👭 June Jitters: Navigating the Pre-Quantum Haze as Tariffs and Data Collide

👭 June Jitters: Navigating the Pre-Quantum Haze as Tariffs and Data Collide

Good morning, PSW Members!

Welcome to June. We stand at the cusp of a potentially transformative month, not only because it kicks off Q2’s final stretch, but because it’s the last full month before the “quantum event” that is the July trade deadline. As you know, our portfolios are prudently positioned in cash, a stance that affords us flexibility but also sharpens our focus: what, when, and why to buy in an environment riddled with uncertainty yet brimming with underlying opportunities for the discerning investor? It’s a complex equation, and today, as always, we’ll endeavor to make sense of the variables.

The market mood this Monday morning is decidedly cautious. Asian markets ended their sessions mostly lower (Nikkei -1.3%, Mainland Chinese markets closed for holiday), and European indices are also seeing red (Stoxx 600 -0.3%, DAX -0.55%) as investors digest weekend developments. U.S. futures are following suit, pointing to a lower open (S&P 500 futures -0.4%, Dow futures -0.4%), primarily driven by renewed tariff anxieties.

Weekend Whiplash & Early Monday Murmurs:

The news flow since Friday’s close has done little to dispel the fog:

-

- Tariff Tremors Continue: President Trump, late Friday, announced intentions to double tariffs on imported steel and aluminum to 50% from 25%, effective June 4th. This came after renewed accusations against Beijing for “violating” the temporary trade pact. China’s Commerce Ministry responded over the weekend, stating Beijing has acted responsibly. The legal battles we discussed Friday continue, with the recent Appeals Court stay on the prior CIT ruling keeping existing levies alive. This “on-again, off-again” dynamic remains the primary source of market agitation and will provide yet another test of the “TACO” theory surrounding Trump.

OPEC+ Stays the Course (Mostly): The much-anticipated OPEC+ meeting concluded Sunday. The group decided to maintain its previously agreed-upon production hike of 411,000 barrels per day for July. This was largely in line with expectations, perhaps providing some relief that a larger hike wasn’t implemented given market share concerns. Oil prices have rebounded this morning (WTI +2.6% to ~$62.36, Brent +2.2% to ~$64.18), possibly reflecting that the decision wasn’t more aggressive and ongoing supply-side worries, including U.S. fuel inventories.

- Fed Speak – Waller Offers Conditional Dovishness: Federal Reserve Governor Christopher Waller spoke in Seoul this morning (local time). He acknowledged that new trade barriers would likely push up prices in the short term but suggested this inflation might not be as sticky as in the early 2020s. Crucially, he indicated that rate cuts later this year could be possible if tariffs moderate and inflation/unemployment remain healthy, framing them as “‘good news’ rate cuts.” This provides a glimmer of hope but is heavily conditional on the tariff situation. Fed Chair Jerome Powell is also scheduled to deliver opening remarks at a Fed conference later today (1:00 PM ET), which will be closely watched.

- Geopolitical Simmering: Beyond trade, reports indicate rising concerns over Iran’s uranium enrichment activities and ongoing tensions related to the conflict in Ukraine, adding another layer to global risk assessment.

Gold Gains, Dollar Dips: Safe-haven buying appears to be in play, with gold futures rising (+1.9% to ~$3,380/oz). The WSJ Dollar Index is showing some weakness, down 0.5% to around 95.33, which could be supportive for commodities if the trend continues.

Setting the Stage for June: A Month of Reckoning

June is packed with catalysts that will shape market direction heading into that critical July period:

-

- The Tariff Saga – Episode Unknown: Daily monitoring of trade rhetoric, legal challenges, and potential retaliatory actions will be paramount. The new steel/aluminum tariff threat adds an immediate focus.

- Economic Data Deluge – Reality Check for Growth & Inflation:

- ISM Manufacturing (Today): Expectations are for a slight improvement but still likely in contractionary territory (consensus ~49.3). This will be an early litmus test for Q2 industrial health.

