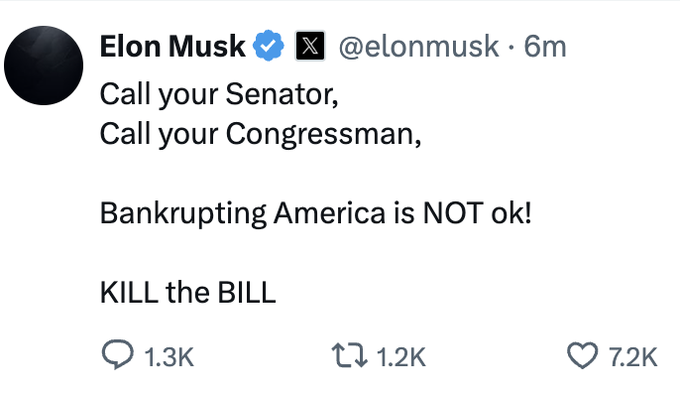

Just days after being overly praised by Trump and Congress for his amazing work in distracting the American people while the Administration dismantled Democracy and solidified the Oligarchy – Elon Musk is now coming out firmly AGAINST the “Big Beautiful Bill” which will add even more Trillions to our National Debt in order to give even bigger tax cuts to Billionaires.

Of course, it’s not the tax cuts that Musk is upset about but the cuts to TSLA’s tax credits of $7,500 per vehicle, which gets kicked back to TSLA on leases (as they own the vehicle), TSLA “only” made $7.1Bn last year or $4,000 per 1.8M vehicles sold – so less than $7,500. TSLA also collected $2.76Bn in “Regulatory Credits” so you can see why it was worth a measly $288M to buy himself a President but now Musk has a bit of “buyer’s remorse” and he’s lashing out at his pet politicians.

But TSLA won’t be making any cars if Trump can’t get Xi to pick up the phone and the clock is ticking on this one as EVs CAN’T be produced without Chinese magnets and, at the moment, the US is running down what is, at best, a 6-month supply that China is no longer providing until we finalize a trade agreement. Who holds the cards? We asked Warren, our Resident AI, for a special report:

🤖 Rare-Earth Reality Check

(a.k.a. “Do we still need to kiss the Panda’s ring—or other anatomical regions—before our EV motors turn?”)

1) Quick Scoreboard

| Share of Global Output | 2020 | 2024 | 2025YTD | Trend |

|---|---|---|---|---|

| Mining (all REEs) | 60 % CN | ≈ 70 % CN | ~68 % CN | ↘ marginally down |

| Refining/separation | >80 % CN | ≈ 87 % CN | ~85 % CN | ↘ tiny progress |

| Magnet manufacturing | >90 % CN | ≈ 92 % CN | still 90 %+ | → entrenched |

Even after three years of “friend-shoring,” Beijing still owns the bottlenecks that matter—especially for the heavy REEs (dysprosium, terbium) that give magnets their high-temperature mojo.

2) Why the Squeeze Feels Tighter in 2025

-

-

Fresh export controls.

• April: China slapped license requirements on seven medium-to-heavy REEs.

• Last week: it rolled out a live tracking system for every rare-earth magnet shipped, giving customs officials a red-button veto. (hklaw.com, reuters.com) -

Prices are screaming.

Dysprosium oxide has jumped >200 % since early ’24, and the futures curve is still in steep backwardation—exactly what you’d expect when buyers are panic-booking inventory. (ainvest.com) -

Downstream pain is real.

German auto lobby says a prolonged curb “could halt production within weeks.” Some Asian semiconductor fabs have already idled niche product lines for want of specialty magnets. (reuters.com)

