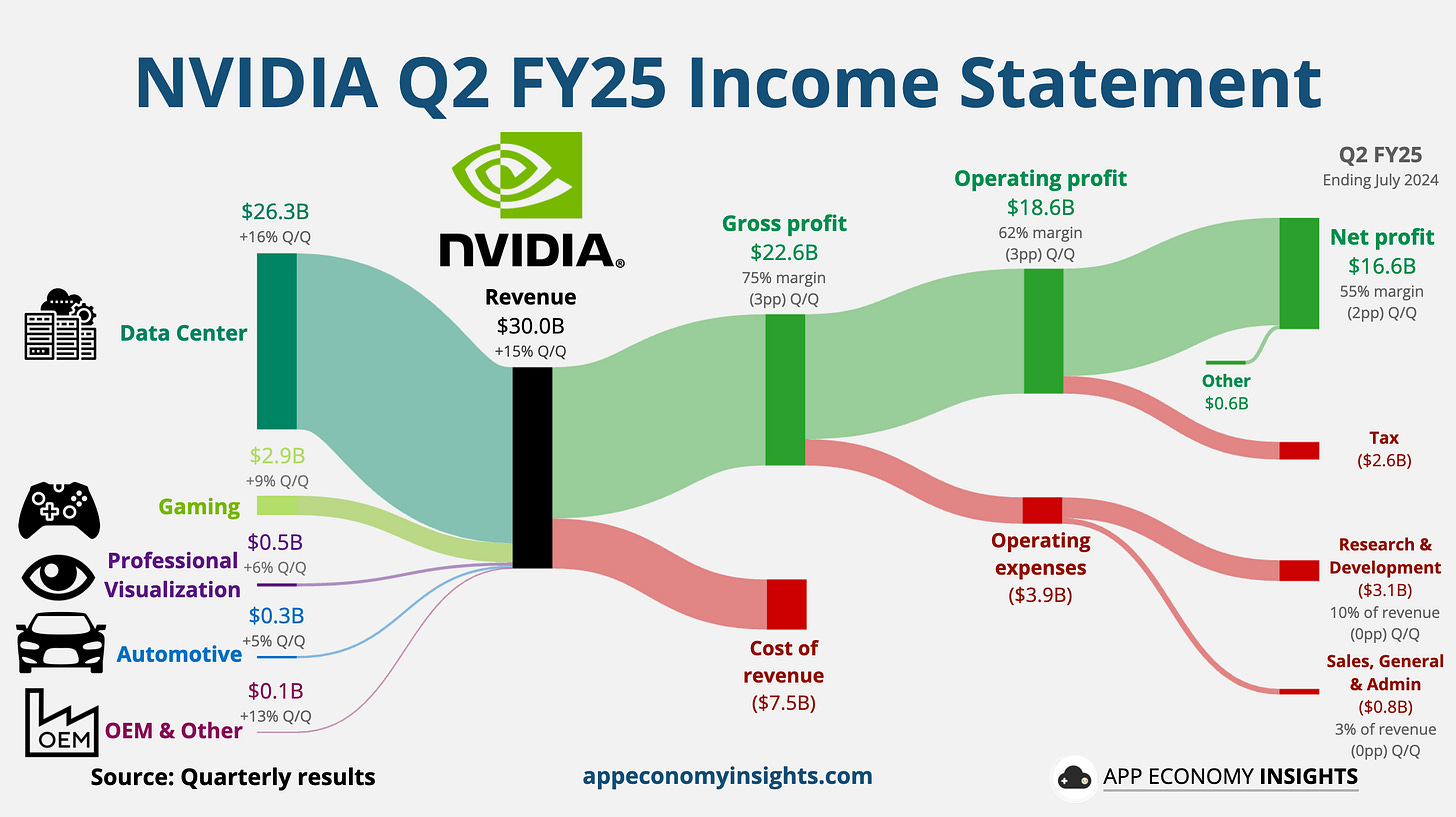

In October of 2022 it was a $300Bn company so, in 2.5 years, NVDA added $3Tn in valuation which, by itself, is 6.9% of the ENTIRE S&P 500 ($47.5Tn) and a whopping 13% of the Nasdaq 100’s $25.3Tn in total market cap. Meanwhile, NVIDIA “only” made $73Bn last year so $3,300Bn is 45 times earnings and this year they project $106Bn, which would bring them down to 31x – not unreasonable IF the company continues to grow and IF they can maintain these sky-high prices on their chips.

