$47,531!

$47,531!

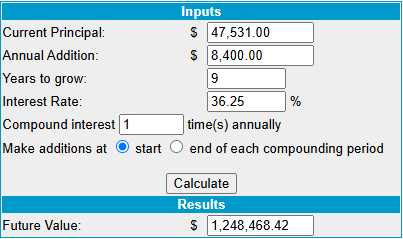

That’s up 99.7% since our Aug 25th, 2022 start and $23,800 came from our monthly $700 contributions and $23,731 is PROFIT! We set out on this journey with a goal of making 10% per year in order to get to $1M in 30 years but there have been plenty of opportunities along the way and, at this pace (36.25% per year), we are LESS THAN 9 YEARS AWAY from our $1M goal!

That means you didn’t miss much if you are just starting now as we are still planning to make another $1,200,937.42 (2,526%) over the next 108 months so the commitment would be to start now with $47,531 and add $700/month ($74,600) for the next 9 years.

Of course you can add $7,000 or $1,400 or $70,000 per month but the main idea of this portfolio is to teach our beginning traders how to select stocks and how to leverage and hedge those selections using basic, no-margin, options strategies – as you would with an IRA or 401K account. We’re also teaching the concept of long-term investing, as noted in our World-famous “How to Get Rich Slowly” explainer video.

That’s all we’re doing here – following the advice from our 2014 (11 years ago!) video and these techniques will serve you very well in any market conditions (as we’ve just had a great chance to prove!). In last month’s review, the $700/Month Portfolio stood at $43,350 and we had not added our $700 yet so now we’ve added $1,400 but we’ve also gained $2,781 (6.4%), which is very nice for a month!