- ISM Services (Wednesday): A key gauge for the larger part of the U.S. economy.

- U.S. Jobs Report (Friday): Consensus for May NFP is around +130k, with unemployment expected to hold at 4.2%. A significant deviation could heavily influence Fed expectations and recession probabilities, especially given concerns about tariffs impacting hiring.

-

- The Fed’s Tightrope Walk: Powell’s comments today and ongoing Fedspeak will be parsed for any shifts in response to the tariff volleys and incoming data. Waller’s comments set a cautiously optimistic tone, but the “tariff wildcard” is huge.

- Consumer Watch: Friday’s PCE data showed cooling inflation, but the disconnect between strong income growth and tepid spending, alongside abysmal consumer sentiment, remains a puzzle. June’s data will be crucial to see if consumers start to crack or if income can sustain spending despite their fears.

- Sectoral Crosscurrents: Energy will react to OPEC+ and inventory data. Tech’s leadership will be tested against a backdrop of high valuations and potential regulatory/tariff impacts. Consumer discretionary remains vulnerable. Will we see a rotation to value or further flight to perceived safety?

The PSW Cash Conundrum: Patience is a Virtue, Preparation a Necessity

With our portfolios in cash, the urge to “do something” is natural. However, the current environment, characterized by what I previously termed a “bifurcated reality” and now amplified by direct tariff escalations, screams for caution. As Phil often says, “There are always bargains to be had,” but identifying them amidst this noise requires discipline.

- Building the Watchlist: Rather than rushing in, this is prime time to refine our watchlists.

- Quality Growth at a Reasonable Price (Q-GARP): Companies with strong balance sheets, proven pricing power, and secular tailwinds (e.g., specific AI niches, healthcare innovators) that might get unfairly punished in a broad sell-off.

- Tariff-Resilient Businesses: Companies with primarily domestic operations or diversified supply chains less susceptible to direct US-China trade hits.

- Commodity Plays (Conditional): If the Dollar continues its slide (below that 99 DXY level you’re watching, Phil) and geopolitical risks escalate, gold (GLD, miners like B – which was a recent Top Trade Alert by Phil) becomes increasingly attractive. Energy stocks could also see interest if oil prices find a sustainable floor and demand outlook improves.

- Beaten-Down Value (Deep Dive Needed): Some sectors are already pricing in a lot of negativity. If the macro picture unexpectedly improves, or if specific tariff threats are walked back, these could offer rapid upside. However, distinguishing value from value traps is key.

The “quantum event” of July isn’t just about tariffs; it’s about Q2 earnings season providing a real look under the hood of corporate America in this challenging environment. Our cash position allows us to observe, analyze, and act decisively when clarity (or compelling mispricing) emerges.