On the revenue side, NVDA “only” generated $130.5Bn in Revenues last year so 25.3x Revenues and you can compare that to AAPL at 8x or MSFT at 12x. NVDA is benefiting from getting EXTREMELY high margins for their chips, which are in short supply – but for how long? Despite generating an impressive $60.85 billion in free cash flow (up 125% year-over-year), NVIDIA is trading at 54x free cash flow. This means investors are paying $54 for every Dollar of actual cash the company generates – a premium that assumes not just continued growth, but exponential acceleration for years to come.

On the revenue side, NVDA “only” generated $130.5Bn in Revenues last year so 25.3x Revenues and you can compare that to AAPL at 8x or MSFT at 12x. NVDA is benefiting from getting EXTREMELY high margins for their chips, which are in short supply – but for how long? Despite generating an impressive $60.85 billion in free cash flow (up 125% year-over-year), NVIDIA is trading at 54x free cash flow. This means investors are paying $54 for every Dollar of actual cash the company generates – a premium that assumes not just continued growth, but exponential acceleration for years to come.

Tonight’s earnings will reveal the true impact of the Trump Administration’s export restrictions on NVIDIA’s H20 chip, which was specifically designed for the Chinese market. The company has already announced a staggering $5.5Bn Inventory write-down which is, of course, the largest in the Chip Sector’s history. UBS, in fact, estimates this represents $15Bn in lost annual revenue going forward.

For context, that $15Bn represents 12% of NVIDIA’s total fiscal 2025 revenue. Imagine if Apple suddenly lost 12% of its iPhone sales permanently – the stock would crater! Yet NVIDIA’s shares have barely flinched, suggesting the market either doesn’t believe these restrictions will stick or is pricing in replacement demand from other markets.