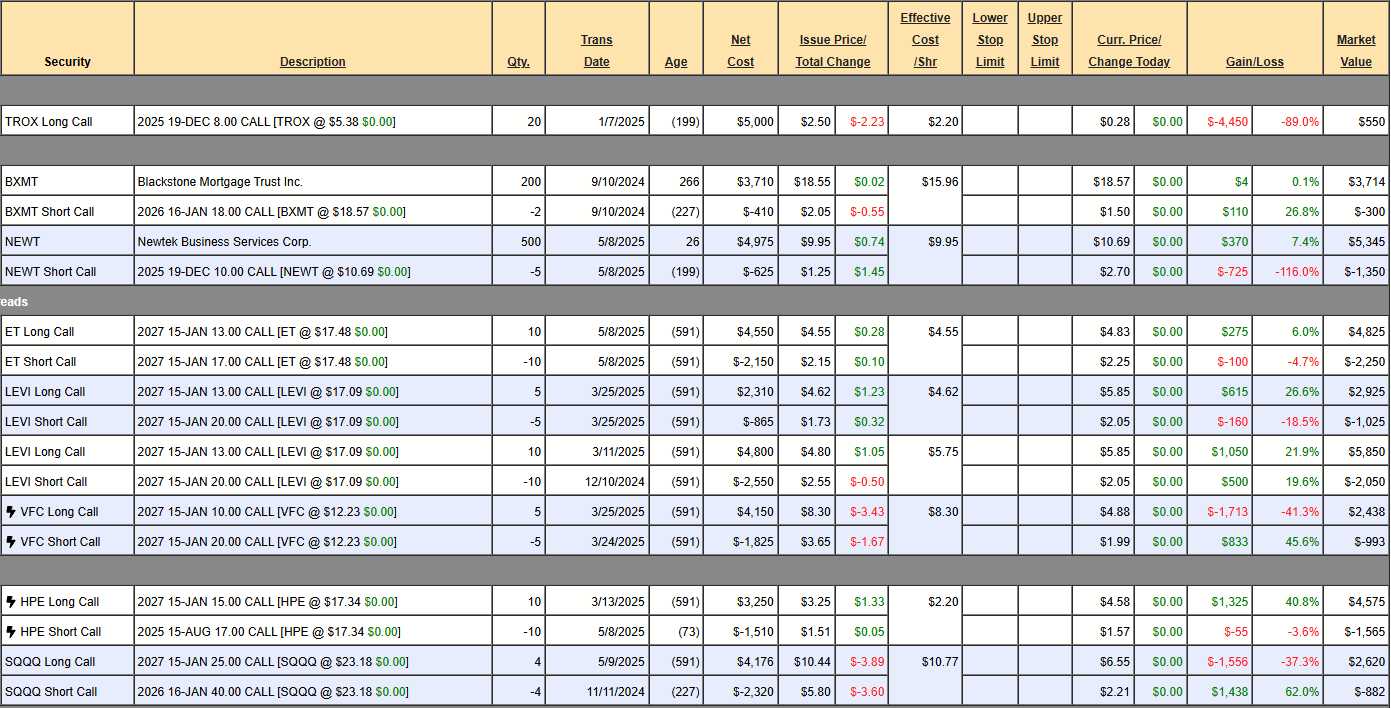

Here’s how we look at the moment with a full review of our positions:

-

- TROX – At this point, we’re just hoping it recovers a bit. Options only go to Jan so not worth rolling yet – we have to wait for new ones to print.

-

- BXMT – We will get a 0.47 ($94) dividend at the end of the month and we’re over our target so we expect to collect 3 dividends ($282) and be called away at $3,600 for net $3,882 and the current net is $3,414 which means we have $468 (13.7%) upside potential over 8 months. This is no longer the best use of our funds so, if we need cash, we would switch this out.

- That is not to say this isn’t a fabulous position – it’s just that we have, consistently, performed much better than an annualized 20% – so our bar is set higher than when we started.

-

- NEWT – We just added this one and losing money so far. NEWT pays an 0.19 dividend ($95) and we should get July and Oct ($190) and called away at $5,000 so $5,190 and currently we’re at net $3,995 so upside potential is $1,195 (29.9%) in just 199 days – THAT’S MORE LIKE IT!

-

- ET – They actually pay a nice, 0.328 dividend, so it wouldn’t be bad to own the stock. As it stands, our $4,000 spread is 100% in the money at just net $2,575 so there’s $1,425 (55.3%) left to gain if they can hold $17 for another 18 months – that’s better than a dividend!

If you are looking for new trade ideas, plays like ET that are fully in the money and can still make another 55% in 18 months are a great place to start! That’s why it’s good to do these calculations – it’s much easier to compare each trade’s potential and give us a good perspective as to the relative potential performance (so we allocate our funds efficiently) as well as making sure we stay on track.

- LEVI – On track at net $1,900 on the $3,500 spread so we have $1,600 (84.2%) upside potential if we can make it to $20 in 18 months. Oops, we liked this one so much we bought it twice! The other $7,000 spread is at net $3,800 with $3,200 (84.2%, of course!) upside potential. No wonder we bought it twice!

-

- VFC – I do like basic clothing in a rough economy. At $12.30, we’re struggling and will continue to do so until there’s some tariff resolution. What traders don’t realize is that – even if everything is from China (it’s not), VFC only pays about $25 for a $100 hoodie so even a 50% tariff only knocks the price up to $37.50 and that would be a 12.5% price increase if they passed it along – not 50%. We’re currently $1,250 in the money on the $5,000 spread and the net is currently $1,310 so, even at $15 ($2,500), we have $1,190 (90.8%) of upside potential so I’m tempted to double down on this one but let’s wait and see what happens in July.

-

- HPE – We just covered this last month and maybe a bit early but better safe than sorry. We’re at net $3,010 on our $2,000 spread that’s 100% in the money but the short calls are August and mostly premium so this position is about selling premium each quarter. How do we determine the potential? Well we collected $1,510 for 100 days and we have 5 more chances to do that ($7,500) and the Aug calls are $1.57 and the 2027 $25s are $1.50 so that would be our ultimate roll SO, CONSERVATIVELY, we can call this a $5,000 spread at $22 which means we have $1,990 (66%) upside potential at just $22.

