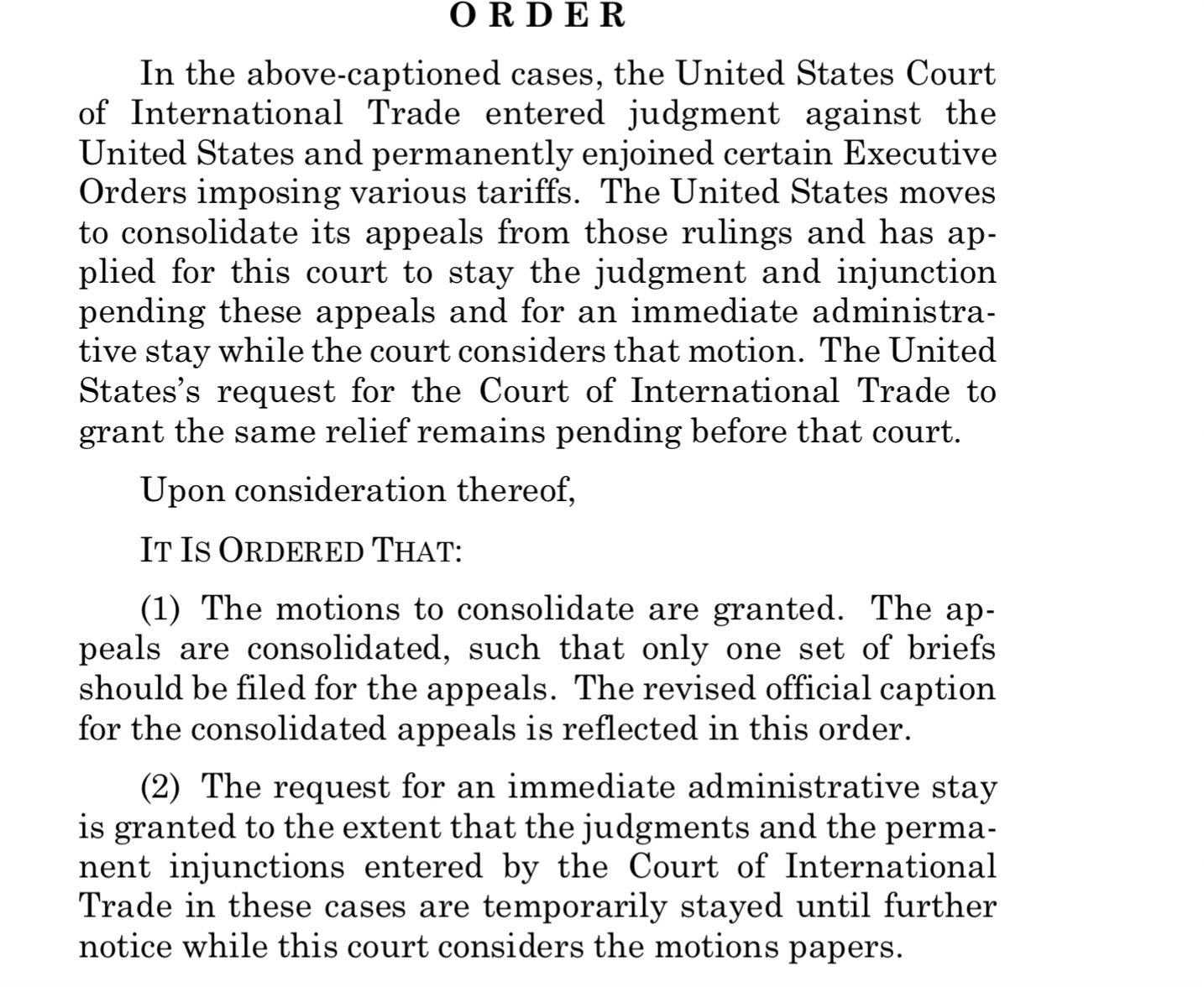

Well, that was fun while it lasted.

One thing you can say about Trump II is they have much better lawyers this time and yesterday they got the Court of Appeals to override the decision of the Federal Trade Court (who specialize in these matters) though it’s only a stay – but it does put the tariffs back on while Trump & Co run it through the Courts until they get the decision they want.