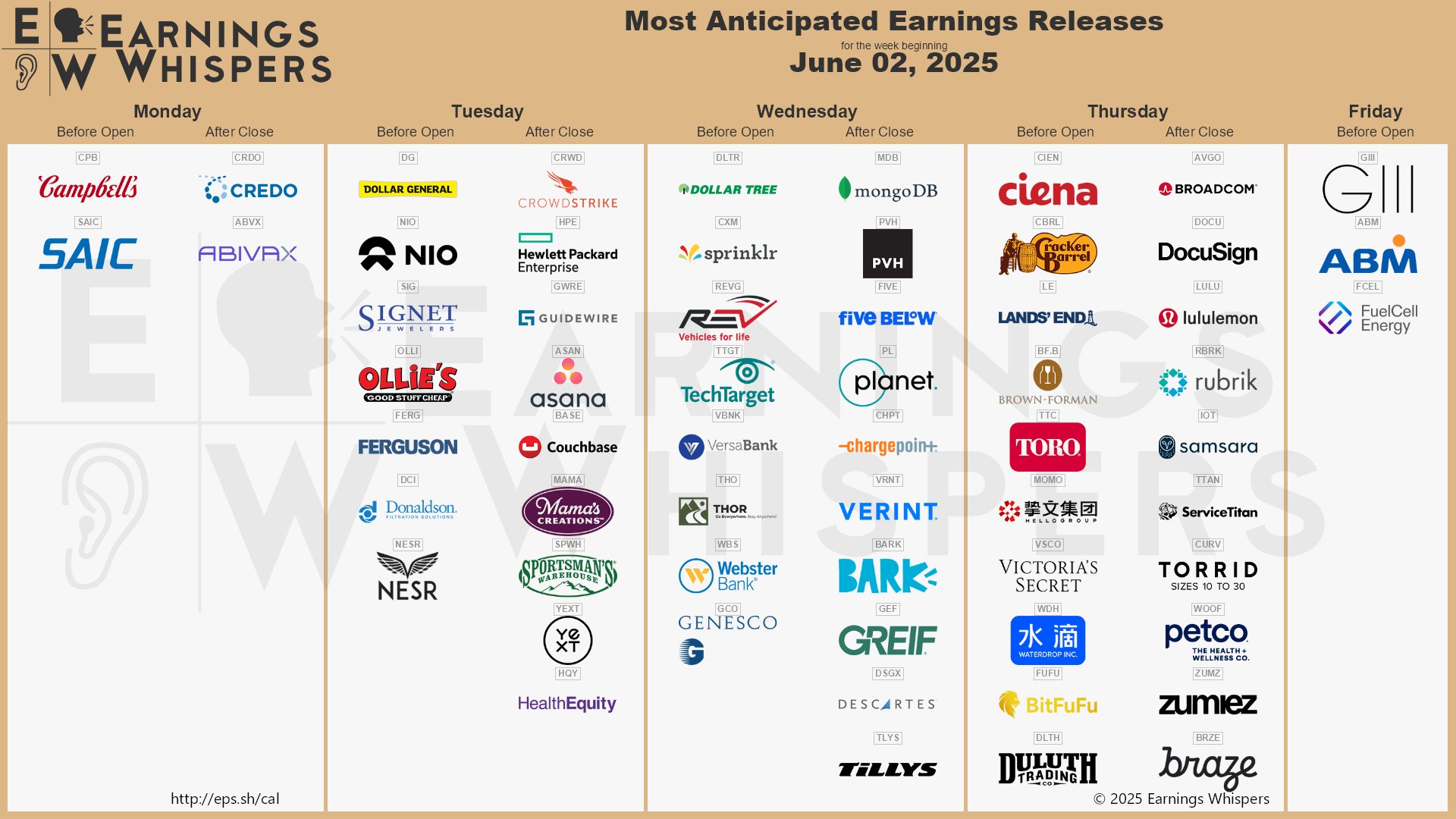

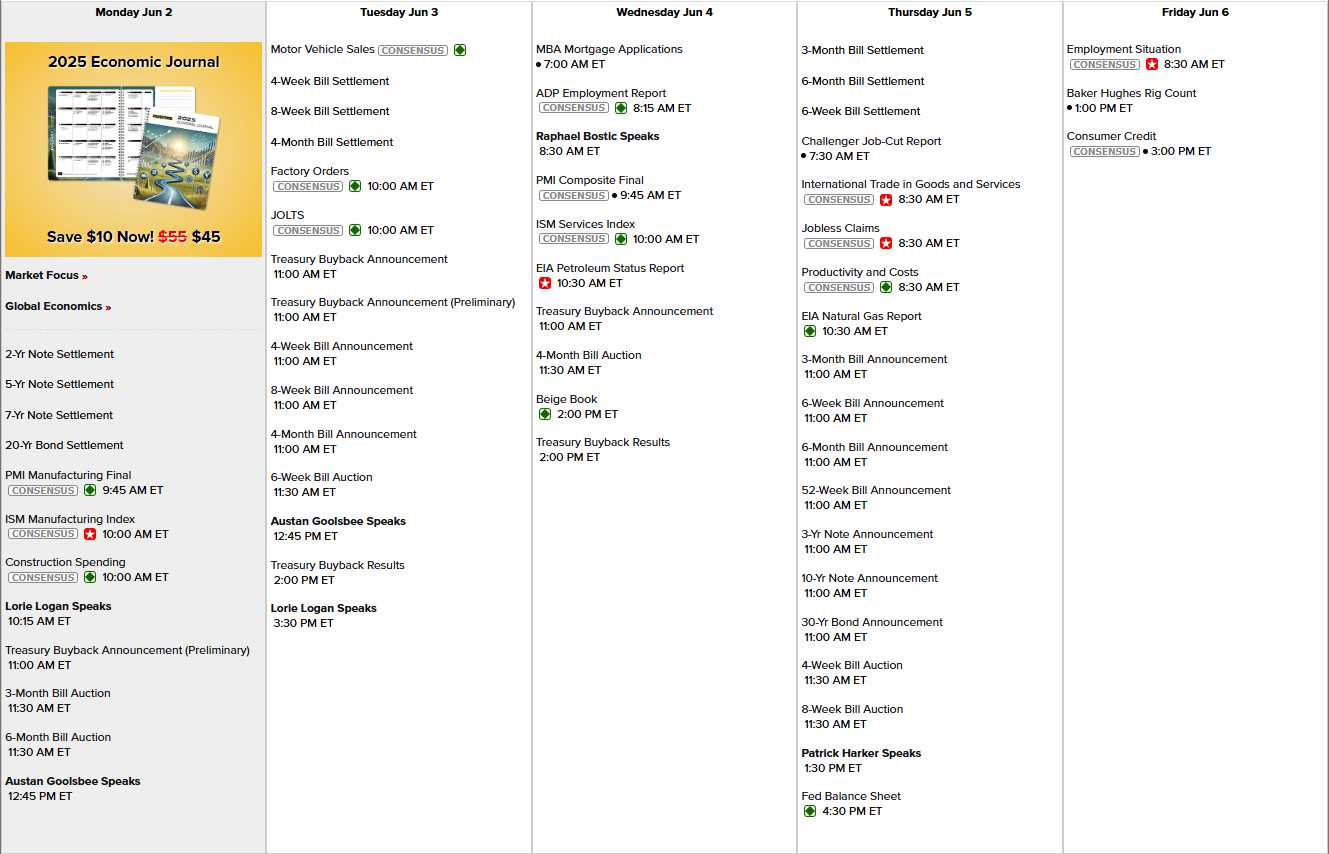

Key Economic Events This Week:

-

- Monday: ISM Manufacturing PMI (US), Fed Chair Powell speaks.

- Wednesday: ISM Services PMI (US), ADP Employment Change (US), BoC Interest Rate Decision.

- Thursday: ECB Interest Rate Decision (cut expected).

- Friday: US Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings (May).

Concluding Thought for PSW Members:

The path through June will likely be choppy. Headline risk is extremely elevated. Our strategy of patience, coupled with rigorous analysis of incoming data and careful watchlist curation, remains our best approach. Let’s stay vigilant, ready to seize opportunities that align with our long-term, value-oriented philosophy when the fog begins to lift, even if just in patches.

“The roses in the window box have tilted to one side

Everything about this house was born to grow and die

Oh, it doesn’t seem a year ago to this very day

You said, “I’m sorry, honey, if I don’t change the pace

I can’t face another day“

Like all the burnin’ hoops of fire that you and I passed through

You’re a bluebird on a telegraph line, I hope you’re happy now

Well, if the wind of change comes down your way, girl

You’ll make it back somehow

Oh, it kills me to think of you with another man

I was playin’ rock and roll, and you were just a fan

But my guitar couldn’t hold you, so I split the band

Love lies bleedin’ in my hands” – Elton John