-

- SQQQ – This is our hedge but it it adequate? Well it’s a 3x inverse ETF so if QQQ falls 20%, SQQQ goes up 60% (less some decay over time) so that’s (1.6 x $23.18 =) $37.08. That would be net $12 ($4,800) on the $25s and the current net is $1,738 which means we have $3,062 protection against a 20% drop. Since I’m a lot more worried about the market going down than up at the moment, let’s offer $2 to buy back the short Jan $40 calls ($800) and then we’ll sell other calls on the next pullback – maybe the $35s (now $2.70) for $3.25 ($1,300) and we could then use the extra $500 to roll the 2027 $25s ($2,620) to the $20s ($8.50 – $3,400) – something like that…

-

- NAK – Fun day today as they collected a royalty ($12M) that buys them another 6 months but, more importantly, Trump is rapidly deregulating and the EPA is being defunded so NAK is feeling good about their chances to be allowed to strip mine Alaska and, if the salmon don’t like it – there’s a gun store at the other end of the bay. We’re on track for $1,500 and the current net is $510 so $990 (194%) upside potential remaining and we started this trade with a net $210 CREDIT in our only trade that uses margin ($1,000) – because it was such a good deal. Obviously great for a new trade as it matures in 5 months!

-

- B – Brand new and on track. This is a net $3,500 spread that’s currently net $3,082 so just $418 (13.5%) left to gain but the July $18 calls ($2.52) can be rolled to the Jan $20 calls ($2.35) or the 2027 $25 calls ($2.20) and that would add $2,100 of additional headroom for a $2,518 potential gain (81.7%) so you can see how cool the flexibility of this trade is. If B goes down – we get to sell more premium and, if not, we roll to a wider spread.

-

- FL – DKS is buying them so we got burned on the short calls but not too badly as it’s only 2 out of 7 and our longs are still $5 lower. Because of the buyout, the premium is squashed and the 2027 $22.50 calls are only $2.25 so net $4 to roll $5 higher and then we are waiting for +$200 better than we are now. Our net is $4,470 so let’s be happy and close it out – raising our CASH!!! by over 50%.

-

- M – Stupidly cheap. They may have inventory adjustment issues but Retail stores have (and stop me if you’ve never heard of this) TURNOVER, which means they are constantly buying and selling inventory and, if there are tariffs, then they will decide what to buy next based on calculations that will include the tariffs and people will go to the store and pick from the items that ARE there – NOT the items that are still in China or Vietnam or whatever that they don’t see.

- So, since we have some cash, we will roll our 10 2027 $12 calls at $2.16 ($2,160) to 15 2027 $10 calls for $3.15 ($4,725) for net $2,565 and the short June calls will go dead and we can sell 5 Aug $12 calls for 0.63 ($315) so now, if we hit our $17 target (and we roll short calls) it’s a $10,500 spread at net (after adjustments) $3,714 so there’s $6,786 (182%) upside potential and we’re $1,980 in the money – SALVAGE!

-

- SOFI – About to break out again, I think. We took a pretty conservative spread that’s good for $5,000 + $7,000 + 2 uncovered at $17 so $12,000 (conservatively) and only showing net $3,472 which means $8,528 (245%) of upside potential is still fantastic for a new trade! And we’re already up over $1,000!

-

- VALE – From the highs to the lows. This is our other disaster but it’s a $40Bn company at $9.50 (and it’s $9.28) that just made $1.4Bn in Q1 on $8.1Bn in sales and that’s with iron ore (what they sell) prices down tremendously. Debt rose 21% to $12.2Bn – that I don’t like but they are paying out a $4Bn dividend so they could cut it and pay down the debt quickly. China is 70% of the Iron Ore demand and everything is on hold at the moment.

-

- We already moved to the 2027 $8s and they either recover or they don’t. I’m not inclined to throw more good money after bad but this is 6.66x earnings – it must be a sign, right? 10x would be a 50% bump to $13.75 and we can get there on one good earnings report and a trade settlement so maybe we will rescue some of the 2026 $12s and the 2027 $8s would then be $5+ ($10,000) and currently net $3,665 so I think a double is realistic – but I won’t count it as upside potential without better news.

Oh, in 2021, when Iron Ore averaged about $175 (100% more than now), VALE made $18Bn! This is a long-term hold but holding on does cost money, unfortunately….

So there’s 14 (after closing FL) positions with $28,920 (59.5%) of upside potential over the next 18 months and that would keep us on track but we have CASH!!! on the sidelines and we’ll pick up more trades along the way so, hopefully, we can improve our 36.25% annual average rate of return.

We also have our $3,062 protective hedge and it’s $1,738 which we’ll lose over 18 months if things go well for our longs – that’s the cost of insurance is all. I’m happy with this mix and we’ll certainly add some more positions but just as certainly there is no hurry as we’re well-balanced and performing well at the moment.