The S&P gave up all of the very brief excitement of courts being able to stop Donald Trump after testing 6,000 for the first time since February’s port-tariff collapse. How we are back so close to the all-time market highs is beyond me – we cashed our 4 of our 6 Member Portfolio on the 15th and we’re ready to restart our Long-Term and Short-Term portfolios next week with a fresh $500,000 and $200,000 respectively but, if you only have $50,000 and $20,000 you will be able to follow along as well!

So we’re back to chaos and uncertainty. That’s fine – we’re used to it as this point and there are plenty of bargains to be had and there will be plenty more come July with tariffs potentially re-instated and another round of earnings reports. I had Anya look over May’s Corporate Guidance Changes and here’s her summary of how things are shaping up:

👭 Overall Market Sentiment from May Guidance: A Mixed Bag with Pockets of Strength

May’s earnings guidance painted a picture of a bifurcated market. While some sectors, particularly those linked to Artificial Intelligence (AI) infrastructure and enterprise software, showed continued strength, many consumer-facing segments and some areas of technology issued cautious or mixed outlooks. Inflationary pressures, shifting consumer spending habits, and higher interest rates appear to be creating a challenging operating environment for some, while others are capitalizing on secular growth trends.

Strong Sectors & Positive Trends:

-

AI Infrastructure & Enterprise Tech Powerhouses:

- Dell (DELL) was a standout, issuing significantly strong Q2 revenue guidance ($28.50-$29.50 bln vs. $25.33 bln consensus) and EPS ($2.15-$2.35 vs. $2.11 consensus), likely driven by booming demand for its AI servers. FY26 guidance was largely in-line.

- NVIDIA (NVDA), a bellwether for the AI boom, provided Q2 revenue guidance of $44.10-$45.90 billion, with consensus at the upper end ($45.92 billion). While not a massive beat on guidance itself, it reflects continued monumental growth.

- UiPath (PATH) showed strength in automation, with Q2 revenue guidance ($345-350 mln vs. $331.30 mln consensus) and FY26 revenue ($1.549-1.554 bln vs. $1.52 bln consensus) both exceeding expectations.

- Salesforce (CRM) indicated robust enterprise demand, with Q2 EPS ($2.76-2.78 vs $2.74) and revenue ($10.11-10.16 bln vs $10.02 bln) guidance beating consensus, and FY26 figures also guided higher.

- CrowdStrike (CRWD) continued its strong performance in cybersecurity, guiding Q1 EPS (at least $0.64-$0.66 vs $0.66) and revenue (at least $1.1006-$1.1064 bln vs $1.10 bln) favorably, and FY26 guidance also pointed to continued growth above consensus.

- Palantir (PLTR) offered strong Q2 revenue guidance ($934-$938 mln vs $899.44 mln) and robust FY25 revenue guidance ($3.890-$3.902 bln vs $3.75 bln), signaling strong uptake of its data analytics platforms.

-

Select Healthcare & Pharmaceuticals:

- Eli Lilly (LLY) provided very strong FY25 guidance, with EPS ($20.78-22.28 vs. $22.22 consensus, though the guided range is wide) and revenue ($58.0-61.0 bln vs. $59.72 bln consensus) showing significant optimism, likely driven by its new drug pipeline.

- Amgen (AMGN) offered solid FY25 EPS guidance ($20.00-$21.20 vs $20.66) and revenue ($34.3-$35.7 bln vs $35.10 bln) generally in line to slightly above consensus at midpoints.

- The Cigna Group (CI) reiterated or slightly increased confidence, guiding FY25 EPS at “at least $29.60,” comfortably meeting consensus.

-

Some Industrial & Manufacturing Bright Spots:

- Vertiv (VRT), benefiting from data center build-outs, guided Q2 EPS ($0.77-0.85 vs $0.83) and revenue ($2.325-2.375 bln vs $2.35 bln) strongly, with FY25 also looking robust.

- Eaton (ETN) showed consistent industrial strength, guiding Q2 EPS ($2.85-2.95 vs $2.98) and FY25 EPS ($11.80-12.20 vs $12.01) slightly below consensus at the midpoint for Q2 but generally in line for the full year, indicating steady demand.

Weak Sectors & Concerning Trends:

-

Consumer Discretionary & Retail Under Pressure: This was the most consistently challenged area.

- Apparel & Department Stores:

- Kohl’s (KSS) presented a mixed picture with FY26 EPS guidance ($0.10-$0.60) well below the $0.42 consensus at the midpoint, though revenue guidance was surprisingly higher.

- American Eagle (AEO) guided Q2 revenue ($1.227 bln) below consensus ($1.24 bln).

- Burlington Stores (BURL) saw Q2 EPS ($1.20-1.30 vs $1.35) and revenue guidance fall short of expectations.

- Capri Holdings (CPRI) issued significantly lower Q1 revenue guidance ($765-780 mln vs $964.68 mln) and FY26 revenue ($3.3-3.4 bln vs $4.10 bln), indicating severe headwinds despite better-than-expected EPS guidance.

- Bath & Body Works (BBWI) guided Q2 EPS ($0.33-$0.38 vs $0.42) and revenue ($1.526-$1.556 bln vs $1.57 bln) downwards.

- Automotive (EVs):

- Li Auto (LI) guided Q2 revenue (RMB32.5-33.8 bln) below consensus ($34.57 bln), suggesting potential slowing in its segment of the EV market.

- Other Retail: While some giants like Walmart (WMT) showed strength (FY26 EPS $2.50-$2.60, beating $2.60 consensus at the high end), many smaller or more specialized retailers expressed caution.

- Apparel & Department Stores:

-

Mixed Signals in Broader Technology: Beyond the AI darlings, the picture was less clear.

-

- PC Market: HP Inc. (HPQ) guided Q3 EPS ($0.68-0.80) and FY25 EPS ($3.00-3.30) significantly below consensus ($0.90 and $3.56 respectively), indicating continued PC market softness.

- Software (Non-AI Focus/Specific Segments): While Salesforce was strong, PagerDuty (PD) offered a mixed outlook with Q2 EPS ($0.19-0.20 vs $0.23) and FY26 revenue ($493-499 mln vs $503.68 mln) guided down. Elastic (ESTC) was also mixed.

- NetApp (NTAP) showed Q1 EPS ($1.48-1.58) guided below consensus ($1.65).

-

Telecommunications:

- AT&T (T) guided FY25 EPS ($1.97-2.07) below consensus ($2.08) at the midpoint.

Developing Trends:

- AI is the Dominant Growth Driver: Companies enabling AI (Nvidia, Dell, various software) are seeing immense demand and guiding strongly. This trend shows no signs of immediate abatement.

- Consumer Prudence: Discretionary spending is clearly under pressure. Retailers, especially in apparel and non-essential goods, are facing a cautious consumer. Value-oriented players or those with strong brand loyalty may fare better.

- Enterprise Spending Remains Selective: While overall enterprise tech saw bright spots (Salesforce, UiPath), spending appears focused on mission-critical applications, AI, and cybersecurity. Other areas might see more scrutiny.

- Data Center Ecosystem Thriving: Beyond chipmakers, companies involved in building and equipping data centers (e.g., Vertiv) are benefiting.

- Persistent Inflation & Rate Impact: Though not always explicitly stated in guidance summaries, the macroeconomic backdrop of higher interest rates and persistent inflation is likely influencing consumer behavior and corporate spending decisions.

Investor Takeaway: The May guidance underscores a market that is rewarding companies aligned with major technological shifts like AI, while penalizing those more exposed to wavering consumer sentiment. Investors will likely continue to scrutinize company outlooks for signs of resilience in their respective end markets and their ability to navigate ongoing economic uncertainties. Diversification and a focus on companies with strong secular growth drivers and pricing power remain key.

So there’s some general guidance we can look for as we move towards the end of Q2 and reports like this will be very helpful in telling us where to focus our efforts and acquiring new stocks for our Member Portfolios as well as telling us what to avoid. After just two weeks back in CASH!!!, we are in no great hurry to re-deploy while all this uncertainty is hanging over the markets.

That doesn’t mean we won’t be able to find bargains – but there are always bargains to be had – we’ve been doing this for 20 years so I can say that with some degree of certainty!

And, of course, the data comes into play. Today, for example, we have Personal Income & Spending for April along with PCE Prices, Chicago PMI and Consumer Sentiment – none of which are likely to be good but we’ll see.

Also, it’s the end of the month so windows must be dressed and they have been all week so we’ll see if they can hold 5,900 into the close but, on the whole, the market has been drifting along for the past two weeks while the Dollar has lost another 1% of its value – and there is the pressure for us to not be complacent with our cash! (diminished)!

We THINK 99 is going to hold on the Dollar but, if it doesn’t, the first thing we buy is likely to be gold or a gold miner next week…

Have a great weekend,

-

- Phil