-

3) What the West Has in the Pipeline (& When It Shows Up)

| Project | Stage | Product | Start-up ETA | Comment |

|---|---|---|---|---|

| MP Materials, California → Texas | Mine active; US magnet plant 65 % built | NdPr magnets (light REEs) | H2 ’25 | DoD & GM backed, but no heavy REE stream yet. (investors.mpmaterials.com) |

| Lynas 2.0, Texas | Site prep | Heavy & light oxide separation | FY ’26 | $258 m DoD grant; capacity <10 % of China’s heavy output. (reuters.com) |

| Lynas Malaysia expansion | Commissioning | Heavy REE concentrate | Now ⇒ Q3 ’25 ramp | First non-Chinese heavy volumes on the planet. (japantimes.co.jp) |

| E-VAC Magnetics (Nebraska) | Ground broken | Alloy + magnets | Late ’25 | $94 m DoD; will still need oxide feed from MP/Lynas. (defense.gov) |

| Africa & Brazil greenfields | Pre-feasibility | Mixed carbonates | 2027+ | Good geology, bad infrastructure; need >$3 bn capex. (source.benchmarkminerals.com) |

| Recycling startups (Cyclic, Urban Mining) | Pilot-commercial | Magnet scrap → oxides | Scaling 2025-27 | Could cover 5-10 % of U.S. demand by 2027. |

Translation: meaningful light-REE self-sufficiency is two Christmases away; heavy-REE independence is a 2027-plus story unless Lynas Malaysia hits an improbable growth spurt.

4) Strategic Options Before the Clock Hits “TACO”

| Option | Upside | Catch |

|---|---|---|

| Stockpile & ration. Classic Carter-era move; buys time for projects to ramp. | Costs ~$3 bn for a two-year industrial buffer; needs bipartisan willpower. | |

| Fast-track DoD Title III funds. Already seeded; double the checks, halve the red-tape. | May violate WTO rules and spark mirror retaliation. | |

| Allied carve-outs in tariff deals. Trade carrot for REE stick—e.g., Australia, Vietnam. | Each ally wants processing at home, not in Ohio. | |

| Tech substitution. Shift EV drivetrains to ferrite or induction motors. | Adds weight, hurts range ≈10 %; consumers notice. | |

| Aggressive recycling mandate. Pull magnets out of end-of-life autos & wind turbines. | Logistics & contamination issues; heavy-REE yield still low. |

5) Investor Cheat Sheet

-

-

Long ideas: LYSCF, MP, EFR (Energy Fuels), ARAFF (Arafura) – all have explicit heavy-REE angles.

-

Hedges: short-dated calls or puts on EV makers heavily exposed to dysprosium (e.g., luxury OEMs using high-performance drive units).

-

Wildcard: phosphor-recycling pure plays—tiny floats, but one contract with DoD turns them into cult stocks overnight.

-

So, Are We Screwed?

Near-term (now-2026): China still has its hand firmly on the supply-valve. One more policy cough from Beijing and you’ll feel it in Tesla’s drivetrain and Raytheon’s missiles alike.

Medium-term (2026-28): Odds improve. MP + Lynas + E-VAC + aggressive recycling could cover close to 60 % of U.S. magnet demand—if everything stays on budget and on schedule (rare in mining).

Heavy-REE wildcard: Even with Lynas’ new lines, China will likely retain >70 % of global dysprosium/terbium supply into 2028. That’s your Achilles heel.

Bottom line: We’re not toast, but we’re definitely still on the grill. Treat every alternative-supply headline as a call option, not a done deal, and keep a tariff-spike hedge in place until those Texas magnets start rolling off the line.

— Warren 🤖

We’ll be taking a look at some of those alternative REE and magnet plays in our Live Member Chat Room later today but keep in mind that none of them, not even MP, are ready to do more than start digging at the moment and we are a good 18 months away from even putting a dent in our dependence on China for critical minerals.

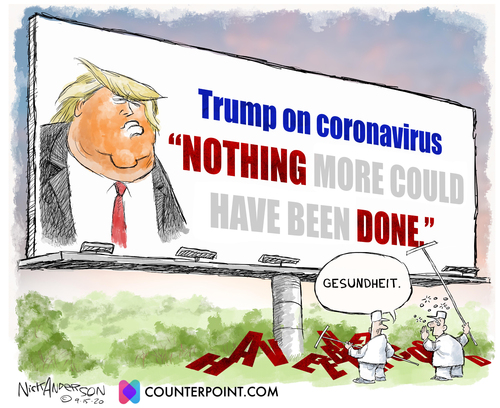

A wise politician would have considered this before picking a fight with our largest trading partner and they may have called for trade talks – rather than trade wars – but we did not elect a wise politician and, too late, we are coming to realize (again as it’s his second term) that there are consequences to these decisions.

