Brand new portfolios!

Brand new portfolios!

Last month, we decided enough was enough and we closed out our 4 active portfolios after 2 years as the market had bounced back and we were miles and miles ahead of our profit goals. It is a good time to start fresh, ahead of the Tariff, Fed, Earnings and Macro uncertainties that lie ahead because you never know what new opportunities await.

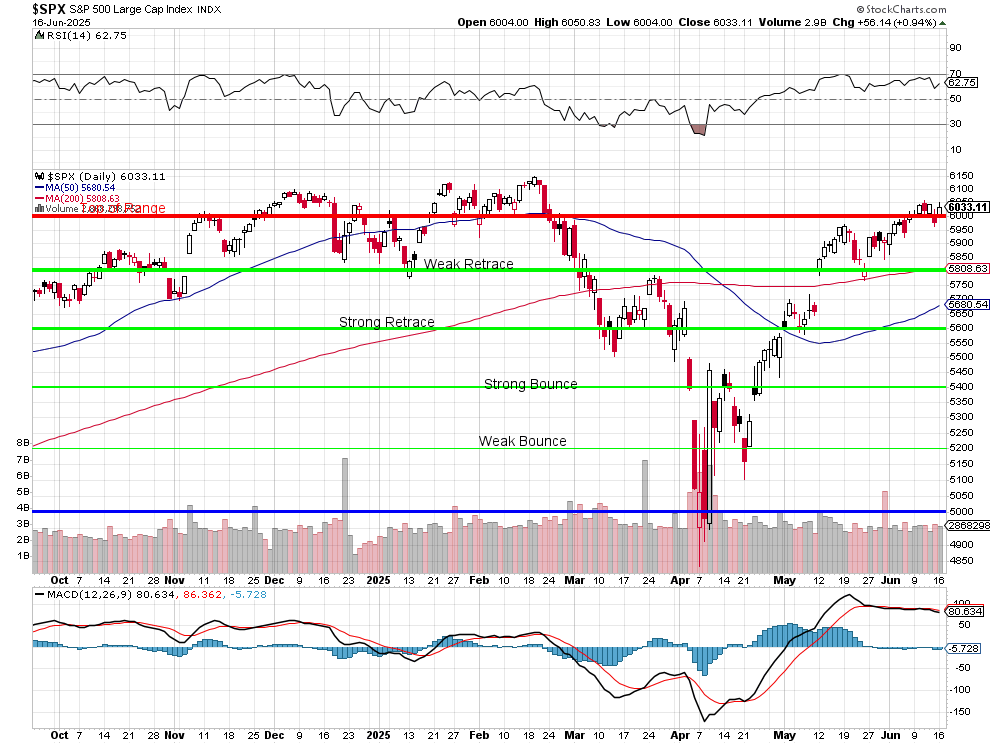

At the moment, the S&P 500 is at the top of our expected range and earnings were certainly better than expected in Q1 - because we expected tariffs and they have been delayed and now we'll have to wait and see if Trump TACOs on his next deadline (July 9th) but we don't have to buy the whole S&P - just the ones that are on sale - so we've already begun shopping.

We were "comfortably" over the top of our range back in February, and then tariffs took us down 20% in a month and here we are again in June - just a bit lower than we were then but the RSI is higher (stressed) and the MACD is higher (stretched) so conditions are ripe for a huge fall once again and I'm glad we are now sitting in CASH!!! - just in case!

Although April and May Earnings Reports have shown companies to be resilient in the current Economy - this has been happening WITHOUT the effect of the tariffs and WITHOUT the Inflation that EVERY Economist says is inevitable if they are put back in place. The Fed says the inflationary boost may be "transitory" - meaning it's a one-time bump in prices but then they calm down but there's also a lot of evidence that Consumers are at the end of their rope and even just a 10% hike in prices may push them over the cliff at this point.