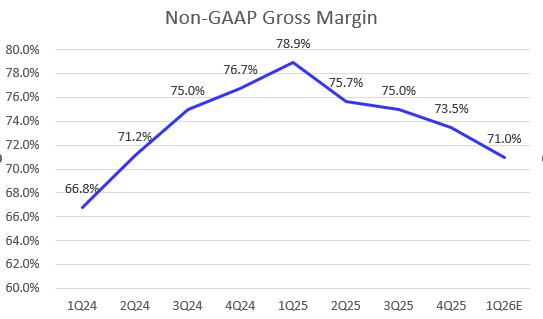

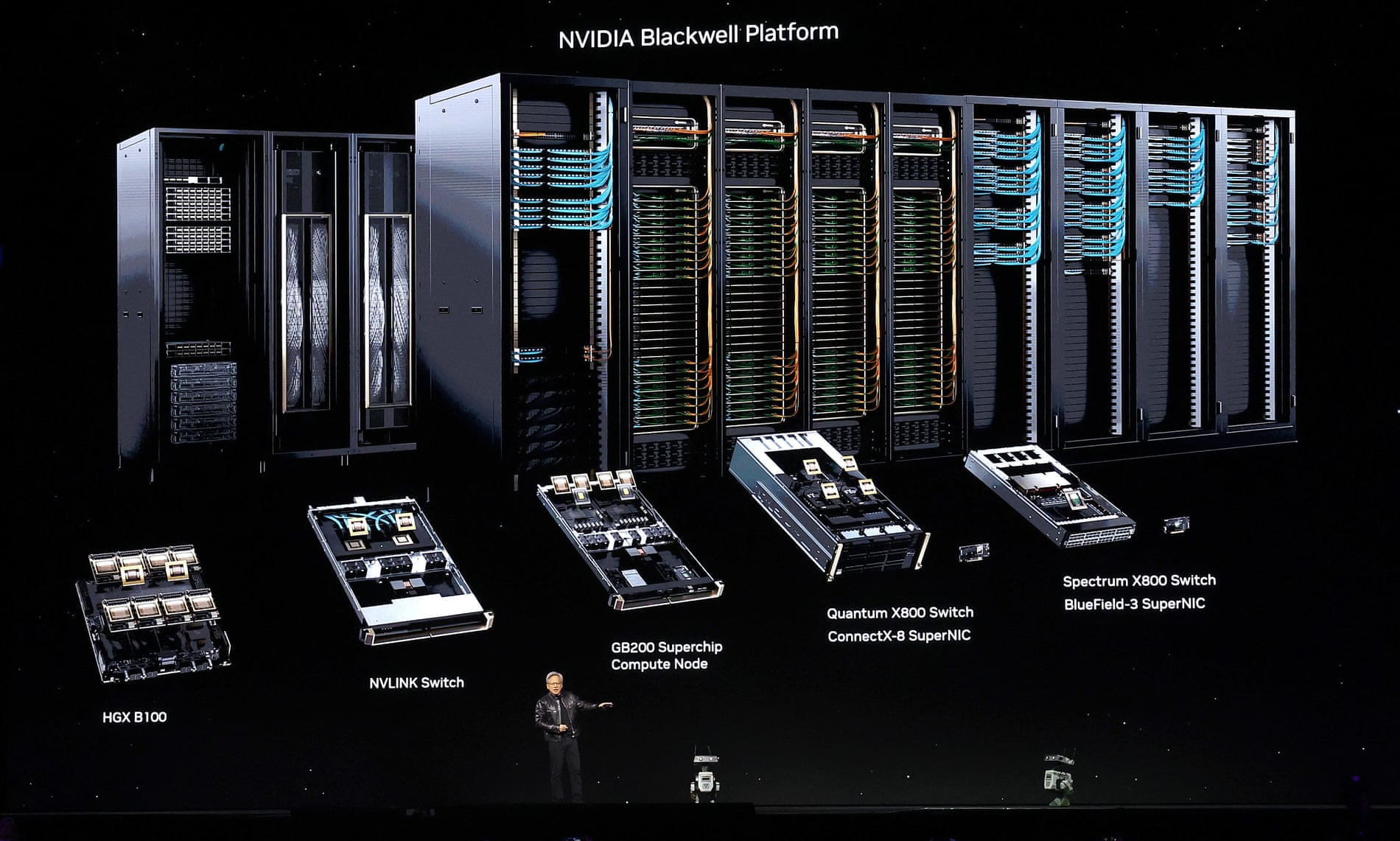

NVIDIA’s entire valuation thesis now rests on the success of its Blackwell architecture. CEO Jensen Huang claims “demand for Blackwell is amazing,” and the company achieved “Billions of Dollars in sales in its first quarter“. But here’s the critical question: can Blackwell command the same premium pricing as current H100/H200 chips, or will competition from AMD, Intel, and custom chips from hyperscalers compress margins?

The company is already signaling potential margin pressure by “sticking with the Bianca compute board configuration for GB300 and pushing the higher margin Cordelia boards to Rubin next year“. Translation: they’re prioritizing Volume over Margins to maintain growth – a classic sign of a maturing market!

We’ll see this evening what NVDA really looks like and forward guidance will be key – anything below $50Bn in Revenues for next Q will be a disappointment and margins are going to be a key factor as AI chips do begin to finally commoditize. Of course NVDA gets most of their Revenues from Mag 7 buddies MSFT, GOOGL, AMZN, META & TSLA/X but they have already reported robust spending plans for 2025.

At 45x earnings, NVIDIA needs to grow earnings by 25-30% ANNUALY – just to justify its current valuation. Any deceleration below 20% growth would suggest the stock is overvalued by 30-40%. With the China restrictions removing $15Bn in annual revenue potential, achieving that growth is going to be exponentially harder.

The company’s PEG ratio of 0.68 suggests the market expects continued acceleration, but the laws of large numbers make this increasingly unlikely. NVIDIA would need to get $250Bn in annual revenue by 2027 to justify current valuations – requiring them to capture nearly the entire global AI chip market or for the AI chip market to grow substantially.

The thing is, the biggest companies on Earth are already NVDA’s biggest customers and they are spending a combined $300Bn on AI infrastructure this year alone – where will the next customers come from?