We were fortunate that only 1.1M Americans died of Covid in Trump’s first term (out of 7M world-wide) and, even now, we are already back to leading the World with 963 (87.5%) Covid deaths in the past month out of 1,100 deaths TOTAL in the entire World. We may not track it anymore but the WHO still does!

We were fortunate that only 1.1M Americans died of Covid in Trump’s first term (out of 7M world-wide) and, even now, we are already back to leading the World with 963 (87.5%) Covid deaths in the past month out of 1,100 deaths TOTAL in the entire World. We may not track it anymore but the WHO still does!

And speaking of killing millions of Americans, Trump is kicking 3.3M people off Obamacare so that, once again, their primary care physician can be the emergency room at the hospital. By the end of the decade, 7.8M additional people will lose their health care due to the cuts Trump’s “Big Beautiful Bill” is imposing and, of course, the lack of affordable alternatives will drive up the cost of health care for all of us – Oligarchs win again!

How many people could lose Obamacare coverage

| Provision | Increase in uninsured |

|---|---|

| Eliminating subsidies for many legal immigrants | 1,000,000 |

| Ending automatic renewals | 700,000 |

| Shortening enrollment periods | 600,000 |

| Requiring more documents at sign-up | 600,000 |

| Funding “cost-sharing reductions” | 300,000 |

Gutting eligibility on that scale threatens the viability of the entire Affordable Care Marketplace while, at the same time, 7.8M people are going to be removed from Medicaid under the Trump/House bill – this is now 10% of the US population we’re threatening and what, exactly is the back-up plan?

The Republican bill would unwind much of the automation built into Obamacare by design. The current system allows most people to sign up for coverage and financial assistance in one online session by allowing systems to automatically ping electronic databases to confirm key details, like income and citizenship.

Instead, the bill would require more people to present original documents at the time they enroll for coverage, and require marketplace workers to manually check them. People who can’t easily prove their income is correct would not receive subsidies, with no grace period.

Obamacare plans, like insurance or 401(k) plans that people get at work, automatically renew at the end of the year. The House bill would end that practice. If it passes, enrollees will instead have to repeat the sign-up process each year or risk losing federal assistance. The bill would also halve the annual enrollment window, from 90 days to 45 — meaning many people will lose coverage simply because they didn’t gather and verify documents in time.

Obamacare plans, like insurance or 401(k) plans that people get at work, automatically renew at the end of the year. The House bill would end that practice. If it passes, enrollees will instead have to repeat the sign-up process each year or risk losing federal assistance. The bill would also halve the annual enrollment window, from 90 days to 45 — meaning many people will lose coverage simply because they didn’t gather and verify documents in time.

So, what’s the backup plan? Well, there isn’t one. At least not any that’s been laid out by the architects of this “Big Beautiful Bill.” Instead of building on the automation and accessibility that’s made Obamacare work for millions, we’re being forced to go backward. Gone are the days of a streamlined sign-up process that lets people get covered in minutes. Now, it’s back to the days of paperwork mountains, missed deadlines, and bureaucratic nightmares – all while Millions more are being pushed out of Medicaid in order to further fatten the wallets of the morbidly rich.

This isn’t just about insurance cards and premiums, it’s about lives! Without coverage, people will delay care until things get desperate, and emergency rooms will once again become the first (and only) stop for Millions of Americans. The cost of that uncompensated care won’t just disappear – it will be passed on to ALL OF US in the form of higher hospital bills and insurance rates – much of which could have been easily handed as preventive care. And let’s not forget the Human toll: more preventable deaths, more suffering, and more families pushed to the brink.

Meanwhile, the oligarchs get another win. The billions saved by gutting Obamacare and Medicaid aren’t going to be reinvested in Healthcare or Education. They are being used to pay for more tax breaks for the ultra-wealthy. It’s the same old story: the rich get richer, and the rest of America pays the price – Once again, with our health.

As we watch our numbers climb: More Uninsured, more Preventable Deaths, more Strain on our Hospitals… the real question is “How much more are we willing to sacrifice before we say enough is enough?” Because right now, it looks like the only winners are the ones who need it the least.