NVDA’s $3.3Tn valuation is the GDP of the UK (6th largest in the World) and Canada is 10th at $2Tn – just to give you a true sense of proportion here. What bothers me about NVDA is that their business model is based on scarcity – and you can ask OPEC how well that holds up over time…

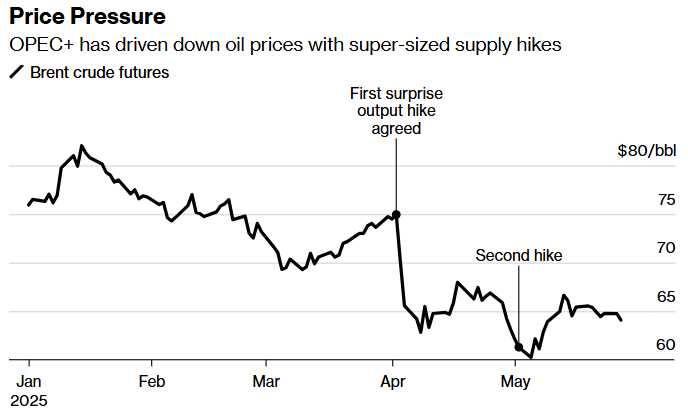

Speaking of OPEC, they are gathering today and will decide whether to hike production for the 3rd month in a row. So far, Oil (/CL) has fallen from $75 in April to $61.50 this morning ($64.27 for Brent) and that has cheered up Consumers and kept inflation under control in Q2 so far.

Speaking of OPEC, they are gathering today and will decide whether to hike production for the 3rd month in a row. So far, Oil (/CL) has fallen from $75 in April to $61.50 this morning ($64.27 for Brent) and that has cheered up Consumers and kept inflation under control in Q2 so far.

OPEC’s hikes are really just recognition of all the cheating that was going on anyway. Russian Oil is banned in name only and the Russian’s send their oil through Kasakstan and other non-banned countries. Output was cut by 2.2Mb/day back in 2023 and about half of that has since been restored but OPEC(+) still has the capacity to put over 1Mb/d back on the market – which they need to do to put a lid on robust US drilling expansion.

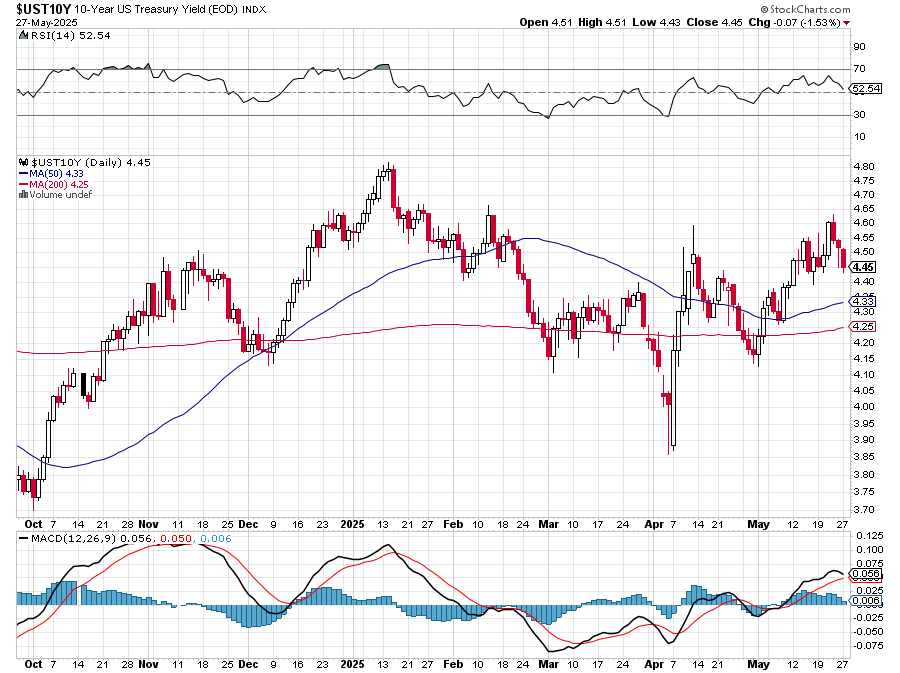

And then there are Bonds. We have a 2-year auction at 11:30, a 5-year auction at 1pm ahead of the Fed Minutes at 2pm. Tomorrow we have the 7-year auction along with short-term notes as well – we’ll see what sells and where rates settle in: